100+ Income Statement Examples to Download

In business, reading and preparing income statements is an essential part of what and how the money is being used throughout the company. Financial statements are part of an income statement and should also be essential to understand it. One of which is learning how to read and use them.

100+ Income Statement Examples

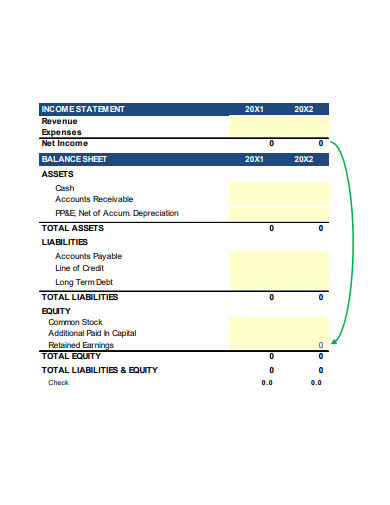

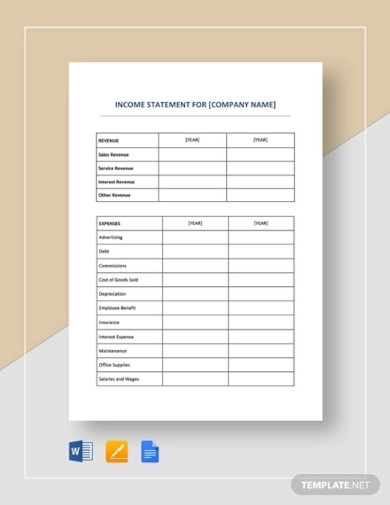

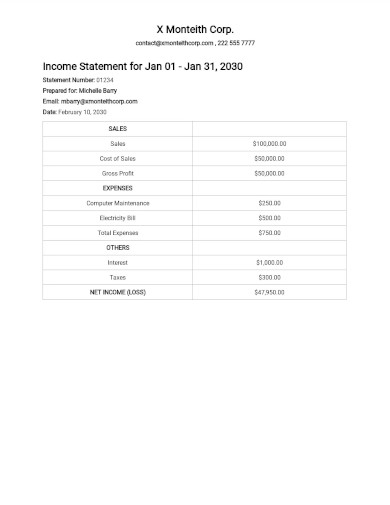

1. Income Statement Example

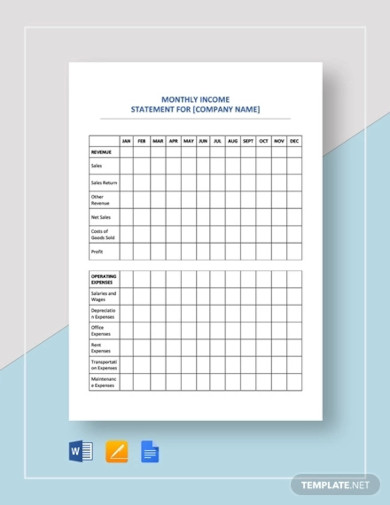

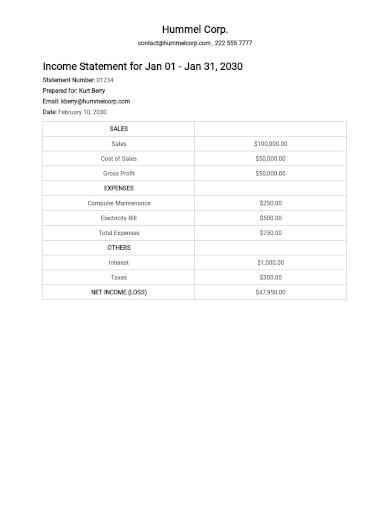

2. Income Statement Monthly Example

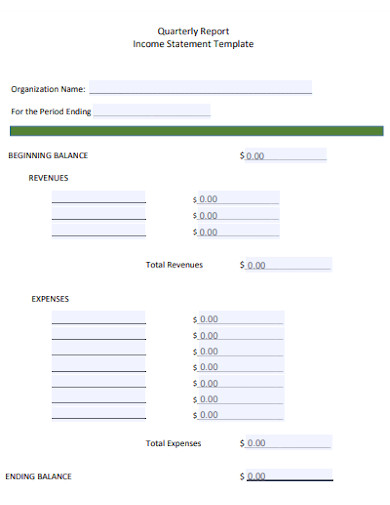

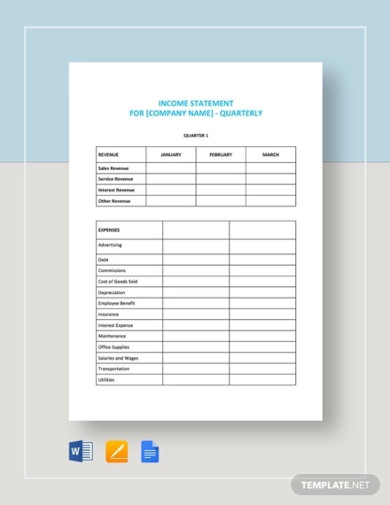

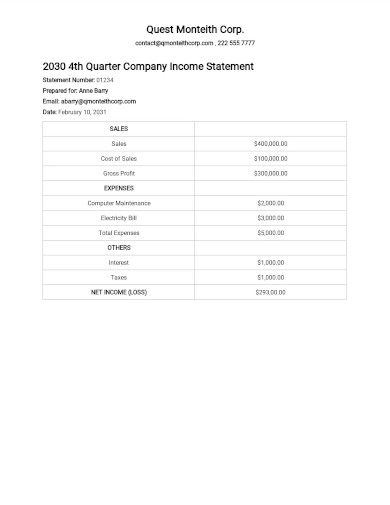

3. Quarterly Income Statement

4. Freelance Income Statement Template

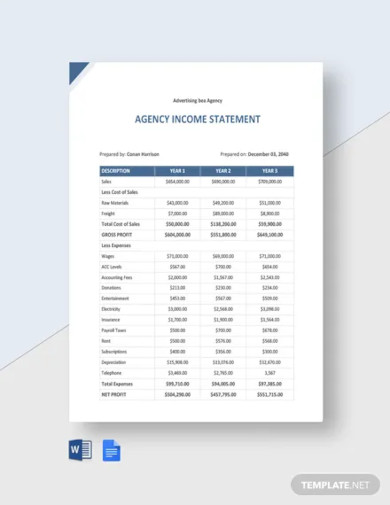

5. Agency Income Statement Template

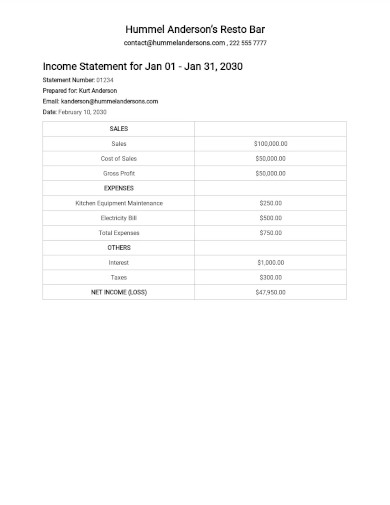

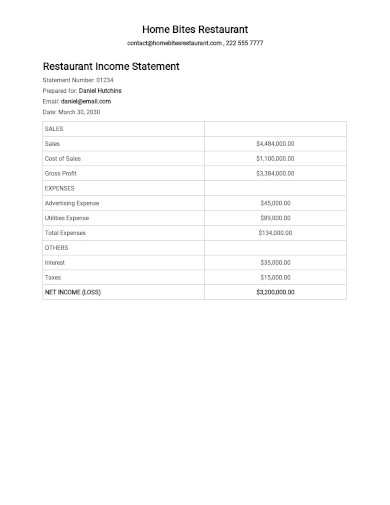

6. Restaurant Income Statement Template

7. Software Income Statement Template

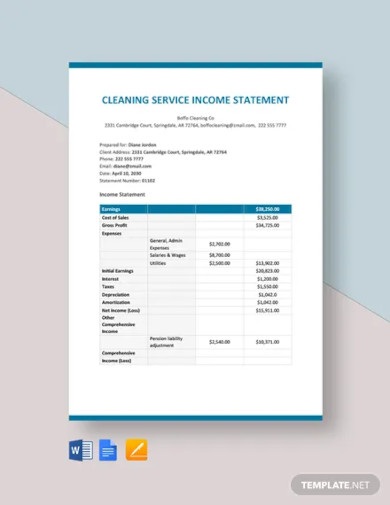

8. Cleaning Service Income Statement Template

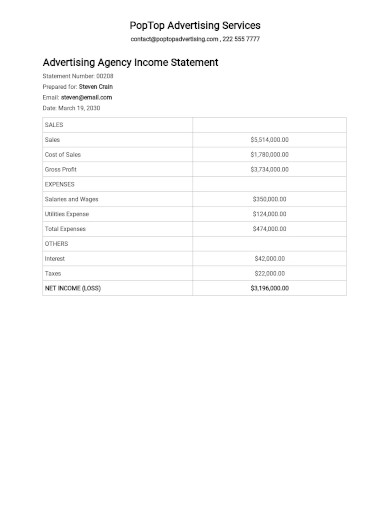

9. Advertising Agency Income Statement Template

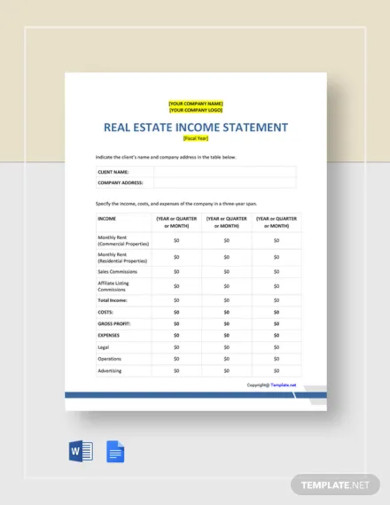

10. Sample Real Estate Income Statement Template

11. Income Statement Template

12. Income Statement Monthly Template

13. Free Restaurant Income Statement Quarterly Template

14. Quarterly Income Statement Template

