16+ Cash Flow Analysis Examples to Download

Cash flow is the amount of money that goes in to a business and the amount of money that goes out. It’s basically the amount of money you earn on a monthly operation, minus your bills, expenses, capital, and other things you need to pay with that money. You may also see financial analysis examples.

Of course, every sane businessman’s goal is to still have an ample amount of money left after all that numerous deductions. So if you want to keep your wallet full, analyzing your cash flow is a necessity, and knowing exactly how to do that is a required skill in the field. You may also see cash flow analysis for small businesses.

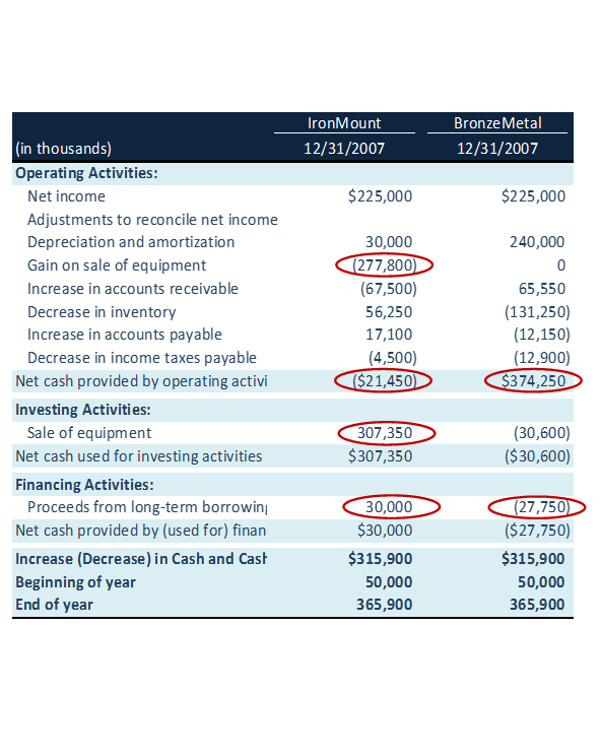

Cash Flow Analysis Example

Simple Cash Flow Analysis Example

Global Cash Flow Analysis Template

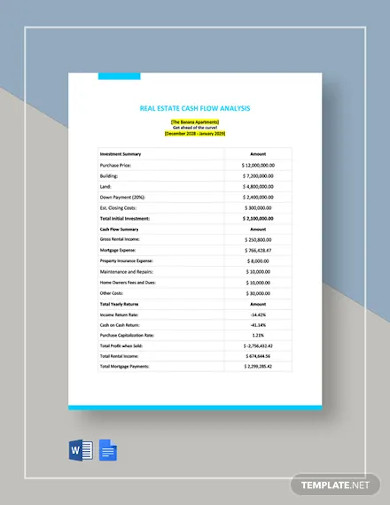

Real Estate Cash Flow Analysis Template

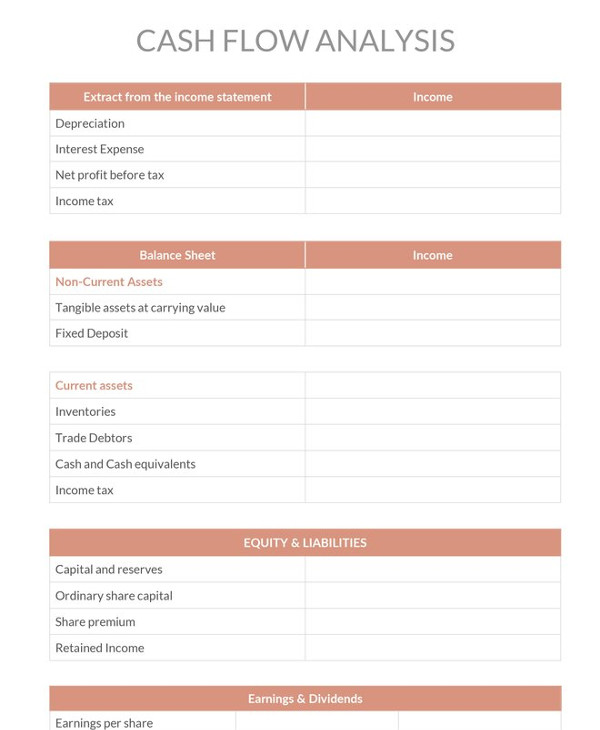

Cash Flow Analysis Template

Cash Flow Analysis Template

Cash Flow Analysis Example

Understanding Cash Flows

The amount of money that goes in, or your cash inflow, is your business’s lifeblood. Your inflow’s main sources may include payments from customers, receipt of a loan, monetary infusion from an investor, or the interest on savings and other investments. You may also see feasibility analysis examples.

This cash is important because you will need it to pay for things that will help you keep your business running, such as expenses on stock or raw materials, your employees’ salaries, rent, maintenance, and other operating expenses. You may also see hospital SWOT analysis examples.

