9+ Break Even Analysis Examples to Download

Every single business company’s main goal is to be profitable in order to expand and widen the scope of the business. Given that you have your marketing, operational, and strategies for your planning and preparation, how then will you specifically assess and analyze if your company is being profitable? How will you know how much is your margin before you incur a loss? In these cases, you need to have a break-even analysis. It helps you in a lot of ways including budgeting, setting targets, monitoring, creating strategies, and a lot more. Hence, you must know and understand the break-even computation and analysis. Through this article, we will provide you the necessary knowledge that you need in order to have a clear understanding of the break-even analysis. You may also see case analysis examples

In the next section, provided are several break-even analysis examples that can help you and guide you to know more about break-even analysis. You may also check out here quantitative analysis examples

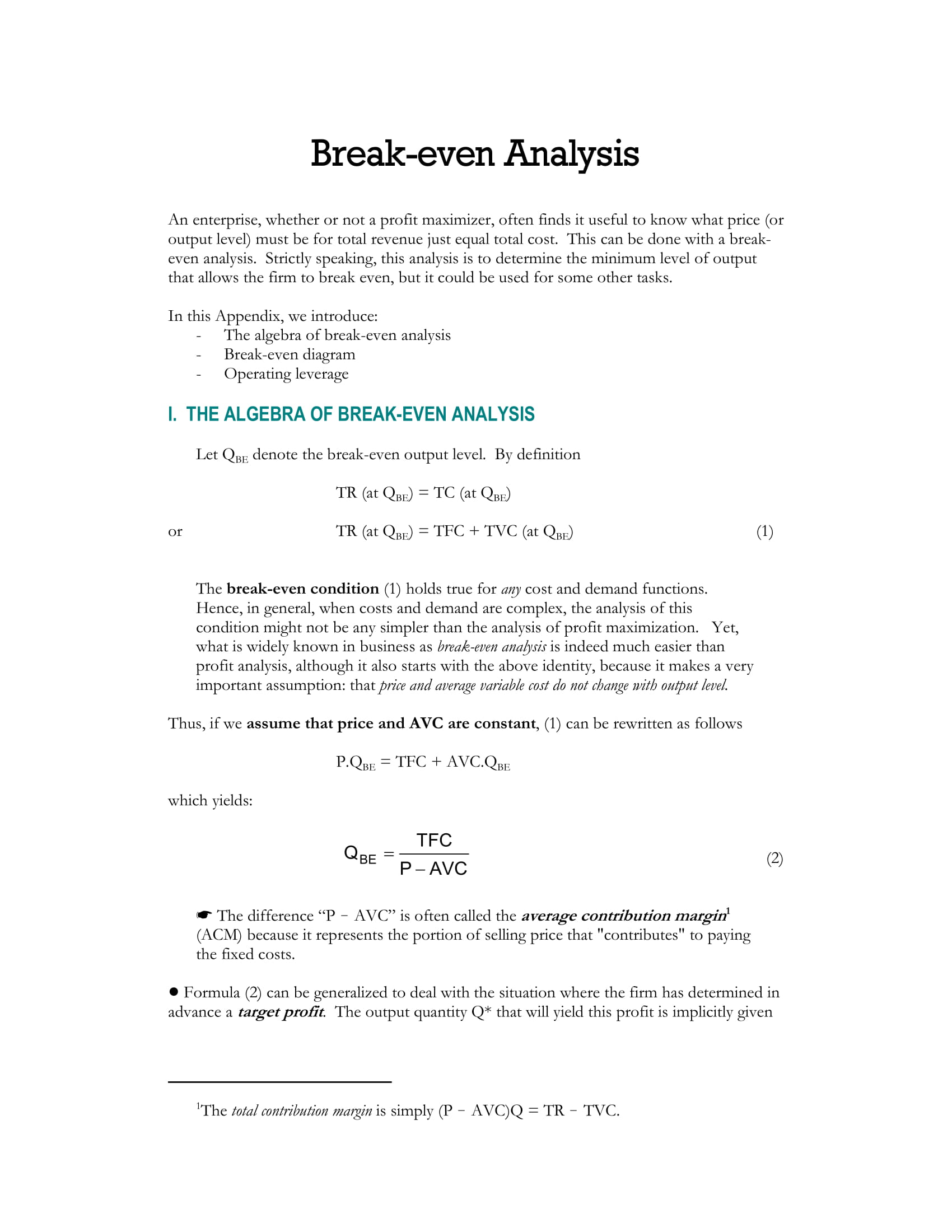

Basic Break-Even Analysis Example

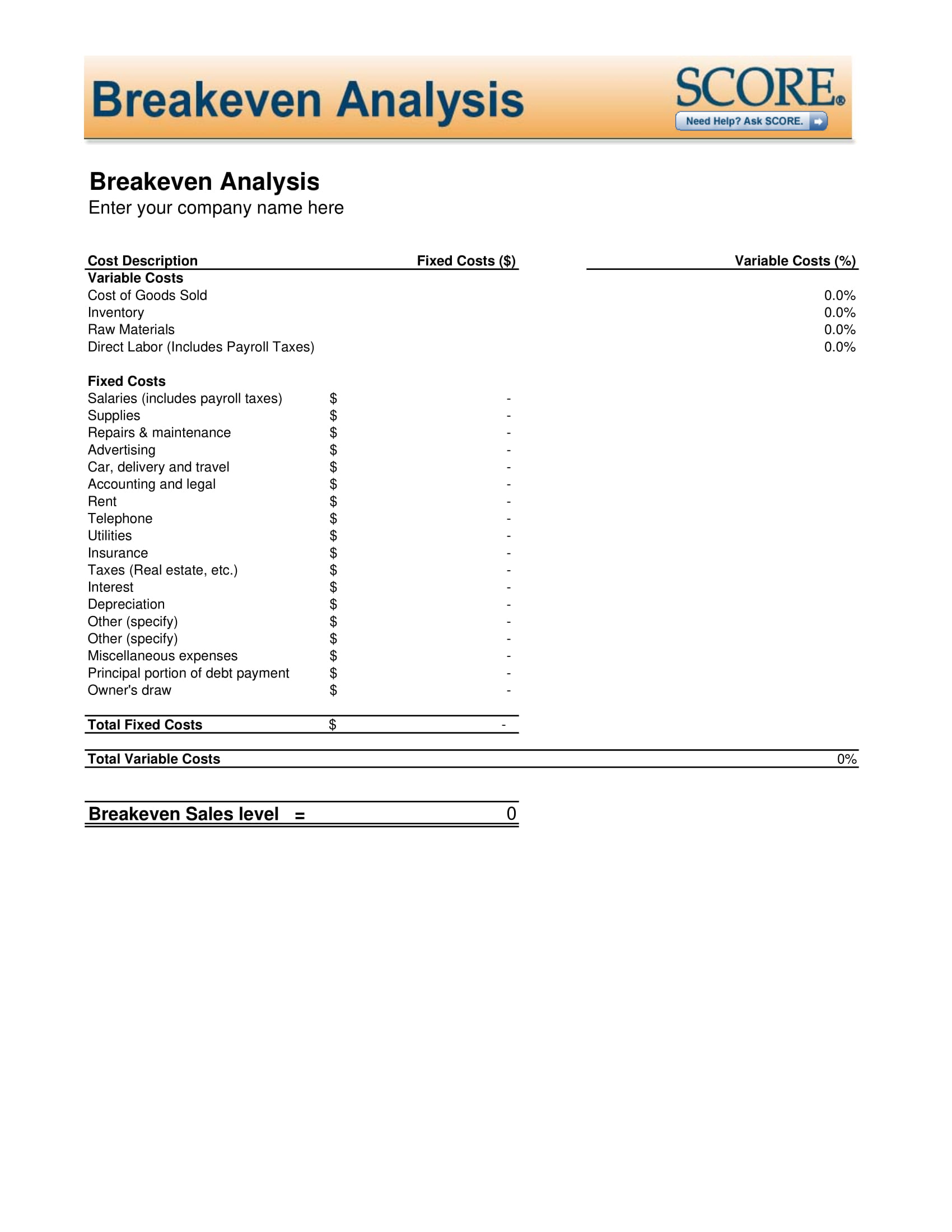

Break-Even Analysis Template Example

What Is Break-Even Point?

In simple terms, break-even point is where there is neither profit nor loss in a company’s operation. This is the result when the expenses incurred by the entity is equal to the sales. The total costs equals the total revenue. The company has simply net zero. In break-even point, it is assumed that all the costs have been paid off including the opportunity costs and capital has received the risk-adjusted, expected return. You may also see job analysis examples

In order for the company to pass the break-even point, the dollar value of sales is higher than the variable cost per unit. Simply stated, the selling price of an item must be higher than what the company has paid for it or its components and more than enough to cover the initial price they paid.

