13+ Proof of Income Letter Examples to Download

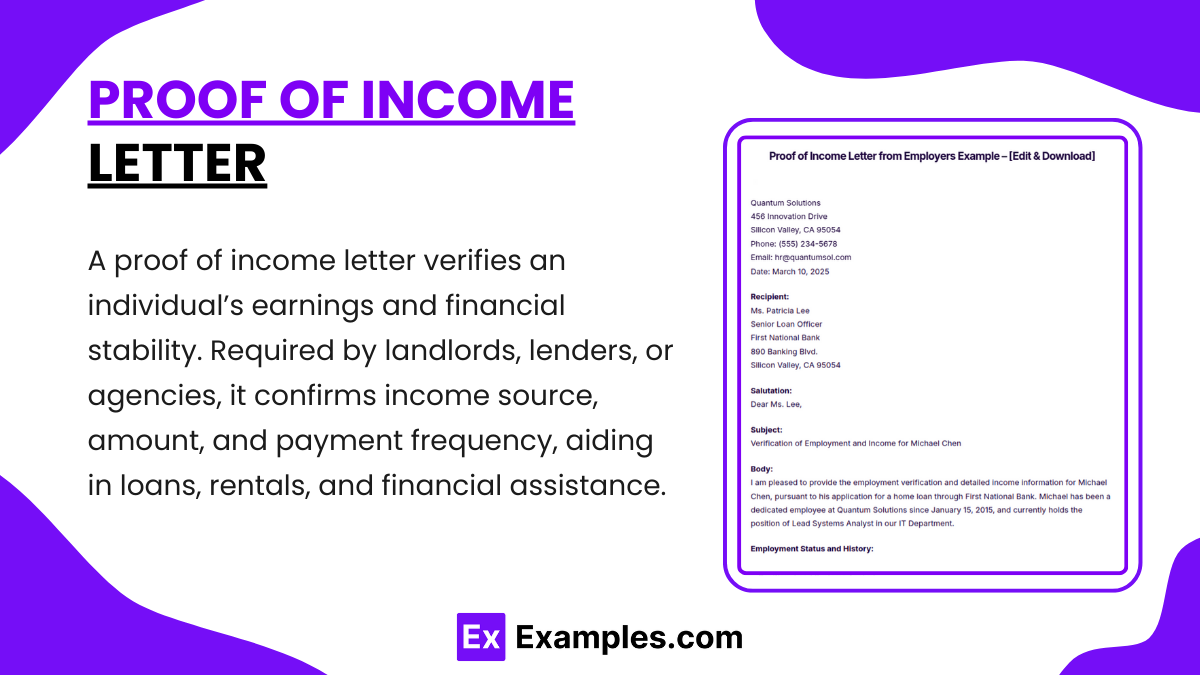

A proof of income letter is an essential document used to verify an individual’s earnings and financial stability. Often required by landlords, lenders, or government agencies, this letter serves as a formal statement of your income, whether you’re an employee, freelancer, or business owner. It details your salary or wages, the frequency of payments, and the source of income, providing reassurance of your ability to meet financial obligations. A clear and concise proof of income letter can streamline processes such as securing loans, renting properties, or obtaining financial assistance, making it a crucial tool in financial dealings

What is Proof of Income Letter?