Regardless of the variables in your equation, you need to focus on one thing: positive cash flow. Positive cash flow means that your business is running smoothly in terms of finances and profits. High positive cash flow, which is, unquestionably, even better, will allow you to make new investments, hire more employees, open another branch in a different location, and further grow your business. You may also see impact analysis examples.

However, running a business isn’t as easy as receiving money, paying your bills with it, and ending up with enough for personal use. If such a thing as positive cash flow exists, naturally, it has a counterpart.

Negative cash flow is what you call a business with more money paying out than coming in. At best, this would mean that you are simply falling behind on your finances. But, worst case scenario has bankruptcy written all over it. If you will not be able to balance out the money that goes in and out of your business, you may be nearing the end of your store. You may also see organizational analysis examples.

Conducting a cash flow analysis will help you understand where you currently are in terms of money. It will let you identify the current financial status of your business. From this knowledge, you will be able to understand the next steps you can take to improve your current state. You may also see regression analysis examples.

Cash Flow Statement Analysis Example

Cash Flow Analysis Sample

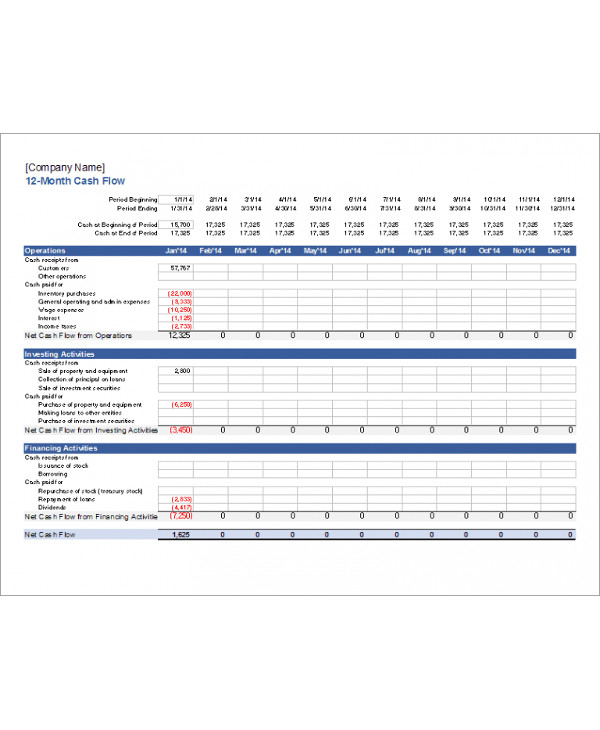

12-Month Cash Flow Analysis

Working Toward a Positive Cash Flow

Positive cash flow is everybody’s goal. Which is why we will describe how to achieve it for your business. Let’s start by understanding the two main factors that drive positive cash flow: organization and planning.

Set your baseline. You can do this by looking at the cash you have in hand, money which you have used to invest in the business, the money in your business’s bank account, the loans you’ve received, and an investment from a partner.

