18+ Audit Checklist Examples to Download

Checking the finances of an organization is very crucial. Whether you work in a retail store, a restaurant, or a hospital, you have to make sure that the financial activities done are both reliable and fair. Doing an audit is one of the usual ways of making sure, and with an audit checklist, you can do it effectively.

18+ Audit Checklist Examples

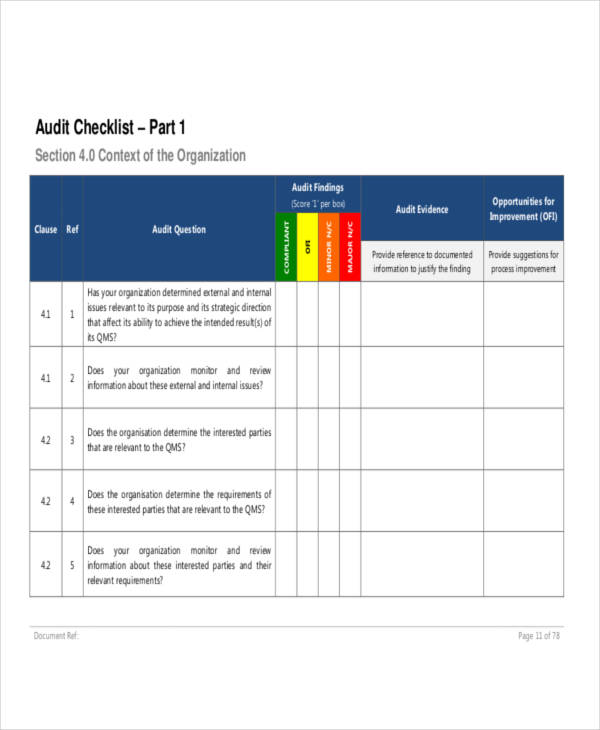

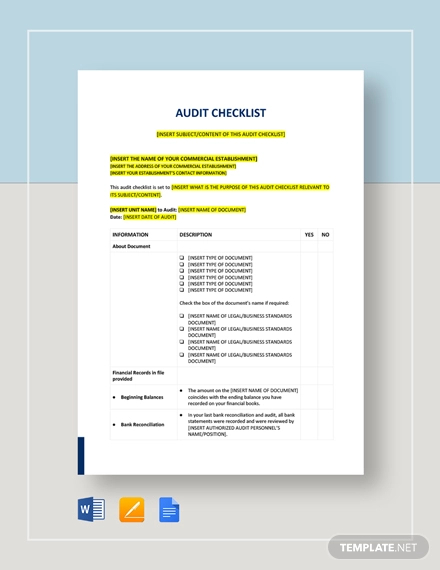

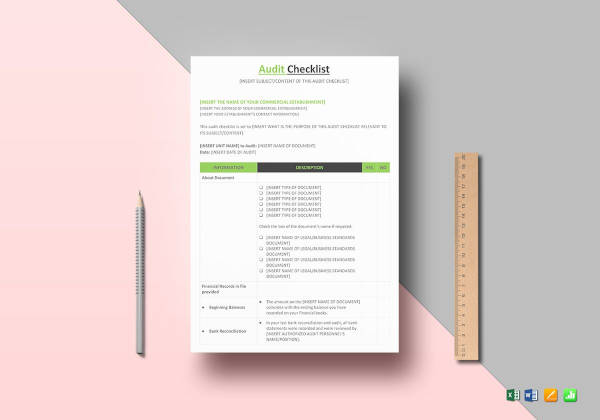

Audit Checklist Example

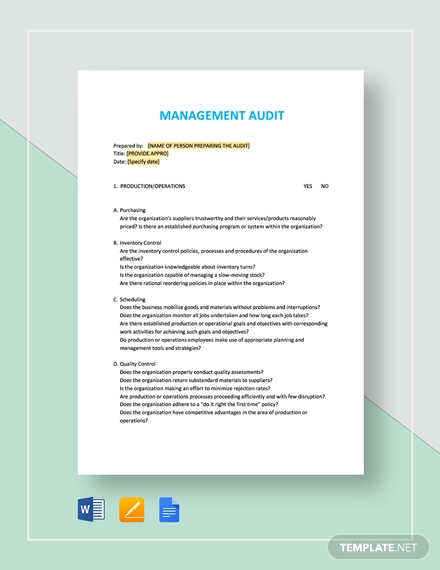

Management Audit Checklist Example

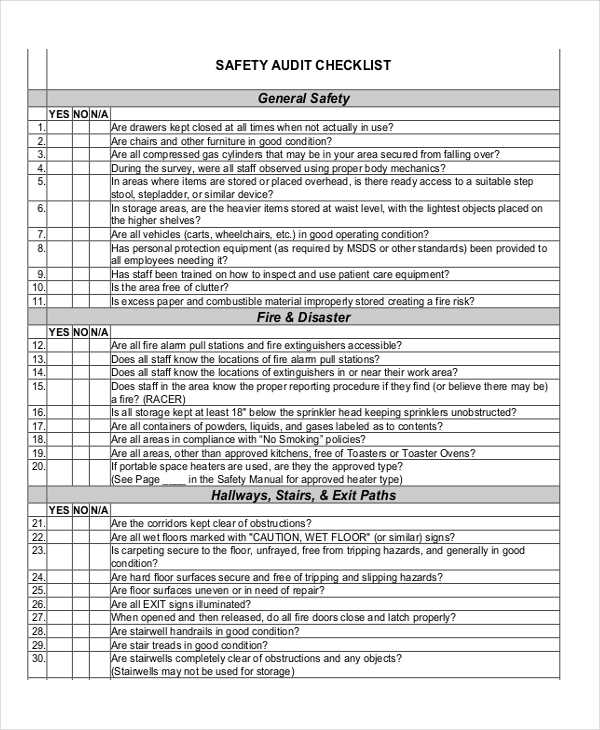

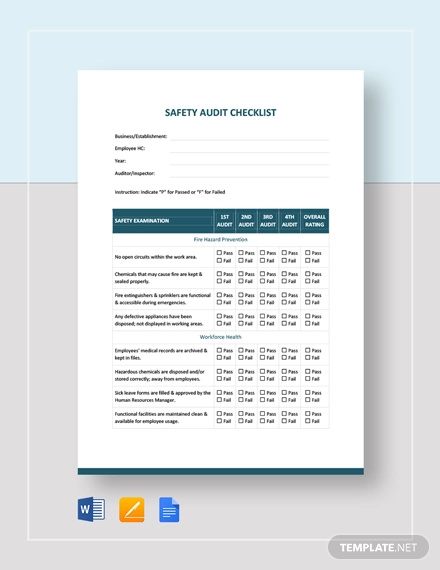

Safety Audit Checklist Example

Restaurant Audit Checklist Example

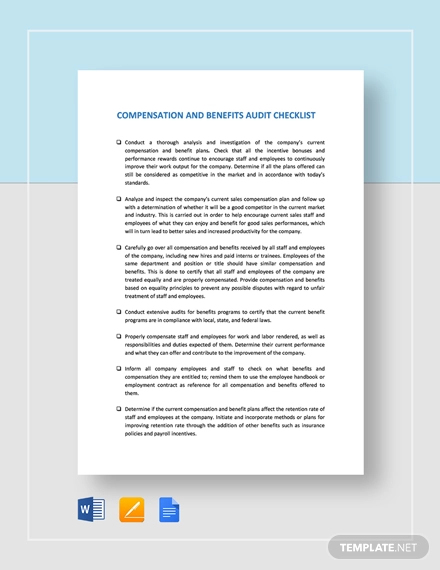

Compensation and Benefits Audit Checklist Example

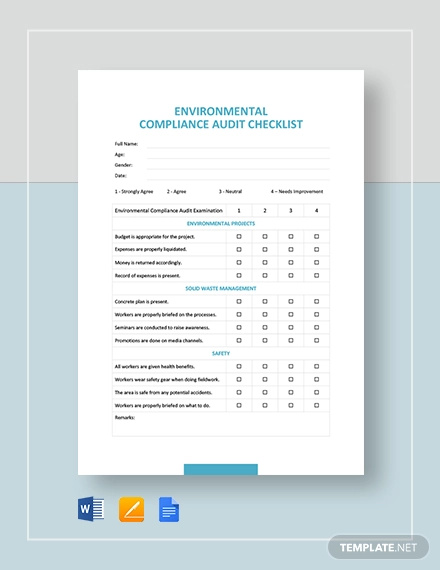

Environmental Compliance Audit Checklist Example

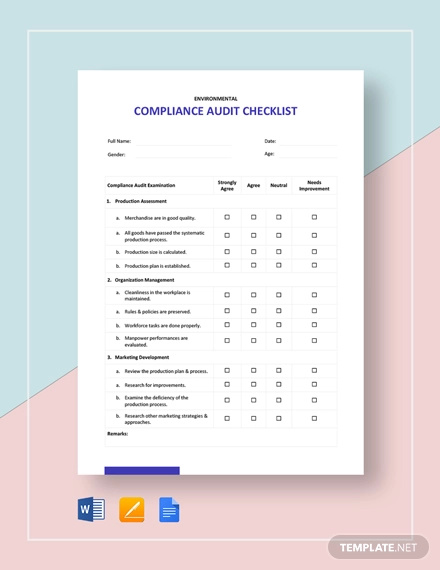

Compliance Audit Checklist Example

