8+ Deposit Receipt Examples to Download

In banking, we usually deposit money to pay off our credit card bill or to add up our savings account. Whenever we do this, nabk tellers or the machines give and provide us with a deposit receipt as proof that you have made a certain deposit in the bank. For organizations running a business receipt, it’s the same thing. You select an item online, you’re provided an invoice with the amount you’re required to settle, and then you pay for it.

Once this is done, a deposit receipt acts as proof of you making a payment. It is the standard protocol for most businesses, as receipts serve as valid proof from any transaction. Making a receipt doesn’t require much work. As long as it contains all the data required to make it valid, then you’re free from any legal woes.

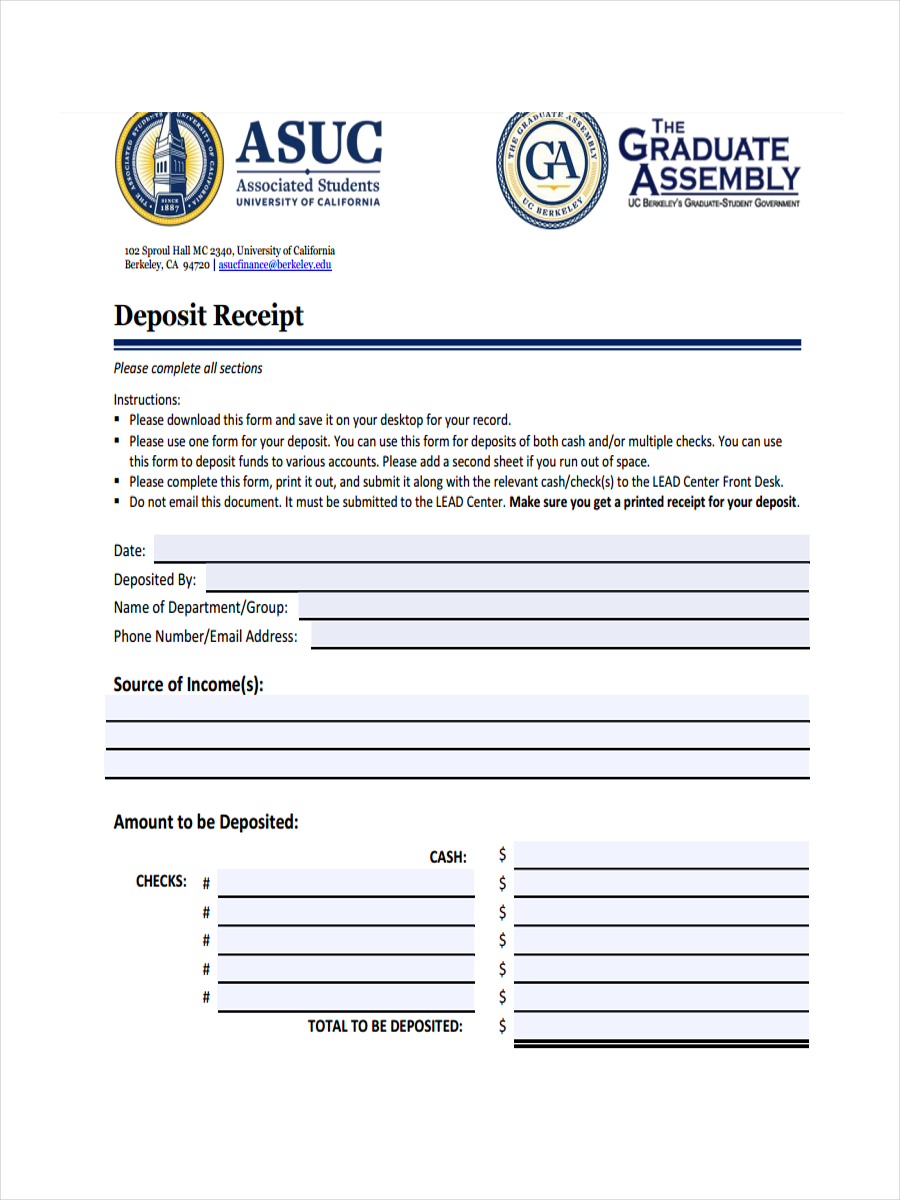

Deposit Receipt Example

People and businesses, on a nearly daily basis, deposit money into their bank accounts. After they’re done making the deposit, they’ll want something to help confirm that the bank has acknowledged it. That’s why deposit receipts must be made and this template is exactly what you need to create one. With it, you’ll be able to make a proper deposit receipt that’s able to provide details such as the amount that was deposited, the person or business who made the deposit, the bank that received the money and so on. With the help of this receipt, your deposits wouldn’t have to worry about then the credit will come and they can also know how much they have put in their accounts. Download this template and make it your own now!