If you’re just starting your business, it’s easier to keep track of your cash flow. Simply record everything you had to pay for to open. This may include incorporation fees, legal and accounting, licenses, permits, construction or remodeling, security deposit on a rental agreement or purchasing property, marketing materials, signage, initial inventory or supplies, fixtures, office supplies, furniture, and equipment. You may also see investment analysis examples.

Once you have the numbers down, proceed by determining your cash source every month. Aside from sales, it can come from loans that you are sure will come in at a certain date, and even investments. With a predicted amount of your monthly income, you can budget your expenses and bills according to the amount you earn. You may also fault tree analysis examples.

If you are new to the business, you might want to be humble with your financial predictions. It’s better to come up with more at the end of the month, instead of coming up with less. If you’ve had your business for quite some time, on the other hand, you can refer to your sales history for clearer, more precise numbers. Although your records can’t give you the exact profit you will have every month, it will give you a rough estimation as long as things go the way they always have for you. You may also see financial health analysis examples.

The final step is to assess your monthly expenses. This may include your rent or mortgage, insurance, advertising, marketing, travel, utilities, payroll, inventory, taxes, loan payments, working capital, and personal compensation for all of the hard work you are putting into this.

It may sound easy, creating a list of your bills, but it’s actually a little trickier than you might think. Make sure that you are honest and objective throughout the whole process, unless you want to end up with a surprise bill for which you didn’t prepare any money. You may also see internal audit swot analysis.

