9+ Financial Adviser Marketing Plan Examples to Download

A financial adviser is an individual who helps people with financial problems and helps them get back on track on their savings as well as expenses. A financial adviser is like a good mechanic—a person who has vast knowledge and skill set, and fixes things without really having to rely on your input and proceeds with his job until it’s done.

If you are a financial adviser yourself and plan to create a marketing plan to improve your visibility among clients and potential ones, here are some financial adviser marketing plan examples (in PDF format) you can use.

Easy Marketing Strategy Example

Writing a Simple Marketing Plan Example

Executive Summary Marketing Plan Template Example

Tips in Creating an Effective Marketing Plan

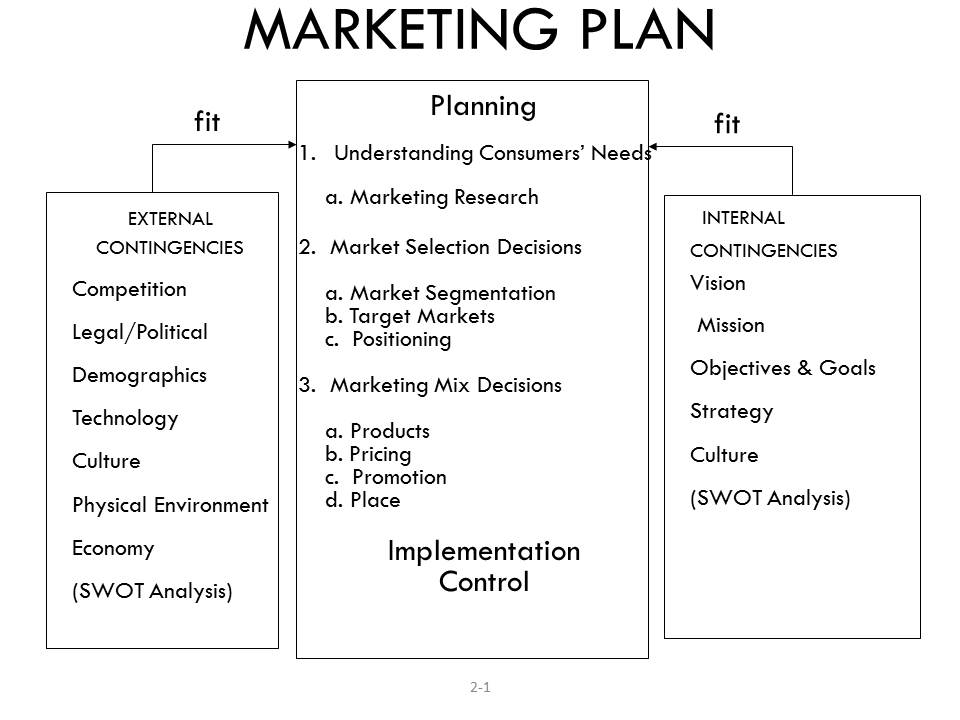

Similar to other marketing plans, a financial adviser marketing plan also focuses on sales and marketing. You should be able to create a marketing plan that focuses on how to not only market yourself to clients, but also identify their needs so that you can create a better customer and competitor analysis, in which both are crucial in the formulation and implementation of a marketing plan examples.

1. Carefully choose your market

Choosing a market in the financial service industry is not as simple as choosing a market for a restaurant. You have different individuals having different needs and different individuals facing different financial issues. Two individuals having similar financial problems may not be advantageous on your end compared to a hundred individuals seeking the same financial service assistance.

Even though you are willing to help these individuals, at the end of the day it is still a business, and you should put yourself in a position where you can maximize the opportunity to earn.You may also see financial plans

2. Identify short-term and long-term goals

Identifying short-term and long-term goals is paramount if you want to succeed as a financial adviser. Take note that short-term goals are goals that are set and accomplished within one day to one year. Long-term goals meanwhile are set and accomplished one year onward.You may also see plan examples.

