Collections Checklist Example to Download

Extending credit to your clients and/or customers can be good for your business in terms of retaining the professional relationship of the company and its market. However, the downside of this process is that it is possible for customers to not pay the specific amount that you expect from them in time. Moreover, there can also be instances where payment may not be made. You may also see blank checklist examples.

If you want to be more efficient when it comes to improving the processes of collecting accounts, then you should develop a checklist that can help you become more organized especially in relation to decision making. Browse through this post an identify ways on how you can come up with a great collections checklist that focuses on the actions that you need to execute to improve collections of account. You may also like printable checklist examples.

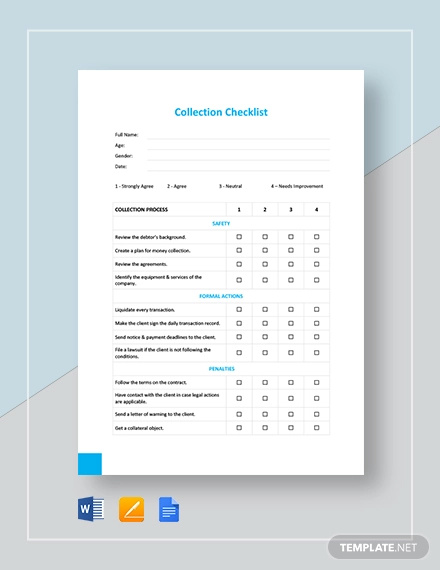

Collection Checklist Example

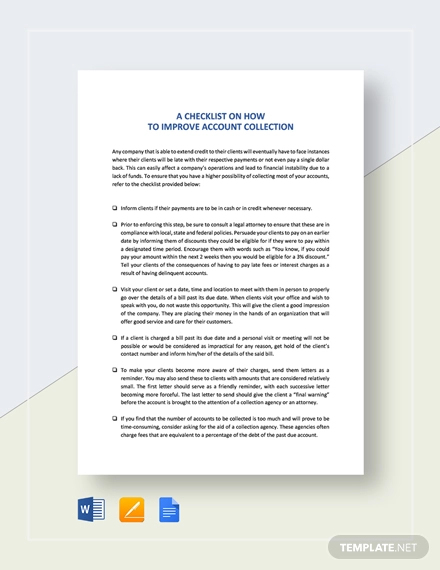

Checklist Action to Improve Collection of Accounts Example

What Actions Should I Put in a Collections Checklist?

The collection of accounts play a very important role in the entire procedures of lending. This is the reason why most entities whose operations are associated with micro-financing always find ways on how they can improve collection of accounts. If you will create a checklist that you can use to develop your processes when it comes to the collection of accounts, here are some call to actions that you can include:

1. Require your customers or clients to be aware of the due dates for payment. Moreover, you can specify the modes of payment that you accept. Being more engaged with your clients can help you know their payment habits. Giving a time frame is very beneficial especially if you will do this day ahead of the collection so that your clients can prepare the specific amount that you are asking for them. You may also see checklist templates.

2. Visit your clients if possible. Only do this either because the amount unpaid is already big and above the maximum that your company allows or if it is convenient for you to visit the client do the proximity of his or her location to your small business. This will allow you to discuss the bills and accounts that they have not paid in a more professional yet personal manner as well.

3. Offer discounts, deals, promos and other advantages for early payments. Clients always appreciate these programs. If they can pay earlier due to the special offers that you can give, then it will be easier for you to collect accounts. You may also like to do checklist examples.

4. Always remind your clients about your schedule. There are some clients who would like to personally visit you for the accounts that they will pay. Knowing that you will be in the same location and at the same time can make the transaction of discussing and collecting accounts more efficient and time-saving. You may also see maintenance checklist examples.

5. As much as possible, make your clients pay for an earlier period of time. As specified above, there are already programs that can help you do this. Having clients pay for an earlier time period will help you to focus on a lesser number of people who have not paid their accounts on time. You may also see HR checklist examples.

6. It may be harsh for some, but it actually works if you will charge interest and late fees should clients pay the account at a later date than the deadline. Who would want to pay on top of their accounts, right? If this is the only way possible for clients to take account payments seriously, then do so as you have an underlying business-related reason for doing it. You may also see quality checklist examples.

7. Make phone calls or develop letters that will remind your clients about the accounts that they need to pay. You can just have a single letter or you can make three letters in the following order:

- Have an initial letter with a friendly tone. This will only serve as a reminder if the account is still not due and you just want the client to know his or her responsibilities.

- If the client is already behind the payment schedule, then you can send him or her a letter that is more forceful compared to the first one. You have to make your grounds when collecting accounts as most clients tend to abuse entities who are too kind to them.

- Your third and final letter should already contain a demand for the client to pay the account. You can already specify the possibility of taking legal actions should the client still not take the collection letters seriously.

8. Do not hesitate to take legal actions to make things easier for you. Give the account either to your lawyer or to a collection agency so that legal actions can already be implemented. You have to protect your simple business as much as you would like to protect and help your customers as well.

Tips When Making a Collections Checklist for Improving Collection of Accounts

Improvement, no matter where industry your business belongs or no matter what field it is that you are currently practicing, is an essential part of growth. If you want to create a checklist for the main reason that you would like to improve your organizational skills, strategies, and processes; then do not be afraid to do so. Listed below are some of the tips that can help you make a collections checklist for improving collection of accounts in a more efficient and effective way. You may also like cleaning checklist examples.

1. Make yourself knowledgeable of the best industry practices that are applied in accounts collection. This will help you to identify the actions that truly work.

2. Be aware of collection strategies and identify the specific strategy which you think will best work for your operations. Knowing different possibilities when it comes to strategically collect accounts can help you become more immersed in the entire process. You may also see registry checklist examples.

3. Refer to samples and templates of checklists that are used in the same process. This can allow you to know the formats and layouts that can organize the items that you would like to put in the document in a more organized manner.

4. Always review the checklist before actually implementing its content. You have to ensure that all the items are complete and relevant to your operations and the objectives that you would like to achieve. You may also see service contract checklists.

Always consult legal entities to make sure that your checklist includes a call to actions that are aligned with the law in the country, state, or city where your business is doing operations. This can help you reduce the possibilities of disputes, facing legal cases and the like. You may also like team meeting checklists.

With the tips and other information that we have specified, it should already be easier for you to develop your own collections checklist. Improve the way you collect accounts through a checklist and see how it can make things easier for you in the near future. You may also see safety checklist examples.