10+ Growth Portfolio Examples to Download

The primary goal of the growth portfolio is to diversify its fund to the stocks that have capital appreciation with minimal or nil payouts. It is framed only with above-average companies that invest and reinvest to expand their acquisition, research, and development. The growth portfolio offers capital appreciation but at some risks. In simple words, when you invest in mutual funds, you are in a growth or dividend investment.

What are the Features of Growth Portfolio?

1. It has the potential and offers high returns, and this is the reason that this process attracts many investors.

2. If you are investing in growth funds, you have to have more than normal risk tolerance capacity because they are very vulnerable to the sudden rise and drop in stock’s price.

3. Growth funding has such exposure to risks that might make you lose your entire invested amount.

4. They are highly volatile and might face value depreciation in the market as per the demand.

5. Growth funds are tax-efficient if the amount of earning is above rupees 100,000 and held more than a year.

6. Growth funds might increase your expense ratio and add additional charges as it requires more management charges.

7. You have the chance to become a passive investor as the growth funds are mostly managed by the expert team of qualified professionals who give an idea to the investors in which stock to invest. Even they are also allowed to take all the buying and selling decisions of the stocks.

8. Diversified funds help to reduce risks of returns while investing in volatile stocks. It doesn’t minimise the risk as a whole, but to a certain extent, it does.

9. Offering a regular return is not like growth funding like dividends or interests.

10. Growth funding is a long-term commitment and can offer you benefit only when you can hold an investment for more than 5 to 10 years.

10+ Growth Portfolio Examples

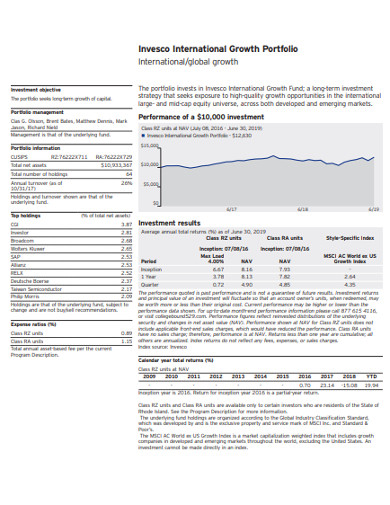

1. International Growth Portfolio Example

When investing in growth stocks planning your steps properly is very important. Planned steps in investment help to save you from a vulnerable situation in risking your capital. If you need ideas to prepare a model portfolio for growth funding you may refer to the given sample of the template. The template might detail you on the different aspects, features, advantages, and disadvantages of the process.

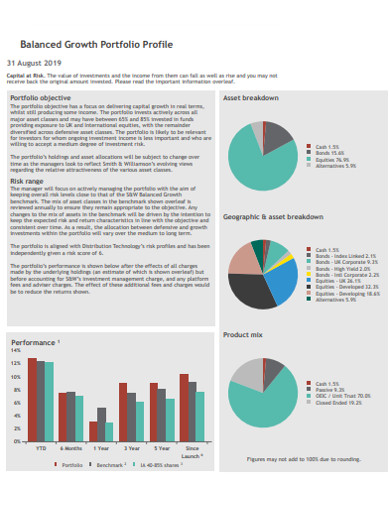

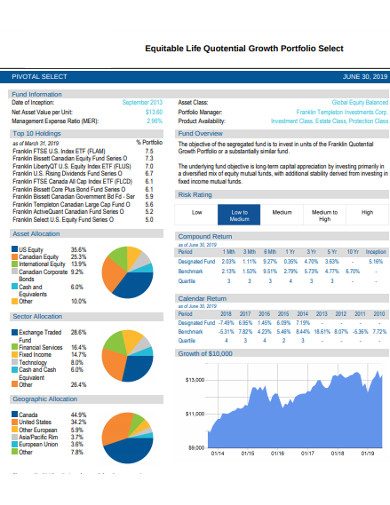

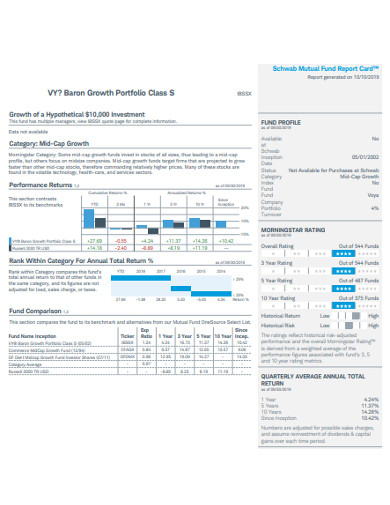

2. Balanced Growth Portfolio Profile Example

A properly framed growth portfolio is something that defines your investment and helps you know how much you can invest in the next projects. Designing the frame of growth portfolio might be a little hectic sometimes that is why we suggest you choose this portfolio designs. The template frames all the important data of the investment process citing the objectives and other details. So, have a look at the template today!

