15+ Receipt of Payment Examples to Download

In our world where business transactions are everywhere, every day, we might have more than five transactions involving money. It is undeniable that almost everything we do involves money. We lived through mutual benefit from each other, and everyone must be compensated fair enough. You may also see company receipt examples.

In the market, when prices are too high, the tendency is that people would not buy the certain product especially when the product is not a commodity. The demand would be lesser if the prices go up, except for staple food and commodities, which are the necessity of the people. You may also like catering receipt examples.

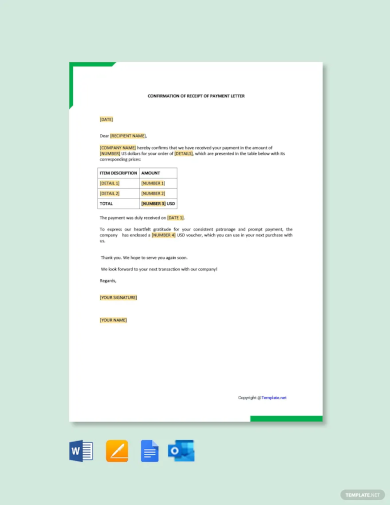

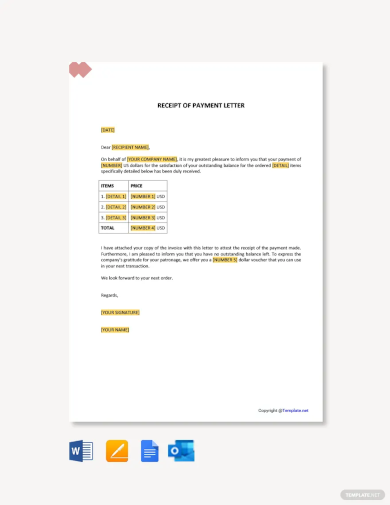

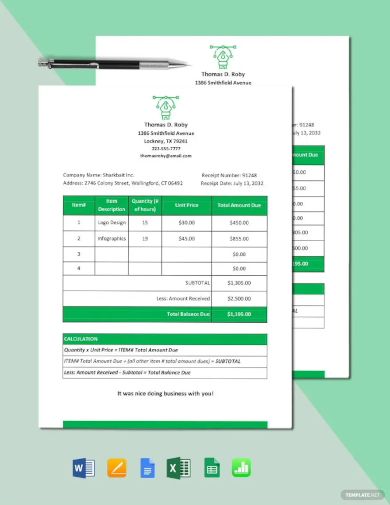

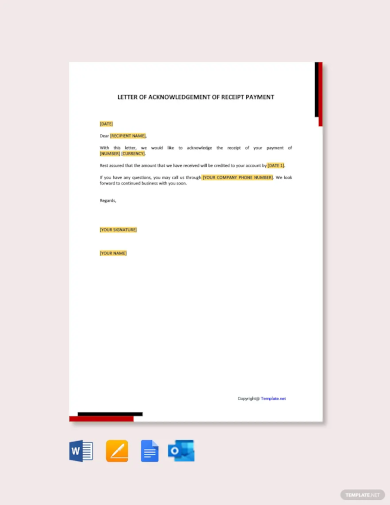

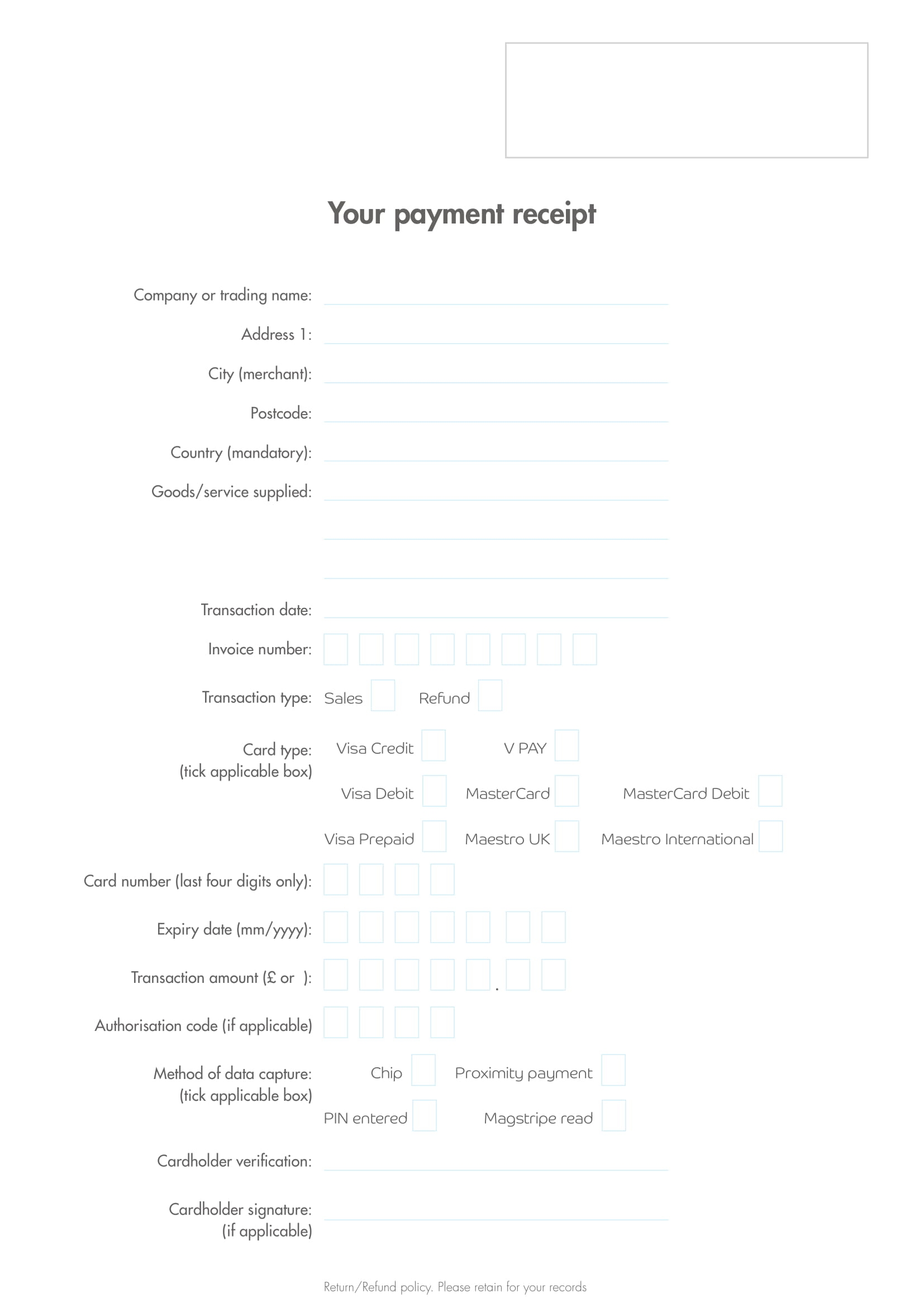

Payment Receipt Example

Confirmation of Receipt of Payment Letter Template

Receipt of Payment Letter Template

Freelance Receipt of Payment Template

Letter for Acknowledgement of Receipt of Payment Template

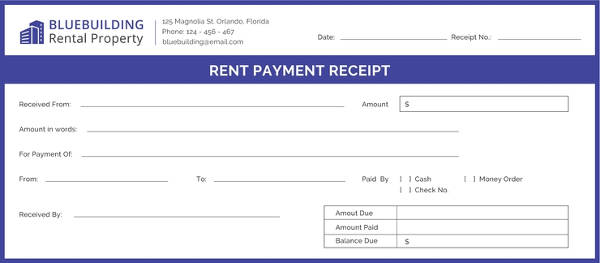

Free Rent Payment Receipt Example

On the other hand, when the prices are too low, there will be a strong demand for that certain product. However, when the prices would be lower than that, there is a possibility of killing the economy. Hence, a fair price must be implemented. To support and have evidence over these transactions, a receipt of payment must be issued by the seller to the buyer whether the buyer partially paid, paid in full, or buy in credit terms.

