6+ Loan Receipt Examples to Download

In business transactions, specifically in sales transactions, receipt examples do not merely prove that the client paid for what the service provider rendered, and the service provider received the payment. It also proves that both parties reached an agreement, and the receipt will be the proof of such agreement.

Serving as proof of a specific transaction, a receipt can become an evidence in case a conflict arises between the parties involved in such transaction. The importance of receipts is thus emphasized. Here, we will be talking about loan receipts, their purpose, and a few steps in crafting one

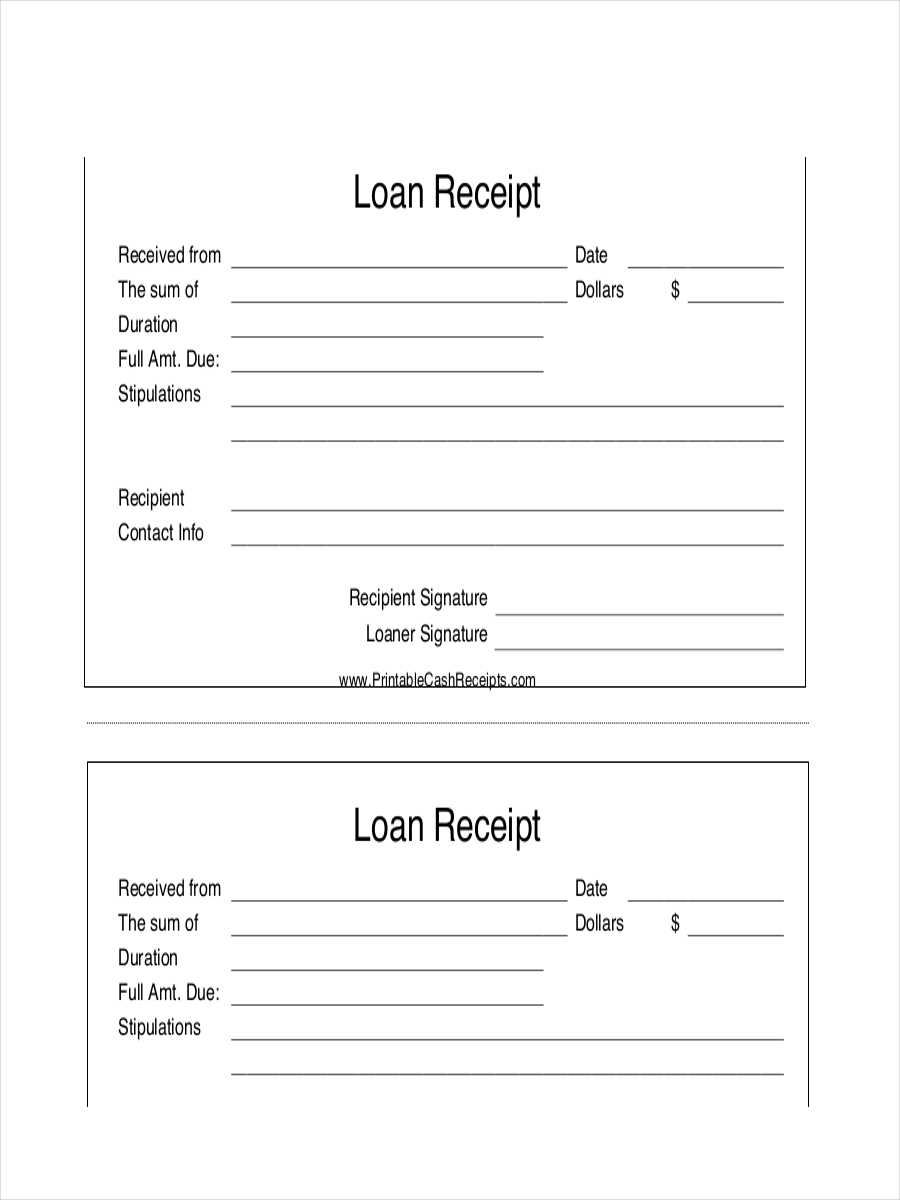

Bank Loan Receipt

Loan Payment Receipt

What Is a Loan Receipt?