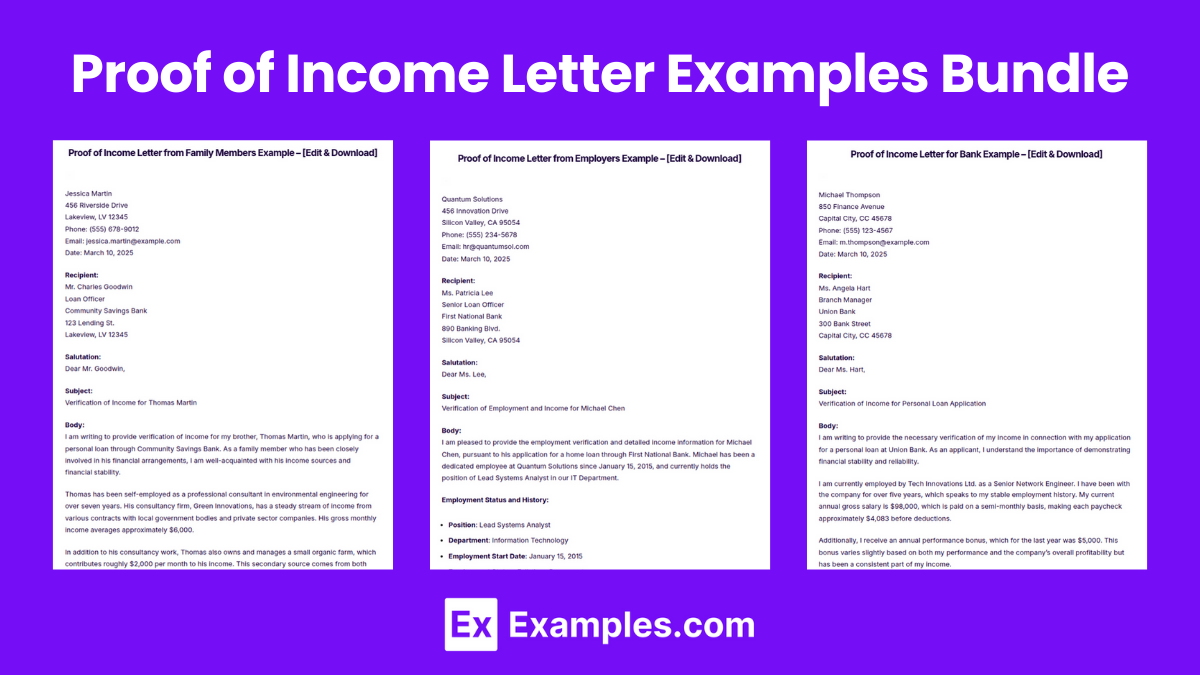

Proof of Income Letter Examples Bundle

Proof of Income Letter Format

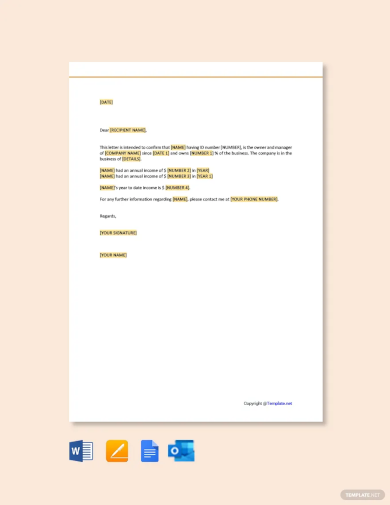

Header

Start with your name, address, and contact information at the top of the letter. Below this, write the date and the recipient’s name and address.

Salutation

Address the recipient formally, such as “Dear [Name]” or “To Whom It May Concern,” depending on how formal you need to be.

Subject

Briefly state the purpose of the letter. Mention that you are providing proof of your income as requested.

Body

Describe your employment including job title, employer’s name, and duration of employment.

State your total income before taxes, payment frequency (weekly, biweekly, monthly), and payment method (check, direct deposit).

Mention any additional sources of income, such as freelance work or dividends, if applicable.

Conclusion

Reiterate that the information provided is accurate and offer to provide further documentation or clarification if needed.

Closing

End with a formal closing, such as “Sincerely,” followed by your signature and printed name.

Attachments

List any documents you are including with the letter, such as pay stubs or tax returns.