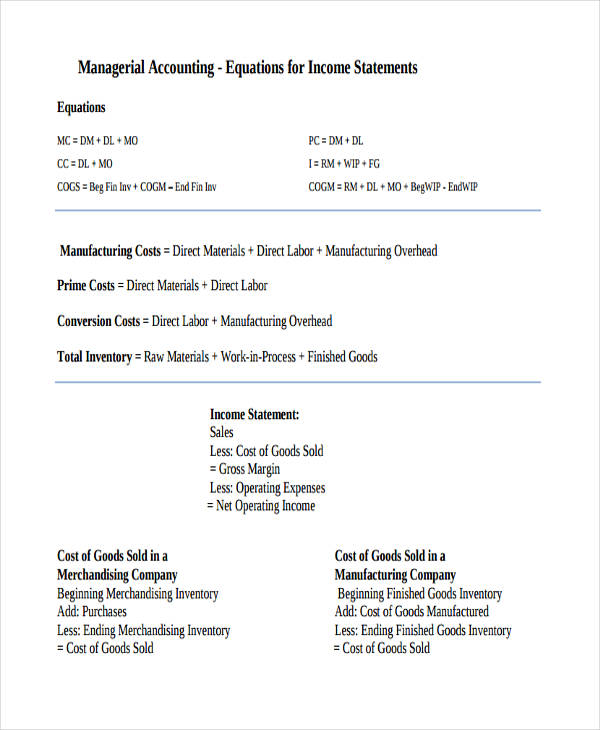

15. Managerial Accounting Income

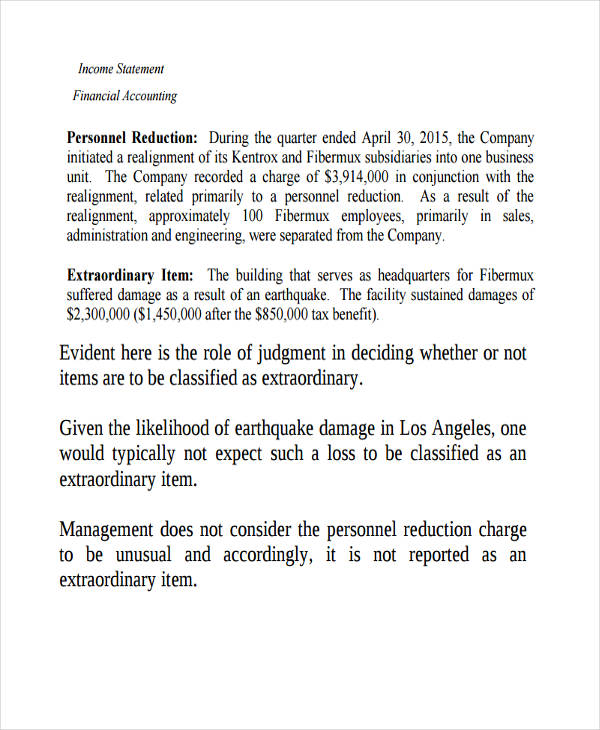

16. Financial Accounting Statement

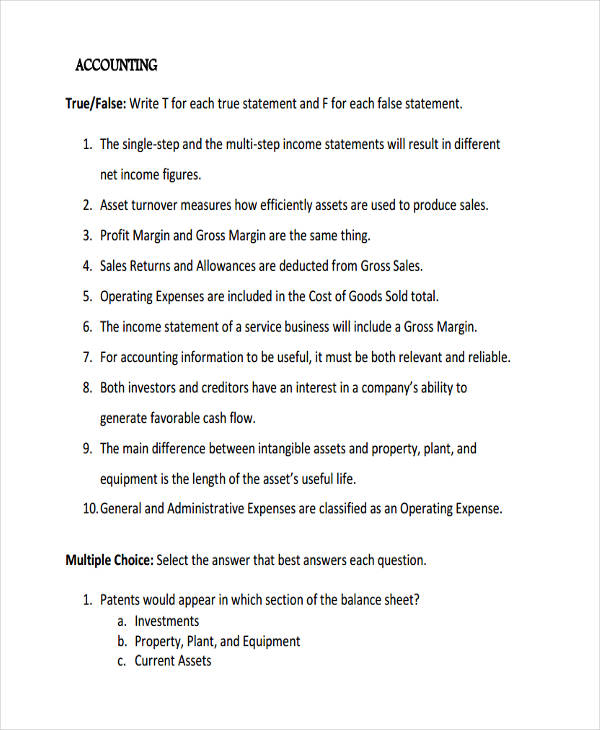

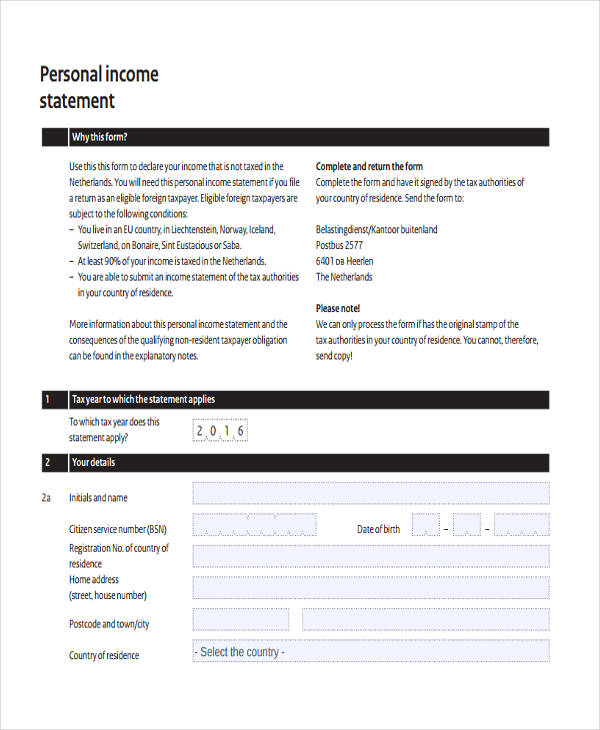

17. Accounting Multi-Step Income Sample

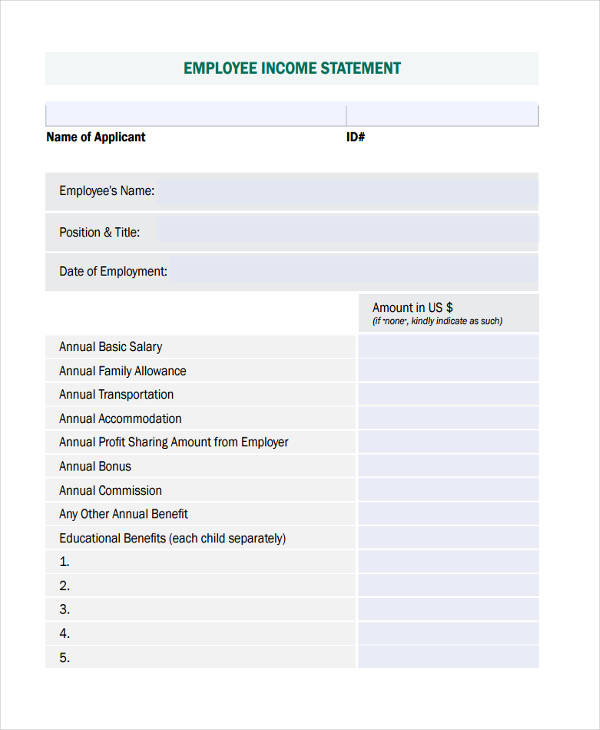

18. Employee Annual Income

19. Personal Annual Statement

20. Simple Annual Statement Example

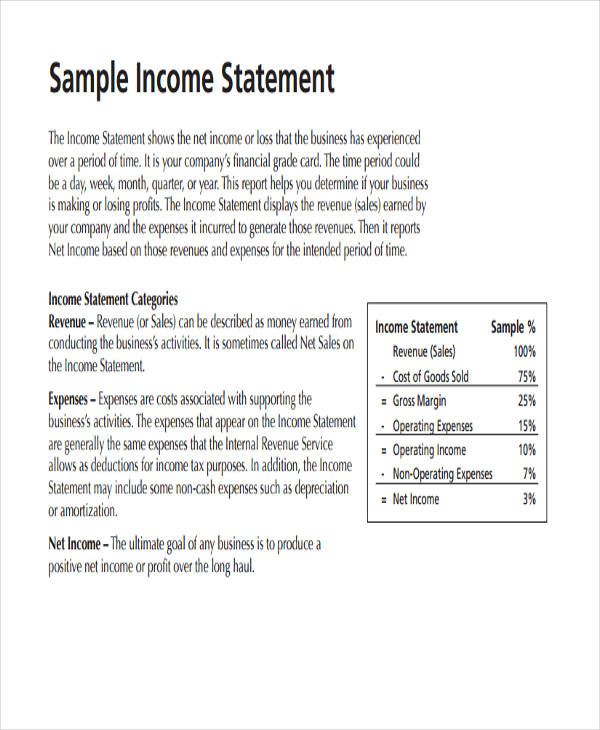

The Purpose of Income Statements

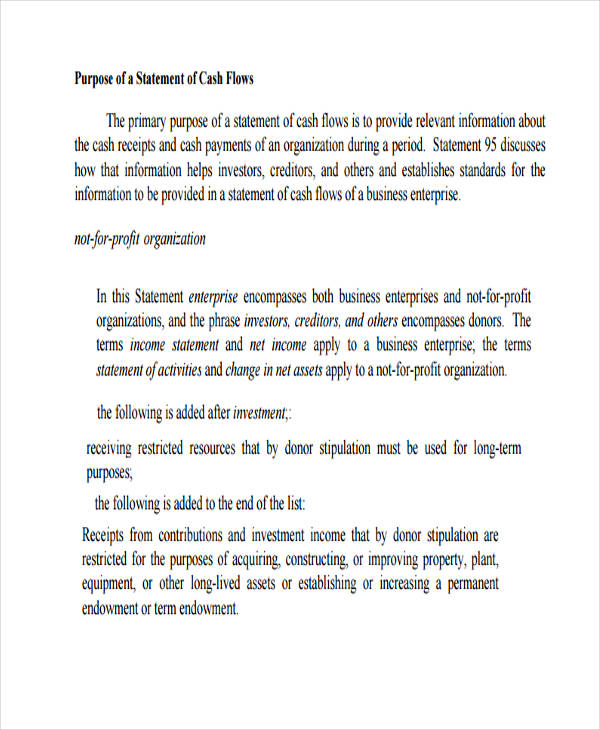

An income statement is just one of the many documents included in a financial statement, which also includes other financial reports like the balance sheet and cash flow statement. Also called the profit and loss statement, the income statement focuses on the revenue and losses of the company, basically providing the company an overall view of their gains and losses in a specific period.

This is very important for an organization to know their profitability. It tells them if they have higher expenses than income so it provides them an opportunity to improve.

Money is the fuel to run a business. Having no knowledge on where your money ends up is the same thing as leading your business to its ruins. Preparing a profit and loss statement will allow you to have a hawk’s eye on your company. You will be able to identify if you are losing a lot that gaining. Then you can have a better perspective on how to properly pull the strings to keep your company from falling apart.