Being a financial adviser is not easy, but setting the right goals (as well as aiming to assist individuals with their financial concerns the best and most ethical way possible) will definitely result in long-term success.

Listed below are example of short-term and long-term goals:

Short-term goals

- Meet with five clients this month and conduct a financial literacy seminar for each client

- Close a pitch with 10 clients by the end of September as they each aim to avail a variable life insurance policy.You may also see financial analysis examples

Long-term goals

- Earn $5,000 in commission by the end of year two, $7,000 by the end of year three, and $9,000 in year four.

- Convince 50 clients to avail of an emergency medical insurance policy by the end of year two.

3. Partner with private and public sector

One method where you can list down and implement in your marketing plan is to partner with the private and public sector. This provides a great opportunity not only to market your products and services but also market yourself as a financial adviser.You may also see financial report

You can offer financial services in university events as well as present your products in front of a corporate crowd. This way, you can easily increase the number of potential clients as you are showcasing your products to a large audience. Just make sure that your communication and presentation skills have been sharpened before you even attempt to show your face in front of a large audience.You may also see strategic plan

In one setting where you are able to do a sales pitch in front of 20 people, even if only one of two persons commit to purchase your product, the event will already be a success. Insurance is a long-term commitment and requires the individual to spend a sizable amount on a monthly basis.You may also see project plans.