Break-Even and Cost-Volume-Profit Analysis Example

Comprehensive Break-Even Analysis Example

Concise Break-Even Analysis Example

Calculation of Break-Even Point

There are certain formulas relating to the calculation of break-even point. The formulas below may be somewhat confusing at first, but when you start to understand the whole concept, you will find yourself amazed of how you can calculate fast and accurately in terms of break-even point. You may also see hazard vulnerability analysis examples

To start, you must understand that sales (S) less costs or expenses (C) equals profit (P). Note that C can be broken down into fixed costs (FC) and variable costs (VC). In order to break even, your profit must be equal to 0. Hence, S?FC?VC=0.

This is the very basic thing that you need to keep in mind regarding break-even point. Moreover, below are some fundamental formulas that you must also understand. You may also see dust hazard analysis examples

Break-Even Point in Units

In order to calculate for the break-even point (BEP) in units (u), you must divide the total fixed costs of production by the sales price (S) per unit less the variable costs to produce the product.

BEPu=FC/(Su?VCu)

Note that when you thoroughly examine the equation, this is just the same as the basic computation displayed above only that the parts have been rearranged. Furthermore, you must know that Su?VCu is the contribution margin (CM) per unit. So, to simplify the equation, You may also see earned value analysis examples

BEPu=FC/CMu

Break-Even Point in Dollars

In the above section, it presents the calculation of the break-even point in units. On the other hand, if you want to calculate for the break-even point in dollars (d), simply multiply the sales price (SP) per unit by the BEPu.

BEPd=SPu×BEPu

Break-Even Analysis

After knowing the above equation, let us take a step further and compute for the number of units to be sold to achieve a certain level of profitability. To compute, we must divide the goal amount of profit (G) in dollars by the contribution margin per unit. Then, add back the BEPu.

No. of Units to Produce G=(Gd/CMu)+BEPu

Detailed Break-Even Analysis Example

Discussion on Break-Even Analysis Example

Where to Start

In order to start your break-even point analysis, especially if you have never conducted a break-even point analysis before, you must assess the entity’s commonly sold goods. Additionally, you must also gather several important information such as the total fixed costs that are incurred in making each product, the variable costs for each product, the sales price of the product, as well as the net profit derived from selling it. These are the first things and amount that you must secure in order complete your equation. You may also see functional behavioral analysis examples

Applying these basic information that you gathered to the formulas presented above, it is now a lot more easy for you to start your break-even point analysis.

Importance and Significance of Break-Even Analysis

As stated above, the break-even point is where your total costs equal your total revenue; hence, you incur neither profit nor loss. This concept is not only limited to economic use but also used by a lot of professionals relating to business and finance such as the entrepreneurs, accountants, financial planners, manager, and marketers, helping them in the decision-making process as well as to calculate the costs and sales in order to be profitable. You may also see force field analysis examples

Until today, break-even analysis is still widely used because of the benefit it has provided to the business people. Speaking of the importance of break-even analysis, below are several key importance and significance of break-even analysis. You may also see data analysis examples

Helps in Determining the Number of Units to be Sold

As we can see from formulas above, through the computation of break-even point, we can determine the number of units needed to be sold in order to compensate all the costs that are incurred in making the product or bringing the product to its current salable condition. Through determining the selling price for each product as well as the variable and fixed costs, you will have a full understanding of the break-even analysis. You may also see cash flow analysis examples

Aids in Budgeting and Setting Targets

We have also observed from the formulas how to reach a break-even point in your product. Accordingly, when you know at which point and how much you are going to sell in order to break even, you can easily set budgets, which is important in making desired profits. Moreover, break-even analysis can also be used in setting realistic targets for the business because you know at which point you become profitable; hence, you can use this knowledge to set benchmarks or targets for your entity. You may also see business systems analysis examples

Helps in the Calculation of the Margin of Safety

Your break-even analysis is also of great help in the calculation of your margin of safety, which is the difference between actual or budgeted sales and the level of break-even sales. It can be calculated by subtracting the current level of sales less the break-even point and then dividing it by the selling price per unit. In instances when there is a recession or an economic downturn, the sales of your company may tend to decline. Hence, with the help of the break-even analysis, it is easy for you to determine the minimum level of sales required so you can still make profits. You may also see vendor analysis examples

Helps in Cost Control and Monitoring

Since it is clearly presented in the equation the fixed and variable costs, business owner can now monitor and assess the changes to these costs with the help of break-even analysis. This also helps in determining the extent of changes in costs which affects the profitability as well as the break-even point. You may also see training needs analysis examples