Proof of Income Letter Example

Proof of Income Letter Examples

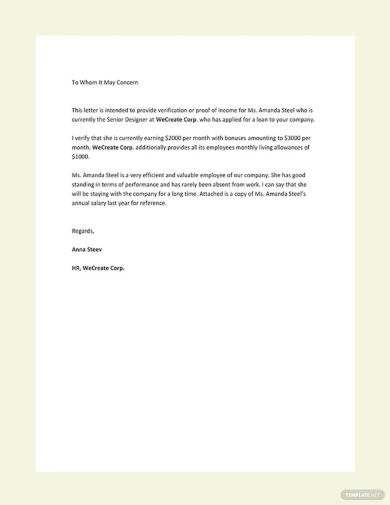

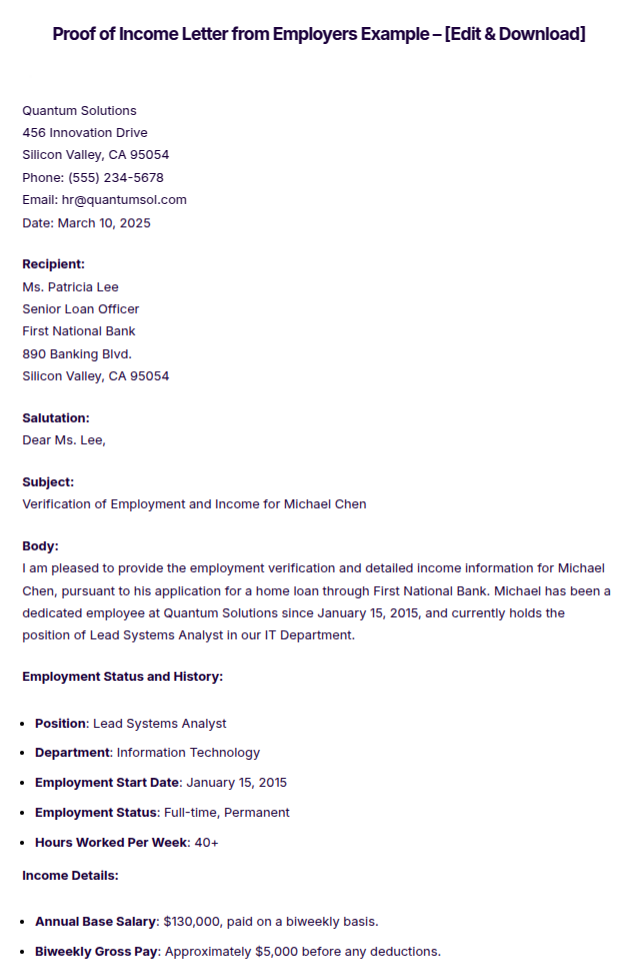

Proof of Income Letter from Employers

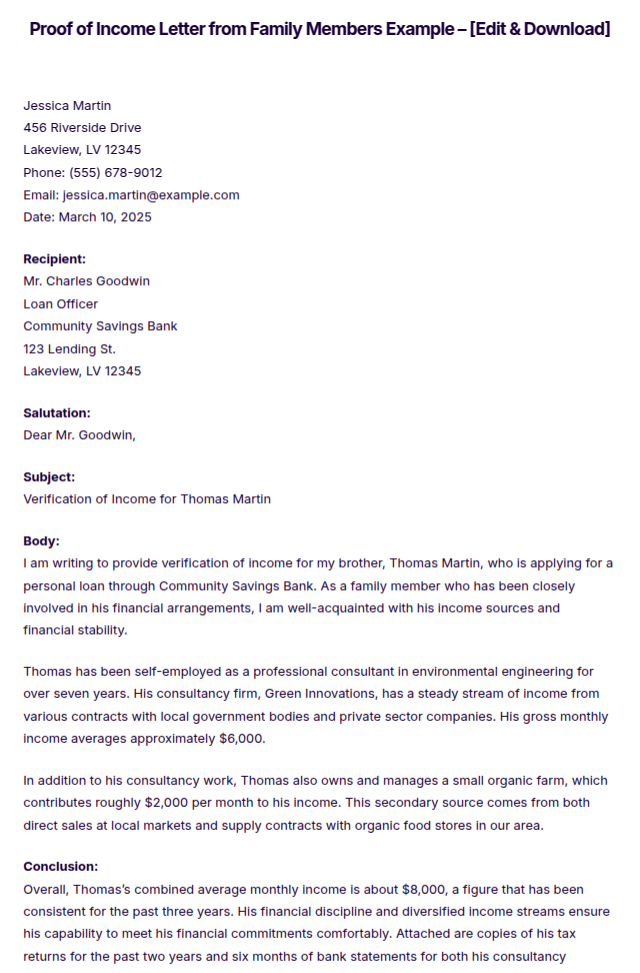

Proof of Income Letter from Family Members

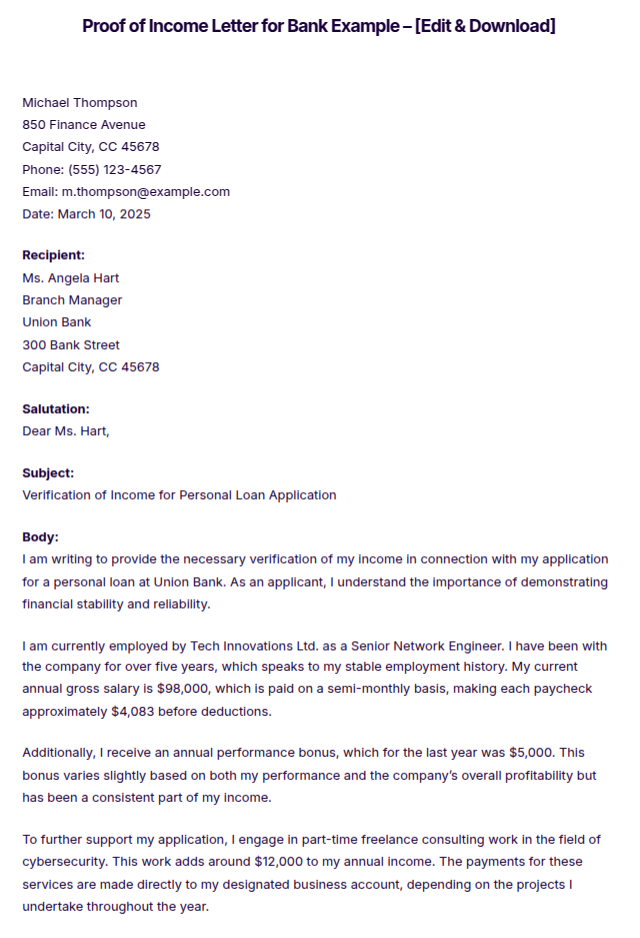

Proof of Income Letter for Bank

More Examples on Proof of Income Letter

- Proof of Income Letter from Social Security

- Proof of Income Letter Self Employed

- Proof of Income Letter for Apartment

- Proof of Income Letter for Employee

- Proof of Income Letter for Medicial

- Proof of Income Letter for Independent Contractor

- Proof of Income Letter for Snap

- Child Support Proof of Income Letter

- Notarized Proof of Income Letter