Audit Checklist Template

Management Audit Checklist Template

Compensation and Benefits Audit Checklist Template

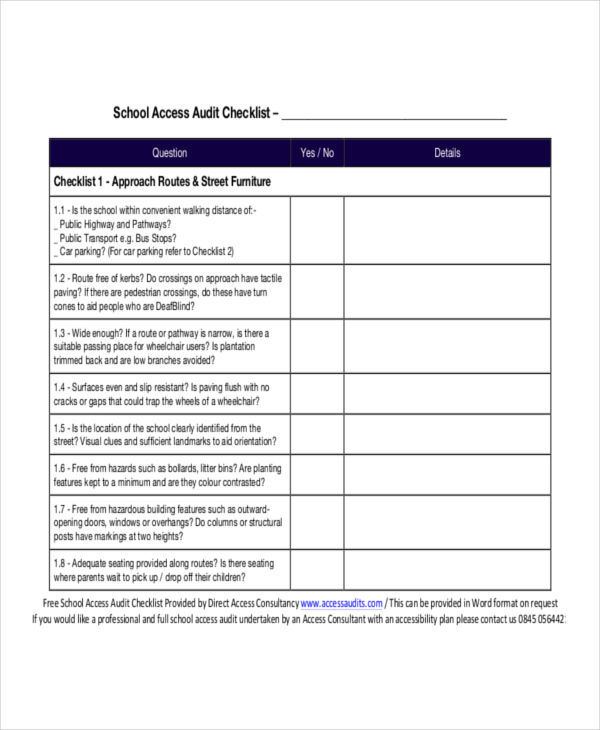

Safety Audit Example

Checklist for an Internal Audit

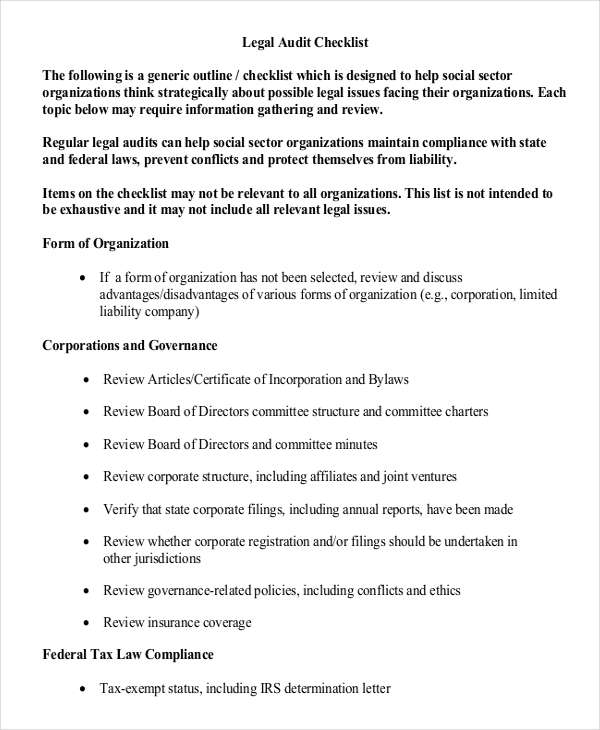

Legal Audit Sample

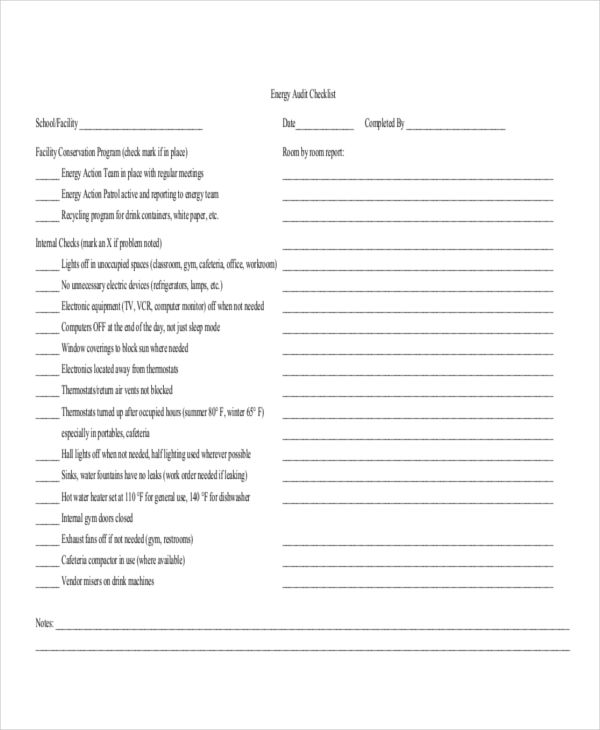

Energy Audit Checklist

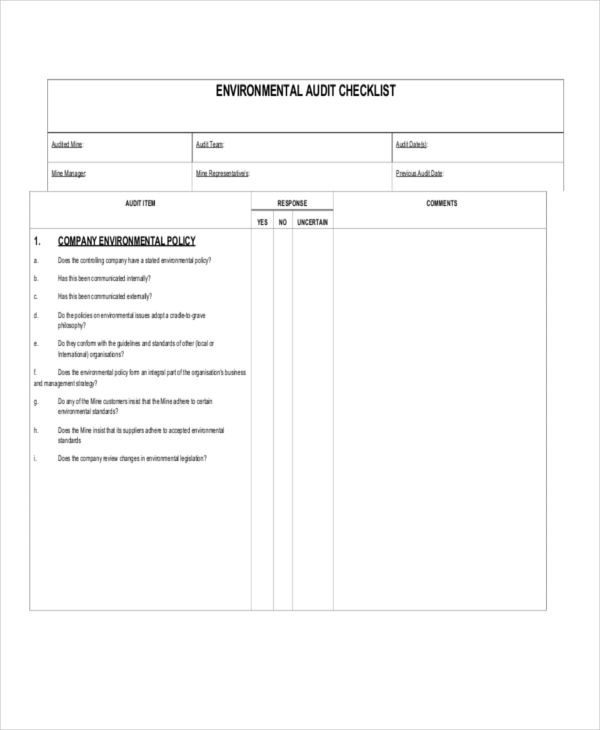

Environmental Audit Example

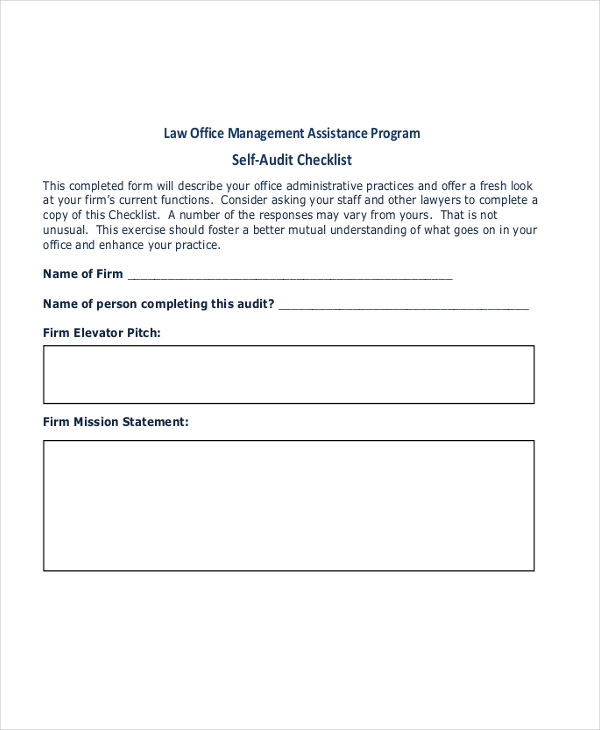

Self-Audit Checklist

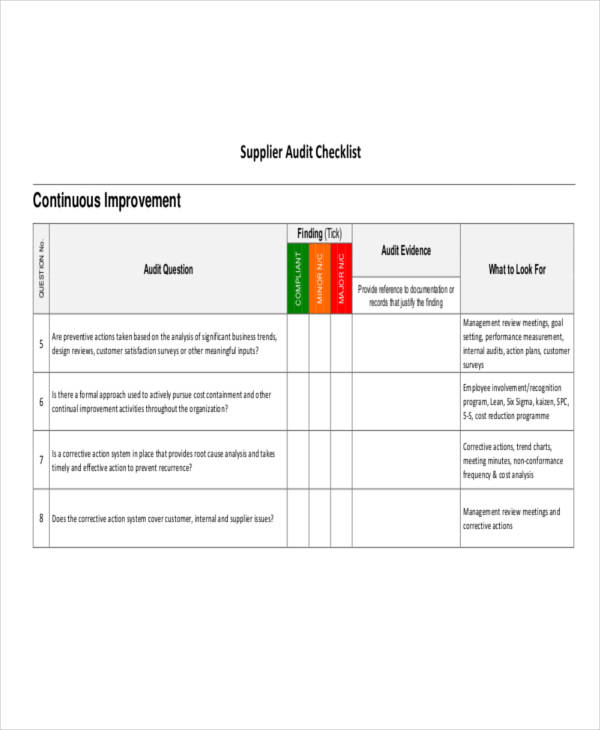

Supplier Audit Example

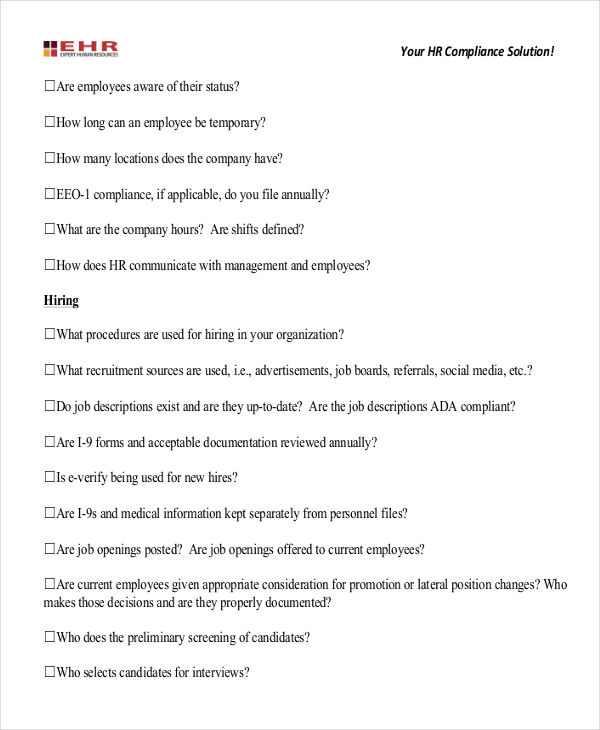

Hr Audit Checklist

Free Audit Checklist Sample

What is an Audit Checklist?

An audit checklist is a tool used by auditors to keep track of what they need to do during the audit process. This is to make sure they didn’t overlook anything significant. An audit checklist will also allow users to think strategically on how to do their work. It will also be easier to take corrective actions to resolve issues and concerns. Employees who work in the human resources or accounting department tend to be those who handle an audit checklist.