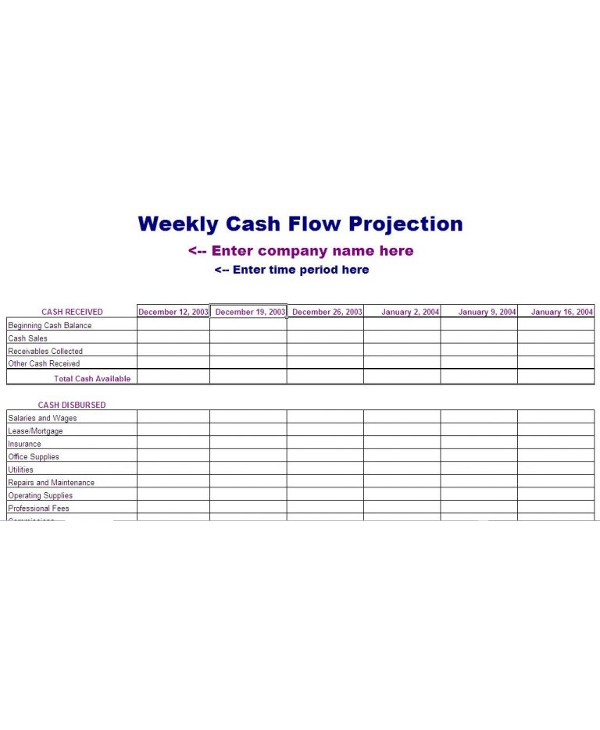

Weekly Cash Flow Analysis Projection

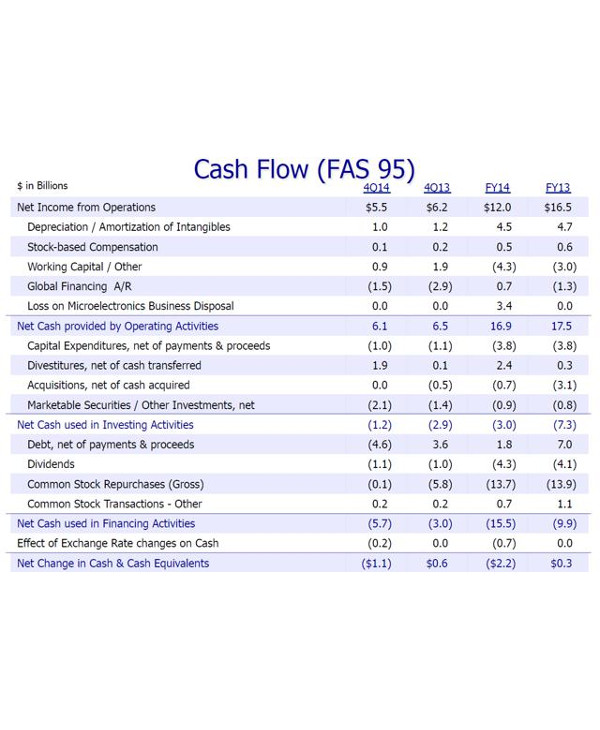

IBM’s 2014 Cash Flow Analysis

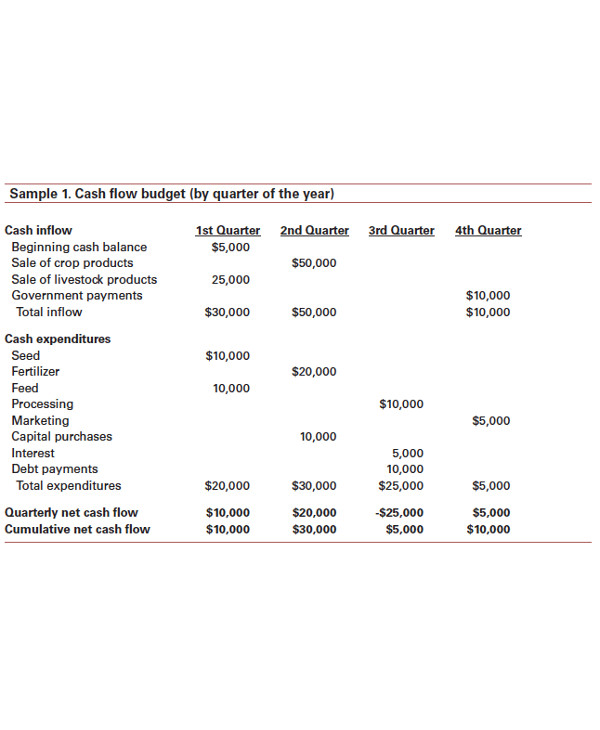

Cash Flow Budget Analysis

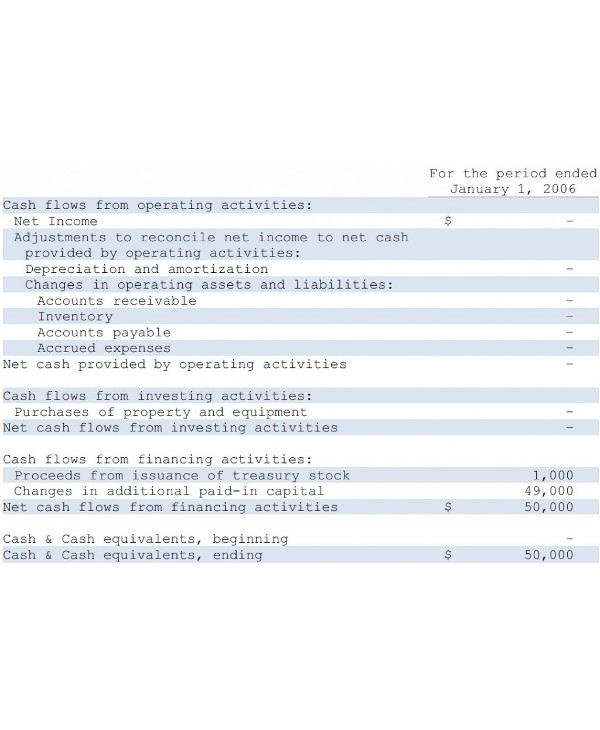

Preparing Your Cash Flow Statement

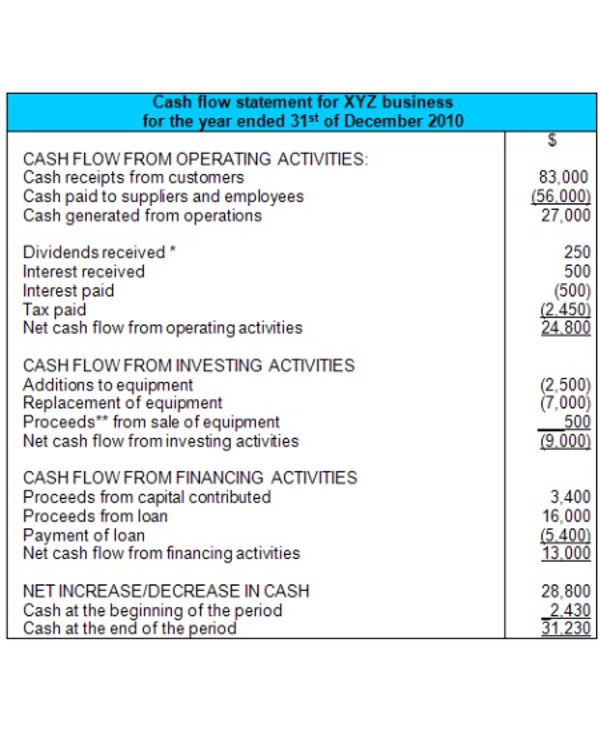

A cash flow analysis cannot be performed without a cash flow statement. It is a tool that will allow you to track the amount of money that you have available in a given period of time. It is an official financial statement that will show the changes in the balance sheet accounts and breaks down to three main sections: operating activities, investing activities, and financing activities. You may also see manager swot analysis examples.

It is a useful analytical tool that can help a company determine its ability, in simple words, to pay bills. It can provide further information on the company’s assets and liabilities, while effectively unifying different accounting methods that may be utilized by different company firms, which is effective in eliminating allocations.