- Medicaid Proof of Income Letter

- Proof of Income Letter for Food Stamps

- SSI Proof of Income Letter

Proof of Income Letter Samples

Proof of Income Letter for Self Employed Template

Proof of Income Letter Template

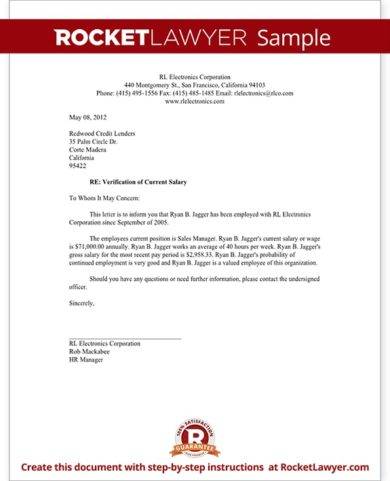

Sales Manager Proof of Income Letter Example

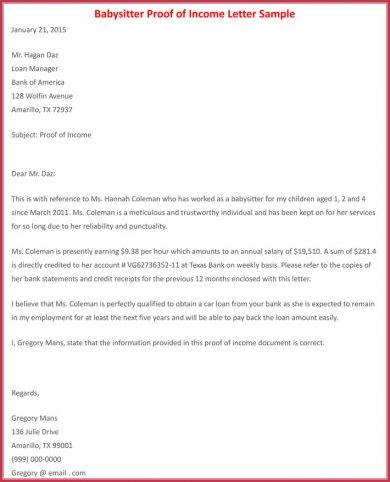

Babysitter Proof of Letter Example

A proof of income is basically created if a person wants something immediate. But for verification purposes and to see if the individual can actually pay the product (especially if there is a longer payment term), a proof of income is needed by the bank or other financial institution. You may also see formal letter examples and samples.

