12+ Sales Receipt Examples Examples to Download

In every purchase that you make in a grocery store or a supermarket, it is expected that you will get a sales receipt handed by the cashier. In fact, in some countries, consumers have the right to demand for a receipt. So when you are in business, it is a must to make a receipt.

Almost all business establishments issue a receipt. It is because that piece of paper helps them in their inventory and bookkeeping. Even landlords who run apartments issue receipts for security deposits each of his/her tenants pays. Let us further learn more about receipts and how they are made.

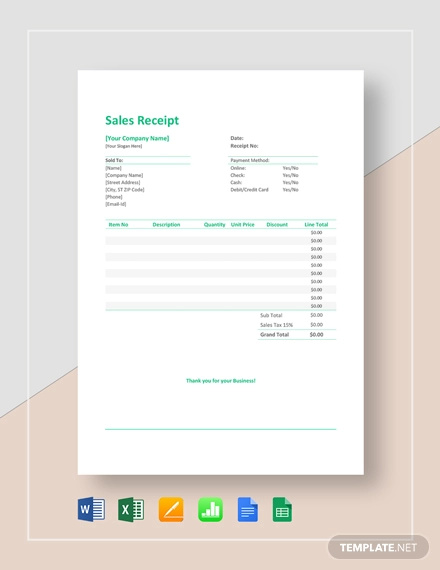

Sales Receipt Example

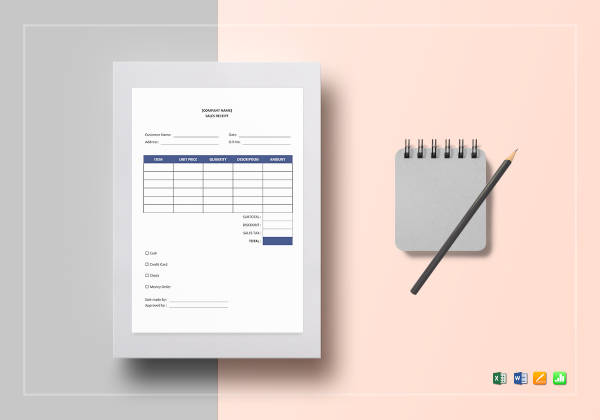

Simple Sales Receipt Example

Blank Sales Receipt Template

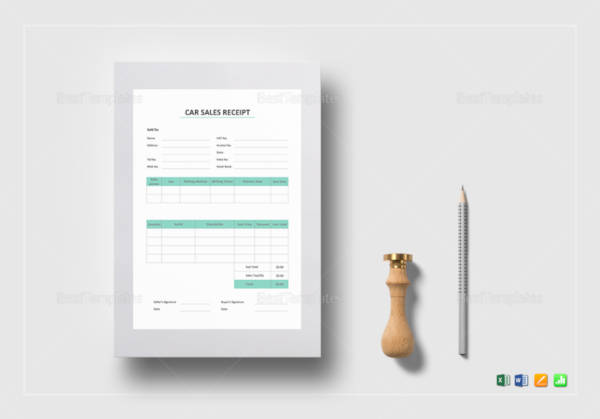

Sample Car Sale Receipt

Printable Receipt Template

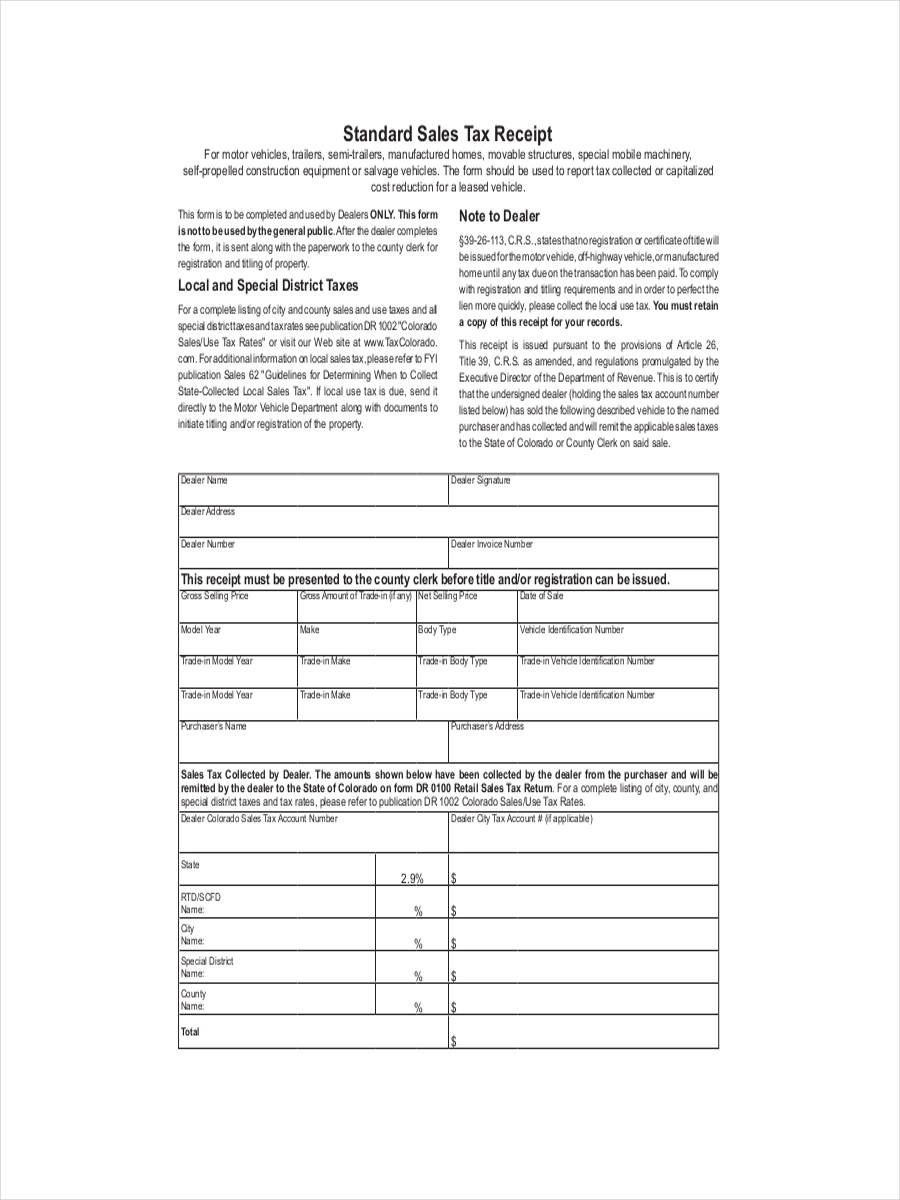

Sales Tax Receipt Example

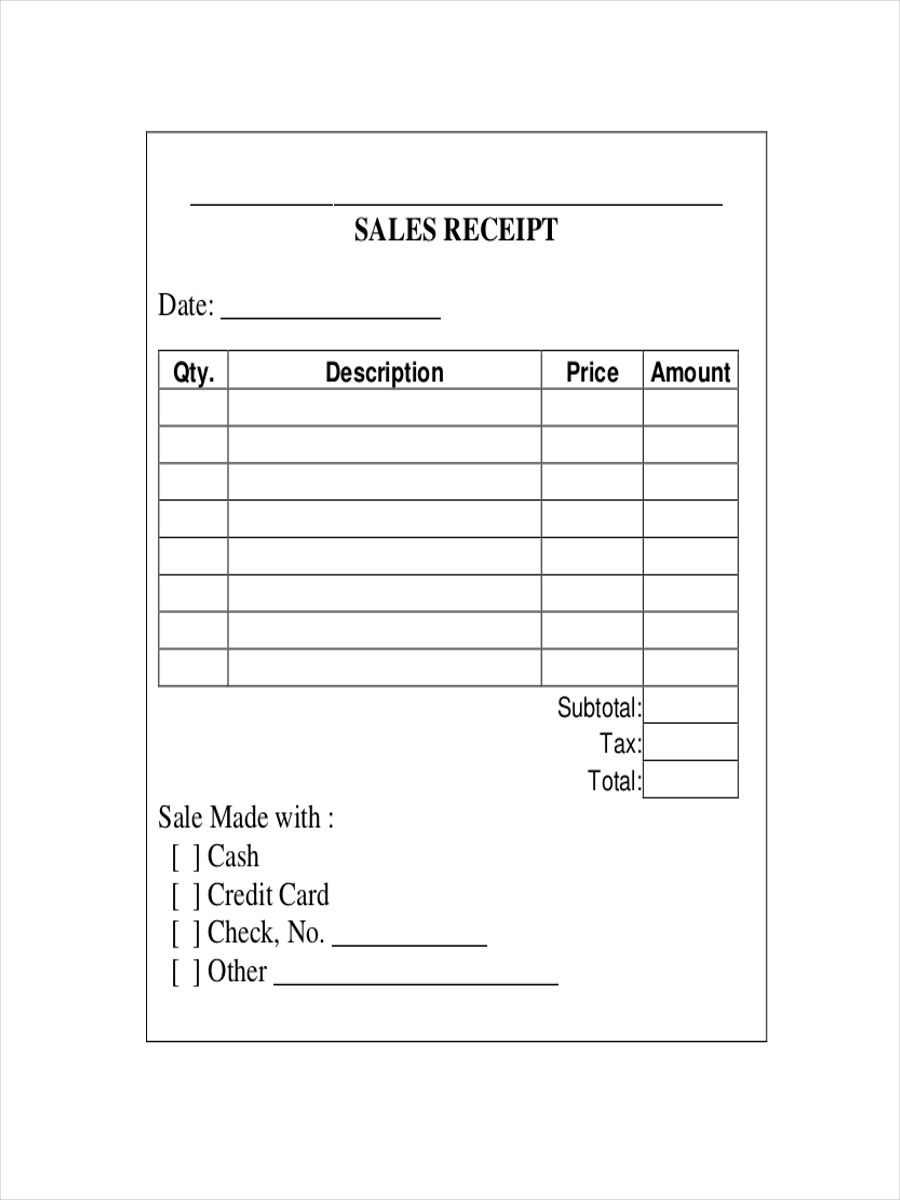

Simple Sales Receipt

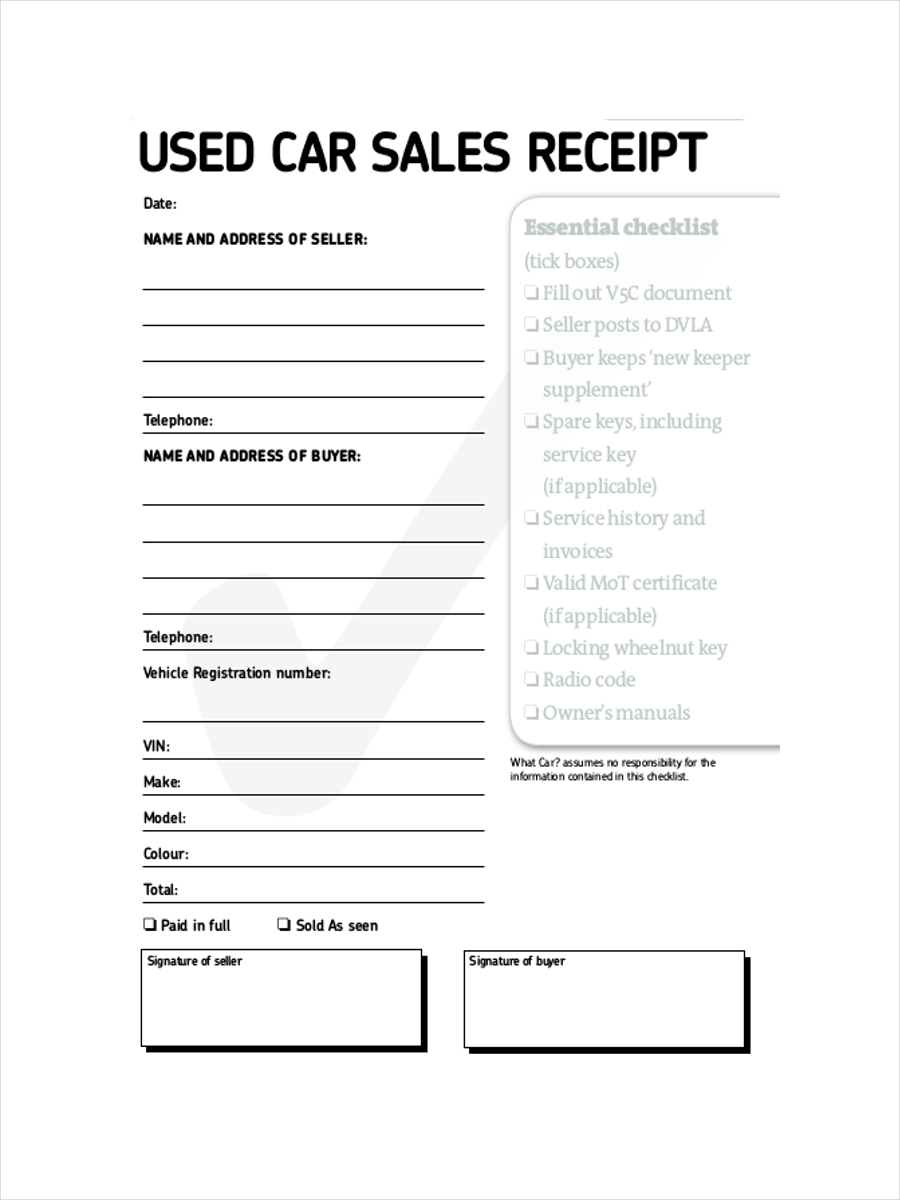

Used Car Sales Receipt

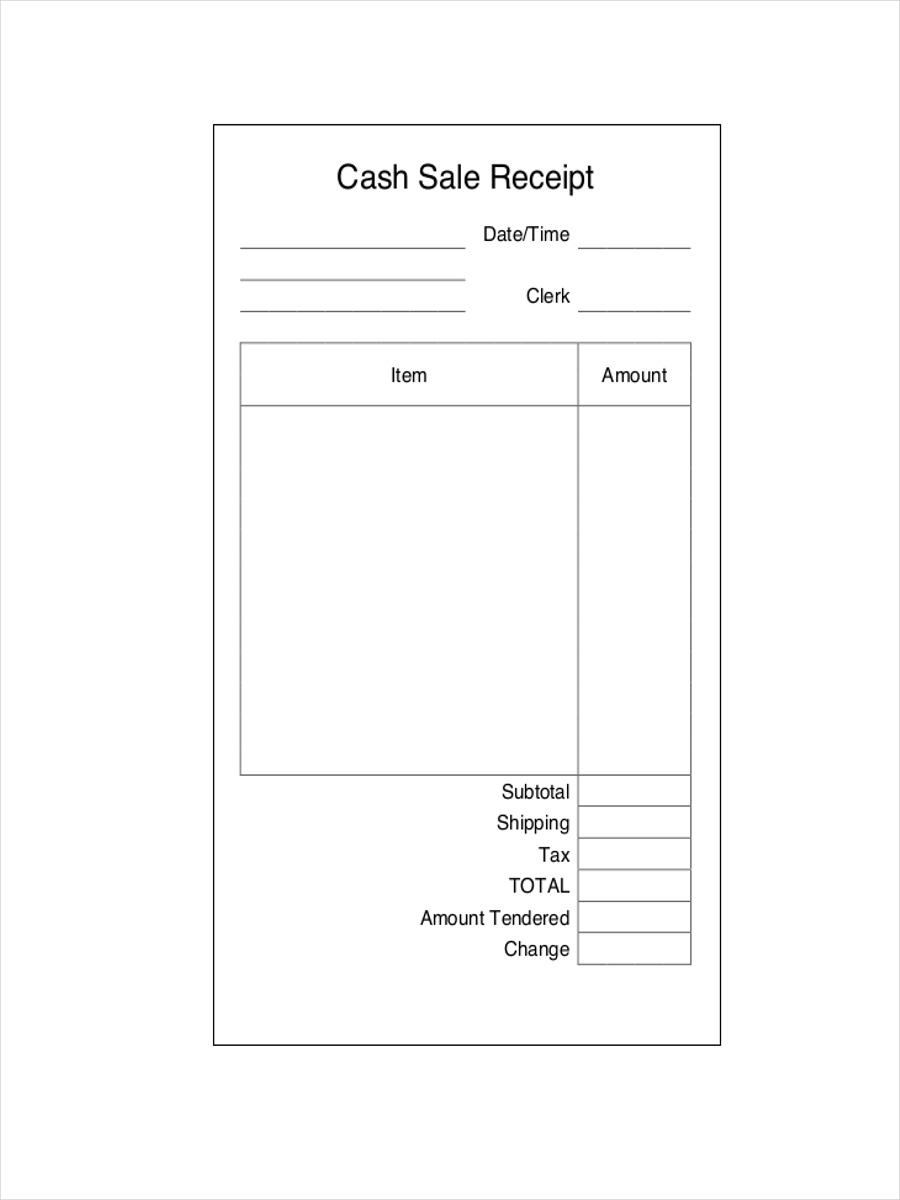

Blank Sales Receipt

What Is a Sales Receipt?

A sales receipt is a document issued by a seller to a buyer in a business receipt transaction where goods or services are offered. It is a piece of paper that includes the date and time of purchase, the items bought and their corresponding prices, the method of payment used, etc.

It is usually provided at business establishments where there is an exchange of goods happening. The moment that a customer goes to the cashier and pays the products bought, a sales receipt is then provided. A sample receipt then serves as a proof of purchase for the buyer.

How to Make a Sales Receipt

Since digital technology’s birth and the popularity of new and better means in handling business, there are already different ways on how to create a sales receipt. However, whatever the format they are in, there are always basic stuff that makes a receipt.

- Write the business details. It is necessary that you write your business name, address, and contact number preferably on top.

- Observe proper sorting. If you are preparing a sample receipt or a blank one, make sure to leave a space for the date/time, items, amount, total, etc.

- Create a layout. Your receipt will reflect how professional you are in business. Make a layout that is neat and proper.