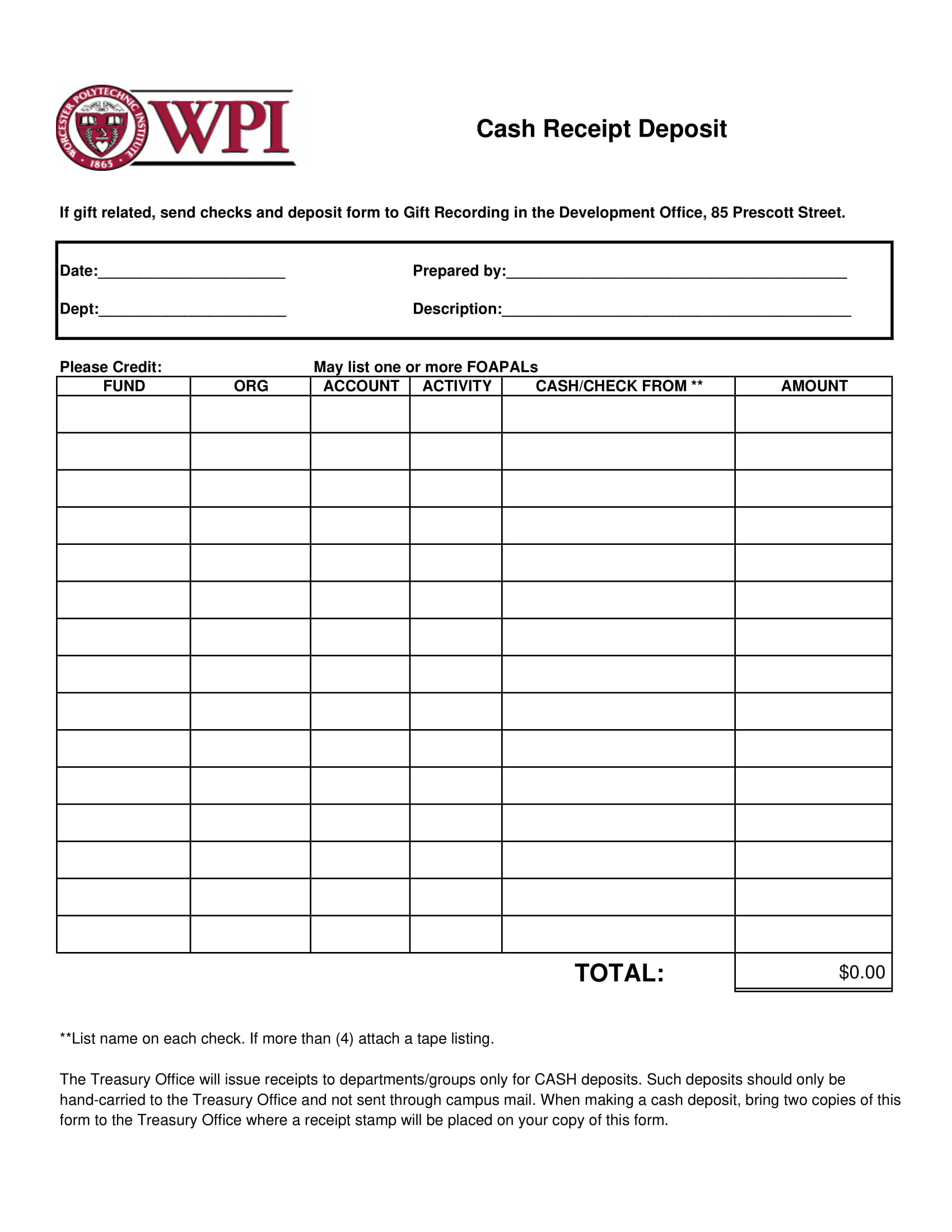

Cash Payment Receipt Deposit Example

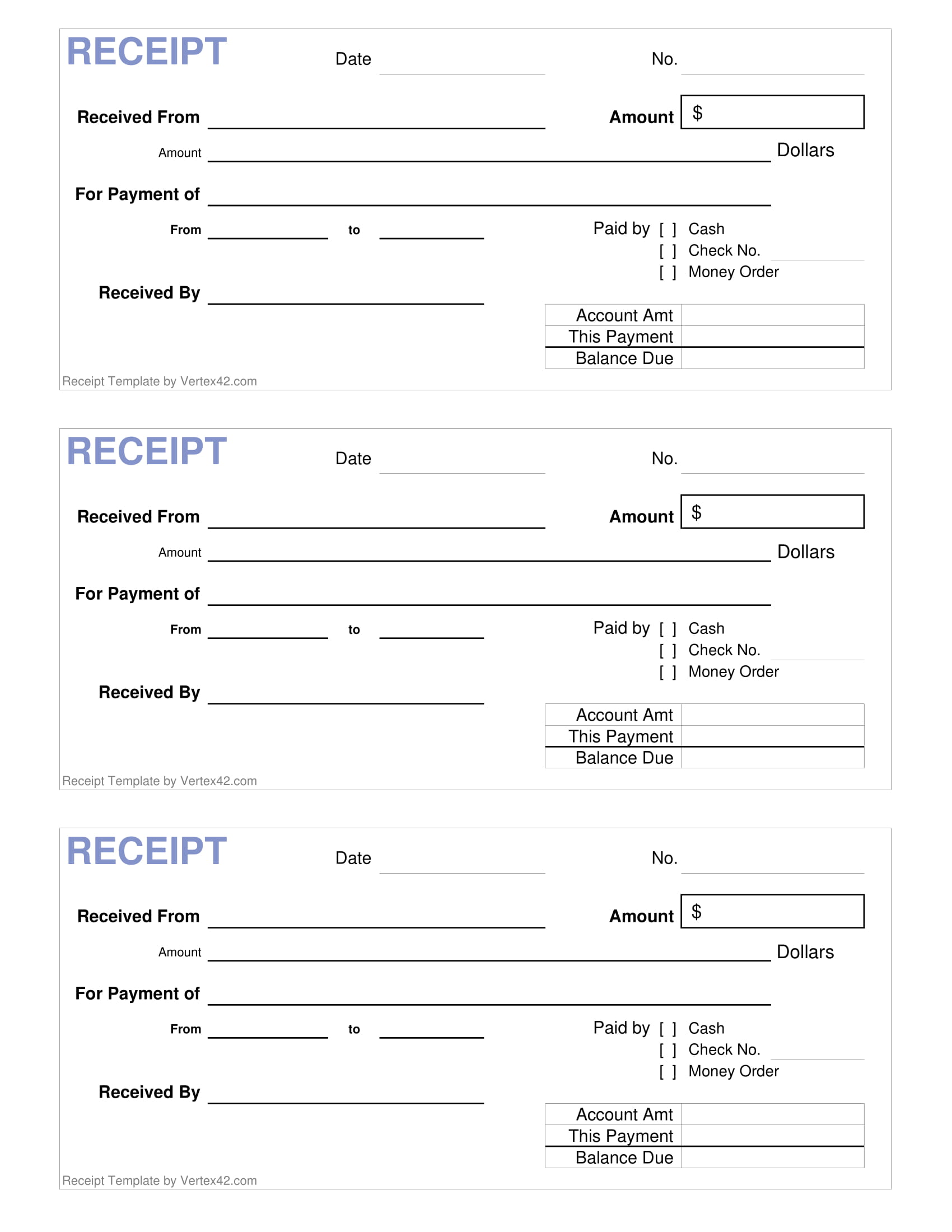

Cash Payment Receipt Example

What Is Receipt of Payment?

A receipt of payment, also known as payment receipt or receipt for payment, is a kind of receipt that is issued by the seller to the buyer, verifying that a payment has been made as an exchange for receiving goods or services.

Even if the payment by the buyer is for partial settlement, a receipt of payment can still be issued. For transactions involving full payment by the buyer, payment receipts serve as a proof that both parties have successfully done their part in the transaction. You may also see transfer receipt examples & samples.

General receipts of payment usually only include the basics in a transaction, but for this case, it can be presented with a more detailed description of the goods and services received. One must take note that a receipt of payment is among the important papers in a business transaction since it can be used for the protection of both the seller and the buyer as well as it serves as an additional document used in communication in the sales process.

What Is Included on a Payment Receipt?

There are no specific requirements on what items must be included on a payment receipt, but typically it will include the following:

- The seller’s name

- Logo (optional)

- A label “payment receipt”

- The original invoice number

- The date the payment was received

- The sum amount received

- Any remaining amount due

In cases when the buyer has paid in full, it must also be indicated on the payment receipt to avoid confusion on the part of the customer. You may also like service receipt examples & samples.

