10+ Loan Payment Schedule Examples to Download

These days, credits have become an imperative portion of each individual’s life, and overseeing credits on time may be an issue, and this can be where the loan payment schedule templates are genuinely needed. You can utilize these paid, premium payment and free download loan payback templates to oversee your other credits and their particular payment schedules efficiently so that you never miss a due date once more. You’ll too see the Amortization Schedule Template.

10+ Loan Payment Schedule Examples

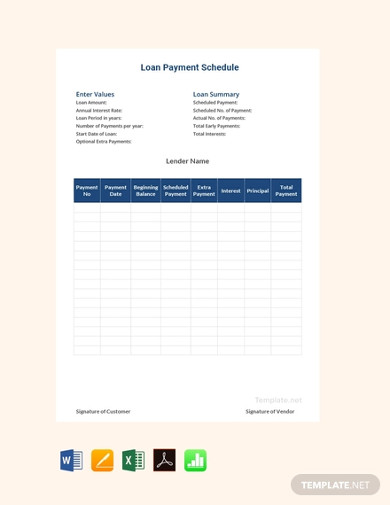

1. Loan Payment Schedule Template

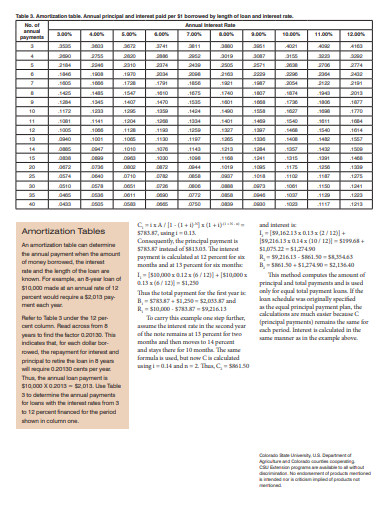

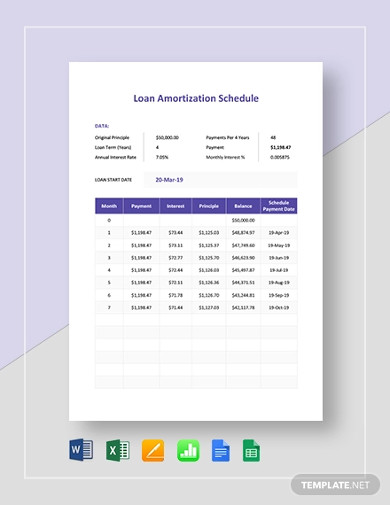

2. Loan Amortization Schedule Template

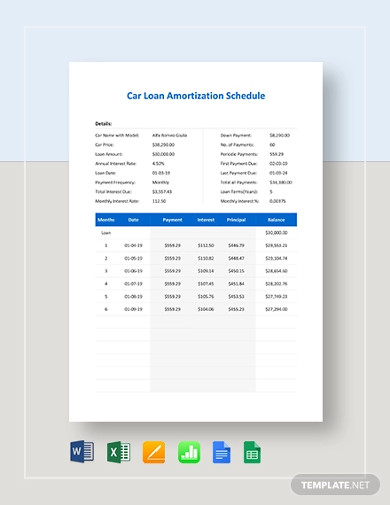

3. Car Loan Amortization Schedule Template

4. Free Loan Payment Schedule Template

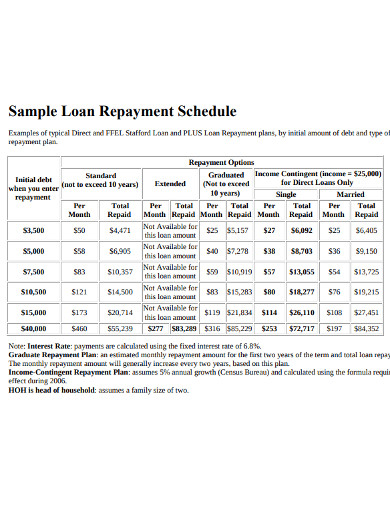

5. Sample Loan Repayment Schedule

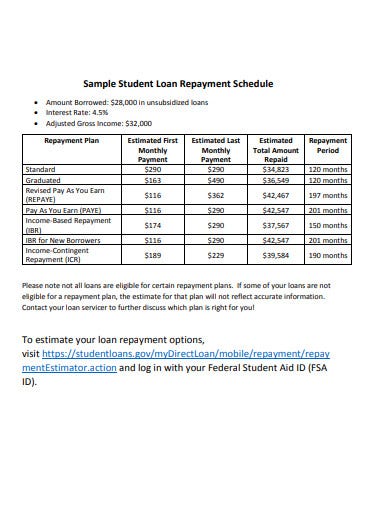

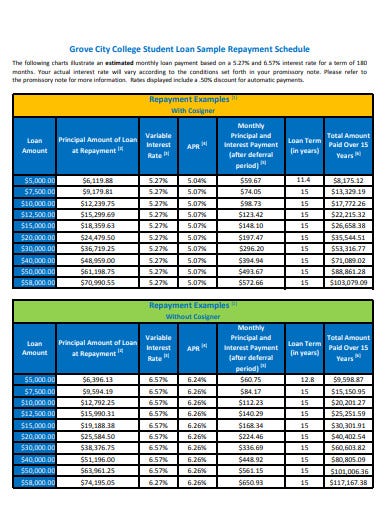

6. Sample Student Loan Repayment Schedule

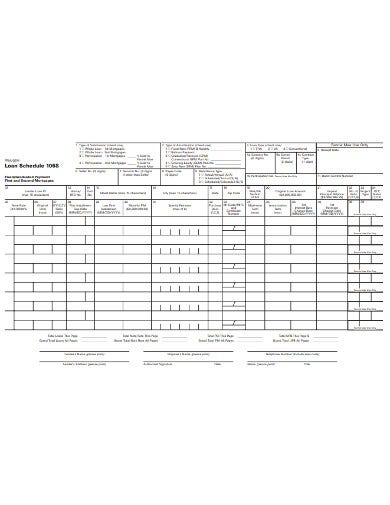

7. Loan Payment Schedule Format

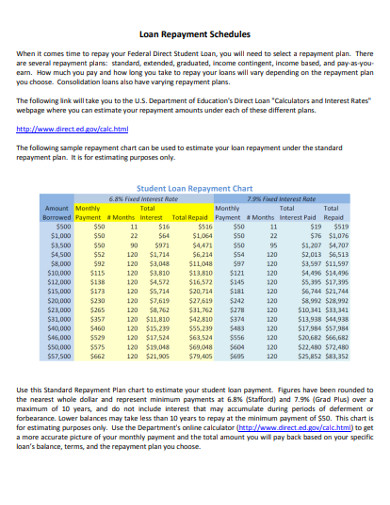

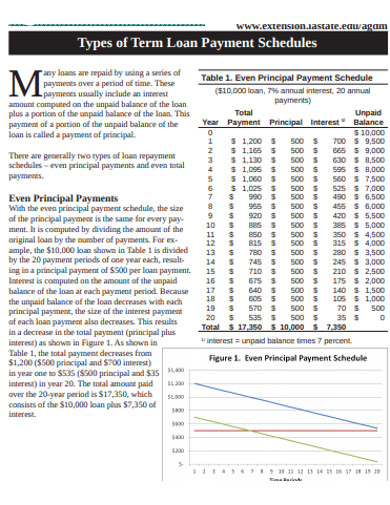

8. Loan Repayment Schedules Example

9. Simple Loan Payment Schedule Template

10. Student Loan Repayment Schedule

11. Long-Term Loan Repayment Format

What Is a Loan Payment Schedule?

Loan amortization is the plan of periodic installments for an advance and gives borrowers a clear picture of what they will compensate in each reimbursement cycle. You’ll have a settled, steady reimbursement plan over the whole period of your advance term.

How To Create a Loan Payment Schedule in Excel?

Utilizing an amortization schedule template exceeds expectations. You’ll plot your different advances with the individual sums, the installments due at various time intervals, and arrange for their repayment and track it every day. You’ll even take a print of the layout and fill it physically and after that put it at a put which you get to so that you continuously pay your credits on time regularly. Here are some steps that you can follow in creating your loan plan template.

1. Open your Excel.

The first starting step within the payment schedule is opening an excel spreadsheet. It’s easier to work with excel because you’ll be able to input equations and get your calculations effortlessly done without hassle. Open a new document and include the title “Payment Schedule” at the top of the report. On the off chance that you got numerous forms, arrange them accordingly.

