9+ Financial Risk Management Examples to Download

The world is full of risks to take and in the financial world, risks are something that is inherent particularly in the business sector. One of the finance essentials you need to secure for your business’ success includes implementing financial risk management. Through financial risk management, you can deal with all the various types of risks your business will inevitably face and you can also anticipate these risks and have a solid financial management plan to combat it all. In this article, let us delve deeper into the concepts, terms, and all things that surround financial risk management.

What Is Financial Risk Management?

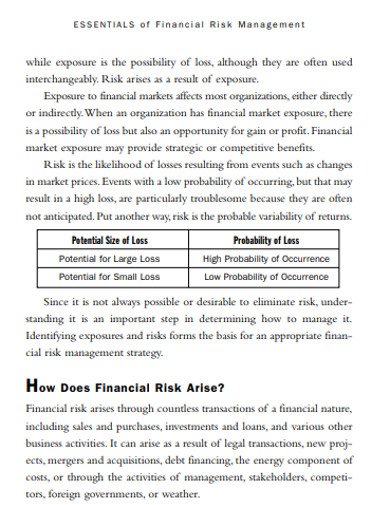

The process of determining, understanding, and managing the various financial risks businesses face is called financial risk management. Financial risk management is not all about eliminating financial risks in the business altogether but this is about understanding what and how much risk you are willing to face and take, how much you should avoid, and what strategy you need to come up with basing on your risk appetite.

With the help of financial risk management, the plans of action as to what the staff can do and cannot do, what decisions need to be escalated, and who are the key individuals to turn to as soon as any risk would arise.

Who Manages Financial Risks?

The one who is responsible to manage financial risks depends on the size of the business. For small businesses, the business owner and/or the senior managers are the ones who are assigned for risk management. For bigger businesses that have multiple departments, a Financial Risk Manager (FRM) may be assigned in every department and he or she is responsible for making sound decisions when managing financial risk.

9+ Financial Risk Management Examples

1. Coordinator Financial Risk Management Example

2. Sample Financial Risk Management Example

3. Primer Financial Risk Management Example

4. Business Financial Risk Management Example

5. Standard Financial Risk Management Example

6. Printable Financial Risk Management Example

7. Financial Risk Management in PDF

8. Corporate Financial Risk Management Example

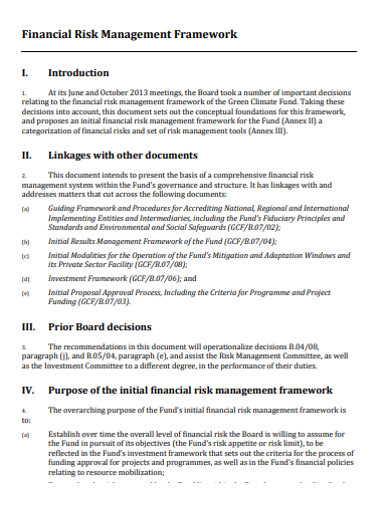

9. Financial Risk Management Framework Example

10. Simple Financial Risk Management Example

Why Acquire Financial Risk Management Certification?

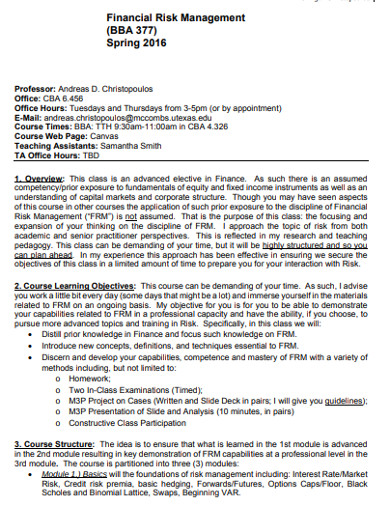

If you have plans to further your credentials as someone who manages risks, then you should consider getting a certification as a certified FRM. This international professional certification is offered by the Global Association of Risk Professionals (GARP).

Those who apply for it would under a two-part exam which includes the FRM exam Part I that covers the tools that are used in assessing financial risks and the FRM Exam Part II that focuses on how the tools acquired from the part I of the exam is applied.

By having an FRM certification, you let your employers know that you mean business when it comes to risk management and that your knowledge of managing risks is validated by international and professional standards.

Uses of Financial Risk Management

Businesses utilise financial risk management as a way of forecasting and analysing the potential financial risks of an organisation or a company. Apart from that, it is also used in identifying the procedures or actions that need to be implemented in order for the possible risks to be mitigated or avoided altogether. It also through financial risk management that the practices, procedures, and policies are encapsulated and are used as guidelines as to what financial risks are acceptable to the company.

Benefits of Risk Management

Risks are something you can never really avoid; however, if you have an effective risk management plan, you can easily mitigate it to negligible levels. It cannot be denied that risk management can really provide numerous benefits. Make sure you learn some about these below.

- It avoids any possible catastrophe: Through risk management, you can come up with a financial business strategy that is specifically tailored for the potential risks your company might face. Such strategy is also built on the goal that aims to continuously keep the profitability of a business as well as to effectively manage all the possible financial pitfalls that lead to any catastrophe.

- It maximizes opportunities: This kind of management cannot only determine potential problems and risks but it can also be used to predict opportunities. Through risk management, your business can easily figure out what to do whenever a good investment scenario is laid out in front of it and how to maximise such scenarios.

- It ensures the growth of a business: One of the important factors in financial risk management is competition. Through this, a business is given an ability to determine how their target market responds to competition and, most importantly, determine an effective strategy as to how it can grow amidst all the competition and risks that surround them.

Why Is Financial Risk Management Important?

With financial risk management, you can get yourself prepared for all of the possible unexpected situations of your business that is related to finances. Sure, one cannot perfectly plan for every single possible scenario out there but with financial risk management, anyone can minimise its effects.

How Do You Implement Financial Risk Control

Financial risks are dealt in so many ways and this is because it depends on what an organisation does, its target market, and the level of risk its willing to take. While financial risk control is up to the business owner or to the directors of an organisation, its financial risk management process would commonly involve the following stages:

- Identification of risk exposures: A financial risk control should start by identifying the potential financial risks of an organization including its sources or causes. One way to accomplish this step is by starting with the balance sheet of an organization or a company as this can provide a clear view of the debt, liquidity, interest rate risk, and other vulnerabilities the company faces. Other methods include examining the company’s income and cash flow statement.

- Quantifying the risk exposure: Once you have already identified the risk exposures, the next steps you should do is to quantify it or to determine its numerical value. You should also know that risk is uncertain and that when you quantify it, you will never come up with something that is exact. However, you can always make use of various statistical models like the standard deviation so you can measure the exposure of a company to risk factors. Keep in mind the general rule: the greater the standard deviation, the greater the risk associated with what you are quantifying.

- Decide your next action: As soon as you have already determined and quantified the risks, it is time for you to determine the next action or steps you should take. Ask yourself whether your company can continue to operate with such risk exposure or whether there is a need for you to mitigate or hedge these. Make sure your decision is based on various factors such as your company goals, the business environment your company belongs in, and how much risk it is willing to take.