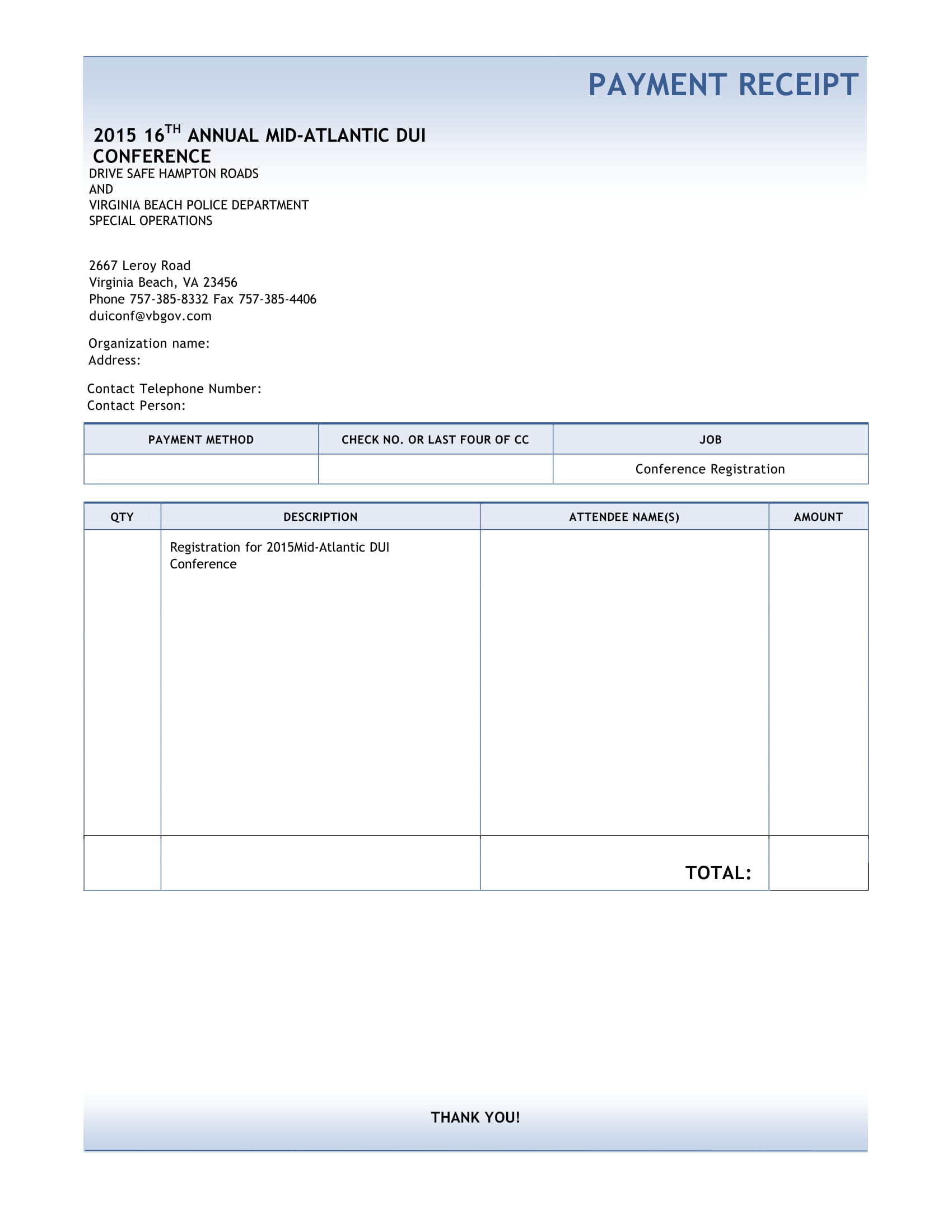

Conference Payment Receipt Example

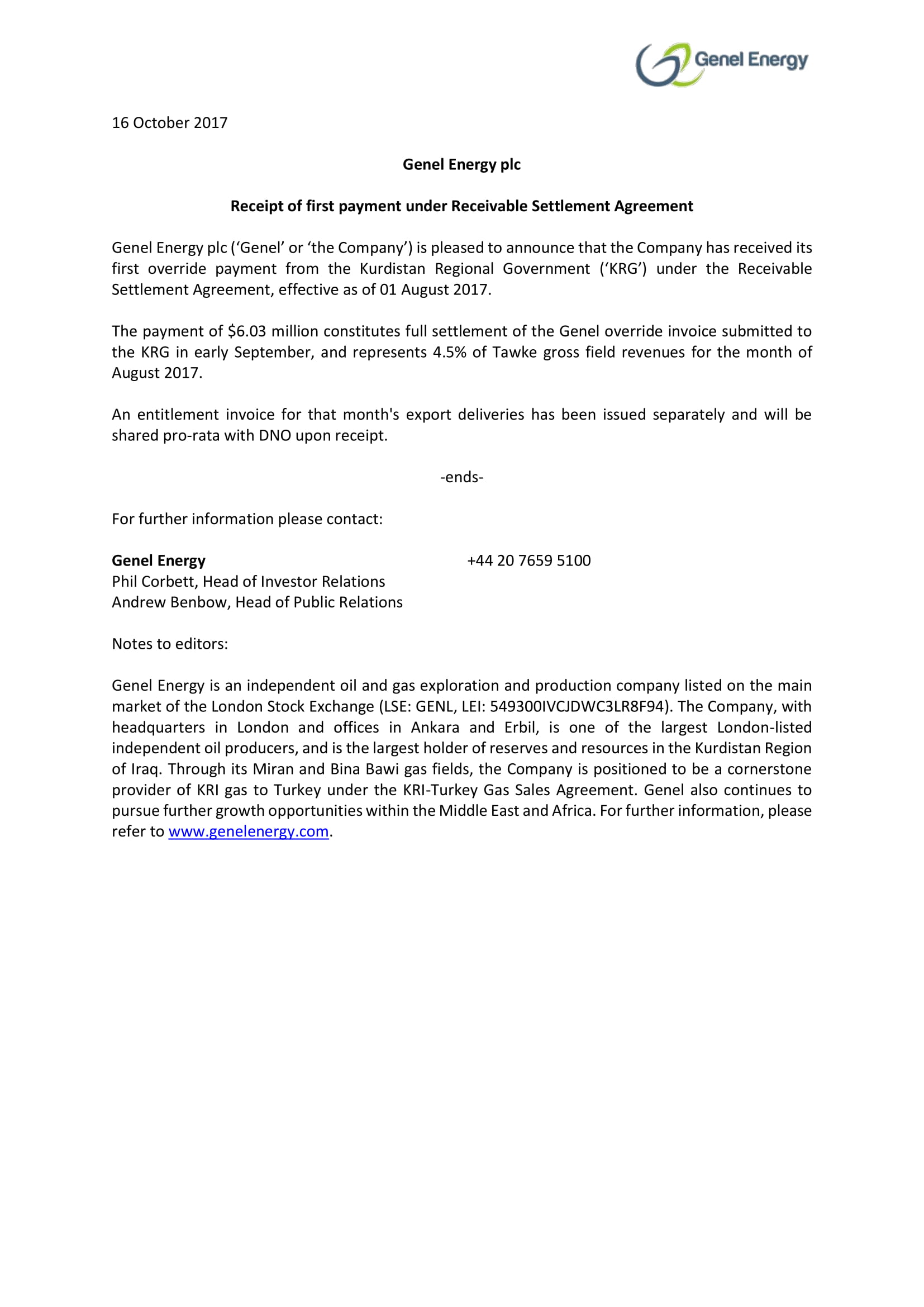

Genel Energry Receipt of First Payment

Generic Payment Receipt Example

Benefits of a Payment Receipt

Just like any other types of receipts, payment receipts or even receipts in general, provide benefits to the selling as well as buying parties. Here are several advantages of a payment receipt that the users can benefit:

1. Evidence for reimbursements or warranties.

A payment receipt can be used to request reimbursements and warranties especially when you spend for a company operation. Service warranties can also be availed of if payment receipts are showed to the service provider. Furthermore, payment receipts will also allow a customer to return or exchange goods that might be defective as this is a proof of the previous transaction. You may also see restaurant receipt examples & samples.

2. Contract or agreement of both parties.

There are also instances when a payment receipt can be used as a valid contract or agreement, which can be presented in the court of law when conditions with regard to the transaction are violated by any of the parties involved. Hence, when you are drafting a receipt, make sure that you are including and writing the correct and exact information for this is something that you can use as your defense or can be used against you.

3. Support of accounting records.

Payment receipts will also prove that a reasonable amount was asked in exchange for the goods given or services performed. These will complete the accounting records and will simplify the process of tracking the finances of a business. Furthermore, when an internal auditor will perform an audit of the company’s financial statements, it is easier for the auditor to trace or vouch for the related receipts of the recorded transaction.

Additionally, for an external audit, the external auditor might request from the management or key personnel of additional documents such as receipts as a support of the accounting records. A payment of receipt, just like any other receipt, is a valid document that can serve as a proof of the transactions. You may also like loan receipt examples & samples.