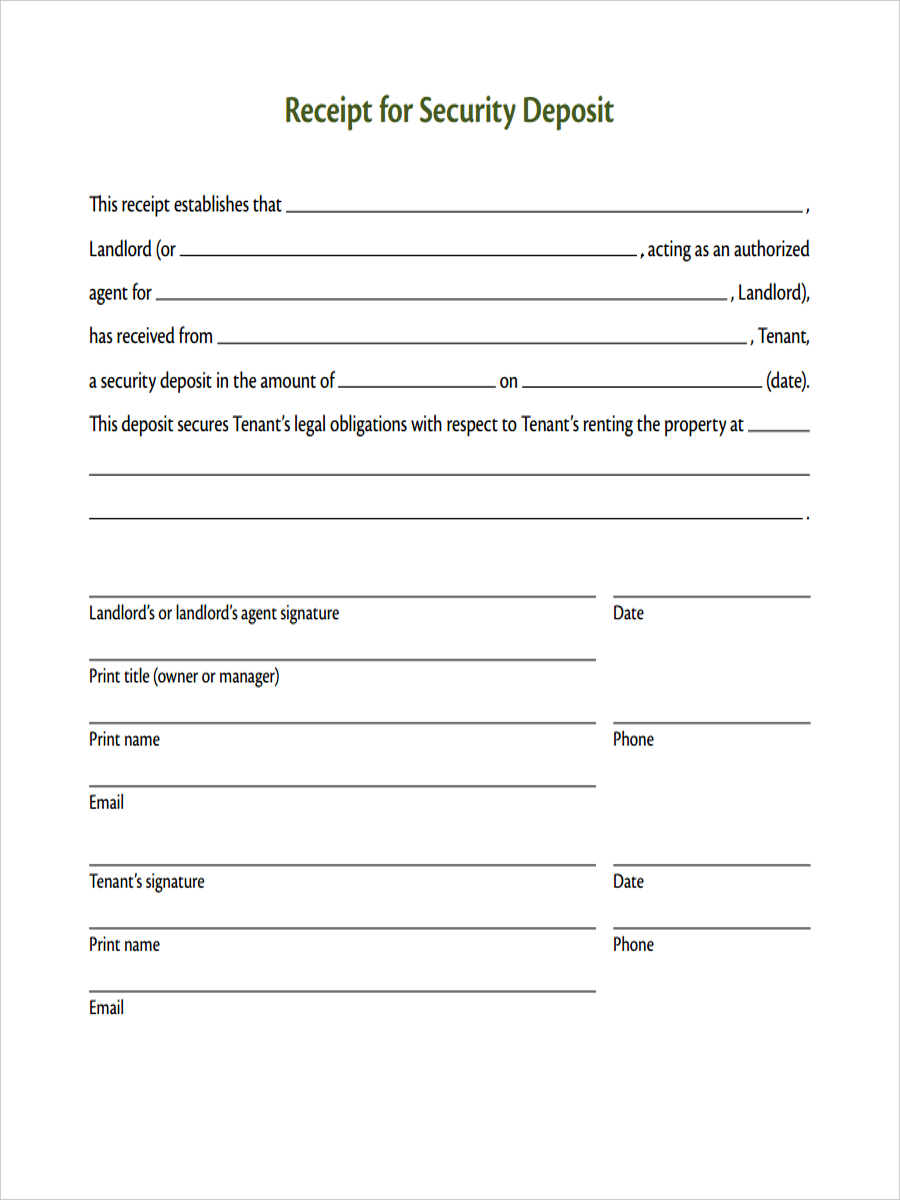

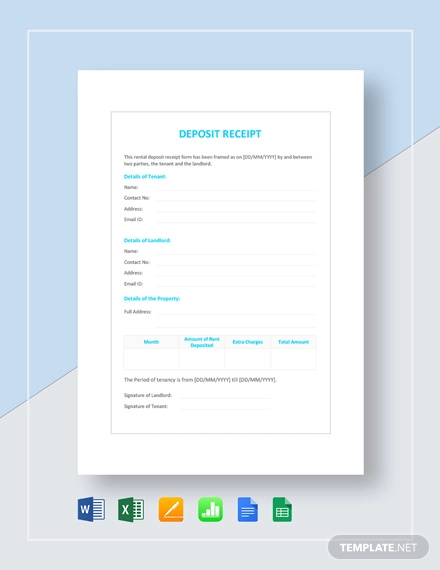

Receipt of Security Deposit

During security deposits, it is compulsory that you be handed over a receipt as it acts like proof that you have deposited a certain amount of money with a certain bank/individual, etc. A security deposit is made between a landlord and a tenant. A security deposit can be defined as a deposit of money with the landlord to ensure that the rent will be paid by the tenant and also, all the other responsibilities of the lease will be fulfilled. This above-mentioned template is one such file that can be of great help to you Try it out now!