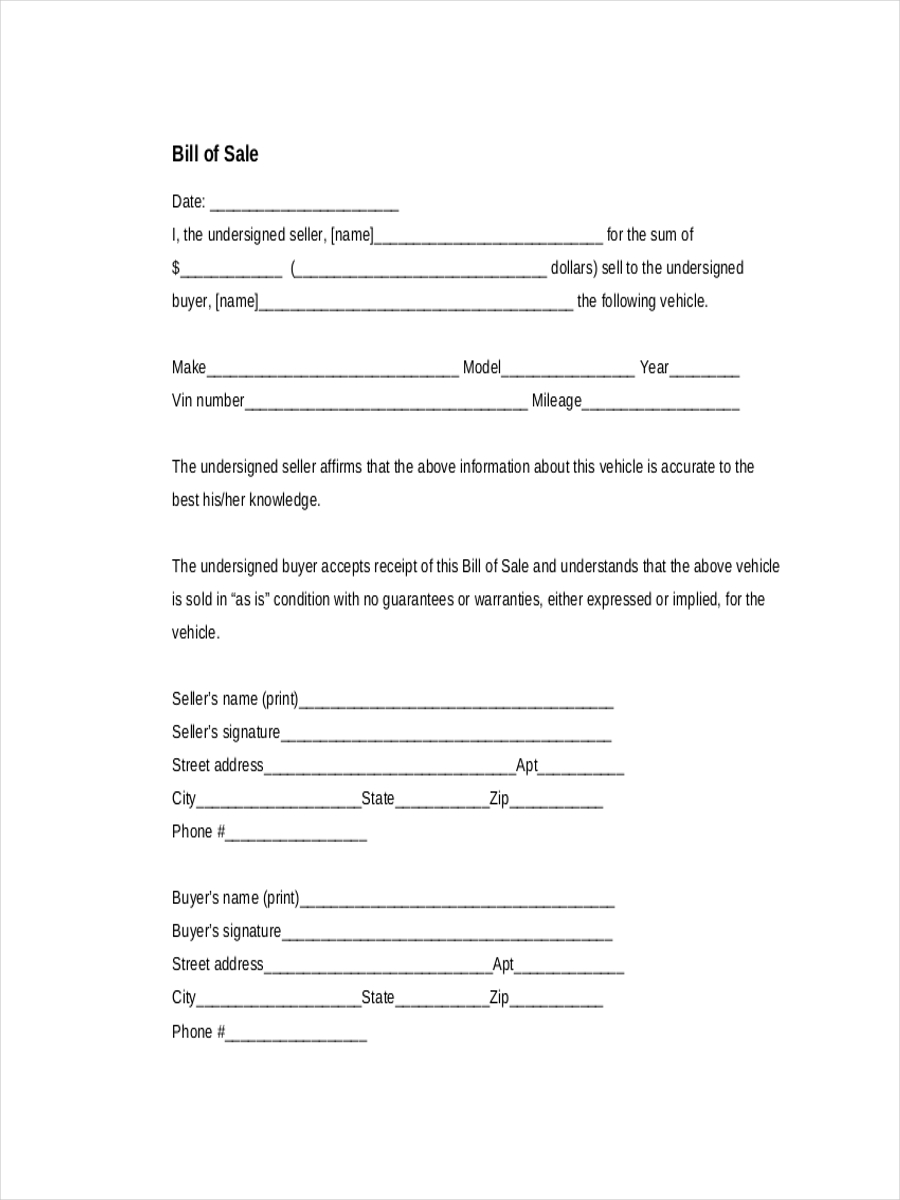

Bill of Sale Receipt

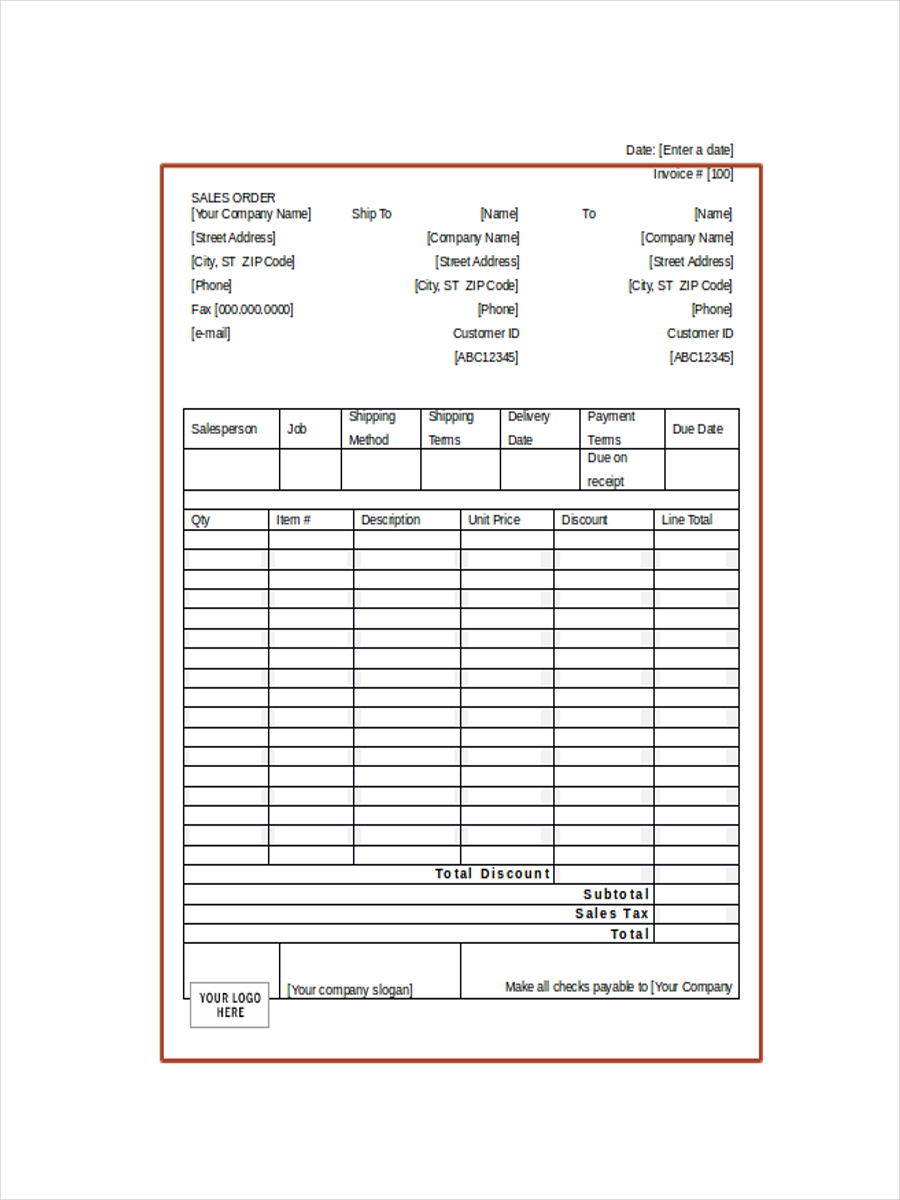

Generic Sales Receipt

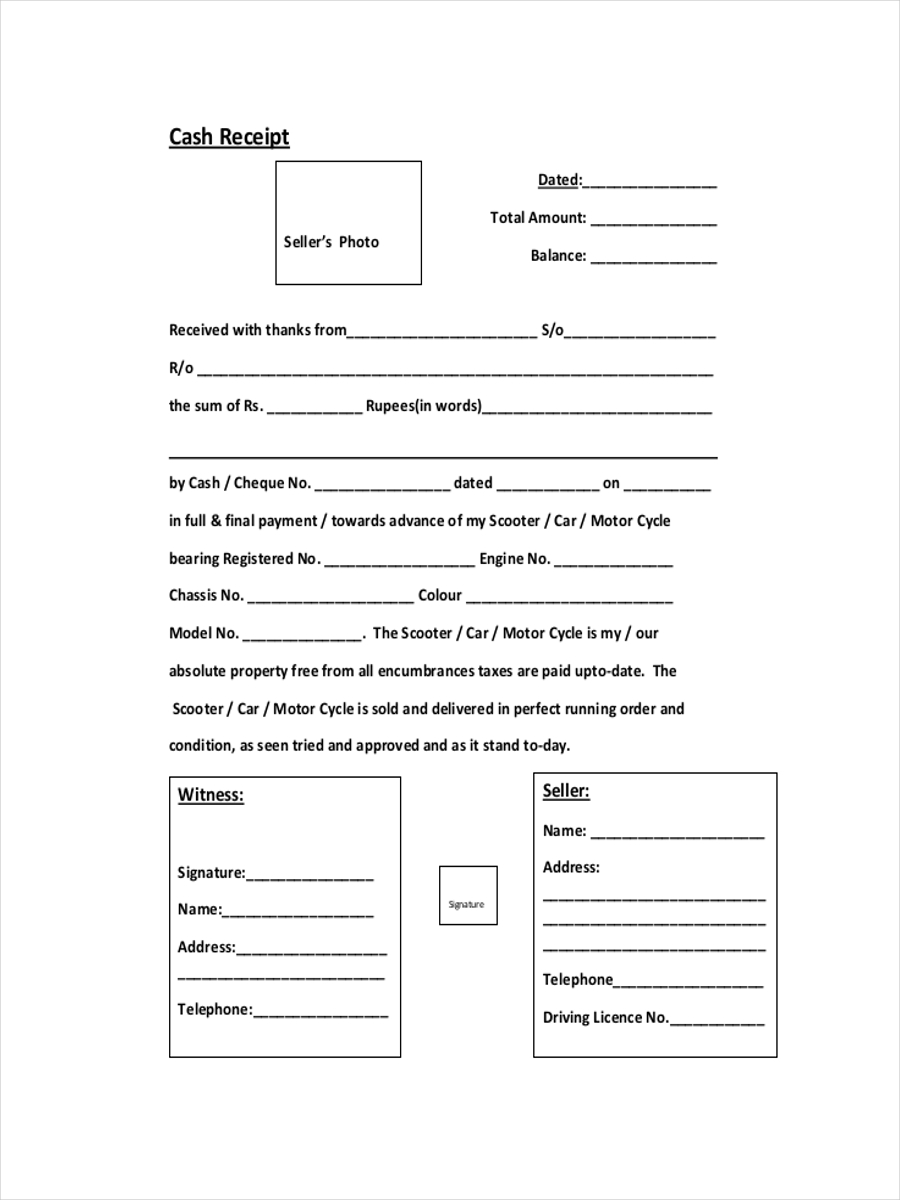

Sales Receipt for Vehicle

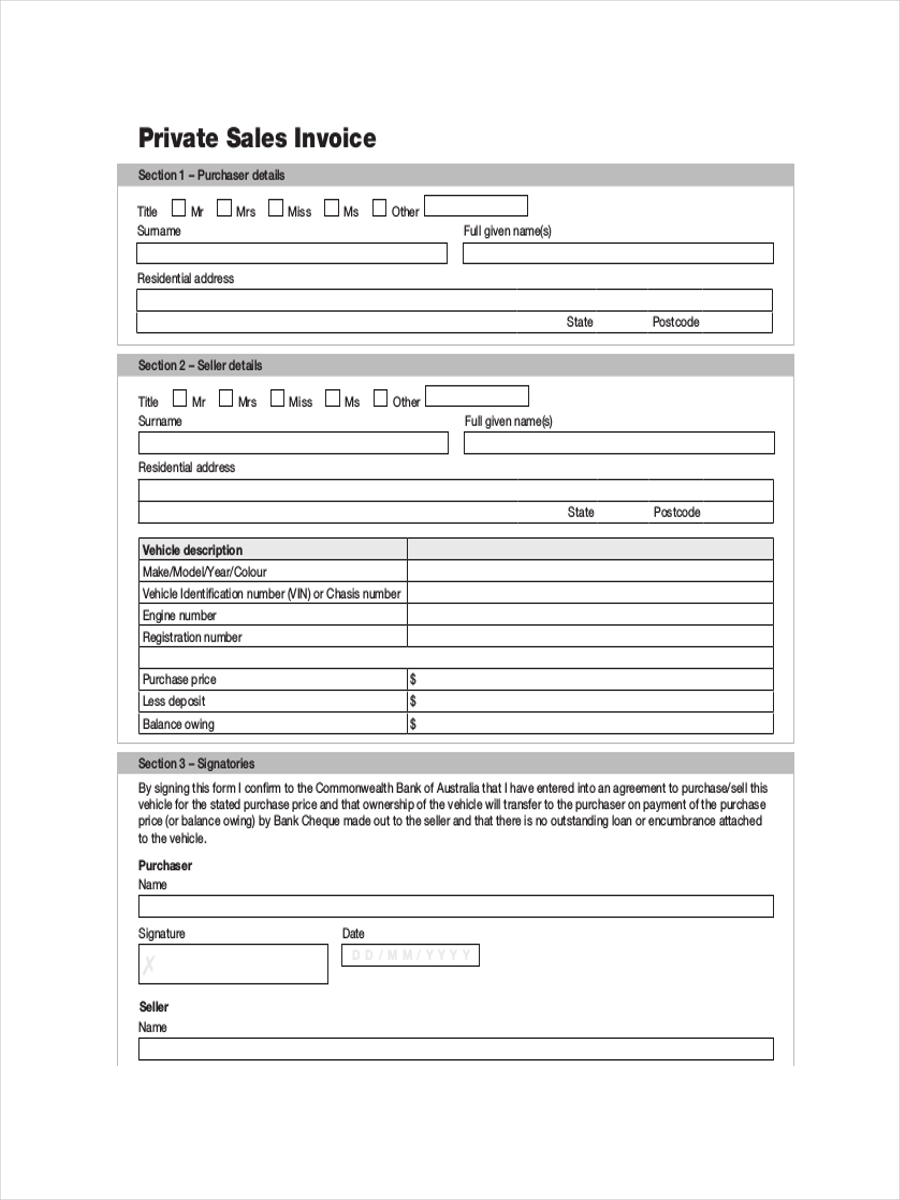

Private Sales Receipt

How to Apply Sales Receipt to an Existing Invoice

Applying a sales receipt to an existing invoice could be a little tricky. That is because these two are almost one and the same.

An invoice example is usually sent to a customer for a demand for payment for the services availed. It is therefore containing the items that are yet to be paid or settled. While a sales receipt is a proof of sale meaning a payment has already been made.

However, for proper accounting and bookkeeping you have to get rid of the invoice. The sales receipt acts as an invoice and a payment at the same time.

Layouts For Sales Receipt

When you are creating a receipt you can go with the traditional way of writing or use modern technology. Whichever way you go, you need to create a layout so your receipt is presentable.

The most common layout for a sales receipt starts with the business details as the heading, the items and amounts as the body, and the amount at the bottom. For some business owners, they usually add another line at the lower right of the paper for customers to affix their signature. This is a proof that the buyer has read and carefully checked the receipt .