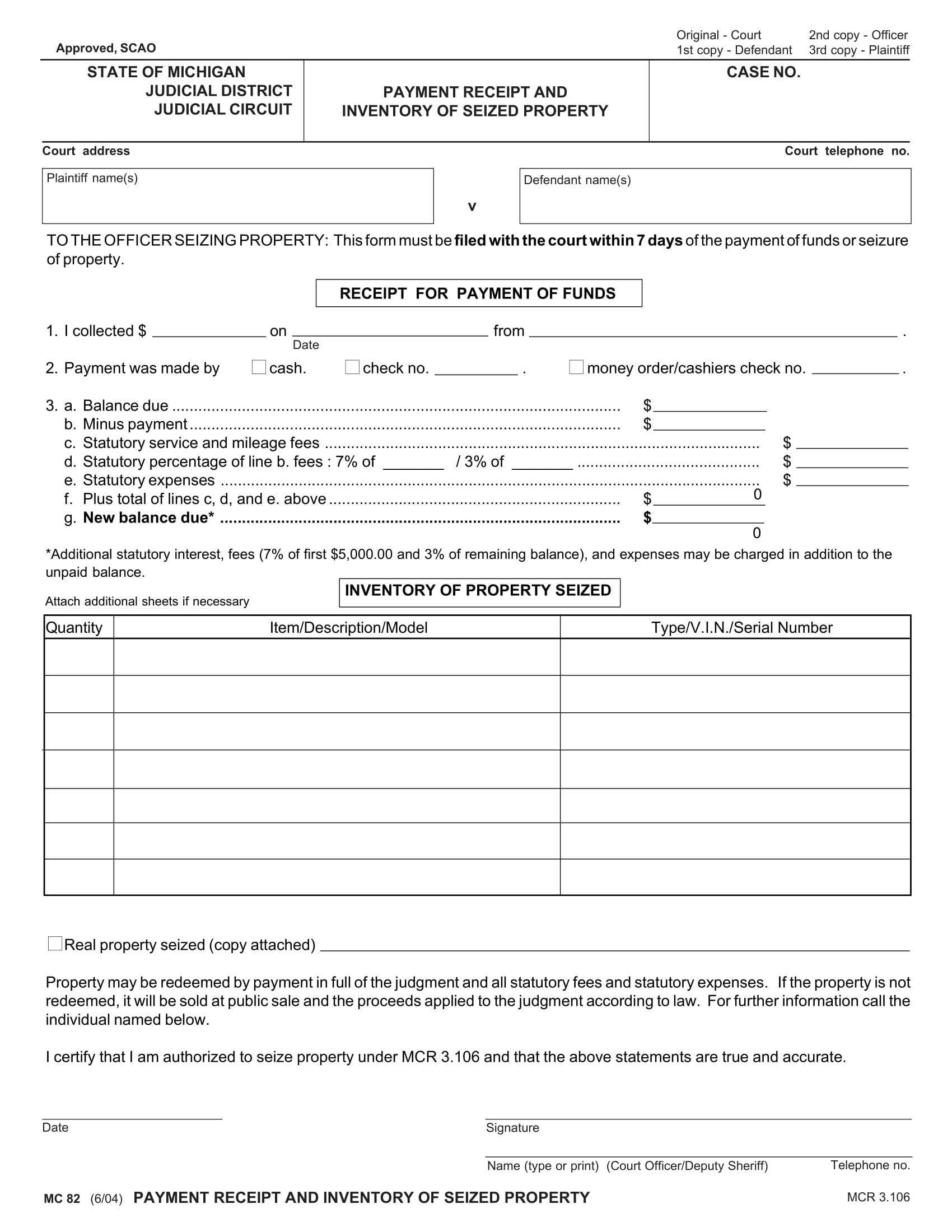

Payment Receipt and Inventory of Seized Property Example

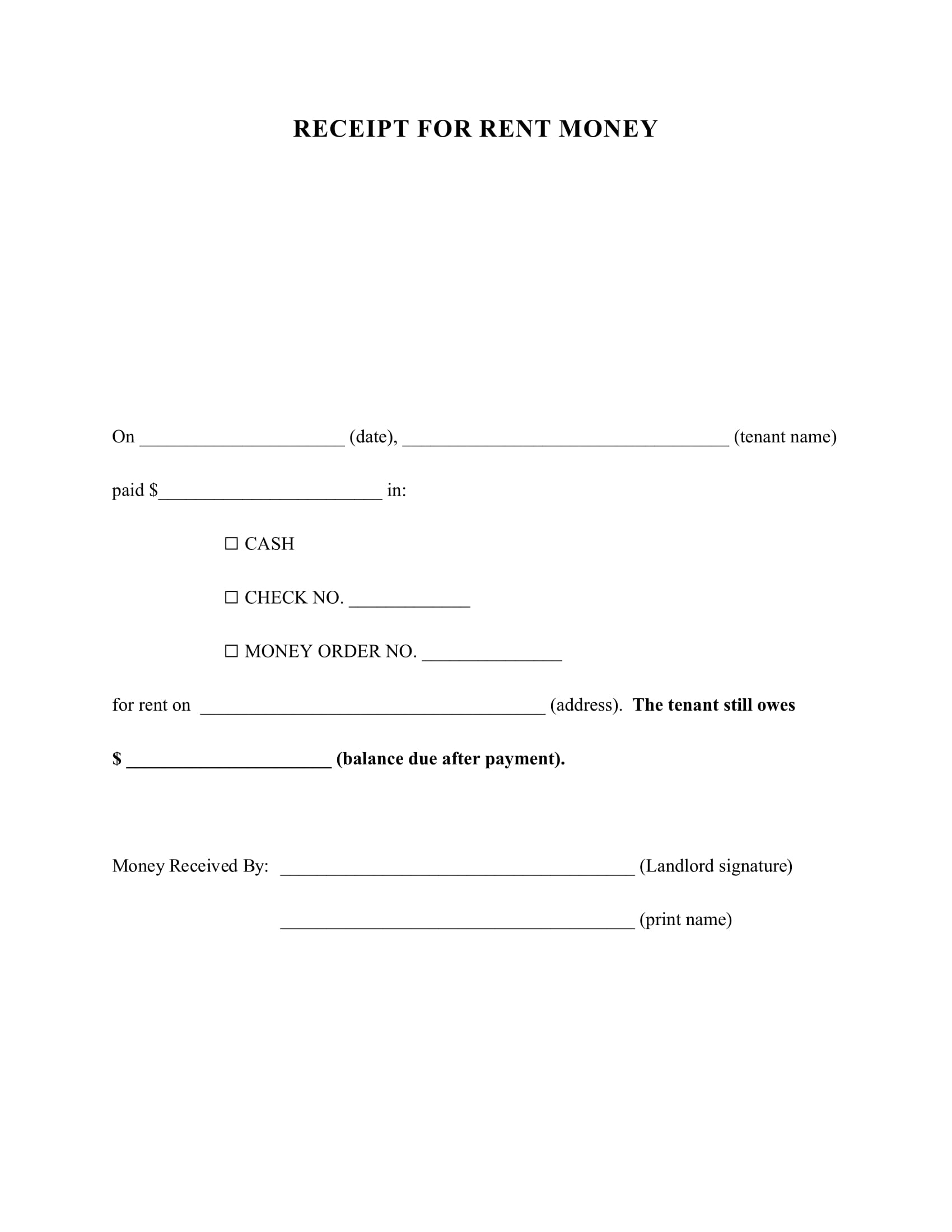

Rent Money Payment Receipt Example

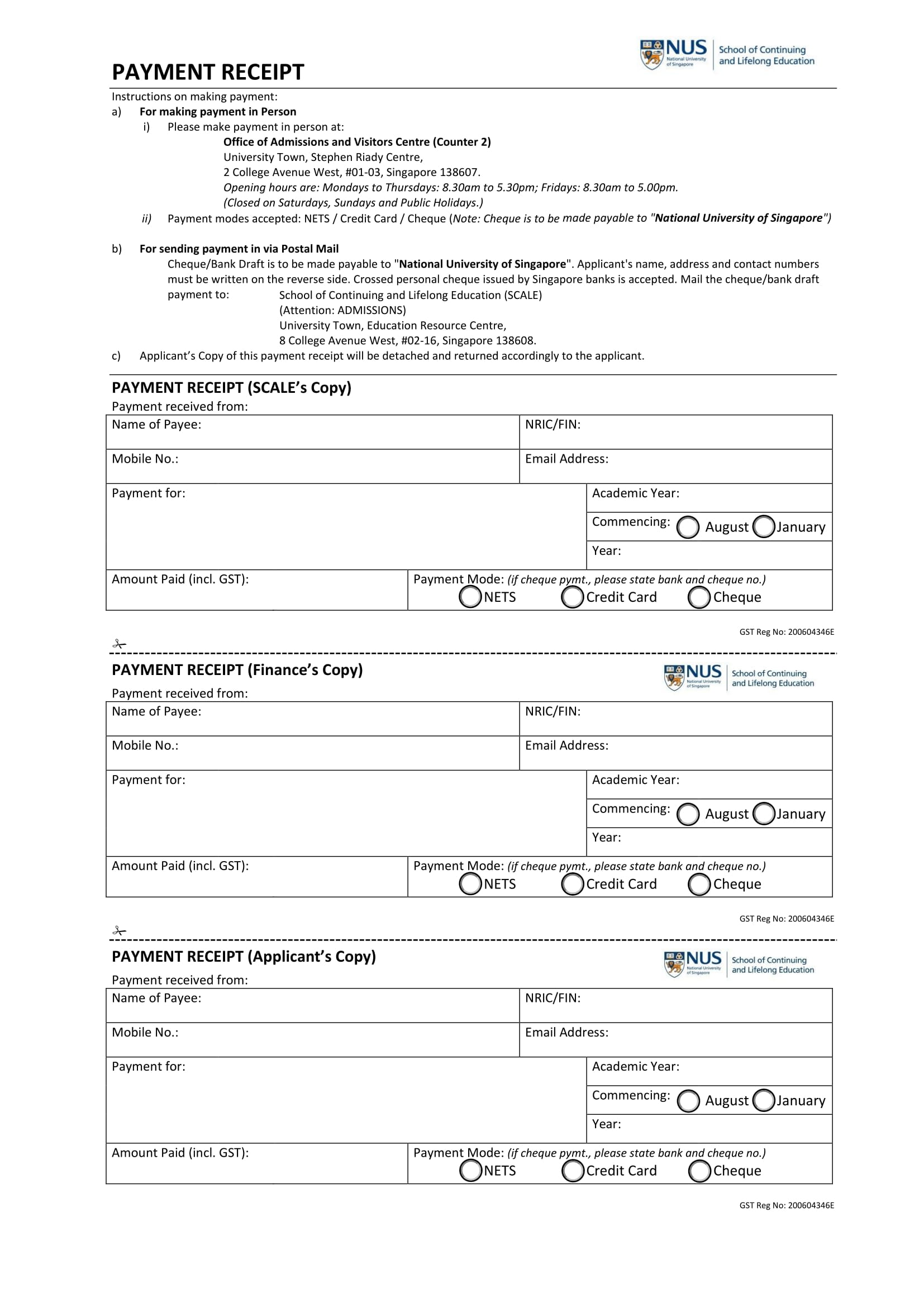

SCALE Payment Receipt Example

Tips for Writing Payment Receipts

Creating a payment receipt for the first time can be an intimidating and at the same time a challenging experience. While many people find receipts a hassle, you must bear in mind that general receipts are important because, as explained above, they can be used as an evidence for reimbursements or warranties, an advantage for the buyer; they serve as a contract or agreement of both parties, in which both parties can benefit; and lastly, they can be used to support the accounting records, which is a benefit of the seller.

Keeping those things in mind, you must be motivated and encouraged to write and issue payment receipts. Don’t worry because it only takes a minute of your precious time to write payment receipts, and the tips for writing payment receipts presented below can surely help you get the job done. You may also see sales receipt examples & samples.

1. The moment that you are starting your business, one of the basic things that you must have is a payment receipt. It should be among the first steps that you must take. There are a lot of templates online such as those presented in the previous section that you can use, or you can create and customize your own payment receipt.

2. If you opt for online templates, make sure that you are choosing a payment receipt that goes well with your company.

Remember that a payment receipt is not just a mere paper to be used in a business transaction; through the logo and company name that is placed as a header for your official receipt, people will know and recognize your brand. Hence, payment receipts can also be used in your branding. So, don’t forget to include the basic information regarding your company such as your company name, tagline, address, contact information and logo.

3. In selecting for the format and design of your payment receipt, you must bear in mind that you cannot easily change your payment receipt every now and then. Hence, choose the design and format carefully before proceeding with the implementation process. You may also check out hotel receipt examples & samples.

4. Lastly, check if everything you input in the generic receipt is correct and without any mistakes for this may affect the credibility of the business. Be extra careful in including contact details, especially the contact number, people might not be able to reach your line when you have written an incorrect number.