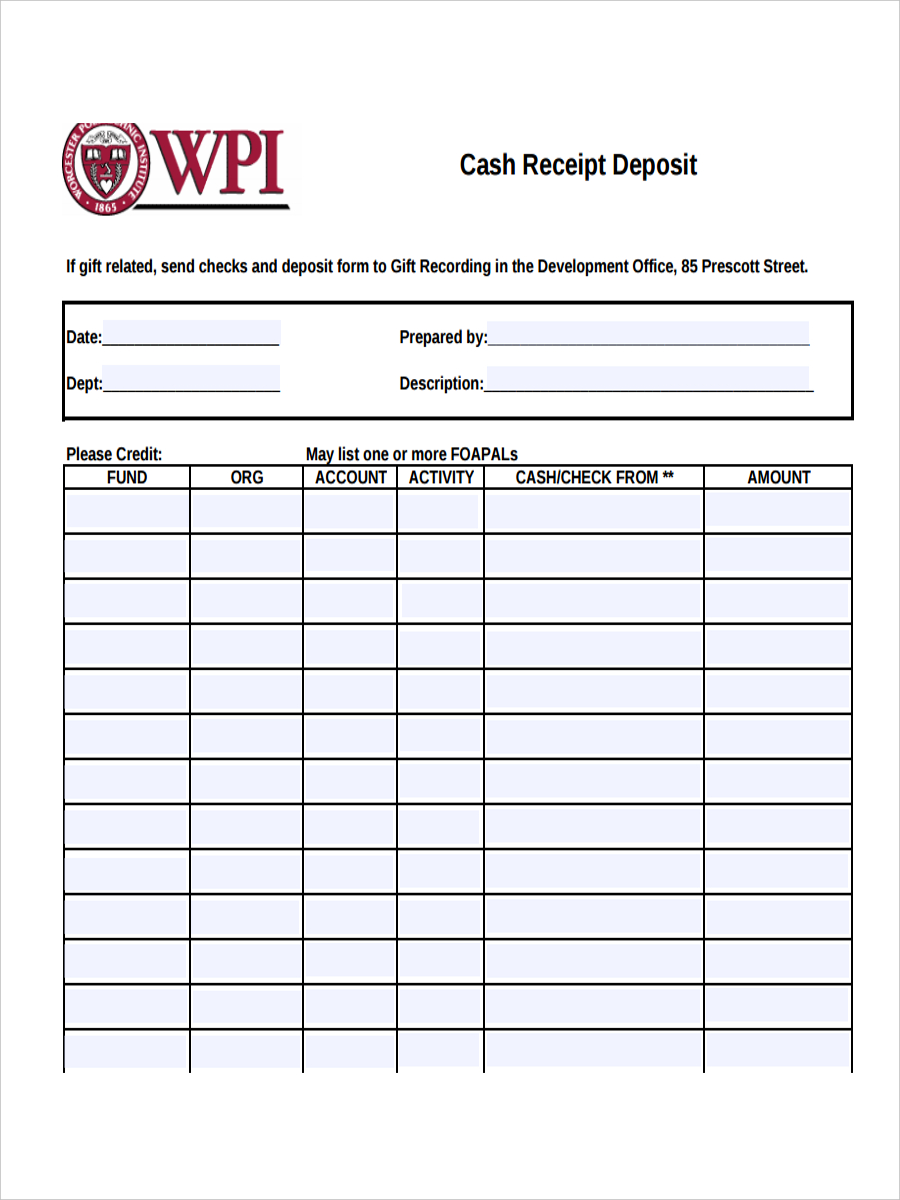

Cash Deposit Receipt

Cash receipt deposits can also be used as gift deposit to give to your loved ones as gifts. Details like why the receipt is being used, the credit and debit amount, the account details, the date, department it is being used for, who is