19+ Expense Worksheet Examples to Download

An expense worksheet is a lifesaver when you want to know exactly how much you are spending and earning. The expense worksheet will allow you to organize your expenses and reflect on them seriously. If you are an organization, using an expense worksheet is important to keep a track of your financial situation. Use these expense worksheet examples and templates to help you in organizing your financial data.

Expense Worksheet Examples & Templates

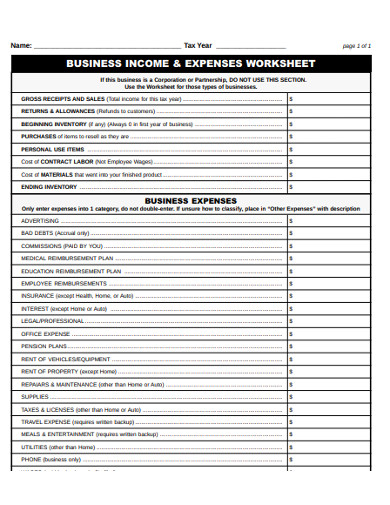

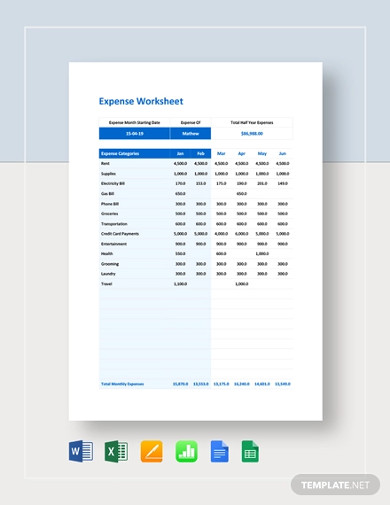

1. Expense Worksheet Template

Use this simple expense worksheet to note down your monthly expenses and monthly income from sale. You can edit the headings after downloading it for free. It will help you take strategic financial decisions for your business as you would be able to see a quick snapshot of your financial situation. Expense worksheets such as this one also help in compilation of annual financial sheets.

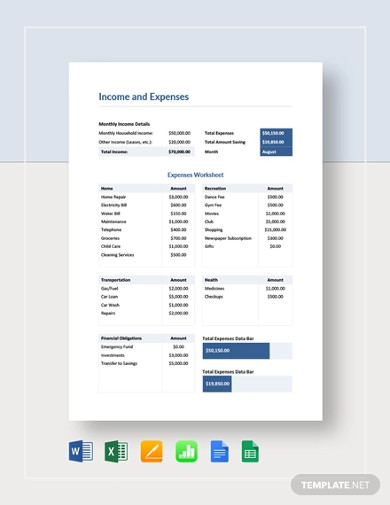

2. Income and Expense Worksheet Template

A business can only flourish if its income is more than its expenses. However, it needs to keep a track of both cash inflow and cash outflow to understand where it stands financially. Use this income and expense worksheet template for this purpose. It is editable in PDF.

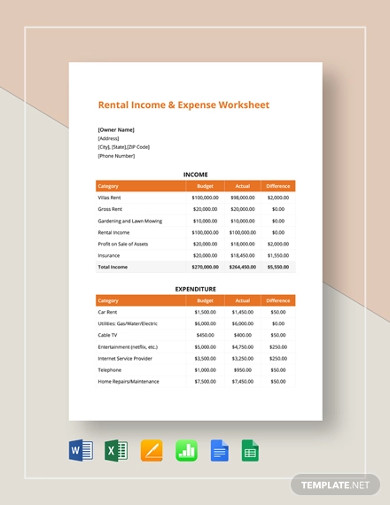

3. Rental Income & Expense Worksheet Template

If you have properties that you have rented out, then you can use this rental income and expense worksheet template to jot down the rents you receive on a weekly or monthly basis. You can calculate your budget against the actual amount and see the difference. Download today and edit this in a number of applications.