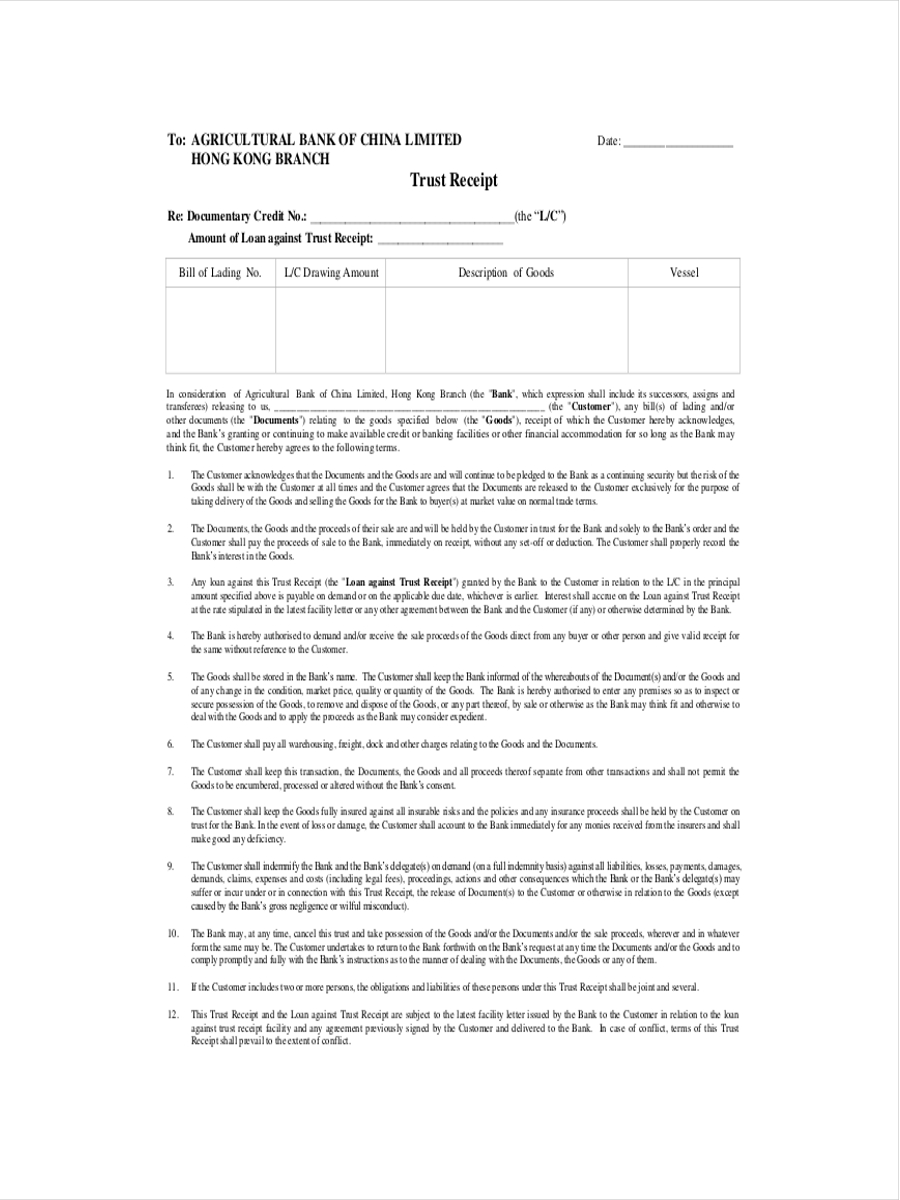

A loan receipt, or loan payment receipt, is a business document which is used in loan processes (either a loan payment, an acknowledgement of a loan, etc).