giving it, etc. should be mentioned, The above document is one such file you can take help of. All you would have to do is edit and customize the template with your details and you are good to go. Try it out now!

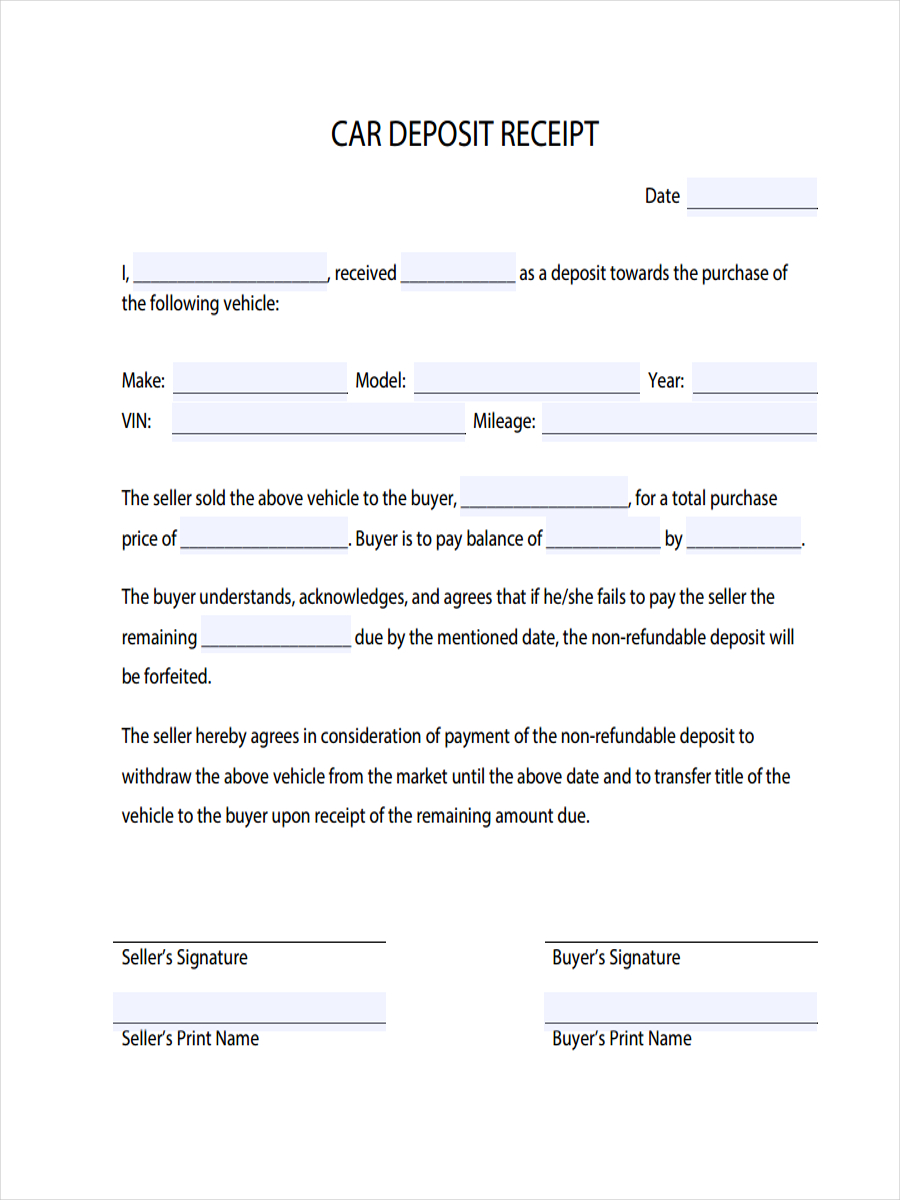

Car Deposit Receipt

What is a Deposit Receipt?