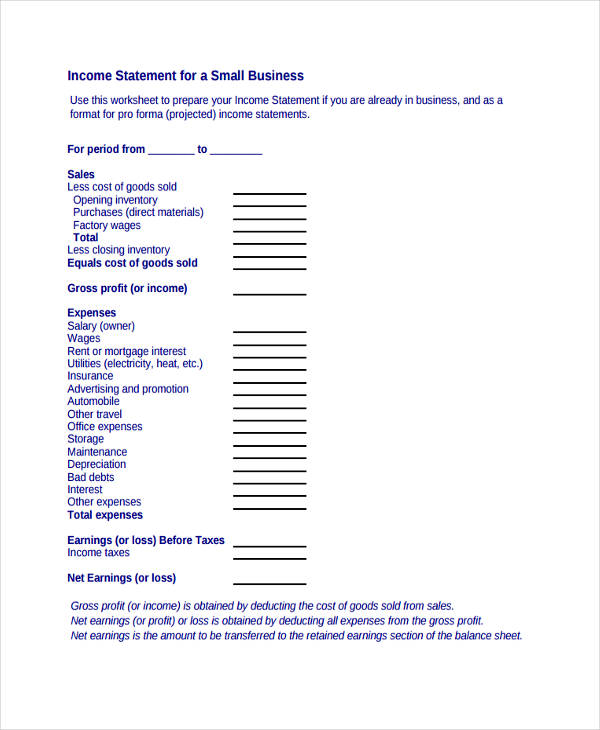

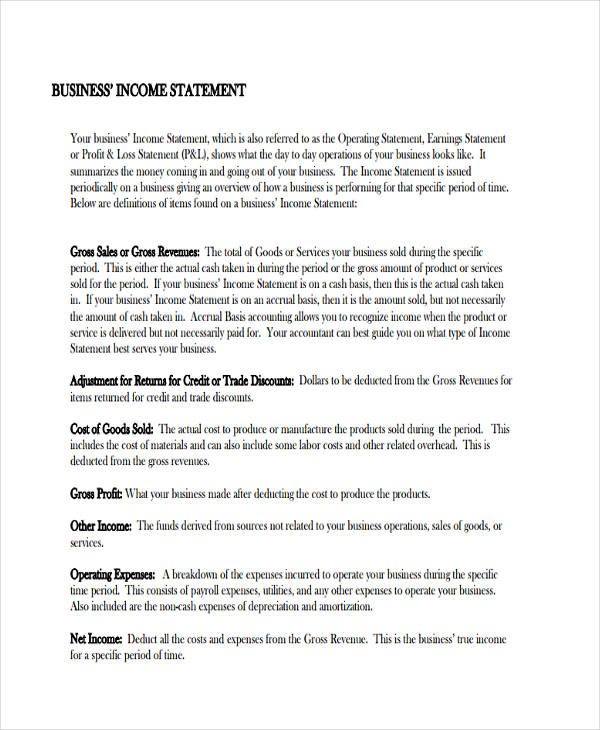

21. Small Business Income Statement

22. Start Up Business Income

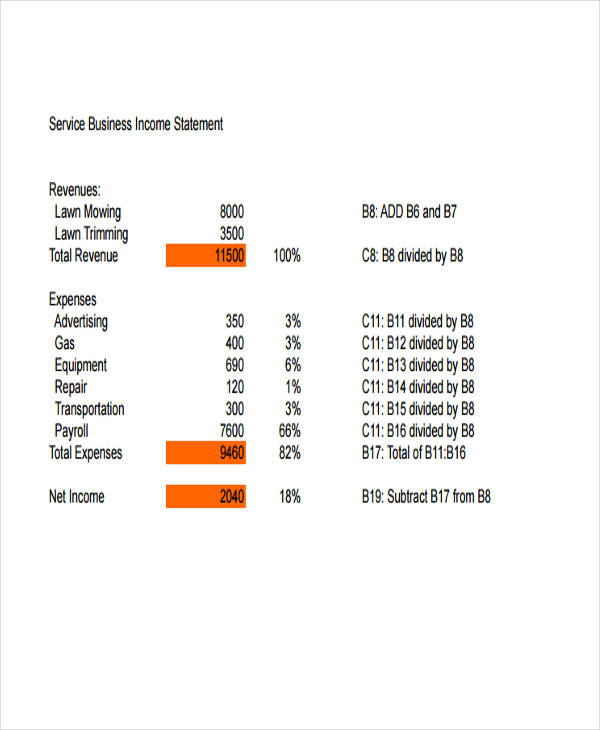

23. Service Business Statement

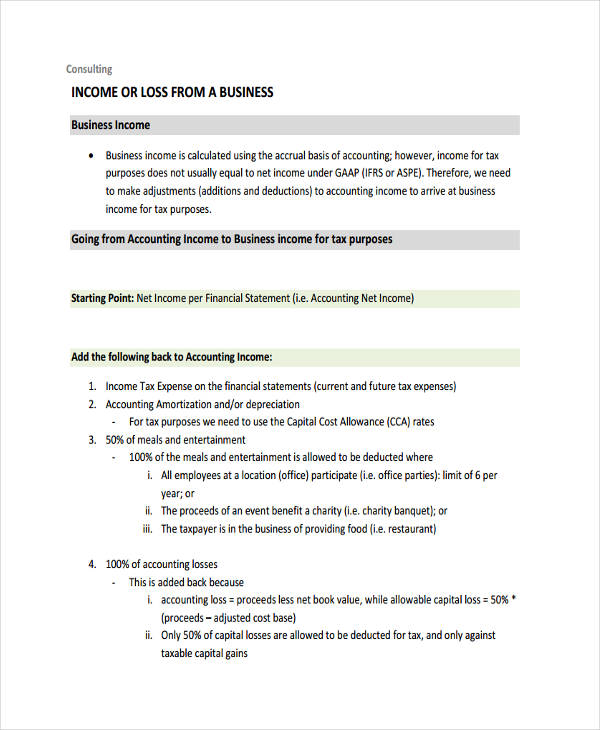

24. Consulting Business Income Sample

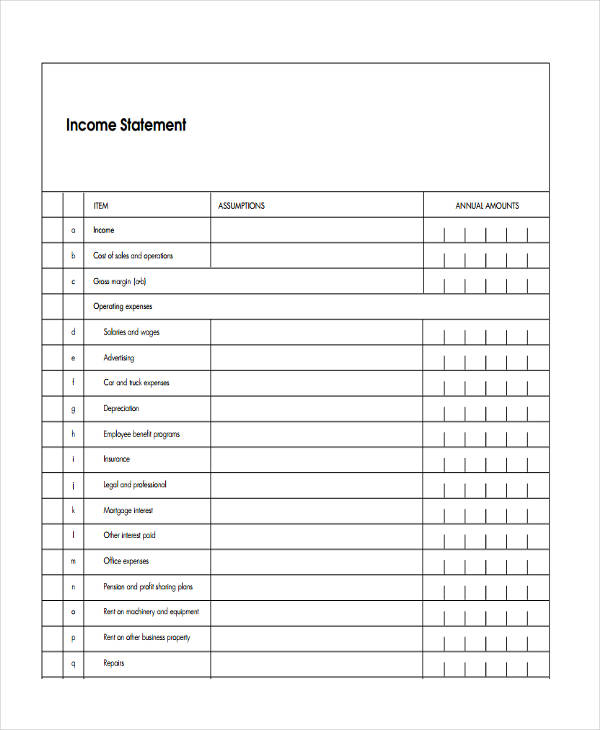

25. Free Blank Income Statement

26. Blank Business Income Example

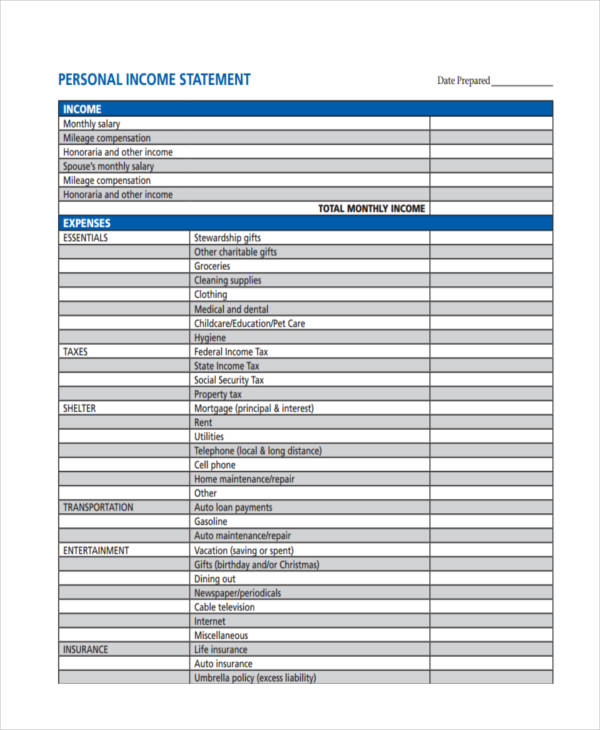

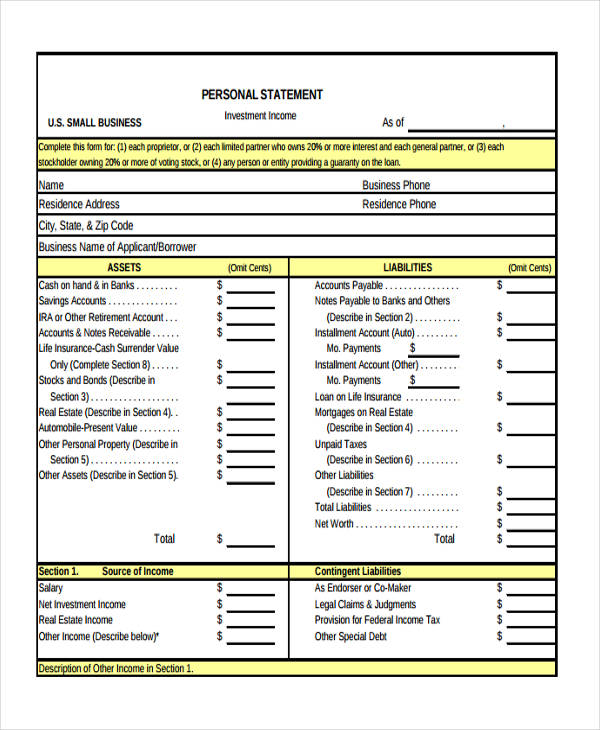

27. Blank Personal Statement

28. Service Company Income Statement

29. Construction Company Statement

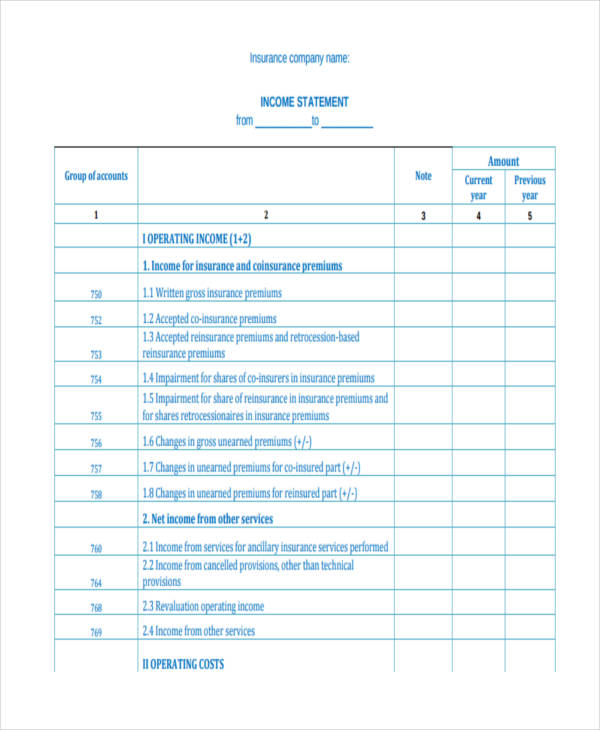

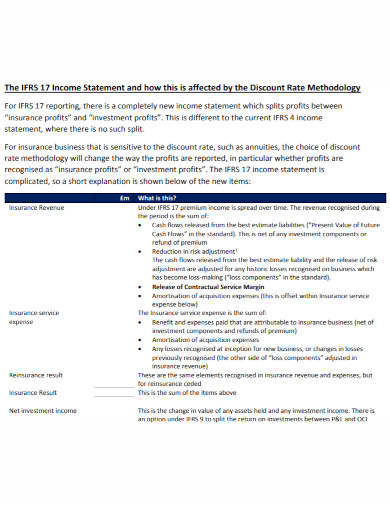

30. Insurance Company Income

Types of Income Statements

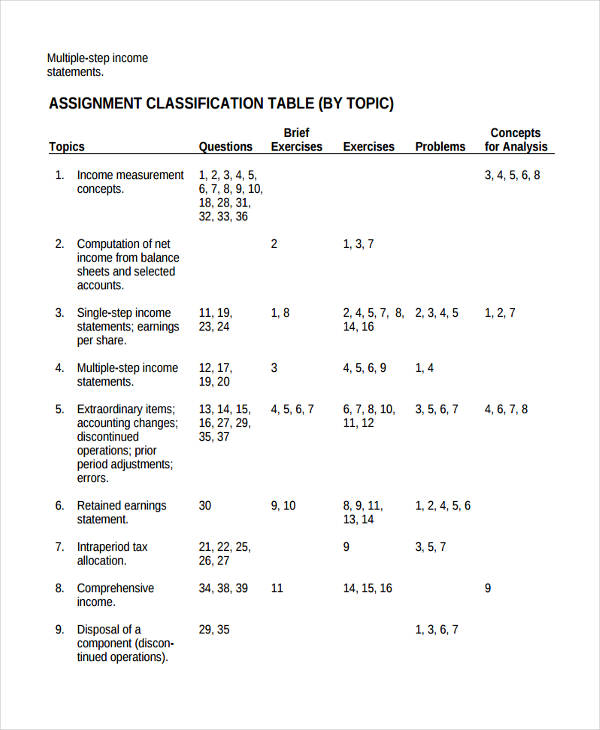

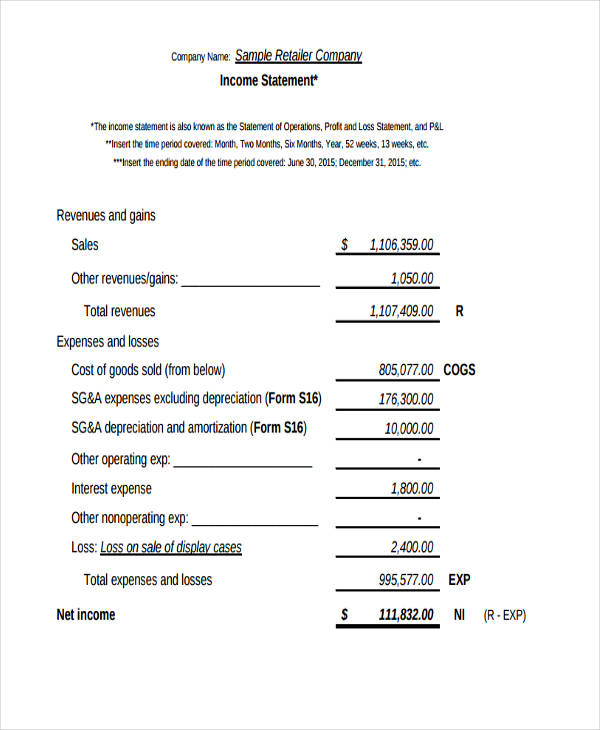

There are two types of income statement: single-step income statement and multi-step income statement.

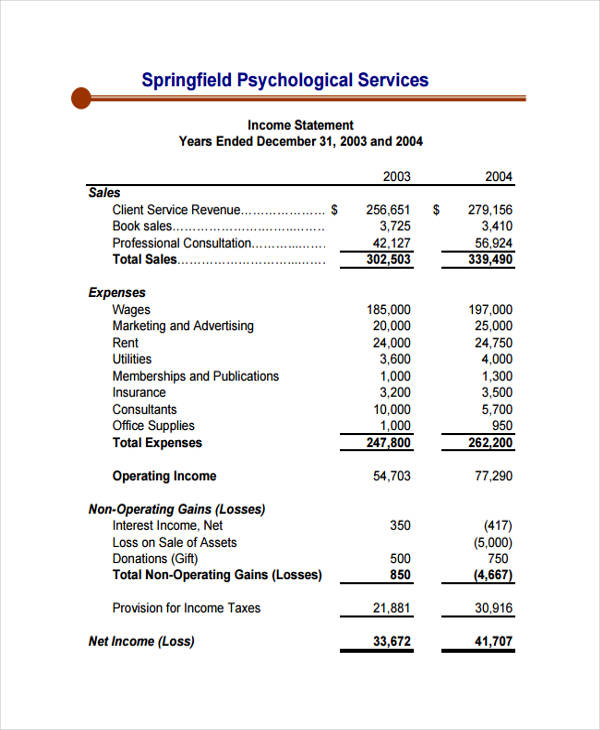

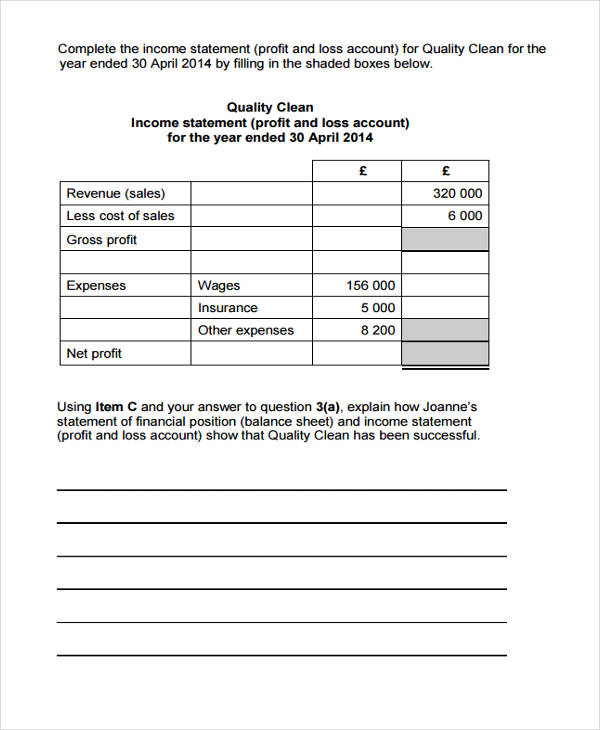

- Single-step Income Statement. This statement has two separate fields. The first one is for the revenue (cash inflows) and the other one is for the expense reports (cash outflows). In one step, you calculate the net profit or loss based on the total revenue minus the total expenses. This basic format is also used when creating a sales report.