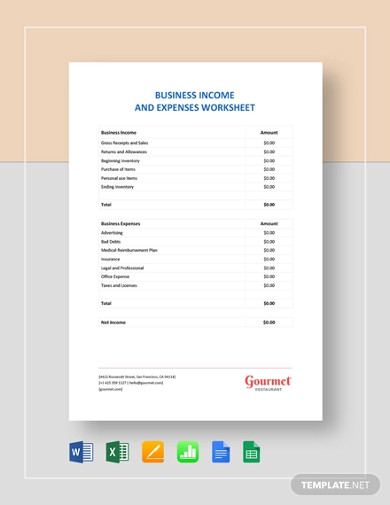

4. Business Income & Expenses Worksheet Template

A finance manager will be thrilled to have this business income and expense worksheet template because it is simple yet has a very professional and formal format. You can simply mention the expense categories and calculate the total amount spent. Download this today and edit in a number of applications like Word, Numbers and Pages.

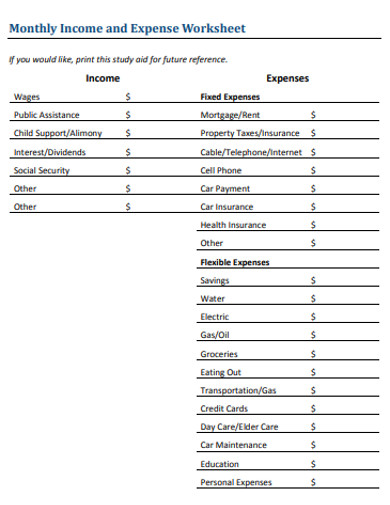

5. Monthly Income and Expense Worksheet

If you are looking for a monthly income and expense worksheet, then this one will come in handy for you. It allows you to note down income details like wages, public assistance, child security and others. You can also note down your fixed expenses and flexible expenses.

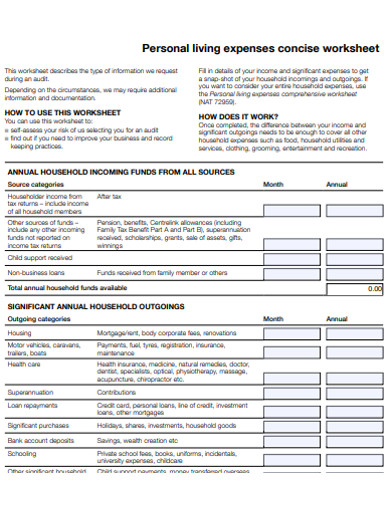

6. Personal Living Expenses Concise Worksheet Example

It is important to have your expenses sorted out and you can do that by download and using this personal living expenses concise worksheet example. You can note down your annual household expenses and see how much you are spending and on what.

7. Expense Tracker Worksheet Example

If you have shifted into a new country for just a couple of months, you can use this expense tracker worksheet and track your expenses related to housing, utilities, loans and lease payments.

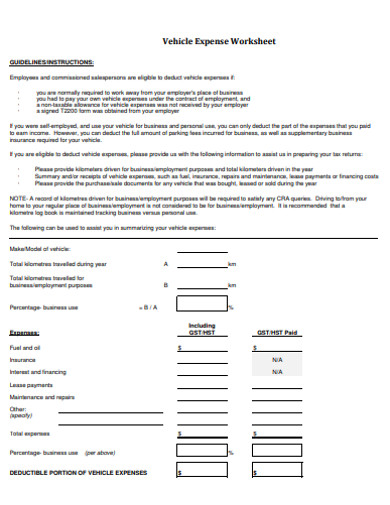

8. Vehicle Expense Worksheet Example

Vehicles and transportations can cost a lot. Download this vehicle expense sheet to note down how much fuel you are using and how much expense you are incurring on maintaining a vehicle on monthly basis.

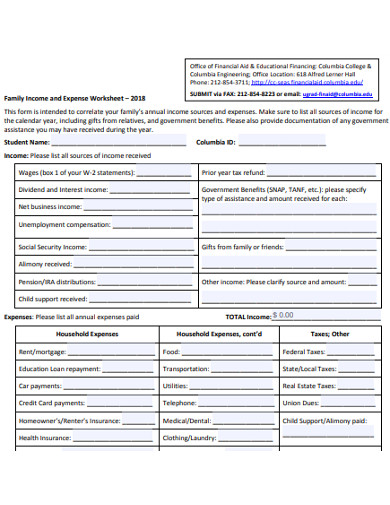

9. Family Income and Expense Worksheet Example

If you want to keep track of your family income then this elaborated family income and expense worksheet will be useful for you. It even includes the dividends received, child support and gifts received from other friends.