Aids in Devising a Pricing Strategy

Now that we have understood how the break-even point is computed, we can easily devise a pricing strategy for your products because you already know that a certain change in the selling price can affect the break-even point, thus affecting your income. In general, break-even analysis helps people dealing with businesses to make the right decisions toward creating a pricing strategy that would work given the information from their break-even analysis. You may also see business case analysis examples

Lengthy Explanation on Break-Even Analysis Example

Managerial Economics Break-Even Analysis Example

Well-Discussed Break-Even Analysis Example

Break-Even Analysis Assumptions and Limitations

Break-even analysis has proven to be useful by many people in different industries in different ways. More and more people are adopting this concept as this can greatly help them improve their business just as presented in the previous section.

However, just like any other concepts, the break-even analysis has some assumptions and limitations, which is equally its strengths and weakness. Although break-even analysis is beneficial mainly in determining how to increase the profit as well as the specific quantity needed to get pass the break-even point, certain assumptions and limitation may prove that there are other factors that may affect the operation in the real world. You may also see job task analysis examples

On a positive note, break-even analysis are still recommended and used by professionals because although it has limitations, it can still be a functional and practical approach.

Below are the basic assumptions as well as the limitations in the use of break-even analysis.

Assumptions

- The first assumption is that all costs can be categorized as fixed or variable costs.

- Total fixed costs remain the same for all output levels.

- Total variable costs vary proportionately with output level. Hence, the variable cost per unit will not change.

- Sale price per unit remains the same for each output level.

- Costs and revenue act in a linear manner within a relevant range.

- Other than sales volume, no other factor can affect costs and sales revenue.

- It is also assumed that the analysis relates to businesses producing one product only or a constant product mix.

- The technology, production methods, and efficiency remain the same, consistently working in a good condition and producing same quality output.

- Inventory levels are also expected to remain constant.

- Lastly, it has also to be assumed that there are no inventories at beginning or at end of the accounting period.

Limitations

- Because only the variable and fixed costs are considered, semi-variable costs, which is also a kind of cost that usually exists in every business, are ignored and are taken into account.

- Fixed costs may vary if output increases or decreases substantially.

- There might be changes in per unit variable costs when you consider various reasons such as bulk buying discounts, overtime, among others. These costs are being ignored when computing for the break-even point.

- It might also be possible that the sales price may have to be reduced to have more sales or may be increased to cover increased costs.

- Selling prices and variable costs per unit may differ at different output levels.

- This computation does not also consider various inflation rate and other external factors in economic state that may also affect sales volume.

- There might be changes in the practice for the technology or even the production methods.

- When there are changes in technology or production method, there might also be the possibility of any increase in inventory levels, when production volume exceeds sales volume, or de-stocking, when sales volume exceeds the production levels.

Last Say

Since all business companies need to be profitable to make the business grow, calculating your break-even point is important in order for you to make a target sales and to determine how much you must sell so you won’t incur a loss. Simply, break-even point is the point where there is no profit or loss, where the expenses you incur are in the same amount as the revenue you have earned. You may also see failure analysis examples

Finally, break-even analysis is important especially in determining the number of units to be sold, in budgeting and setting targets, in the calculation of the margin of safety, in cost control and monitoring, and in devising a pricing strategy. You may also see situation analysis examples

Never miss this opportunity to check out the examples of break-even analysis as presented in the above section.

9+ Break Even Analysis Examples to Download

Every single business company’s main goal is to be profitable in order to expand and widen the scope of the business. Given that you have your marketing, operational, and strategies for your planning and preparation, how then will you specifically assess and analyze if your company is being profitable? How will you know how much is your margin before you incur a loss? In these cases, you need to have a break-even analysis. It helps you in a lot of ways including budgeting, setting targets, monitoring, creating strategies, and a lot more. Hence, you must know and understand the break-even computation and analysis. Through this article, we will provide you the necessary knowledge that you need in order to have a clear understanding of the break-even analysis. You may also see case analysis examples

In the next section, provided are several break-even analysis examples that can help you and guide you to know more about break-even analysis. You may also check out here quantitative analysis examples

Basic Break-Even Analysis Example

wright.edu

Details

File Format

PDF

Size: 336.6 KB

Break-Even Analysis Template Example

fitsmallbusiness.com

Details

File Format

PDF

Size: 46.8 KB

What Is Break-Even Point?