How to Make an Audit Checklist

There’s not exactly the best way to write an audit checklist, but there’s a right way to do so. The design of your checklist is the least you need to worry about as there are blank checklists that you can fill and print so just focus on the checklist’s content.

1. Include What is Necessary

If there is a detail that isn’t relevant to the audit, then don’t include it. It will only distract you from focusing on the audit’s main objectives. For example, if you need to look into the customer service department’s payroll, focus on all the information you have on them to make an effective audit.

2. List Down Questions Concisely

Make the financial statements clearly and directly to the point for an auditor to easily understand. You can take a look at inventory and questionnaire templates to figure out how to model the statements in your audit checklist. Adding relevant questions can help you make a more accurate audit.

3. Organize Items Accordingly

It is essential to categorize items into related sections or to list them one by one. This way you can carry out the flow of the process. For example, suppose you are doing an audit for the manufacturing process of a company’s product. Keep it in categories for each aspect, like the maintenance costs of the factory and the production itself.

4. Add Details of The Organization

Make sure to include the professional details of those who are a part of the audit process to make your audit checklist foolproof. You may include the name of the organization and the logo into the checklist’s design. This will help your auditors instantly recognize your audit with ease as they do their work.

FAQ’s

What are some of the documents needed for an audit?

To make an audit, you will have to have a lot of records and proof of the transaction. It could include invoices, sales receipts, checkbooks, tax forms, and inventory records for starters.

What are the two types of auditing?

There are two ways to do an audit: internal and external. Someone who is part of the organization does an internal audit. Meanwhile, third parties are the ones who do external audits. They could be from an insurance company or a tax agency.

What makes an auditor different from an accountant?

While they both seem to have similar jobs, an auditor’s responsibility is to verify financial statements’ accuracy and ensure all the numbers add up. An accountant, in comparison, usually prepares documents and monitors day-to-day financial related operations.

Doing an audit can be a tough job, and it is crucial to be meticulous in this line of work. If you miss one detail, it could lead to a lot of problems that you could avoid in the first place. With the help of a well-made audit checklist, you should be able to have it covered. What’s more, according to an article by Forbes, thanks to the technology we have nowadays like AI, audits are going to be easy in the near future.