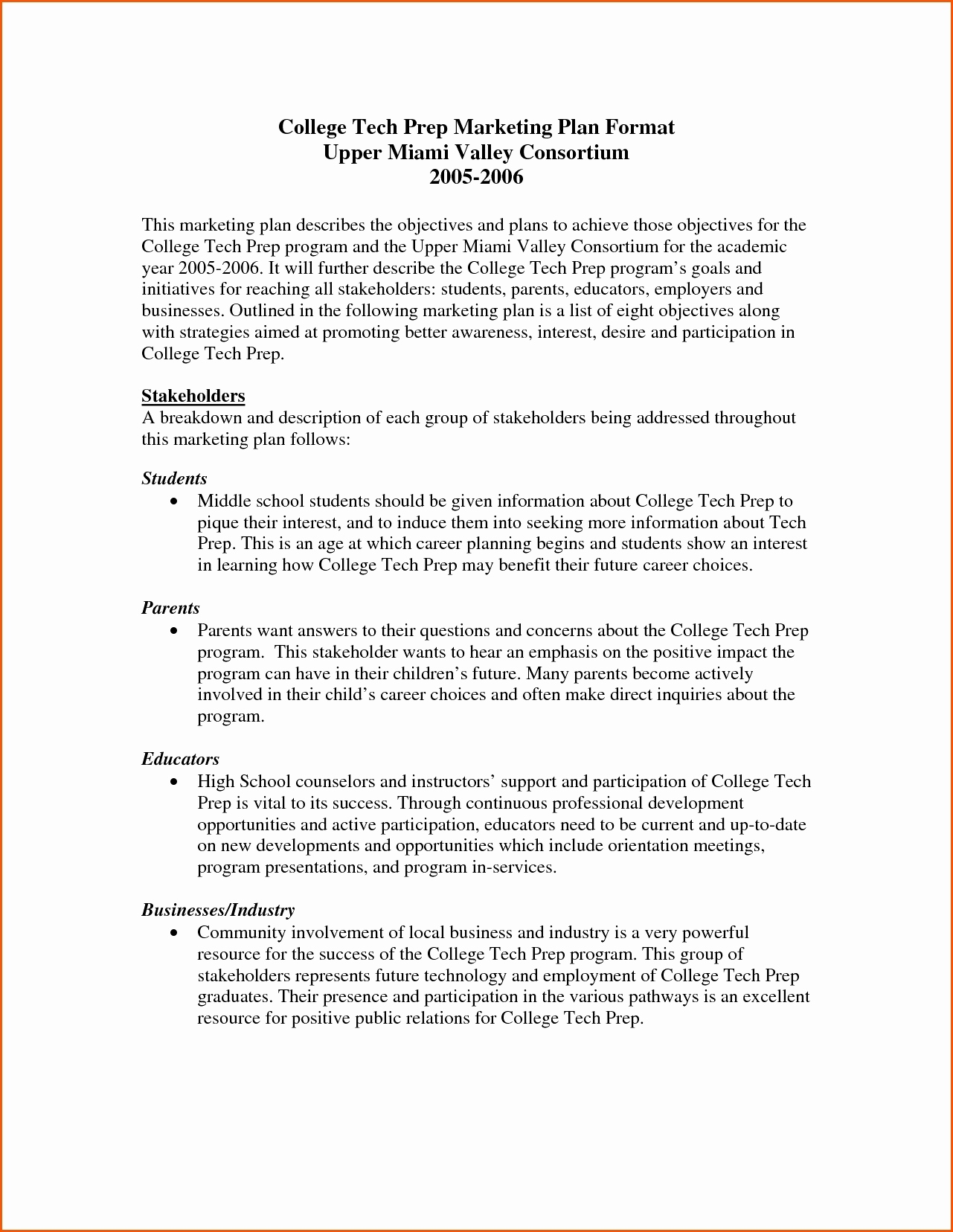

Basic Marketing Plan Outline Example

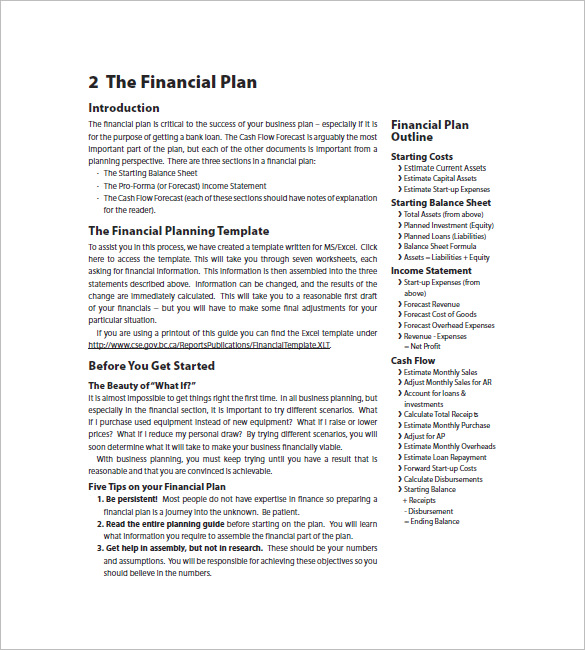

Financial Marketing Plan Outline Example

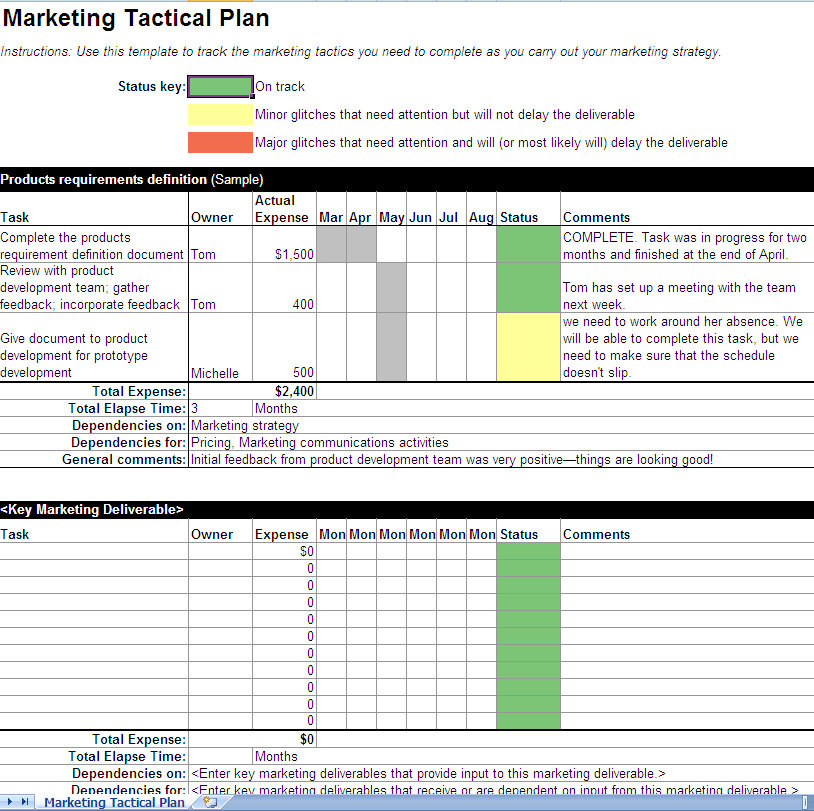

Financial Marketing Tactical Plan Example

New Financial Adviser Plan Example

Tips in Becoming a Better Financial Adviser

To put it bluntly, pursuing a career being a financial adviser is difficult. Getting leads is not enough, and you need to convert those leads into sales. You may have a thousand leads, but if none of those leads purchase your products, it will still be useless in the end.You may also see management plan examples

Additionally, dealing with individuals with financial issues is a case-to-case basis. Each client has their own concern, and it is your job to create a different plan or solution for each of client.

If you are already a financial adviser and plan to improve your craft and overall skill set, here are some essential tips in becoming a better financial adviser:

1. Great advisers take care of themselves

This is the important tip that every financial adviser should apply in their respective careers. The best advisers are not only focused of their work, but they also take care of themselves. Among the habits of successful financial advisers include eating a healthy diet as well as having a regular workout routine. Remember, clients are easily attracted to advisers who don’t only possess all the math and analysis, but also exude an optimistic attitude while presenting themselves in an imposing yet sincere manner.You may also see business financial analysis