it is considered the primary and standard financial statement used in business operations. By creating one, a business illustrates the amount of cash that it has generated during the reporting period, while detailing the purpose of every penny that has been used during that time. This can help the management see where the money is coming from, and where it is going. Without it, tracking the amount of money a business has to finance its continued operations can be trickier than it already is. You may also see operational analysis examples.

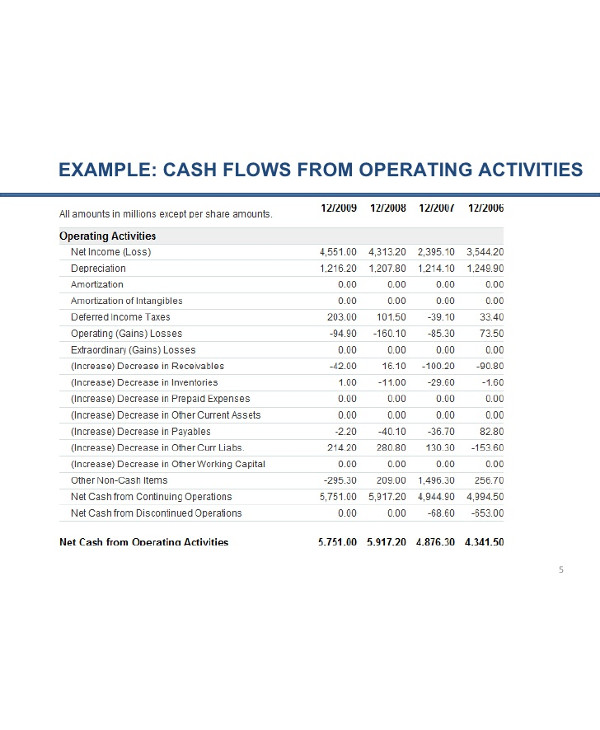

1. Cash Flow from Operating Activities.

This cash flow includes money that are directly related to your core business operations—both inflows and outflows. This may include the production, sales, and delivery of company products, purchasing raw materials, building inventory, advertising, and shipping of products. To properly keep track of the cash you have, and to simultaneously perform an accurate cash flow analysis, you will need to get a more detailed account of your expenses. You may also see behavior analysis overview and examples.

Every action that involves selling products or services will be reported here, along with accounts payable, accounts receivable, prepaid insurance, and unearned revenues. With all these information, you will have a good grasp on your current assets and current liabilities.