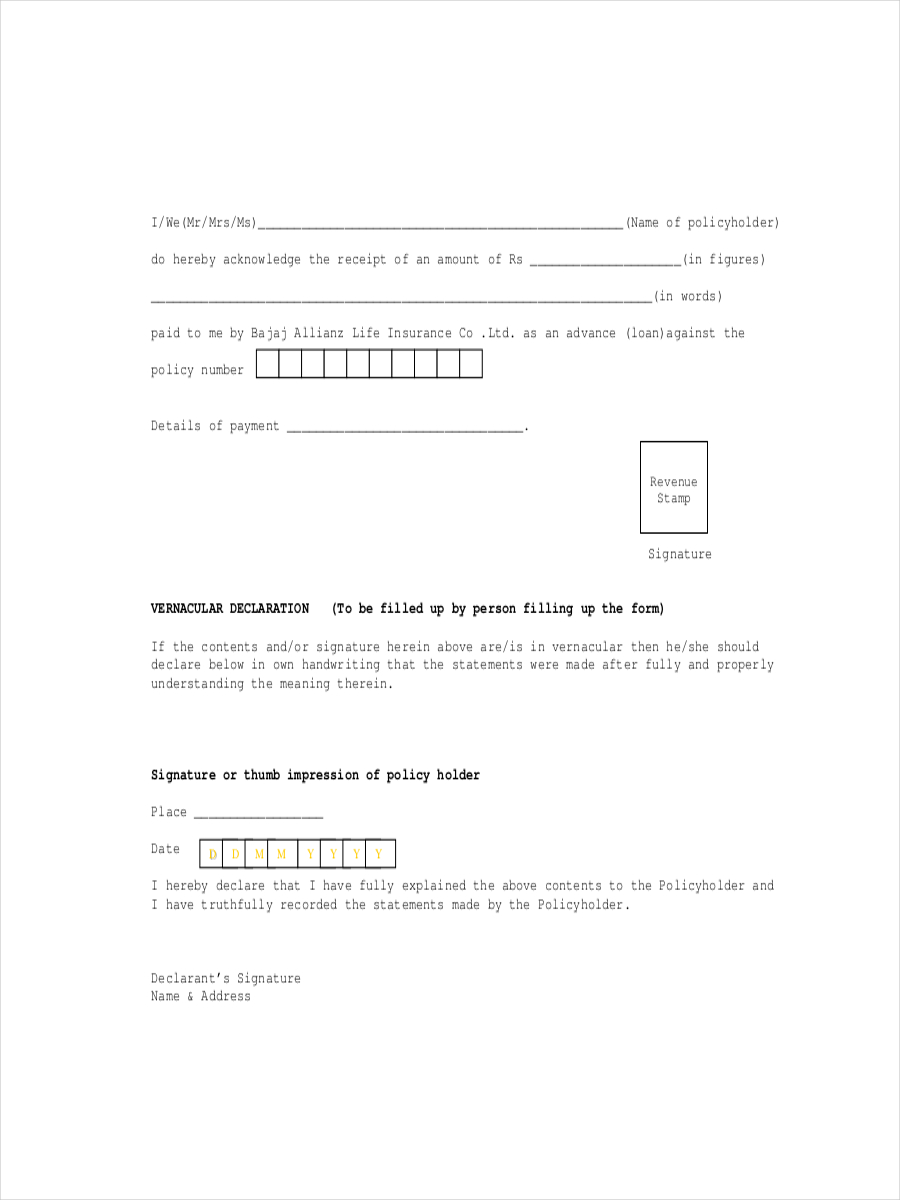

For example, a loan payment receipts are intended to document details of a loan payment completed by a borrower. A typical loan payment receipt usually contains a declaration of the payment indicating the total amount paid in words and in figures, and other important details of the loan.

In legal terms, a loan receipt is a signed document proving a legal settlement agreement between two parties (commonly a defendant and a plaintiff), wherein the defendant (accused of causing a harmful act causing harm to the plaintiff) lends money to the plaintiff, usually free of interest, with the plaintiff paying the loan only if he/she receives money from a third party (usually co-wrongdoers of the defendant), enough to cover for recovery.