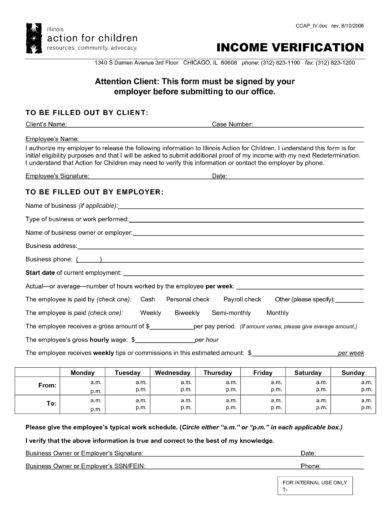

Proof of Income Letter or Income Verification Example

Proof of Income Pitfalls to Avoid

Before you submit your proof of income documents, check out these proof of income pitfalls that should be avoided at all costs.

1. Compile (and submit) the correct documents

It is vital that you compile the right documents as essentially, submitting the wrong ones will result to immediate rejection of your loan or financial request. As previously mentioned, submit the most recent documents especially for the tax return and simple income statement as most banks will not be accepting older versions of those said documents.

To avoid submitting incomplete or wrong documents, have a simple checklist on what documents you will be gathering. Also, have a separate column for the time frame you need for the documents that you will be gathering. If most documents can be gathered in one to two days, then there is no need to add a time frame column in the checklist.

2. Check the bank or lending institution’s profile

Submitting personal information to any institution or organization, let alone banks is always risky. That is why you need to check the profile of these financial institutions and determine if they are truly legitimate businesses. There is probably no need to be concerned about banks as they are constantly being monitored by the national government. You may also see simple resignation letter examples.

In regards to private financial or lending institutions, numerous cases of fraud have been reported with crime syndicates using financial institutions as fronts to conduct their illegal activities.

Before you disclose any personal information, check the organization’s business permits and other operational documents, and also monitor how their employees conduct their daily activities. If payment fees are too high, interest rates are too low, and sales personnel are too aggressive, you might as well avoid these types of companies and report to the relevant authorities if necessary. You may also like business reference letter examples.

3. Don’t submit the documents to the same bank twice

If your request got denied by the bank you submitted the requirements to, never submit the same documents to the same financial institution again. The bank will definitely not be accepting your documents and they might avoid having transactions with you in the long run. Rather, if you got denied the first time, go to another reliable financial institution instead and hope for the best.

As previously mentioned, check the financial institution’s profile before submitting your proof of income and other documents.

4. Check your capability to pay

Even if you were already granted a loan or financial request, this does not mean your responsibility with the bank is finished. If you are availing a long-term loan (for example, buying a car to be paid within five years), you definitely need to fulfill your financial obligations. You may also like offer letter examples.

If you fail to pay within the given time frame, the financial institution or business organization has the right to recover the item that you loaned, borrowed, or purchased. You might also get some jail time if you try to run from your obligations.

Proof of Income Documents You Can Submit

As long as you have a steady income, you can easily present numerous documents that are classified as proof of income.

Listed below are some items that banks and other investment or lending companies accept as proof of income documents, and are universally accepted around the world.

1. Payslip or pay stub

If you are employed, the best option you have as a proof of income is a payslip or pay stub. Employees are given their salaries or wages on a bimonthly basis.

Mostly, employees are paid on the 15th and 30th day of the month, while other companies release employee salary and wages on the 5th and 20th day of the month. Although there are employees who are also paid on a weekly basis, it all depends on the company on what wage schedule they are going to use. You may also like business proposal letter examples.

Oftentimes, the wage schedule depends on the performance of a company’s products and services, and also if sales targets are being met or exceeded by the products being sold by the company’s salespeople.