2. Cash Flow from Investment Activities.

As its name suggests, this section will focus solely on all of your investment activity, which means that all of your company’s investments will be listed under this category. Purchasing or selling a property or equipment will also be detailed here. Long-term investments, company vehicles, capital accounts for equipment, land, and building will also be reviewed for this section. You may also see industry analysis examples.

Even the slightest purchase, such as a new grill or oven for your restaurant business, or a new piece of furniture for your hotel will qualify under Investment Activities. Since the equipment you purchase for your business’s development is also a form of investment, it will be reported in this section as well.

3. Cash Flow from Financing Activities.

The third and last section of the cash flow statement will list the company’s financing activities. Purchasing bonds and stocks, and dividend payments fall under this category. Your capital payment, paid-in capital accounts, bonds payable, and retained earnings may also be found here. For small businesses who sought for help from The Small Business Administration, the loan will be reported here. You may also see competitive analysis examples.

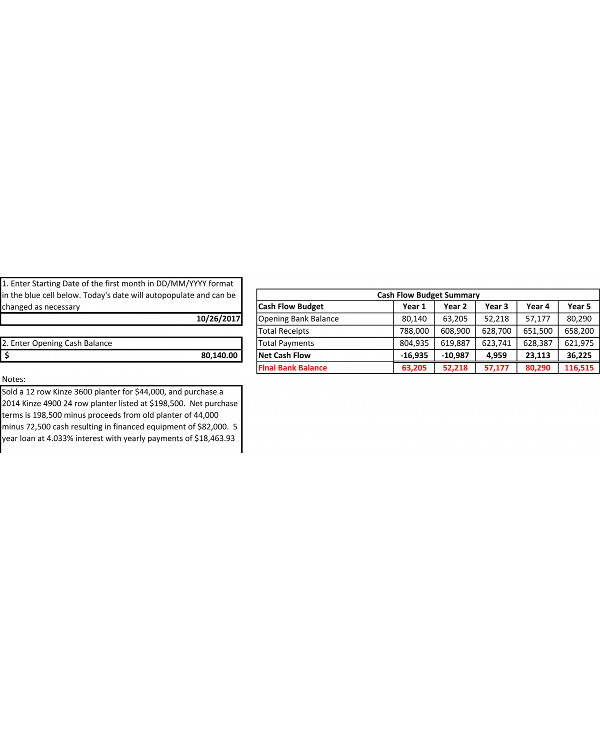

Cash Flow Analysis Budget Summary

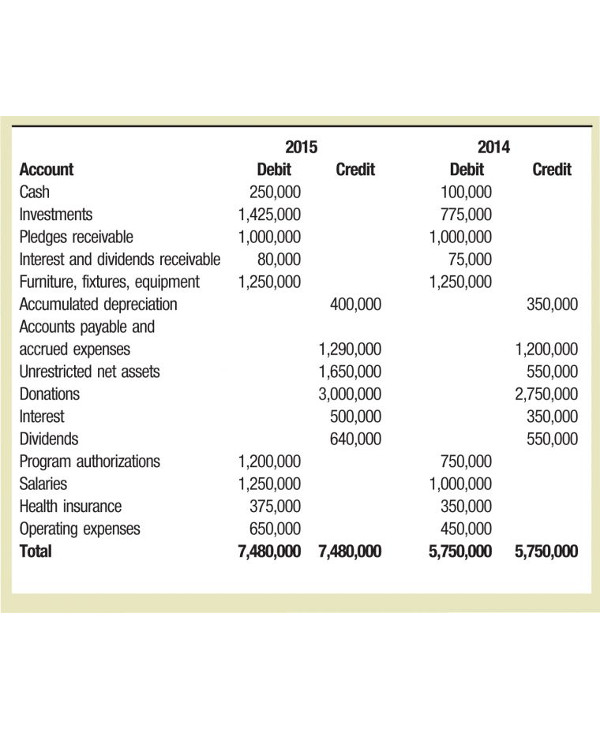

Direct Method of a Cash Flow Analysis

Conducting a Cash Flow Analysis

Since we have already explored the technicalities involved in preparing a cash flow statement, we can now proceed to discussing strategies that can help improve a business’s cash flow management.