- Revenues: Returns from business dealings, market analysis shares, and corporate enterprise, including all the products the company has sold, investment returns, and suppliers’ remittances.

- Expenses: Anything coming out of the company’s pocket, including but not limited to employee salary and bonuses, office and building lease, working materials, hardware maintenance, utilities, employee training and seminars, and other operating costs.

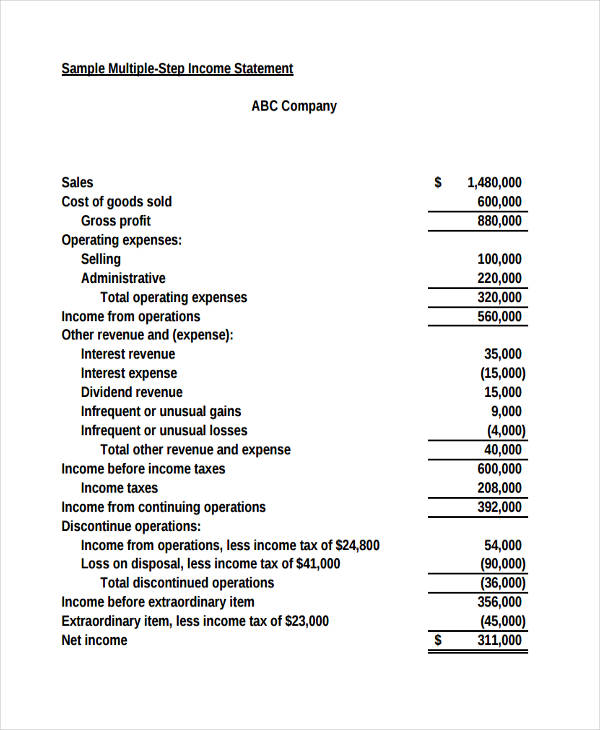

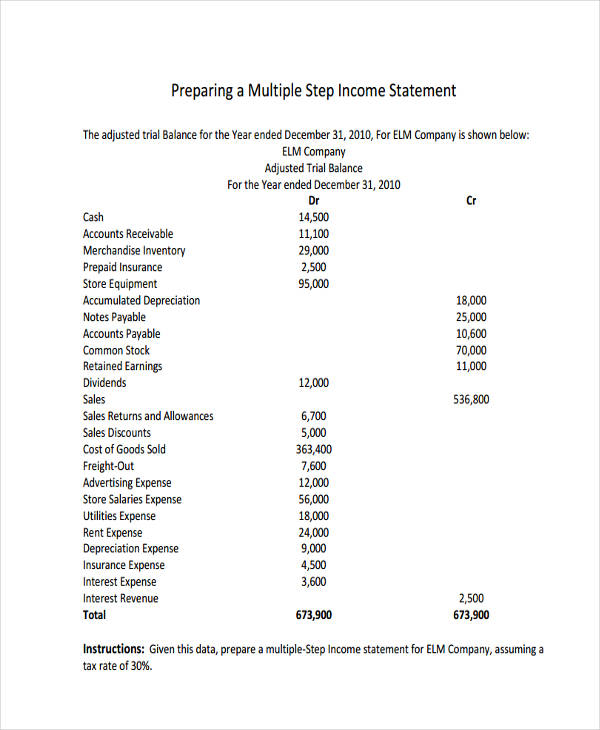

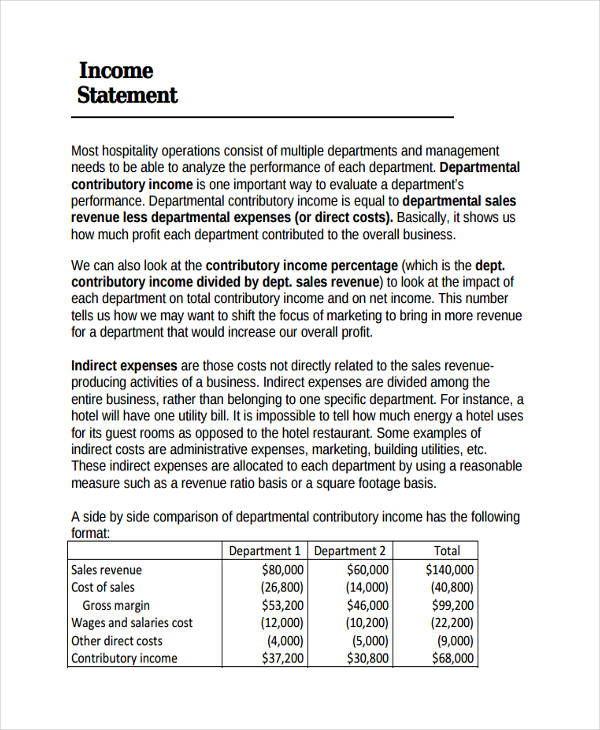

- Multiple-step Income Statement. A multi-step income statement has multiple sub-totals. It separates the sub-totals of the operating revenues and operating expenses from the non-operating revenues and non-operating expenses. This more detailed alternative to single-step statements allows identification of specific information.

- Operating revenue. The revenue from the main operation of the business statement, such as the revenues from a product sales.

- Non-operating revenue. The non-related sales income or revenue. Examples are revenue from sales of assets, dividend income, office leases etc.

- Operating expense. The costs to operate the business, such as employee salary and compensations, building lease (if applicable), hardware and software supplies, furniture and other operation equipment, etc. Basically, any expense used for the main operation of the company to write an income statement.

- Non-operating expense. Includes costs that are not a regular part of the actual operation, such as paid interests on major and minor loans used for the capital, lawsuit settlement fees, discarded inventory charges, etc.