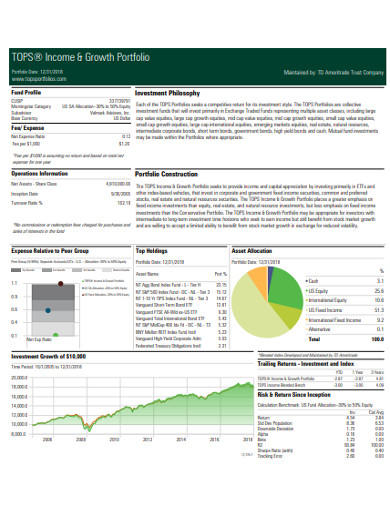

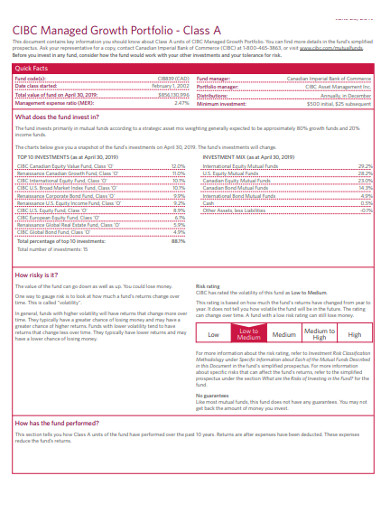

3. Income and Growth Portfolio Example

If you want to have an attractive portfolio for your growth and income portfolio for recording and framing your investments, choosing this template might be a good decision. The template is framed covering different aspects of the portfolio with a specific and precise description with easy and communicable form.

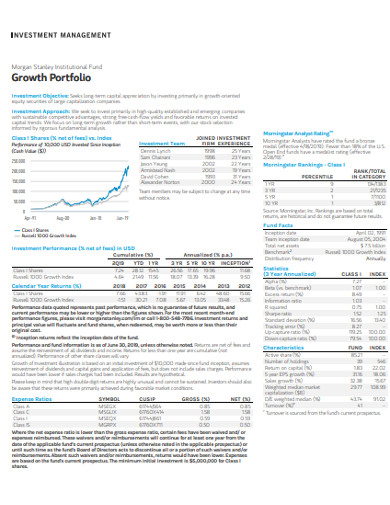

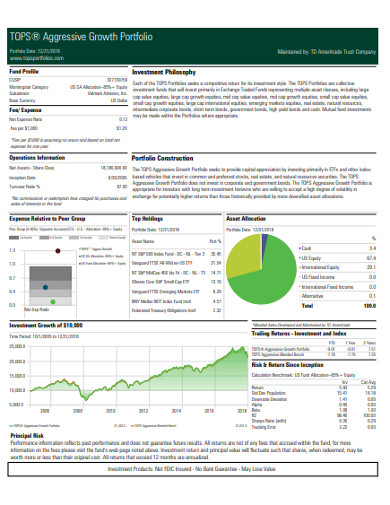

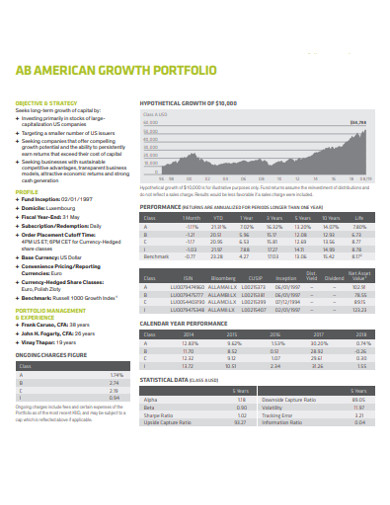

4. Investment Growth Portfolio Example

Growth investments are often a long-term processes for greater yields. It adds high risk but if planned properly it might give you sweet fruits to reap. If you want to learn about its process and how it can be designed you may refer to this template and read it carefully. The graphical, numerical, and descriptive presentation of data and details might help you to get clear insights into the process. You might also refer to our other templates on digital portfolio frames.

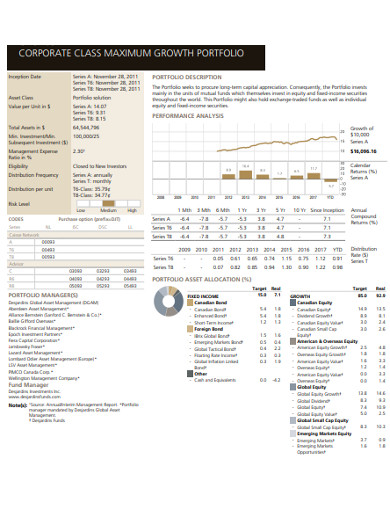

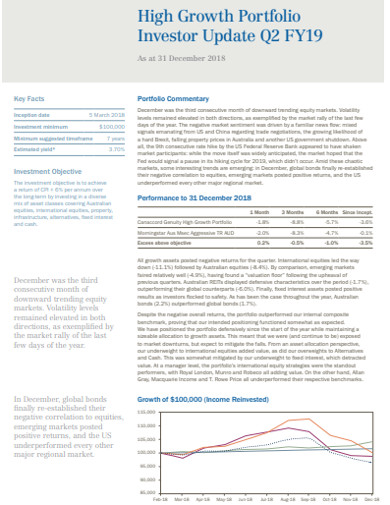

5. Corporate Growth Portfolio Example

Framing a growth portfolio requires detail on different planning procedures that collectively are required to process the investment. Thus giving stress on a perfect portfolio is an important thing for any investor. You can easily design it by following the simple aspects defined in the given example template or you can use it only. The frame has clearly defined and described all the required elements of the process. So, have a look at it before you take the stress!