10. Weekly Expense Tracking Worksheet Examples

Here is a simple weekly expense tracking worksheet that you can use to track your weekly expenses like meals, traveling, fuel and payments.

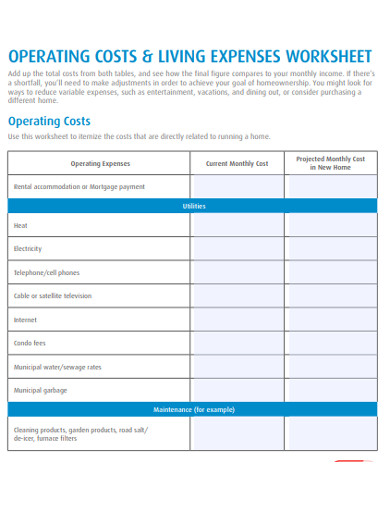

11. Living Expenses Worksheet Example

If you are supporting someone, you can track their living expenses through this worksheet. You can write down the monthly cost of electricity, food, interne, heat and other things.

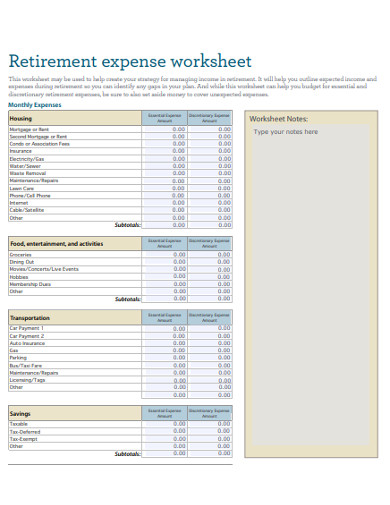

12. Retirement Expense Worksheet Example

Thinking of retiring soon? You would want to know how much it costs to retire and have no income. Here is the perfect retirement expense worksheet in which you can calculate all the possible expenses you will incur once you retire.

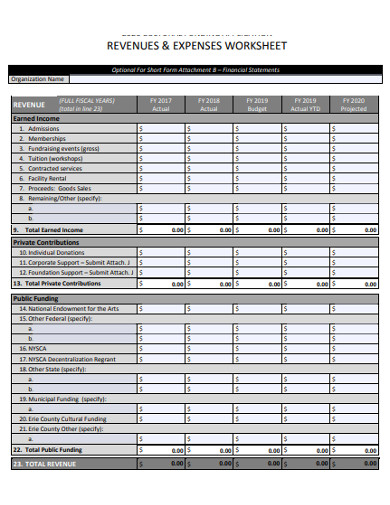

13. Revenues and Expenses Worksheet Examples

Any new startup with limited funding can share this revenue and expenses worksheet with their funders and give a brief presentation of the financial situation.

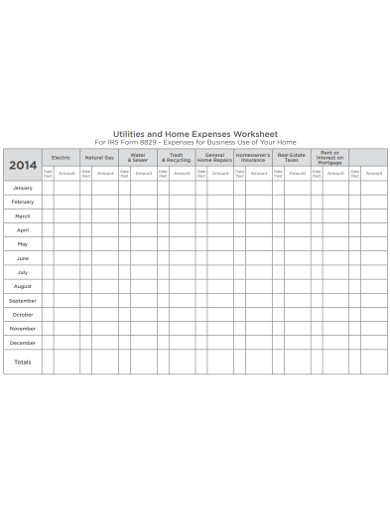

14. Home Expenses Worksheet Example

Do you want to try a new way of managing your expenses? Try this home expenses worksheet which already includes the necessary and relevant categories of expenses.