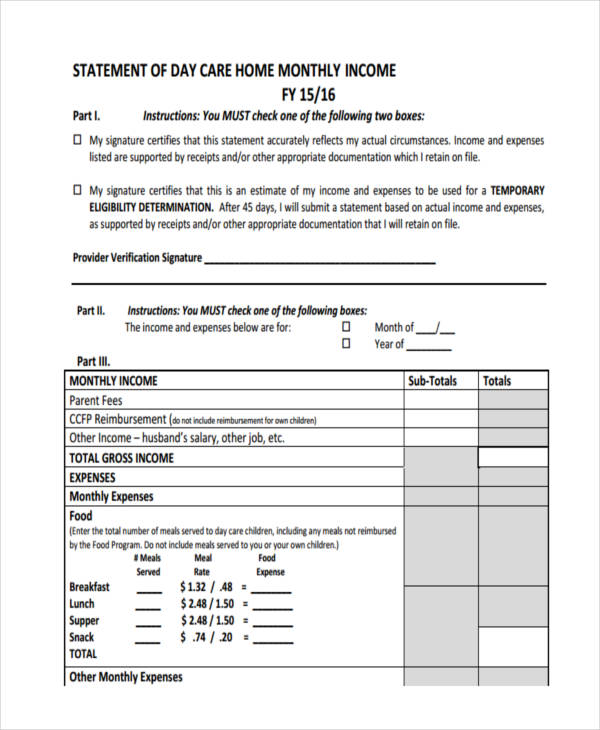

31. Home Daycare Income Statement

32. Dog Daycare Income Sample

33. Projection Statement for Daycare

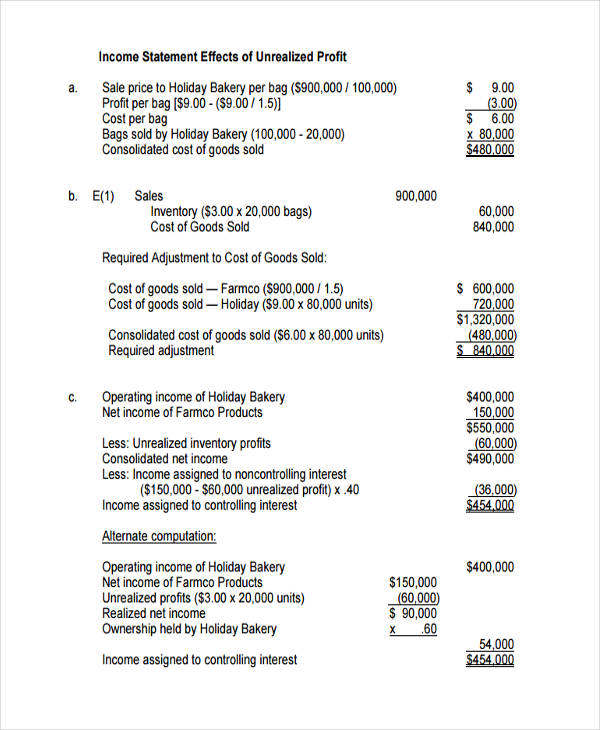

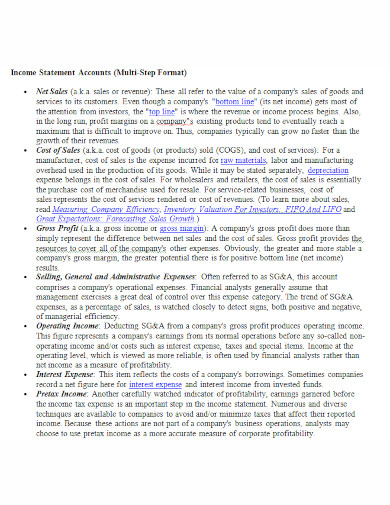

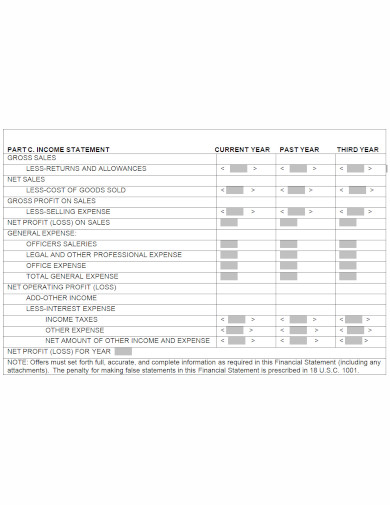

34. Multi-Step Comprehensive Income

35. Company Multi-Step Statement

36. Multi-Step Income Sample Statement

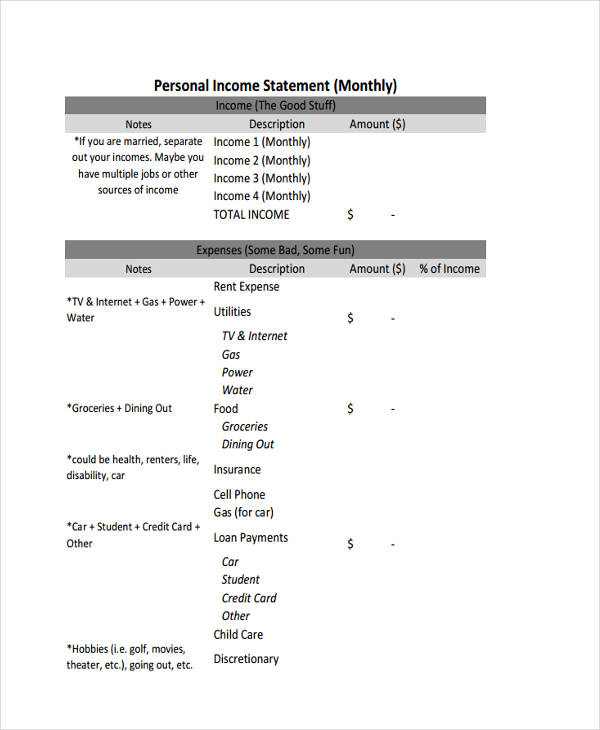

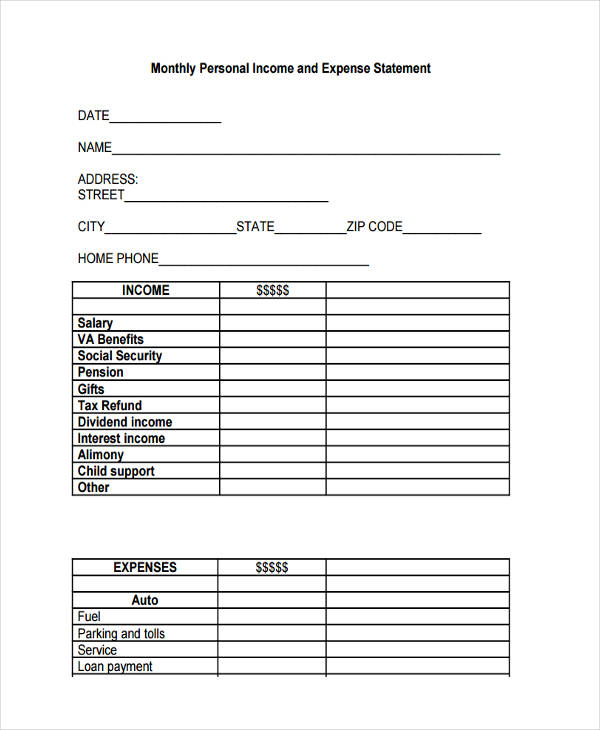

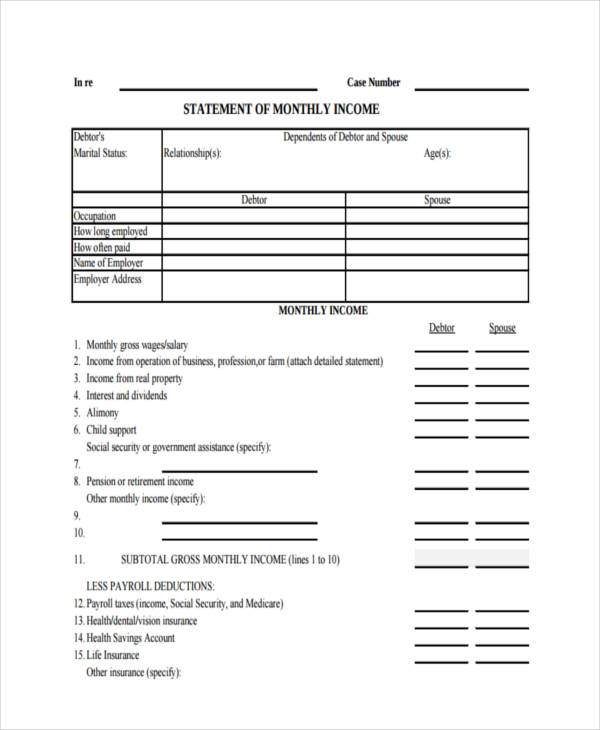

37. Personal Monthly Income

38. Blank Monthly Income Statement

39. Blank Business Statement Free

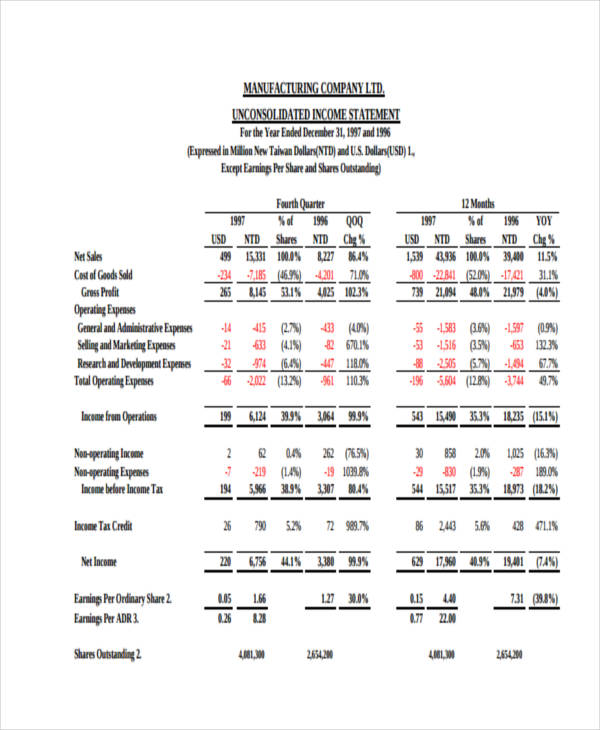

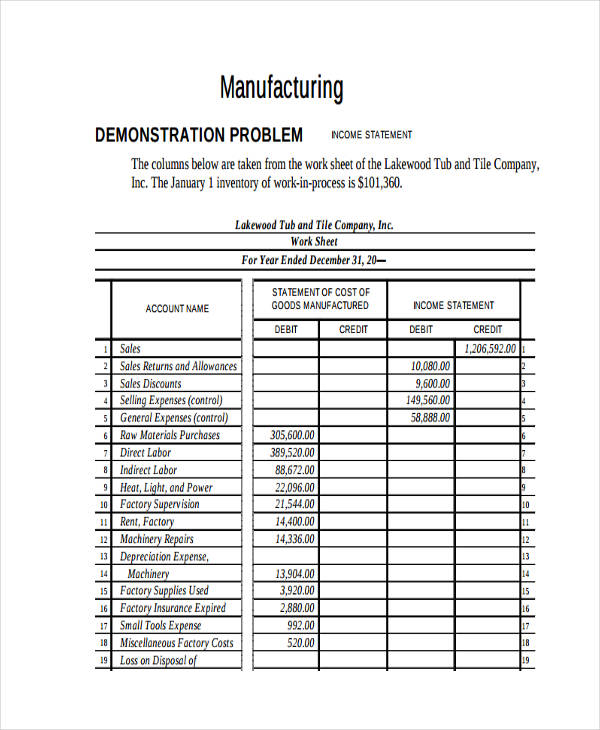

40. Manufacturing Company Income Statement

41. Manufacturing Business Statement

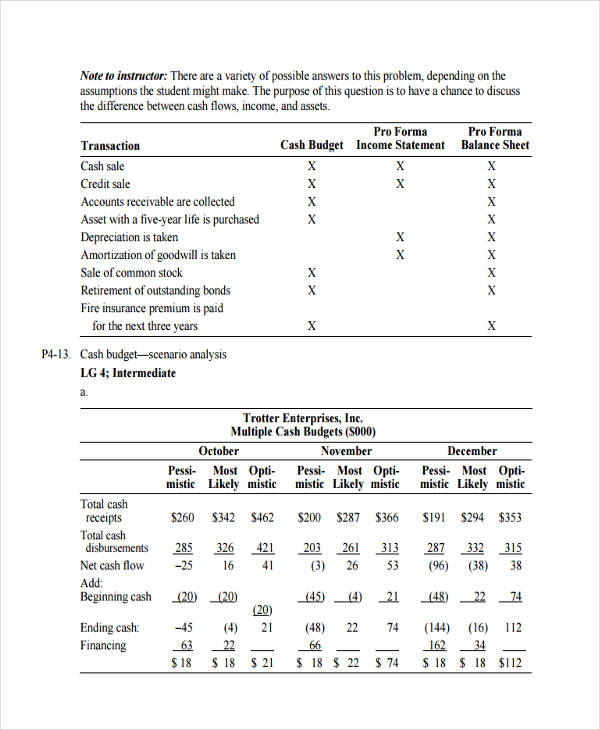

42. Manufacturing Pro Forma Income

43. Basic Personal Income Statement

44. Personal Business Income Statement

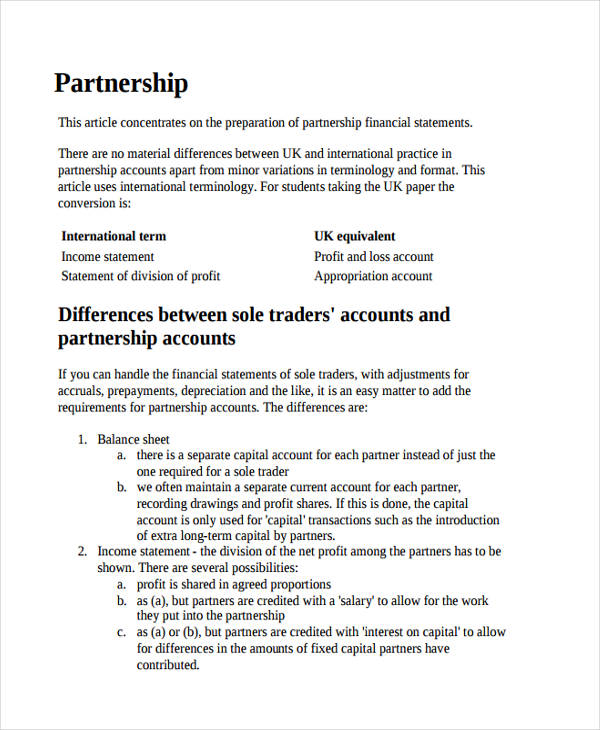

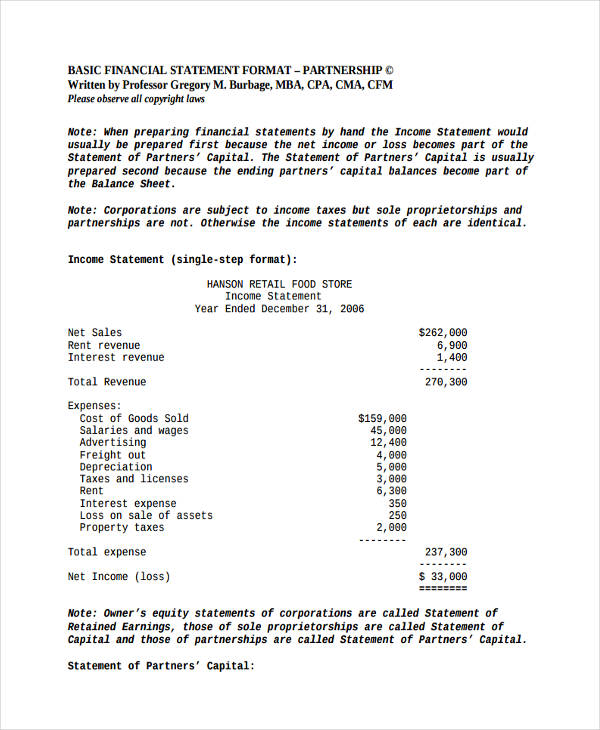

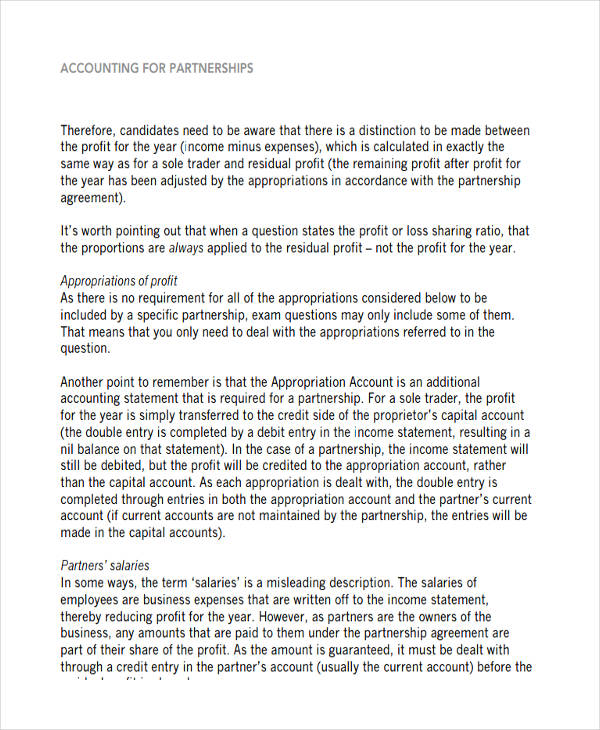

45. Partnership Business Income

46. Partnership Company Income Statement

47. Partnership Accounting Statement

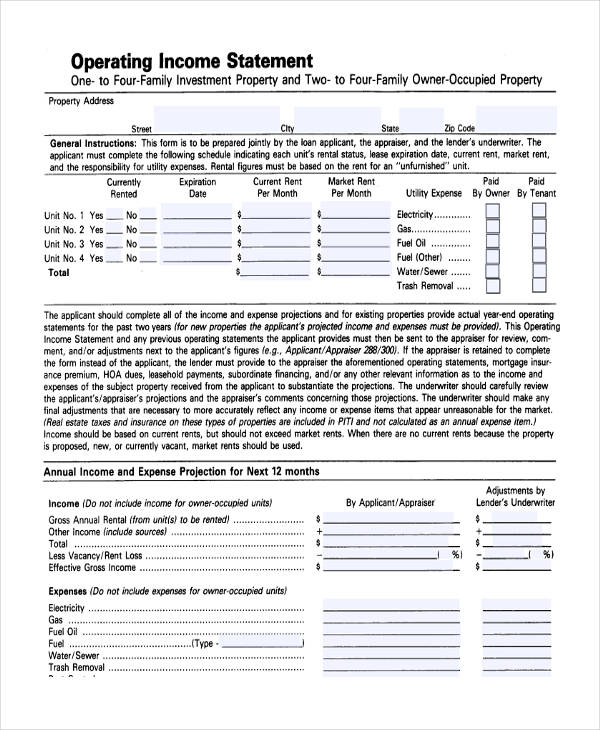

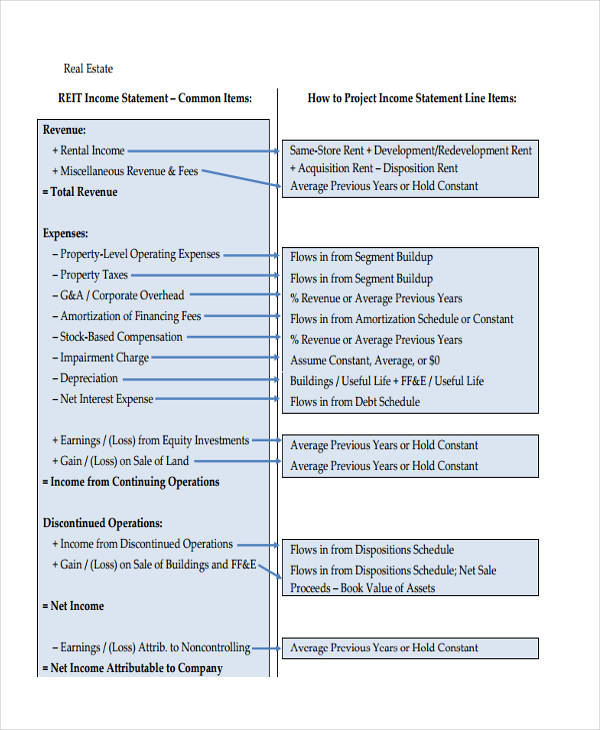

48. Real Estate Agent Income Sample

49. Real Estate Company Income Sample

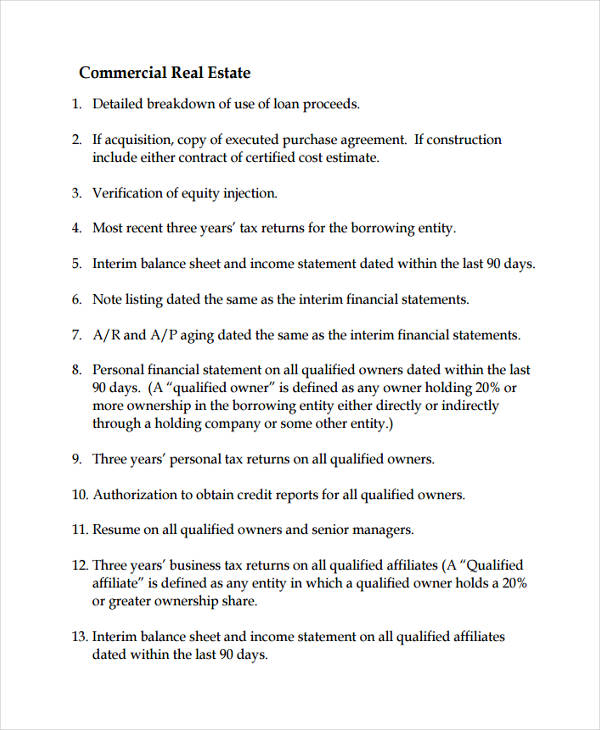

50. Commercial Real Estate Statement

51. Service Industry Income Statement

52. Cleaning Service Sample Statement

53. Service Organization Income Example

54. Small Restaurant Income Statement

55. Restaurant Monthly Statement

56. Start Up Restaurant Income Example

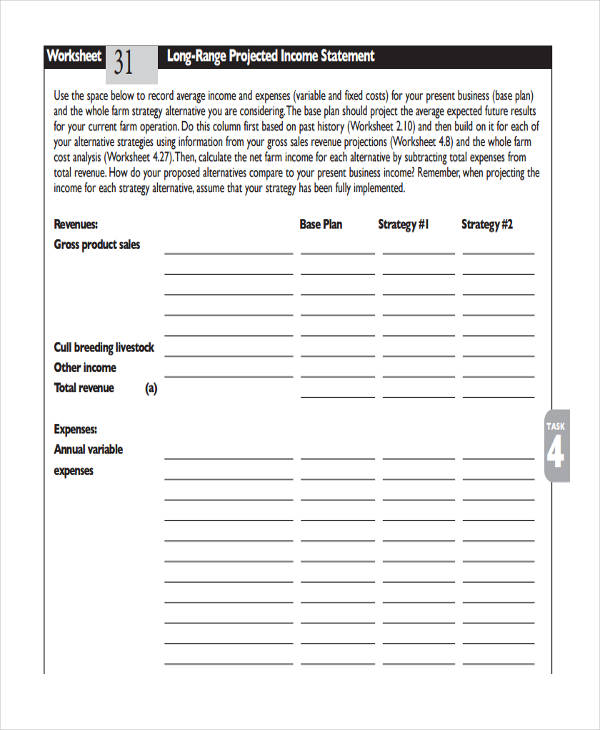

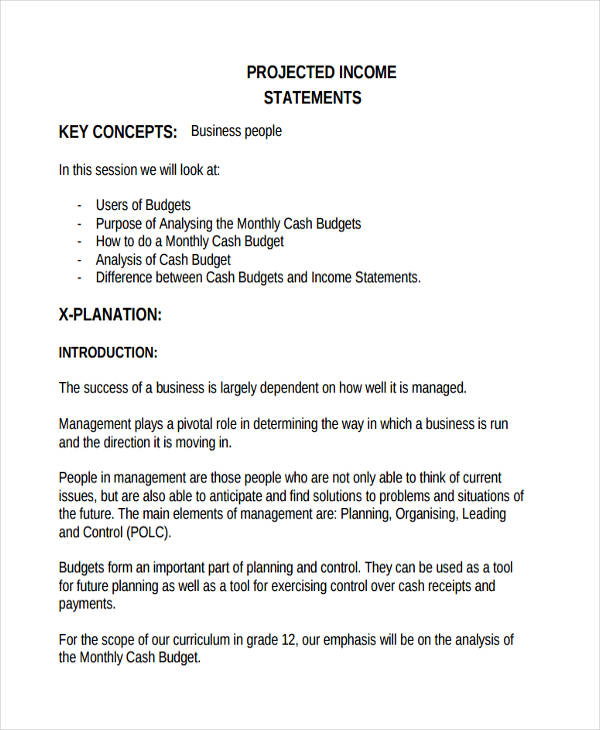

57. Annual Projected Income Statement

58. Blank Projected Income

59. Business Projected Statement

60. Bakery Shop Income Statement

61. Small Bakery Income Statement

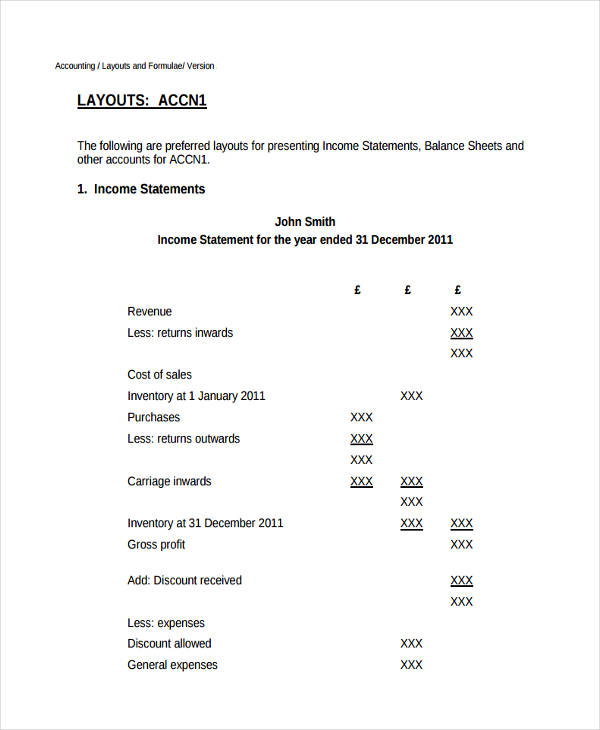

62. Basic Accounting Income Statement

63. Basic Business Income Example

64. Basic Company Statement

65. Basic Monthly Income Example