Most of the time, payslips or pay stubs are the documents being prioritized by banks especially if the individual requesting a loan or purchase of a product cannot present other products. Even if the individual presents other documents relating to his or her source of income, pay slips mostly provide the deciding factor if that person gets approved or rejected by the financial institution. You may also check out formal letter writing examples in pdf.

2. Tax return

Another document that is classified as a proof of income is a tax return. It does not really matter if you are employed or self-employed, an income tax return is very helpful when you will be submitting the document to your preferred financial institution.

Remember that the tax return that you will be submitting must be the most recent one as the financial institution will be doing a background check if you are really paying the correct amount of taxes. The financial institution will also check if you are still attached to the company listed in the tax return. You might be interested in notice letter examples.

Submitting an old tax return (for example, a 2012 tax return) will be immediately rejected by the bank, as well as your loan or request. Banks in most countries even reject tax returns that were accomplished in 2016, so make sure you submit the most recent one. Although it is not required to submit multiple yearly copies of your income tax return, you can always submit them if you want. You may also see application letter examples & samples.

For example, if you are employed from the year 2010, you can submit it together with the tax returns of succeeding years (i.e., 2010–2017). Submitting numerous tax returns will not increase or decrease your chances of getting the loan approved, as it will actually depend on the price of the product and your capacity to pay that product.

3. Income statement

If you are self-employed (having your own business that is registered under your name or together with other business partners), then your best option as a proof of income documentation is an income statement. Usually, business owners who request a loan use the funds for business expansion or other investment opportunities. For example, business owners use the funds to develop or improve an existing product or use the funds to venture into another industry.

Similar to the tax return, you should submit the latest income statement. Also similar to the tax return, most countries do not accept simple income statements that were accomplished in 2016. As much as possible, submit the 2017 version of your income statement. If you fail to provide a recent copy, it is better not to submit at all.

Remember to be ethical when creating your income statement. Even if you have your own accountant or hiring a third party to make all the financial statements for your company, input the correct details and avoid fraud as much as possible. Financial institutions will be verifying the information you entered in the income statement, so any discrepancies they see will not only result in the rejection of your request but you might be subject to criminal charges as well.

4. Bank statement

Another document that will come in handy as a proof of income is a bank statement. The bank statement lists down all of the transactions you made with the bank you opened an account with. The difference between a bank statement and a bank certificate is that the former lists down all the transactions (deposits and withdrawals) together with the current balance of your bank account while the latter only lists down the current balance of your account.

Between the two, the bank statement is a far more superior proof of income document as your every transaction is recorded which is very helpful for your loan or purchase request.

Take note that if you are requesting for a bank statement and you will be submitting the same document to the bank where you opened an account, make sure to submit other documents aside from the bank statement to increase your chances of getting the loan or financing request approved. You may also like email cover letter examples.

Normally, asking for a bank statement does not take a long time. You just have to approach any bank personnel and request for the said statement. For verification purposes, bank personnel will be asking for identification so make sure to bring valid IDs.

5. Certificate of employment

Certificate of employment is a document that entails that the employee is legally working for the company either on a regular, contractual, or probationary basis. The certificate of employment (COE) is written by the employee’s immediate supervisor or manager and enumerates the employee’s current position, start date, while also containing details on the purpose where the certificate of employment will be used for by the employee. You may also check out professional letter format examples.

The certificate of employment cannot act alone in terms of a proof of income document. It needs to be paired with a payslip or tax return so that the bank or financial institution can have information regarding your income