2. Provide important details of your company.

The next step is to supply the company details underneath the title towards the page’s cleared-out side. Include the company name, address, contact number, e-mail id so that you can keep a record of the company’s payment details.

3. Provide sales receipt.

The sales receipt is included within the productivity plan. It ordinarily comprises the date of an installment. You can place other information on the receipt of the deal that suits you.

4. Provide client details.

After the receipt details, you would like to include the client points of interest as well. Say the client’s name, company title, address, and email address as well. It would be best to include other subtle elements like arrange numbers, check numbers, and the sales representative who was managing with the client.

5. Payment

Make a modern table on the sheet and identify it with a thing number, description, amount, and cost. Don’t forget to place the installment alternatives: Cash, Credit Card, or Cash Order. Once you are done, please print out the plan and utilize it at whatever point required.

FAQs

What is Amortization?

Amortization is a bookkeeping method utilized to occasionally lower the book value of a loan over a set period. In connection to a credit, amortization centers on spreading out credit installments over time.

Does loan payment schedule work?

An amortization plan may be a settled table that lays out precisely how much of your month-to-month contract installment goes toward intrigued and how much goes toward your central each month for the entire term of the credit. Yes, it works because as your credit develops, more of your installment goes toward foremost, and less of it goes toward intrigued.

What is an example of Amortization?

Amortization alludes to how loans are connected to certain sorts of advances. Your final advance installment will pay off the ultimate sum remaining on your obligation.

It gets to be tedious to pay back all your credit sums, particularly if they are orchestrated in a disorganized way. Presently make an installment plan for your advantage by downloading this Loan Payment Schedule Layout on our site. Templates are available in MS Word, Excel, Pages, and Numbers, making it all the more harmonious for all your gadgets