In simple terms, break-even point is where there is neither profit nor loss in a company’s operation. This is the result when the expenses incurred by the entity is equal to the sales. The total costs equals the total revenue. The company has simply net zero. In break-even point, it is assumed that all the costs have been paid off including the opportunity costs and capital has received the risk-adjusted, expected return. You may also see job analysis examples

In order for the company to pass the break-even point, the dollar value of sales is higher than the variable cost per unit. Simply stated, the selling price of an item must be higher than what the company has paid for it or its components and more than enough to cover the initial price they paid.

Break-Even and Cost-Volume-Profit Analysis Example

acornlive.com

Details

File Format

PDF

Size: 259.7 KB

Comprehensive Break-Even Analysis Example

georgebrown.ca

Details

File Format

PDF

Size: 120.6 KB

Concise Break-Even Analysis Example

businessplantool.org

Details

File Format

PDF

Size: 265 KB

Calculation of Break-Even Point

There are certain formulas relating to the calculation of break-even point. The formulas below may be somewhat confusing at first, but when you start to understand the whole concept, you will find yourself amazed of how you can calculate fast and accurately in terms of break-even point. You may also see hazard vulnerability analysis examples

To start, you must understand that sales (S) less costs or expenses (C) equals profit (P). Note that C can be broken down into fixed costs (FC) and variable costs (VC). In order to break even, your profit must be equal to 0. Hence, S?FC?VC=0.

This is the very basic thing that you need to keep in mind regarding break-even point. Moreover, below are some fundamental formulas that you must also understand. You may also see dust hazard analysis examples

Break-Even Point in Units

In order to calculate for the break-even point (BEP) in units (u), you must divide the total fixed costs of production by the sales price (S) per unit less the variable costs to produce the product.

BEPu=FC/(Su?VCu)

Note that when you thoroughly examine the equation, this is just the same as the basic computation displayed above only that the parts have been rearranged. Furthermore, you must know that Su?VCu is the contribution margin (CM) per unit. So, to simplify the equation, You may also see earned value analysis examples

BEPu=FC/CMu

Break-Even Point in Dollars

In the above section, it presents the calculation of the break-even point in units. On the other hand, if you want to calculate for the break-even point in dollars (d), simply multiply the sales price (SP) per unit by the BEPu.

BEPd=SPu×BEPu

Break-Even Analysis

After knowing the above equation, let us take a step further and compute for the number of units to be sold to achieve a certain level of profitability. To compute, we must divide the goal amount of profit (G) in dollars by the contribution margin per unit. Then, add back the BEPu.

No. of Units to Produce G=(Gd/CMu)+BEPu

Detailed Break-Even Analysis Example

static1.squarespace.com

Details

File Format

PDF

Size: 843.7 KB

Discussion on Break-Even Analysis Example

faculty.msb.edu

Details

File Format

PDF

Size: 96.3 kb

Where to Start

In order to start your break-even point analysis, especially if you have never conducted a break-even point analysis before, you must assess the entity’s commonly sold goods. Additionally, you must also gather several important information such as the total fixed costs that are incurred in making each product, the variable costs for each product, the sales price of the product, as well as the net profit derived from selling it. These are the first things and amount that you must secure in order complete your equation. You may also see functional behavioral analysis examples

Applying these basic information that you gathered to the formulas presented above, it is now a lot more easy for you to start your break-even point analysis.

Importance and Significance of Break-Even Analysis

As stated above, the break-even point is where your total costs equal your total revenue; hence, you incur neither profit nor loss. This concept is not only limited to economic use but also used by a lot of professionals relating to business and finance such as the entrepreneurs, accountants, financial planners, manager, and marketers, helping them in the decision-making process as well as to calculate the costs and sales in order to be profitable. You may also see force field analysis examples

Until today, break-even analysis is still widely used because of the benefit it has provided to the business people. Speaking of the importance of break-even analysis, below are several key importance and significance of break-even analysis. You may also see data analysis examples

Helps in Determining the Number of Units to be Sold

As we can see from formulas above, through the computation of break-even point, we can determine the number of units needed to be sold in order to compensate all the costs that are incurred in making the product or bringing the product to its current salable condition. Through determining the selling price for each product as well as the variable and fixed costs, you will have a full understanding of the break-even analysis. You may also see cash flow analysis examples

Aids in Budgeting and Setting Targets

We have also observed from the formulas how to reach a break-even point in your product. Accordingly, when you know at which point and how much you are going to sell in order to break even, you can easily set budgets, which is important in making desired profits. Moreover, break-even analysis can also be used in setting realistic targets for the business because you know at which point you become profitable; hence, you can use this knowledge to set benchmarks or targets for your entity. You may also see business systems analysis examples