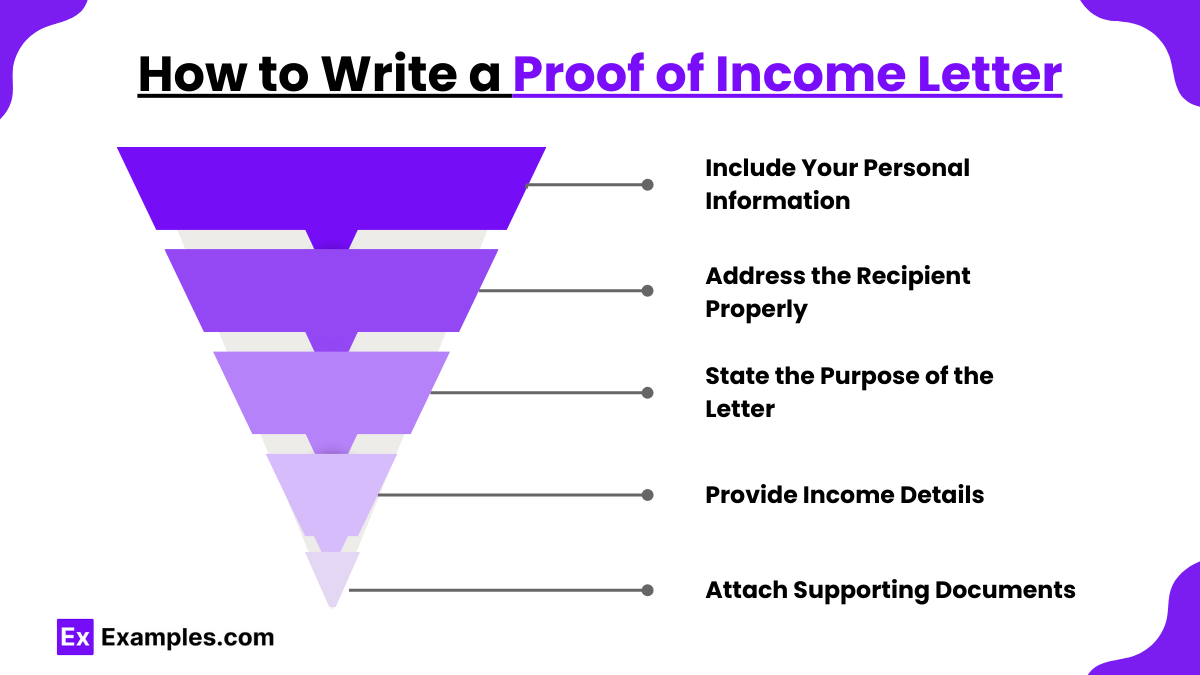

How to Write a Proof of Income Letter

Include Your Personal Information

Write your full name, address, phone number, and email at the top of the letter.

Address the Recipient Properly

Use the correct name and title of the recipient, such as a landlord, loan officer, or government agency.

State the Purpose of the Letter

Clearly mention that the letter is to verify income and specify why it is needed.

Provide Income Details

List your employer, job title, income amount, payment frequency, and any additional income sources.

Attach Supporting Documents

Include pay stubs, tax returns, bank statements, or other proof to validate the income stated in the letter

Tips for Writing Proof of Income Letter

- Use a Professional Format – Keep the letter clear, concise, and formatted professionally.

- Be Honest and Accurate – Provide truthful and up-to-date income details to avoid complications.

- Include Essential Details – Mention your income source, amount, payment frequency, and employer information if applicable.

- Attach Supporting Documents – Include pay stubs, tax returns, or bank statements to verify the stated income.

- Proofread Before Sending – Check for errors and ensure the letter is well-structured and free of mistakes.

FAQs

Who Needs a Proof of Income Letter?

Anyone applying for loans, housing, government benefits, or financial aid may need a proof of income letter to confirm their ability to meet financial obligations.

How Long Is a Proof of Income Letter Valid?

Most organizations accept proof of income letters issued within the last 30 to 90 days. Always check the specific requirements of the institution requesting the letter.

What Documents Can Support a Proof of Income Letter?

Common supporting documents include pay stubs, tax returns, bank statements, employer verification letters, and Social Security or pension statements.

Can Self-Employed Individuals Provide a Proof of Income Letter?

Yes, self-employed individuals can create a proof of income letter using invoices, tax returns, bank statements, or business earnings reports as supporting documents.

Can a Proof of Income Letter Be Handwritten?

A proof of income letter should be typed for professionalism and clarity. However, some cases may accept handwritten letters if legible and supported by official documents.