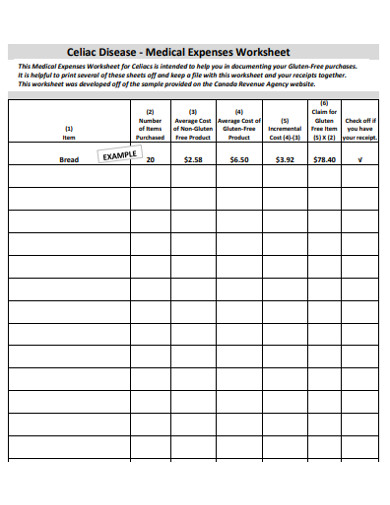

15. Medical Expenses Worksheet Example

Medical expenses can cost a lot. Use this medical expenses worksheet to note down the medication costs and hospital visit costs.

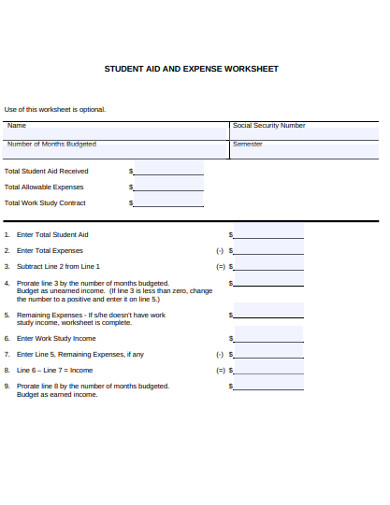

16. Student Aid and Expenses Worksheet Example

If you are sponsoring a student’s graduate studies then you can use this student aid and expenses worksheet to figure out how much the tuition, accommodation and lodging is going to cost.

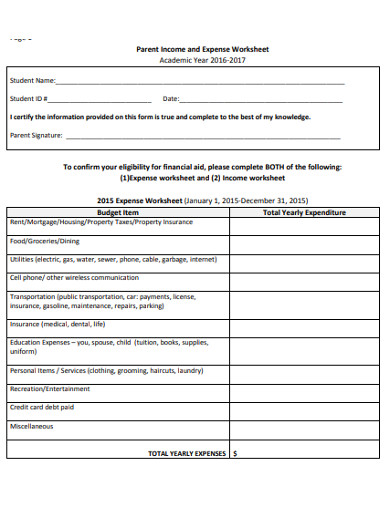

17. Parent Income and Expense Worksheet Example

If you are applying for parent aid then this parent income and expense worksheet will give you an idea of what to include in your application such as credit card bills, medical bills and meals.

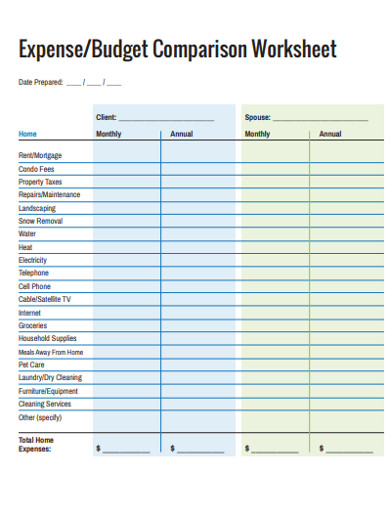

18. Budget Expenses Worksheet Example

If you need to compare your budget against your expenses for a time period, download and use this budget expenses worksheet. It includes all the details of household expenses.

19. Sample Business Income and Expenses Worksheet Example

Have you started your own business but don’t know which expenses you will incur soon? Here is a sample business income and expenses worksheet to give you a fair idea of what costs are coming your way.

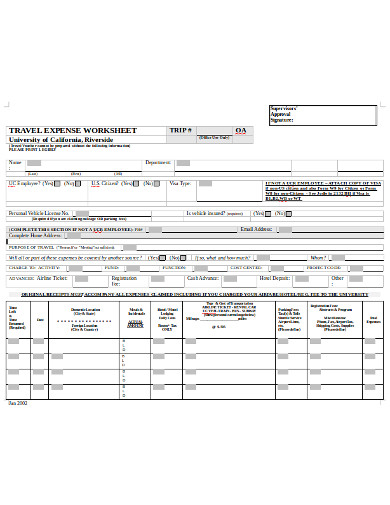

20. Travel Expenses Worksheet Example

If you have traveled a lot on company’s behalf then you can use this travel expenses worksheet to write down all the expenses incurred on your trip. Submit it to your HR department for reimbursement.