In many of the streams like banking and commerce, a deposit receipt refers to the same concept and can be used to make your job easier in keeping track of all the expenses and also, credits you get.

A deposit receipt is also called a deposit slip in many places all around the world. It is a document that shows a particular amount that is paid as a part of an agreement for something a person wishes to purchase or deposit to save for future use. You can take a look at purchase receipts for more. Deposit receipts even include the terms and conditions that are agreed upon by all those involved in the agreement.

It can also be used as concrete proof that a payment has been made to continue a particular transaction successfully. This is mainly used to handle future disputes, and they can be handled well with the help of these receipts. A deposit receipt can also be used to pay bank loans, billing, etc. so that one has the idea of how much has to be paid.

Creating a Sales Receipt for Initial Deposit?

When you are purchasing an item, many companies require a copy of a deposit slip before proceeding to ship the product you ordered. With the help of receipts, it is easier for them to grant and trace your order easily. However, due to different circumstances, people rather deposit the money gradually and in parts, instead of al at once. Initial deposits are generally made as agreed by the parties involved.

To create a sales receipt for this, it may contain the typical data in a standard receipt. This would be a reference number, the date of payment, the amount received, the mode of payment, the reason for such, and the receiver. It can be made short and simple, as long as it contains all the necessary details of the transaction.