Simple Payment Receipt Example

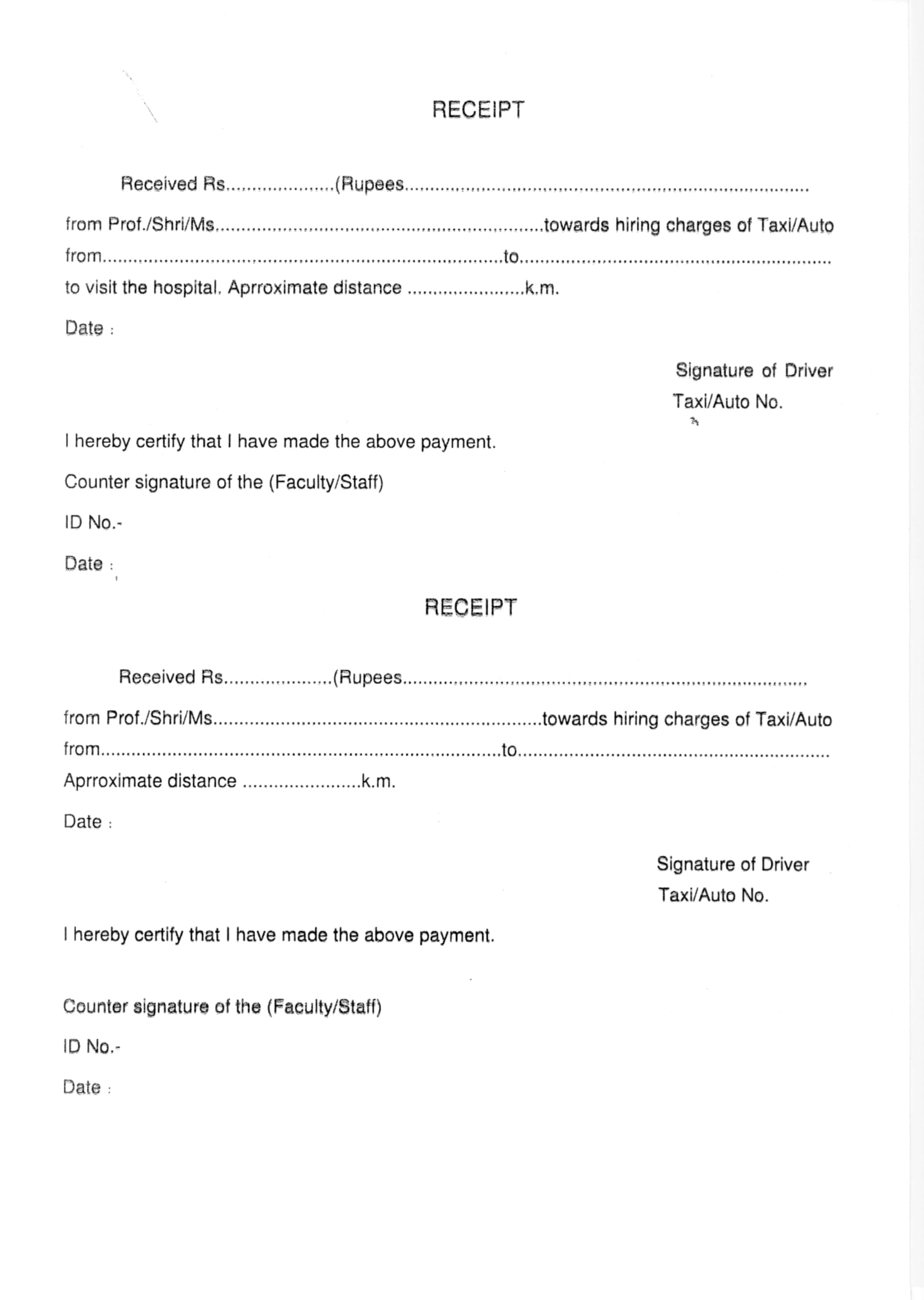

Taxi Payment Receipt Example

Differences between a Payment Receipt and a Sales Receipt

At first glance, it may seem that a payment receipt is similar to a sales receipt. When you take a look at both basic receipts, their differences cannot be easily identified.

Both contain headers that consist of the company details such as the company name, tagline, address, and contact information; the space where the amount due must be written; and any signatories. However, despite their similarities, these receipts have differences that can be important for businesses to understand. You may also see deposit receipt examples & samples.

A payment receipt is a proof of payment created by the seller and is provided to the customer. It is a simple document confirming that the payment from the buyer has been received. The basics with regard to the sale is also included. It assures the buyer that his or her payment has been received by the seller. Typically, payment receipts are not used in accounting for digital products. You may also like salary receipt examples & samples.

On the other hand, a sales receipt is a bill containing a more detailed breakdown of the costs as well as the taxes involved in the transaction. It can also include the information above the business.

Other information that you can find in a sales receipt are the payment method, the date of payment, and the amount of payment. Hence, a sales receipt is more specific. It must also contain a unique receipt number and other strict requirements. However, unlike an invoice, it does not require customer information.

In brief, the main difference between a payment receipt and a sales receipt lies in their complexity and detail with regard to the information contained on the face of the receipt; a payment of receipt need not be detailed as that of a sales receipt.

Summary

In sum, standard receipts are important in whatever business you are dealing with for receipts are a proof of partial or full payment. The elements of a payment receipt are as follows: the seller’s name or best logo, the label “payment receipt,” the original invoice number, the date the payment was received, the sum amount received, and any remaining amount due. Although there are other receipts with more elements that are complex and more specific, these are the usual and important elements to be included in a receipt of payment.

Other than being a proof or evidence of the payment from the buyer, receipts of payment also serve as an evidence for reimbursements or warranties, a contract or agreement of both parties, and a supporting document of accounting records that is needed especially during an audit, whether it is an internal or external audit. You may also see blank receipt examples.

Payment receipts also differ from sales receipts in a way that a sales receipt details and outlines specifics with regard to a specific transaction and is only issued when their is a full payment, while payment receipts are mostly for the buyer rather than for the business, confirming that the payment has been received and giving the basics on the sale. You may also like tax receipt examples & samples.

Lastly, don’t miss to check out the examples and templates of payment receipts provided in the above section.