66. Restaurant Proforma Income Statement

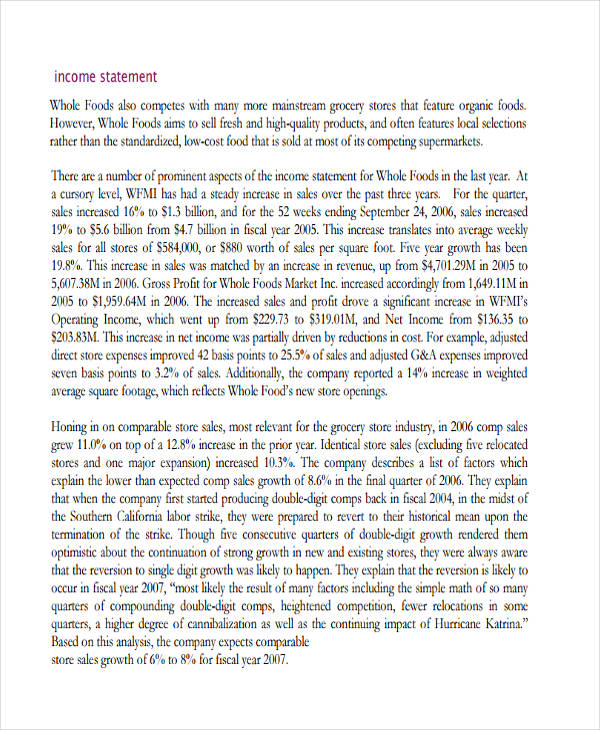

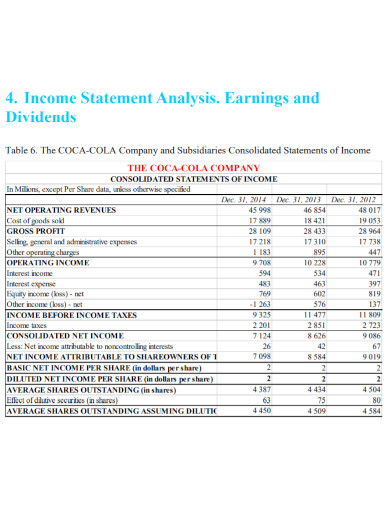

67. Company Income Statement Analysis

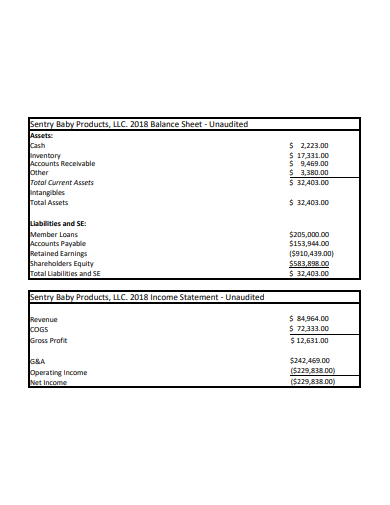

68. Balance Sheet and Income Statement of Baby Products

69. Income Statement in PDF

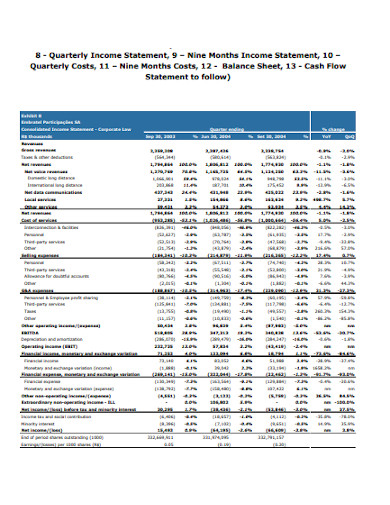

70. Quarterly Income Statement in PDF

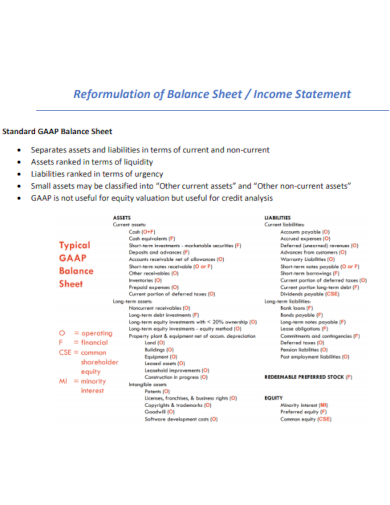

71. Reformulation of Balance Sheet and Income Statement

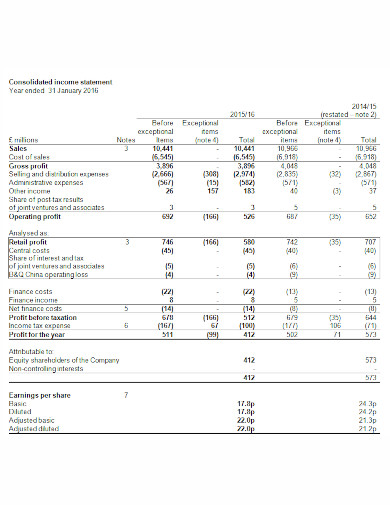

72. Consolidated Income Statement

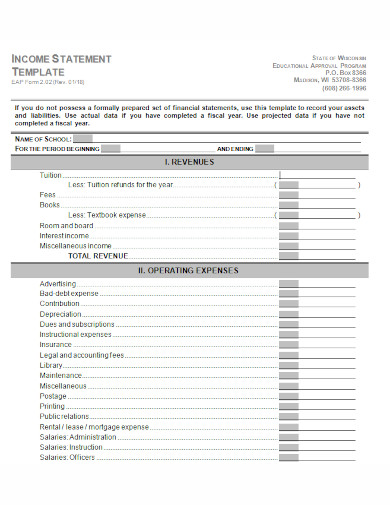

73. School Income Statement

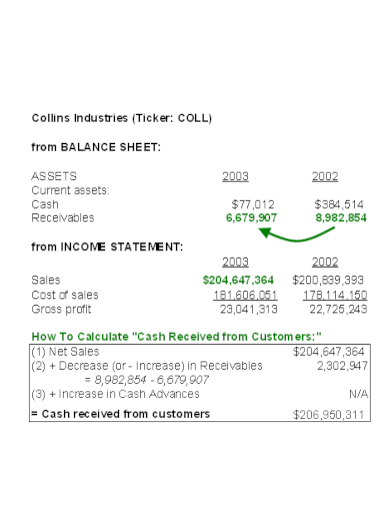

74. Collins Industry Income Statement

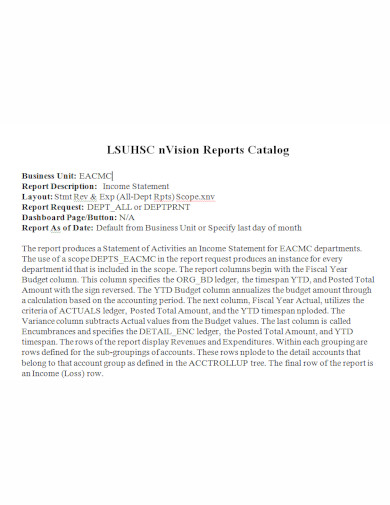

75. Quarterly Report Income Statement

76. Manufacturing Company Income Statement

77. Multi-Step Format Income Statement

78. Income Statement Report

79. Personal Balance Sheet and Income Statement

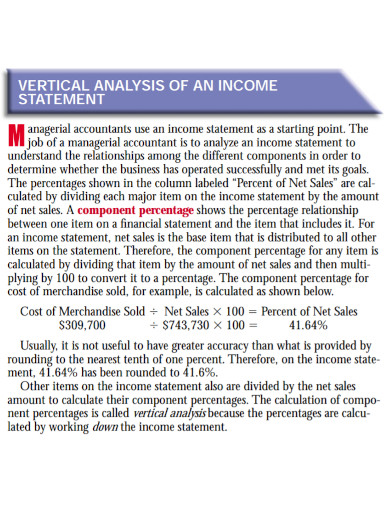

80. Analysis of Income Statement

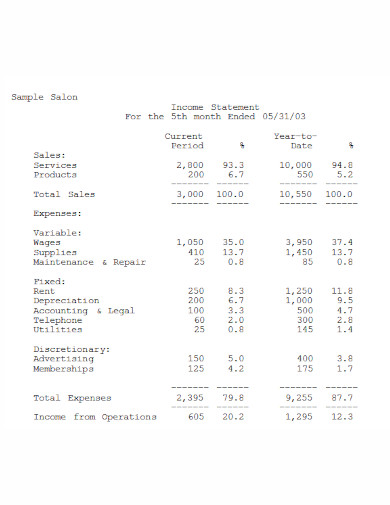

81. Salon Income Statement

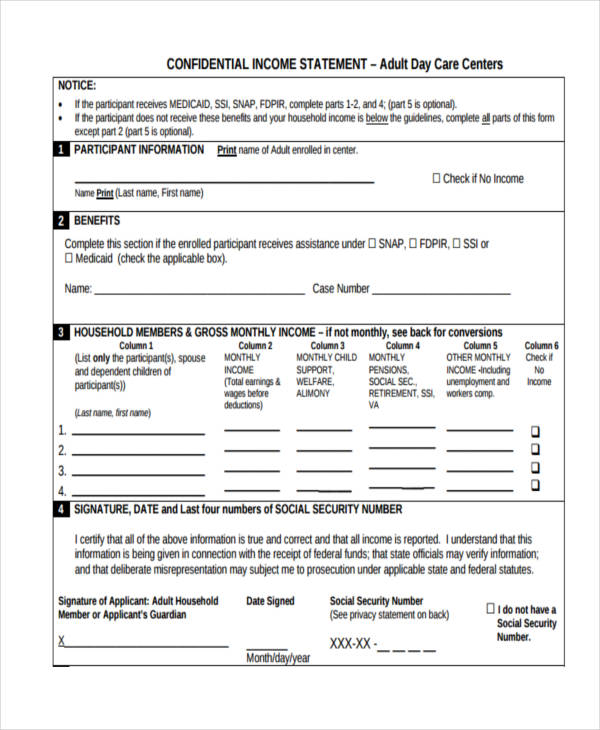

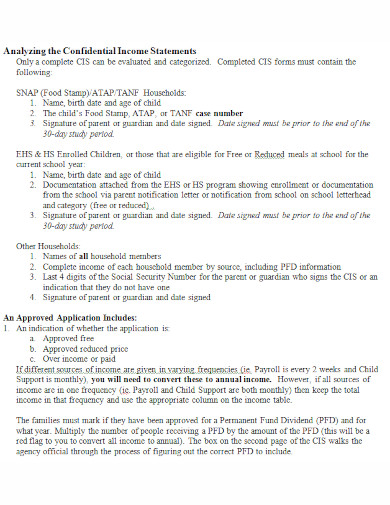

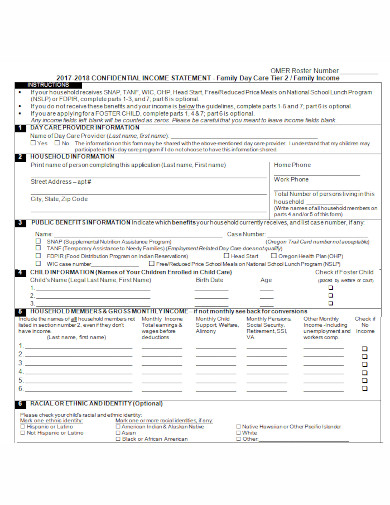

82. Confidential Income Statement

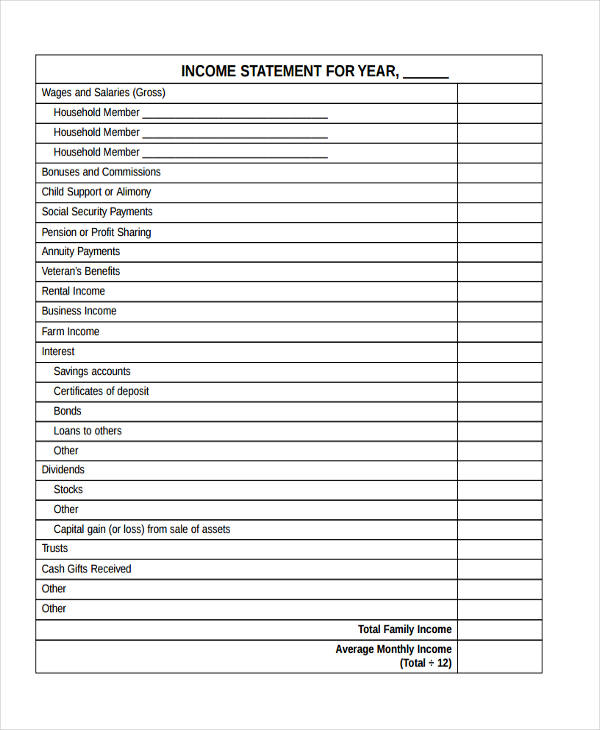

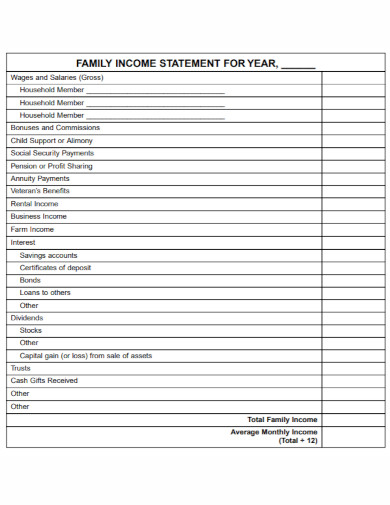

83. Family Income Statement

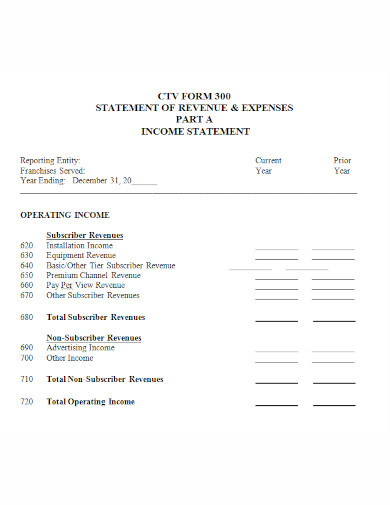

84. Operating Income Statement

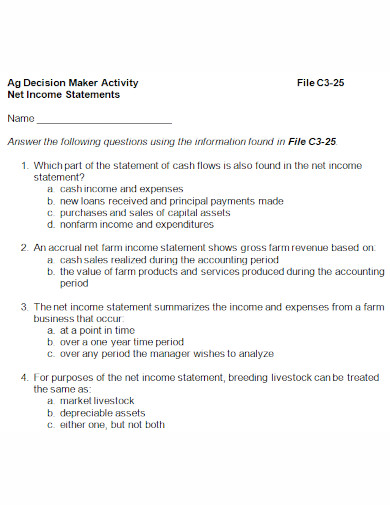

85. Net Income Statements

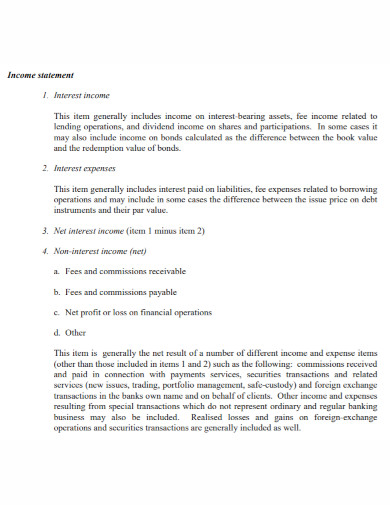

86. Banks Income Statement

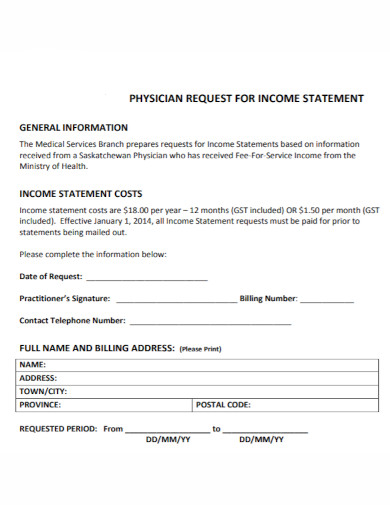

87. Physician Request for Income Statement

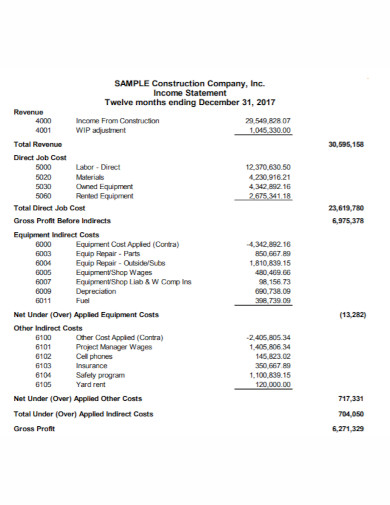

88. Construction Company Income Statement

89. Family Income Statement in PDF

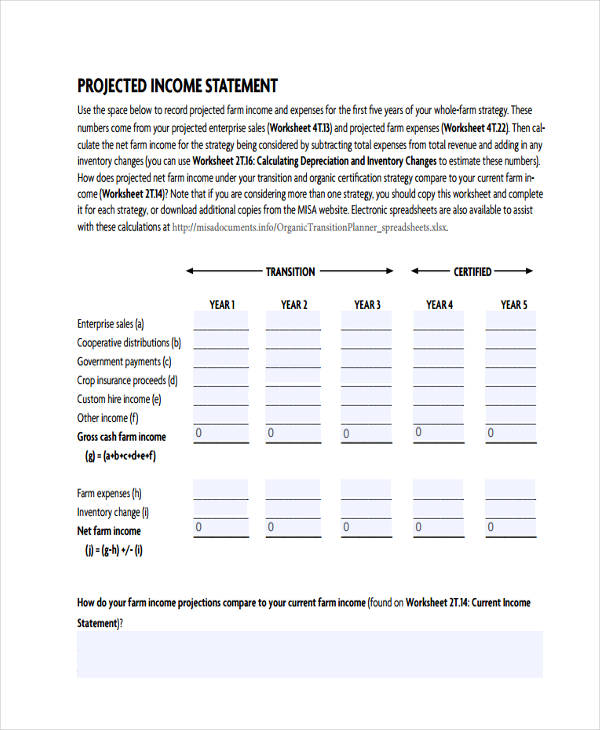

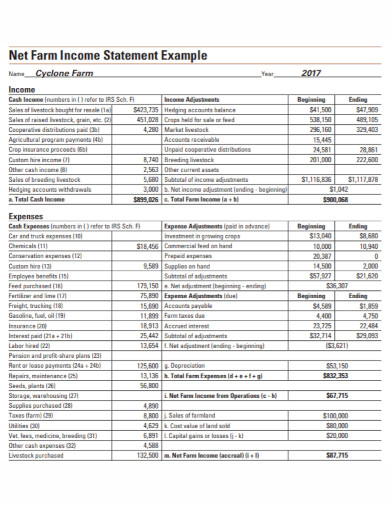

90. Net Farm Income Statement

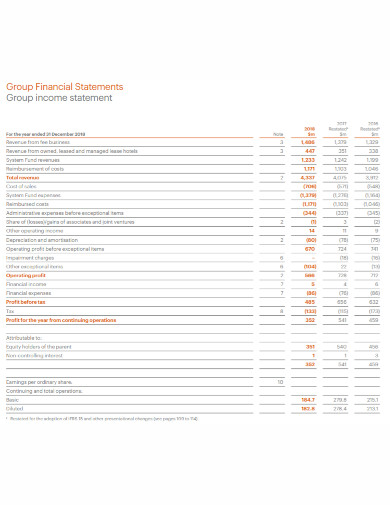

91. Group Income Statement

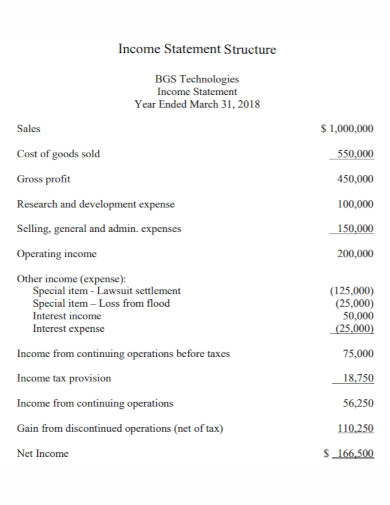

92. Income Statement Structure

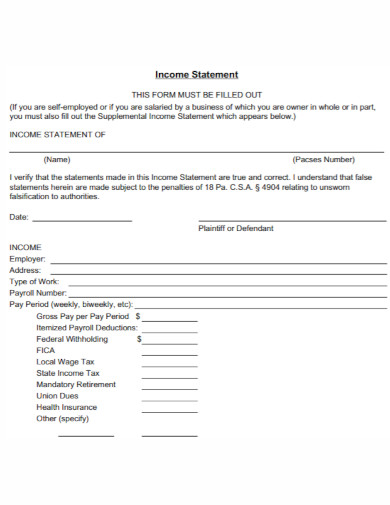