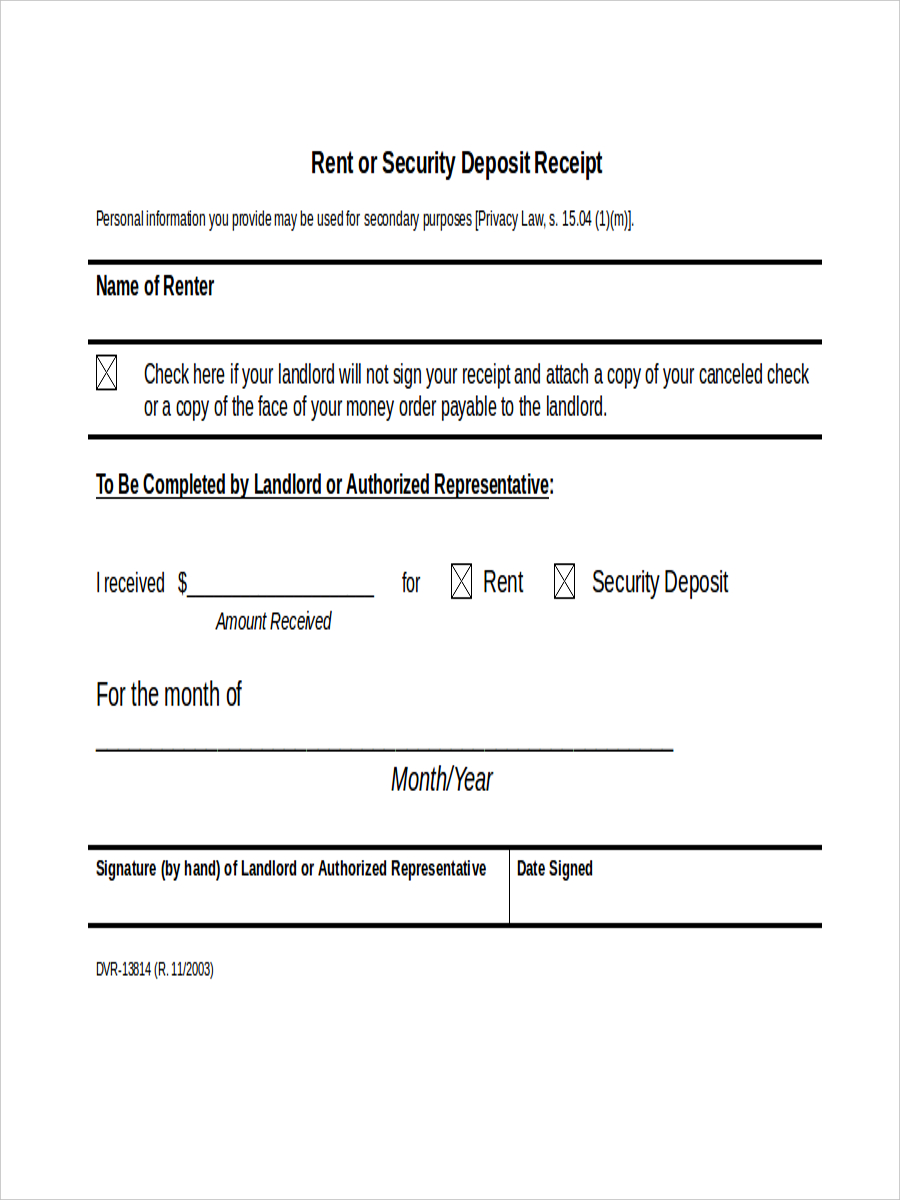

Rent Deposit Receipt

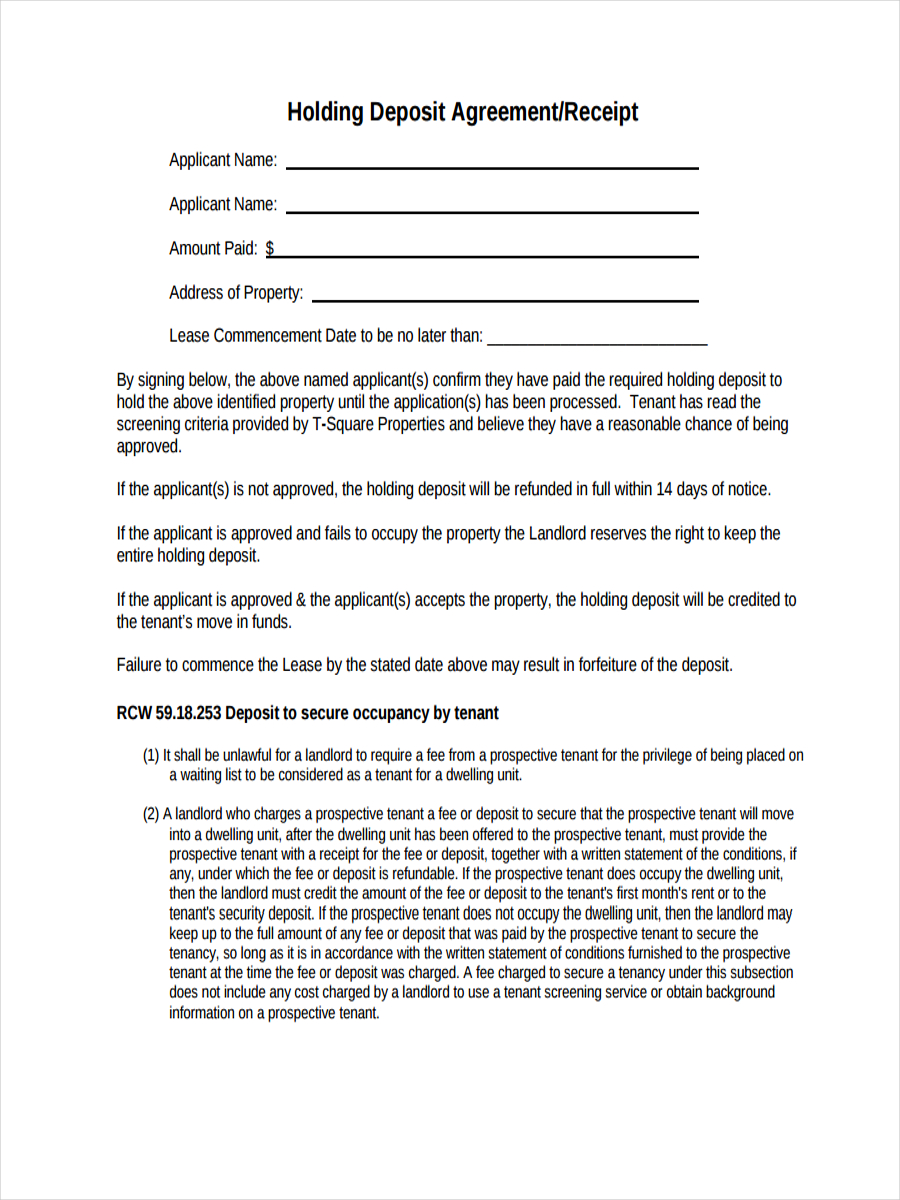

Receipt for Holding Deposit

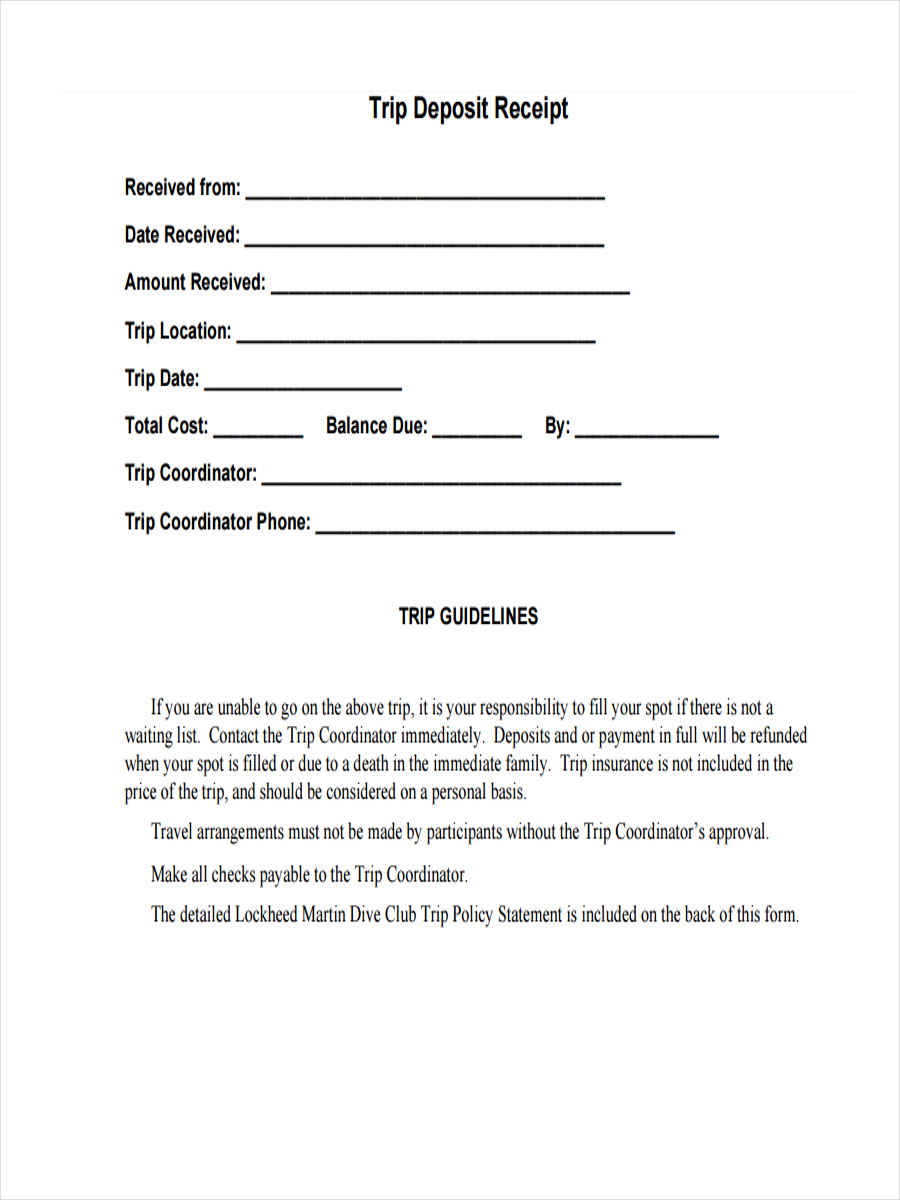

Trip Deposit Receipt

Sample Deposit Receipt

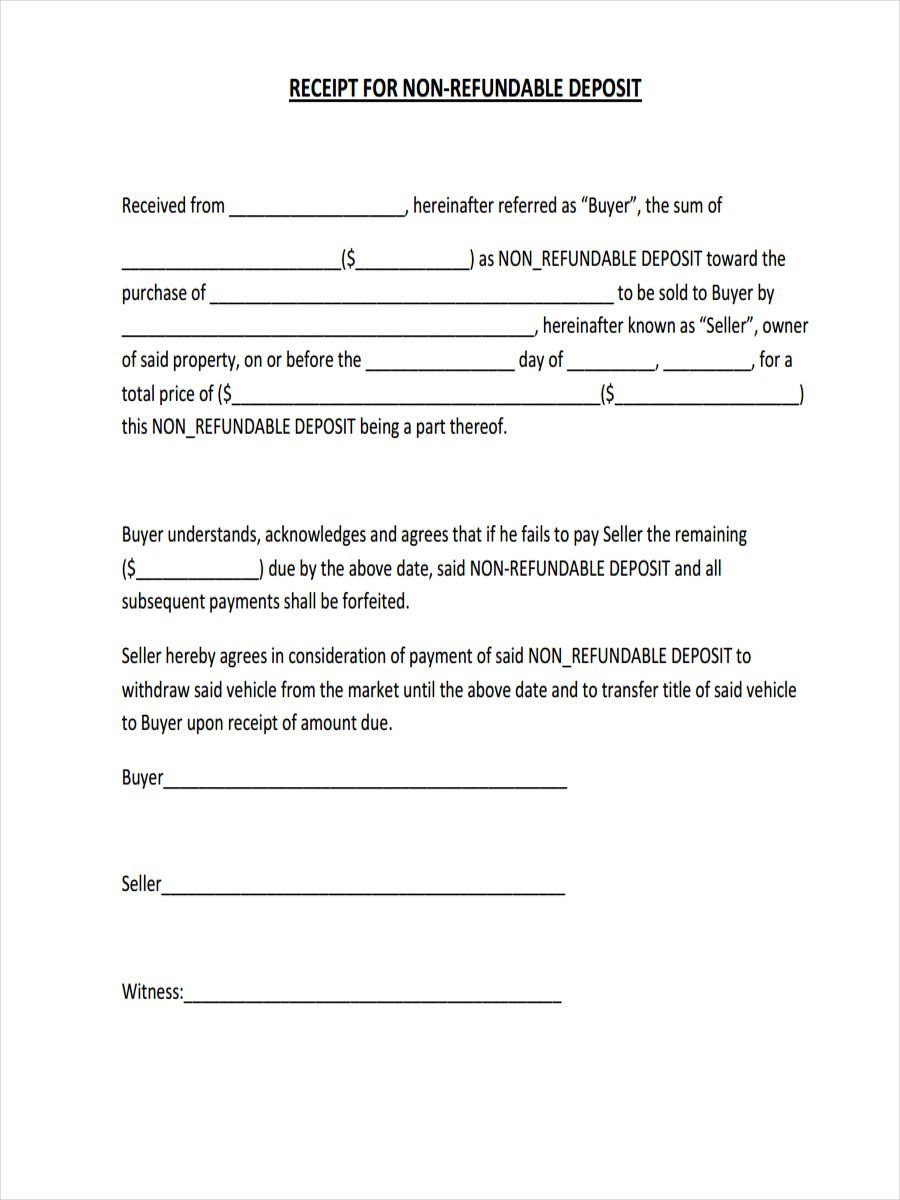

Receipt for Non-Refundable Deposit

Policies and Guidelines of a Deposit Receipt:

A deposit receipt must be made formally and has to be clear with all the details in it for it to be considered valid y the IRS (Internal Revenue Service).

After all, you wouldn’t want to run into any legal problems because of the receipts that your company issues. Keep in mind that these receipts may be used by you and your clients for monitoring income and expenses. There are many various sample receipts you can check out, as they have a similar format that is followed when issuing receipts.

It’s important to take note of the value of such a receipt. It is difficult to settle issues when you do not have the right a base and concreted proof to support what you claim, especially if you are dealing with money here. Bank statements are not considered to be a valid receipt that’s why actual receipts are needed. Furthermore, it’s best to specify the purpose of each deposit receipt for various business purposes.