Helps in the Calculation of the Margin of Safety

Your break-even analysis is also of great help in the calculation of your margin of safety, which is the difference between actual or budgeted sales and the level of break-even sales. It can be calculated by subtracting the current level of sales less the break-even point and then dividing it by the selling price per unit. In instances when there is a recession or an economic downturn, the sales of your company may tend to decline. Hence, with the help of the break-even analysis, it is easy for you to determine the minimum level of sales required so you can still make profits. You may also see vendor analysis examples

Helps in Cost Control and Monitoring

Since it is clearly presented in the equation the fixed and variable costs, business owner can now monitor and assess the changes to these costs with the help of break-even analysis. This also helps in determining the extent of changes in costs which affects the profitability as well as the break-even point. You may also see training needs analysis examples

Aids in Devising a Pricing Strategy

Now that we have understood how the break-even point is computed, we can easily devise a pricing strategy for your products because you already know that a certain change in the selling price can affect the break-even point, thus affecting your income. In general, break-even analysis helps people dealing with businesses to make the right decisions toward creating a pricing strategy that would work given the information from their break-even analysis. You may also see business case analysis examples

Lengthy Explanation on Break-Even Analysis Example

ebooks.bharathuniv.ac.in

Details

File Format

PDF

Size: 745.3 KB

Managerial Economics Break-Even Analysis Example

epgp.inflibnet.ac.in

Details

File Format

PDF

Size: 890.8 KB

Well-Discussed Break-Even Analysis Example

ag.tennessee.eduell

Details

File Format

PDF

Size: 44 KB

Break-Even Analysis Assumptions and Limitations

Break-even analysis has proven to be useful by many people in different industries in different ways. More and more people are adopting this concept as this can greatly help them improve their business just as presented in the previous section.

However, just like any other concepts, the break-even analysis has some assumptions and limitations, which is equally its strengths and weakness. Although break-even analysis is beneficial mainly in determining how to increase the profit as well as the specific quantity needed to get pass the break-even point, certain assumptions and limitation may prove that there are other factors that may affect the operation in the real world. You may also see job task analysis examples

On a positive note, break-even analysis are still recommended and used by professionals because although it has limitations, it can still be a functional and practical approach.

Below are the basic assumptions as well as the limitations in the use of break-even analysis.

Assumptions

The first assumption is that all costs can be categorized as fixed or variable costs.

Total fixed costs remain the same for all output levels.

Total variable costs vary proportionately with output level. Hence, the variable cost per unit will not change.

Sale price per unit remains the same for each output level.

Costs and revenue act in a linear manner within a relevant range.

Other than sales volume, no other factor can affect costs and sales revenue.

It is also assumed that the analysis relates to businesses producing one product only or a constant product mix.

The technology, production methods, and efficiency remain the same, consistently working in a good condition and producing same quality output.

Inventory levels are also expected to remain constant.

Lastly, it has also to be assumed that there are no inventories at beginning or at end of the accounting period.

Limitations

Because only the variable and fixed costs are considered, semi-variable costs, which is also a kind of cost that usually exists in every business, are ignored and are taken into account.

Fixed costs may vary if output increases or decreases substantially.

There might be changes in per unit variable costs when you consider various reasons such as bulk buying discounts, overtime, among others. These costs are being ignored when computing for the break-even point.

It might also be possible that the sales price may have to be reduced to have more sales or may be increased to cover increased costs.

Selling prices and variable costs per unit may differ at different output levels.

This computation does not also consider various inflation rate and other external factors in economic state that may also affect sales volume.

There might be changes in the practice for the technology or even the production methods.

When there are changes in technology or production method, there might also be the possibility of any increase in inventory levels, when production volume exceeds sales volume, or de-stocking, when sales volume exceeds the production levels.

Last Say

Since all business companies need to be profitable to make the business grow, calculating your break-even point is important in order for you to make a target sales and to determine how much you must sell so you won’t incur a loss. Simply, break-even point is the point where there is no profit or loss, where the expenses you incur are in the same amount as the revenue you have earned. You may also see failure analysis examples

Finally, break-even analysis is important especially in determining the number of units to be sold, in budgeting and setting targets, in the calculation of the margin of safety, in cost control and monitoring, and in devising a pricing strategy. You may also see situation analysis examples

Never miss this opportunity to check out the examples of break-even analysis as presented in the above section.