93. Employer Income Statement

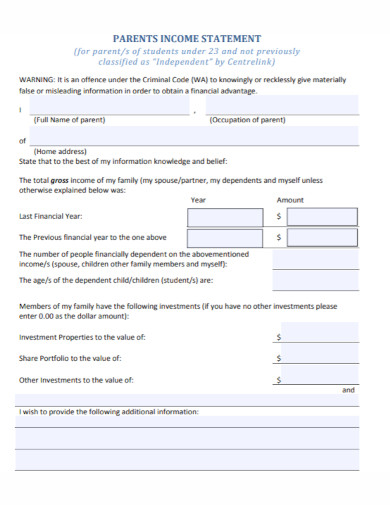

94. Parents Income Statement

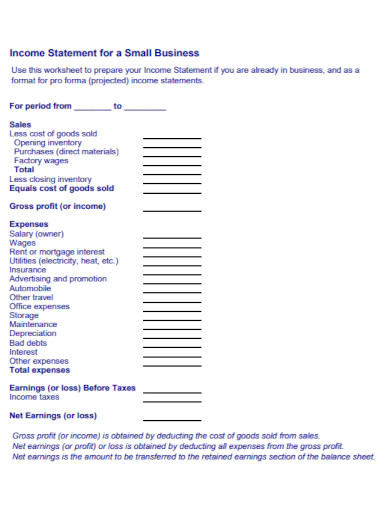

95. Income Statement for a Small Business

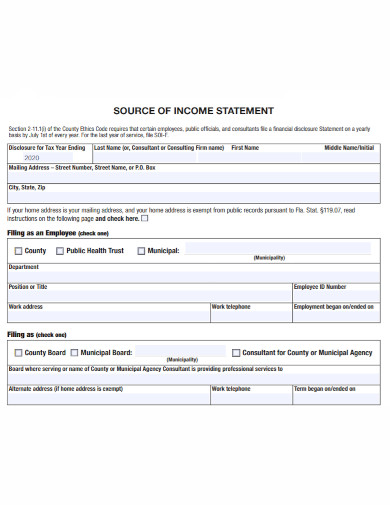

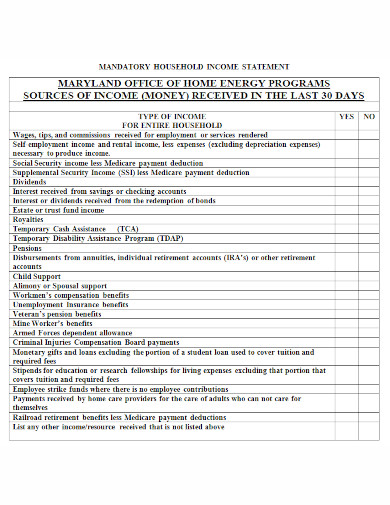

96. Sources of Income Statement

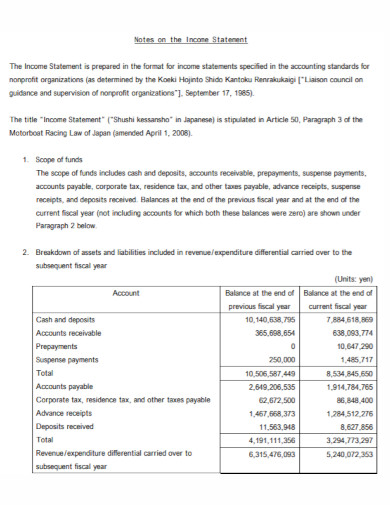

97. Notes on the Income Statement

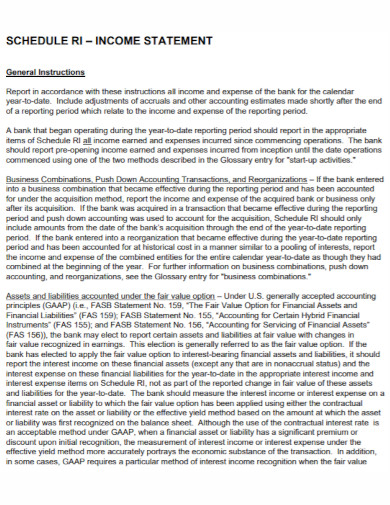

98. Organization Income Statement

99. Household Income Statement

100. Income Statement in DOC

101. Sample Income Statement in DOC

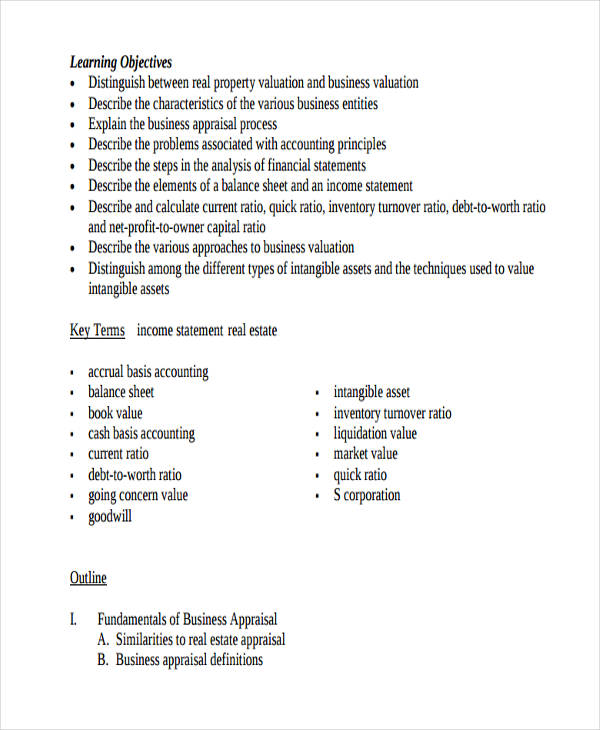

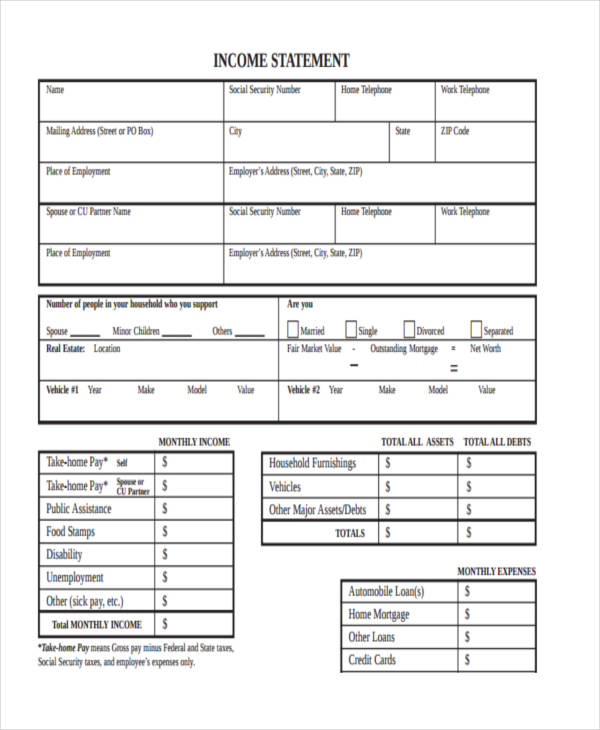

What Is an Income Statement?

Income statements are tools used in businesses and companies to track the cash flow in finance and what it has been used for. It gives out a summary of the entire financial statement status of that quarter. It also holds details of financial growth and financial loss.

How to Read and Analyze Income Statements

Now that we have a general idea the next step is to know how to prepare an income statement could be a challenging task because of the many details you have to train your eyes on. Here are some tips that could help you understand and how to write income statements.

Step 1: Always Be Cautious

Doing a statement analysis takes practice, patience and skill. Being cautious helps you find mistakes and correct them. Remember to always pay attention to the important details such as the company’s expenses, the sources of the revenues, and the other businesses involved during that period.

Step 2: Compare and Check

Preparing a financial statement analysis can come through annual, quarterly or monthly statements of your income. Keep copies of all of it. Do some checks to make sure numbers add up and are correct. Any wrong information may eventually lead to a lot of confusion from both parties.

Step 3: Determine the Important Factors

Business statements also hold key information to help determine the factors of your income statement. This includes expenses, financial breakdowns, and the financial goal. Understand the priority of each factor. Operation expenses should be the main targets of where your finances are going.