Importance of a Loan Payment Receipt

A loan payment receipt basically proves that a borrower has already repaid a certain loan at a specific date.

Such payment will also be recorded by the financial institution where he/she applied for the loan (lender). If the lender fails to record such payment, the borrower will present the loan payment receipt as an evidence of his/her loan payment.

A loan payment receipt, like other receipts, is thus a written agreement between the borrower and the lender. It also helps a lender keep track of the loan histories of the borrowers, and will be one of the documents to be reviewed if one applies for another loan in the same lending company.

Loan Against Trust Receipt

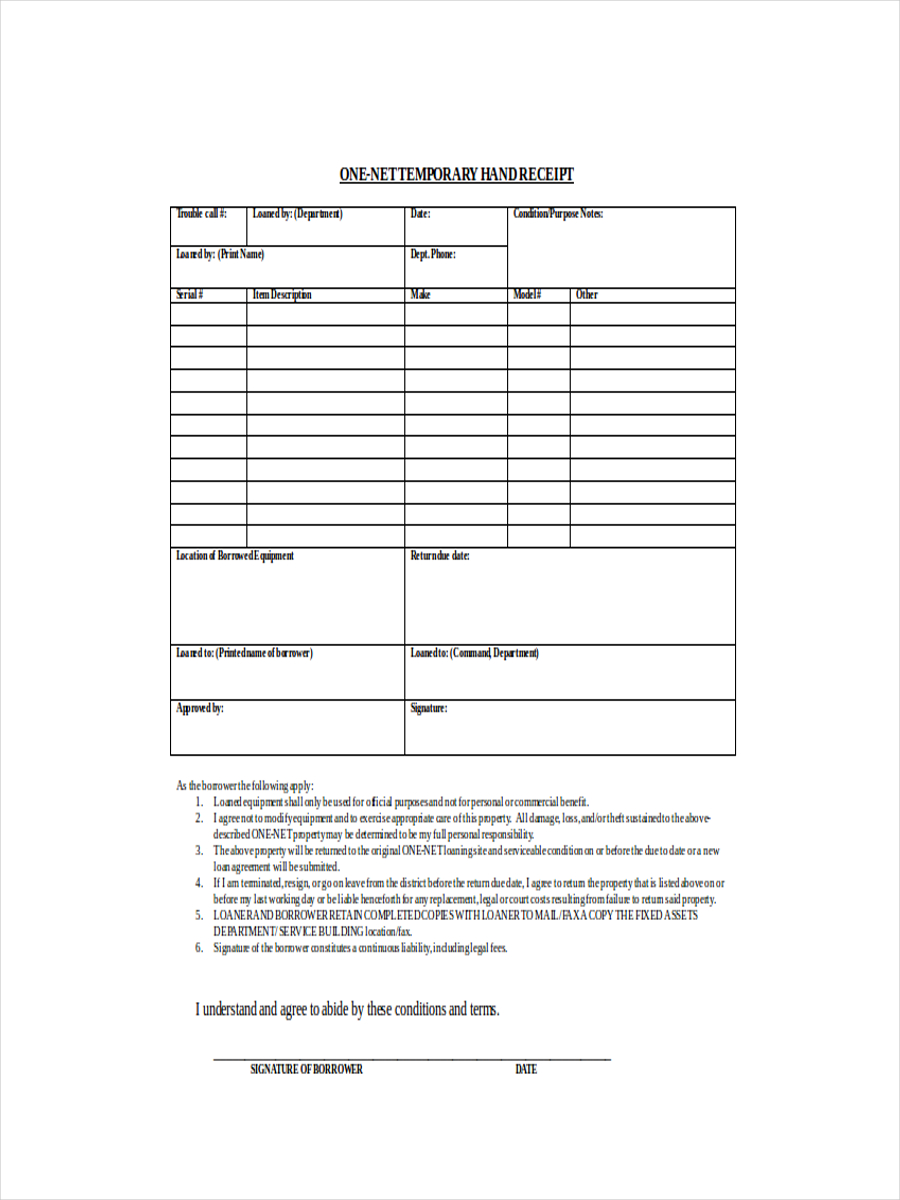

Receipt for Temporary Loan

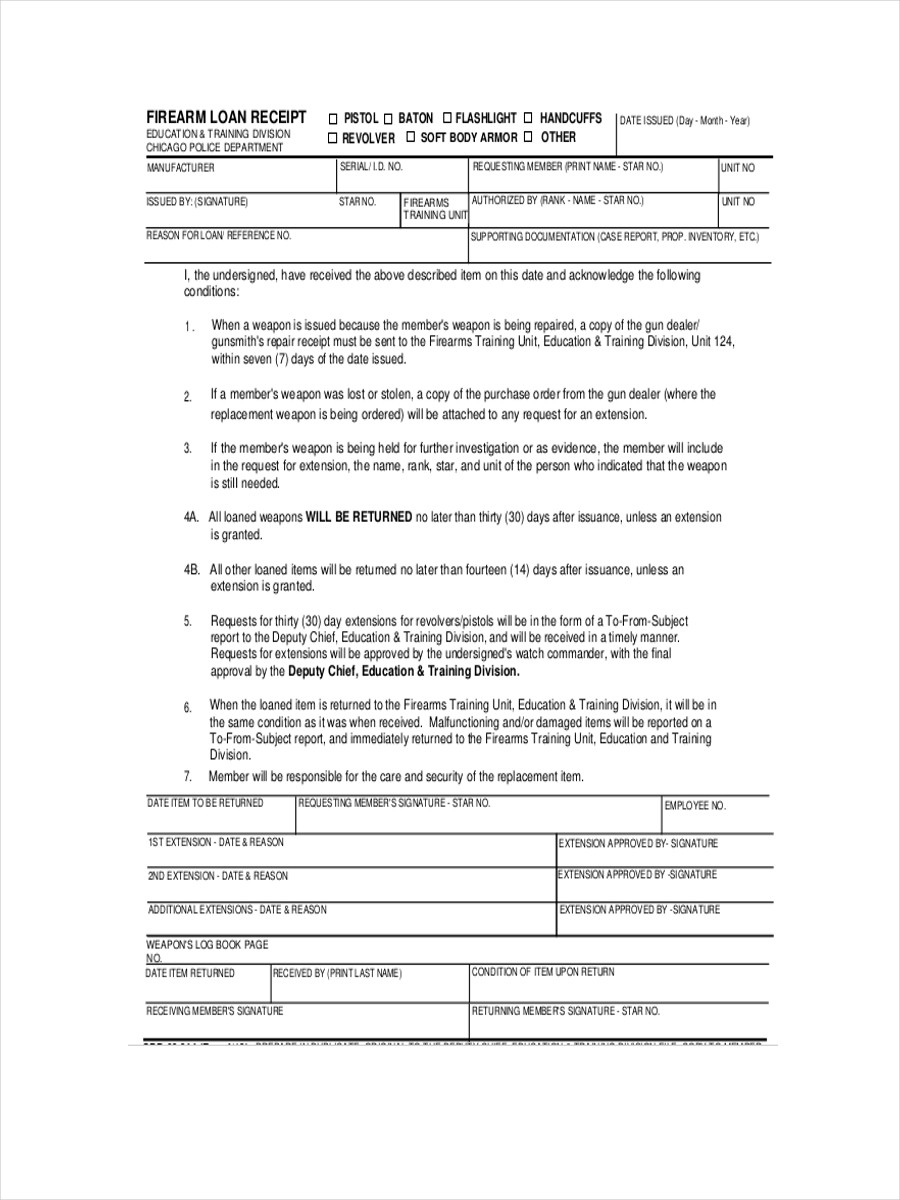

Firearm Loan Receipt

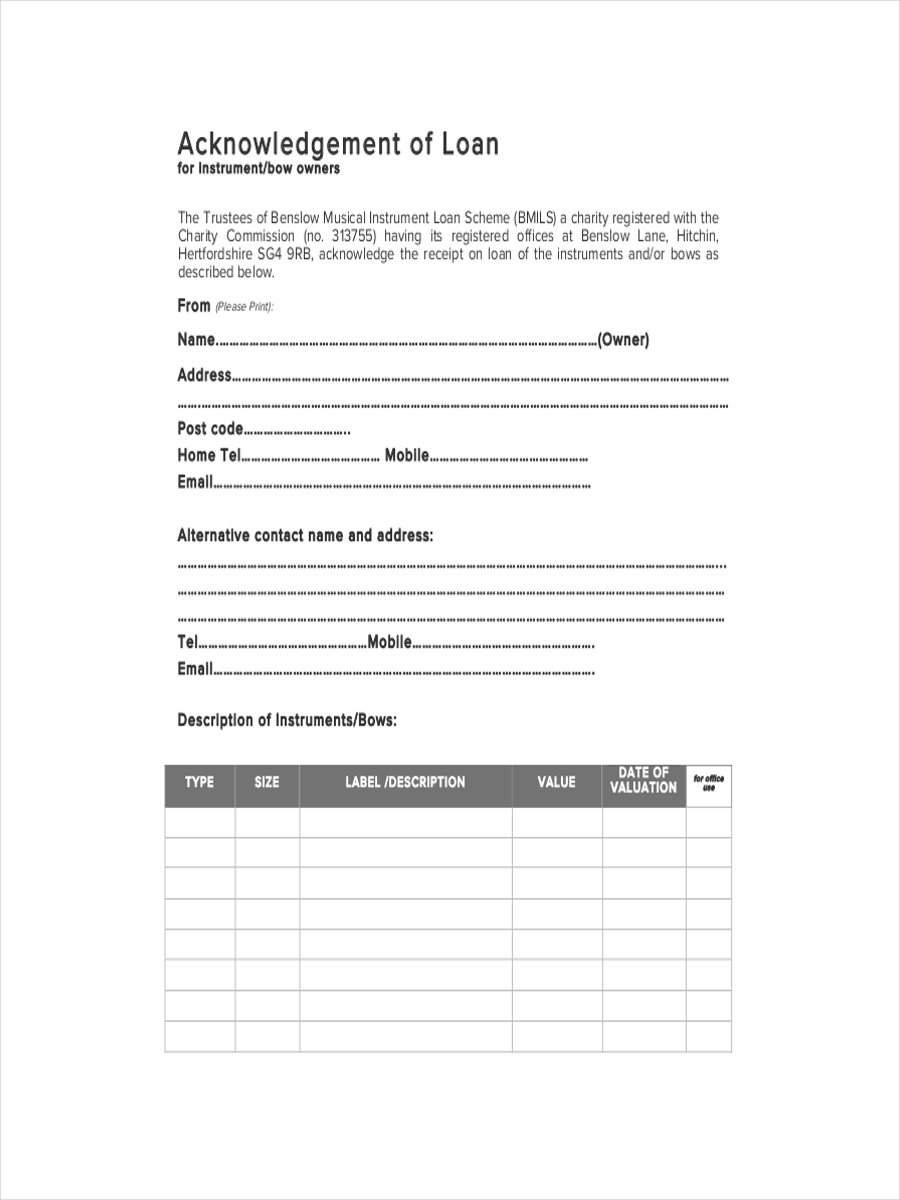

Acknowledgement Receipt for Loan

How to Write a Loan Payment Receipt

Loan receipt sample records every repayment for every loan a borrower makes. It is thus important that a lender issues a loan payment receipt when a borrower repays for a loan. There are no official guidelines, though there are still certain guidelines to be considered when writing a loan payment receipt.

Here are some of them:

- Consider all the information to be included in your receipt. Make sure you write the accurate information.

- Review the terms of the loan. Make sure the borrower (and yourself) has complied with each one.

- You can either fill up the loan payment receipt form on your computer, or you can fill it up manually.

- Leave a space for signatures (yours or the company head’s, and the borrower’s).

- Have a backup copy of the loan payment receipt.