1. Cash Flow from Operations

Aim for a positive cash flow from your operations. Unless you are the owner of a nonprofit organization, naturally, your goal is to earn profit for your business. A few periods of low or negative cash flow in your operations is acceptable, seeing that you have a definite plan to increase your amount of inventories. However, for your small business venture to be sustainable, you will need to maintain a series of positive cash flows. Too many simultaneous negative cash flows may spell trouble for your business. You may also see sales analysis.

Keep tabs on your account receivable. Having accounts receivable is fine considering that your clients pay their credit on time. But, if they don’t, this can offer a major cash crunch for you. Make sure that you have the appropriate billing and collections procedures in place, especially if your accounts receivable are increasing over time. You may also see performance analysis report examples.

2. Loan Advance

Plan ahead for money crunches. There will often come a time in your business’s life wherein you will have to secure some kind of loan to help you bridge those inevitable financial crisis.

Decide on an appropriate form of financing. Applying for a loan in itself is already a risk, since there is always the possibility that the debt can only lead you in a deeper financial difficulty. So instead of jumping into the first lender you find, first, think about the exact reason you need the loan. Do you need it for a small fund shortage that you can pay back in a few weeks, or is the money intended to cover a shortfall caused by, say, a need to renovate, or to gather inventory for a seasonal demand, or for temporary hiring? These are just a few of the factors you need to consider before applying for that loan. You may also see free analysis examples.

3. Loan Payment

Develop a strong history of payment to lenders. Try to create a good image in terms of paying for your loans. By having records of being a consistent payer to your lenders, you will have a strong evidence that can back you up should you need another loan with a higher limit for your business. Try to set a target repayment period and stick to it as much as you can. You may also see statement analysis.

4. Miscellaneous Cash Inflow

Understand your local market. By having a precise and consistent pulse on market trends, you will have more accurate pricing estimates that will allow you to better negotiate the next time that you have to sell your products. You may also see data analysis report examples.

5. Ending Cash Flow

Surplus isn’t always the best. Every business’s aim, as we’ve mentioned so many times already, is to have a positive balance in their cash flow. However, if this balance is aggressively growing, yet left unused for investing activities, this may be a sign that your surplus isn’t being used to grow your small business. You need money to make money, which is why a capital is needed. If you do not use your surplus to fuel your business with tactical purchases of equipment or other assets, you may just be wasting the advantage that comfortable cash flow is offering you. Use your cash flow to make proactive steps to maintain a sustainable operation, and grab every opportunity you can find for the growth of your business. You may also see critical analysis examples.

Cash Flow from Operating Activities

Cash Flow Statement Example

What Comes After a Cash Flow Analysis?

A cash flow analysis must be conducted at least once a month. However, if you are experiencing financial issues, or if you are in a rather unpredictable industry, you may be inclined to perform a cash flow analysis once a week. The more often you have one, and the longer you do so, the more you will realize that the results are just a series of patterns and predictions that you can use to learn more about your operations. You may also see gap analysis examples.

For example, you may discover that your cash flow is positive most of the time, but it regularly falls during the third week of every month. Unfortunately, your bills and payments are due every fourth week of the month. With the crisis you experienced the week prior, you will find yourself short of cash. This can lead to late payments that can hurt your business credit rating and your reputation with suppliers. You may also see Vendor Analysis Examples.

This is just one of the issues you can identify with a cash flow analysis. Now that you have knowledge of it and, possibly, of many other important matters, you can start concocting solutions to keep them from happening again the next time. You may also see cost benefit analysis examples.

Creating and conducting a cash flow analysis may seem intimidating and time-consuming at first, but once you’ve done it and experienced its positive results, you’ll question how your business ever survived without it. You may also see cluster analysis examples.