2. Stay focused

Successful financial advisers work hard, but they are also very focused. They cancel out all the unnecessary noise which makes them more effective in their work. They also stay focused because of the goals they eventually want to achieve.You may also see financial reports.

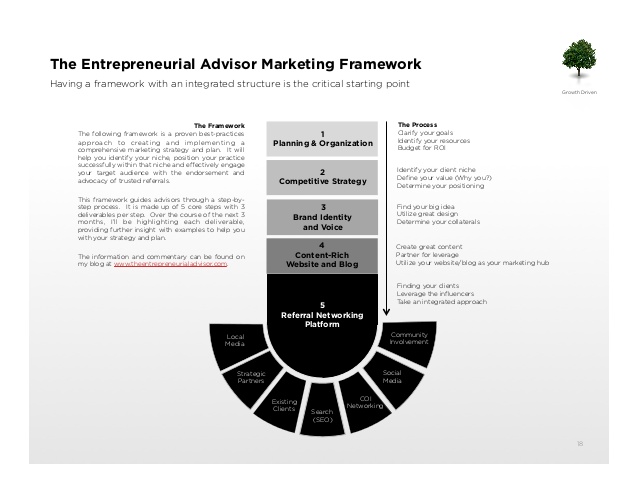

Entrepreneurial Marketing Framework Example

Advisor Marketing Success Example

Basic Financial Advisor Marketing Plan Example

3. Learning never stops

Top financial advisers have multiple designations, licenses, and take time each day practicing and studying their craft. One habit that they also possess is to read at the start of each day. This gets them into the mind-set needed to focus the rest of the day. This is very helpful as clients want their advisers who are well-read and aware of current financial issues and developments.You may also see industry analysis

4. Develop a “bedside manner”

Clients need financial advisers when they’re feeling stressed. Clients who are at ease with their advisers always result with the clients staying longer and will even refer new clients to their advisers.You may also see advertising plans.

We hope you found this article to be informative as you will be creating your own financial adviser marketing plan.