Step 4: Make Sure the Statement Is Complete

Always know that one wrong move or a small mistake may lead to a difficult or different outcome. To avoid that from happening when it comes to making your income statements, check and double check every single detail in the statement.

FAQs

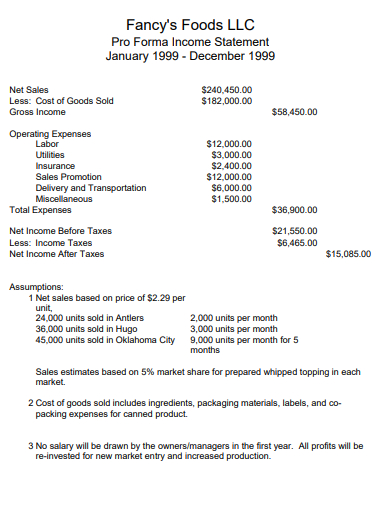

What is the difference between an income statement and a profit and loss statement?

An income statement is the report writing of a company’s revenues and expenses in a certain period of time. The income statement tracks the entire business growth and determines the operating and non-operating revenues and expenses. A profit and loss statement is the guide to develop sales and objectives. To design competitive prices for the company’s goods, products and services. Profit and loss statements are an effective marketing report as it includes real estate statements that focus on the goods and possible returns.

What are the types of statements?

There are a lot of varieties of statements. In business and company related statements, these are the types of statements: classified income statement, comparative income statement, and condensed income statement, business statement, and financial statement. Each of the statements has a purpose.

What purpose does an income statement have?

The purpose of an income statement is to basically check and compare your finance profit and loss from a specific amount of time. An income statement is an essential report that contributes to the growth of the company. So whether you are the one making the statement or the one analyzing it, always consider all the business factors involved.

When you think of income statements, you know that this is part of handling and running a company or a business. It takes a lot of patience and a lot of knowledge to make a correct income statement. An income statement has different focuses whereas the profit and loss operates toward one goal.