17+ Sales Invoice Examples to Download

Quotation, sales order, sales invoice, receipt there are a lot of documents related to a single transaction in a business entity. Sometimes, we unknowingly interchange the terms for they are really a bit confusing. Well, here’s a tip: each of the stated documents form part of the process and they are already presented in sequence. You can use an invoice maker to generate these documents efficiently, and refer to invoice templates to ensure consistency and professionalism in your formatting.

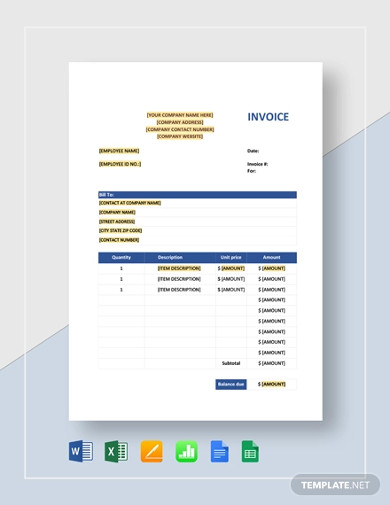

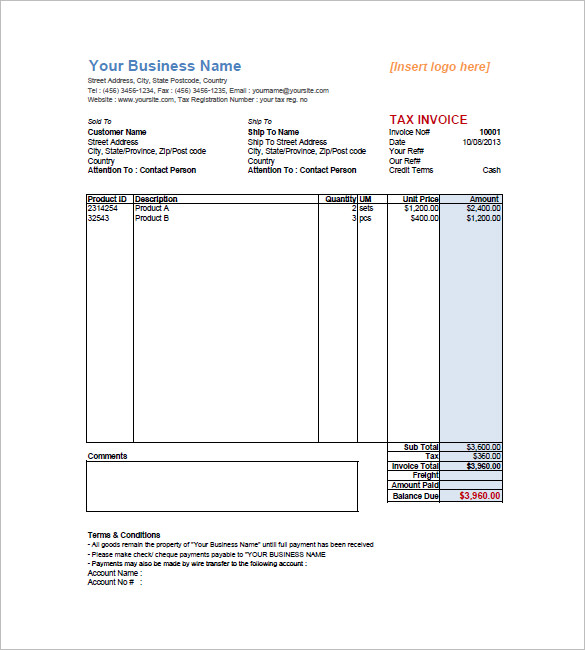

Sales Invoice Template

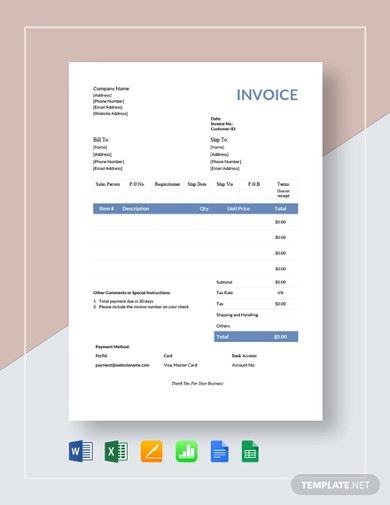

Product Sales Invoice

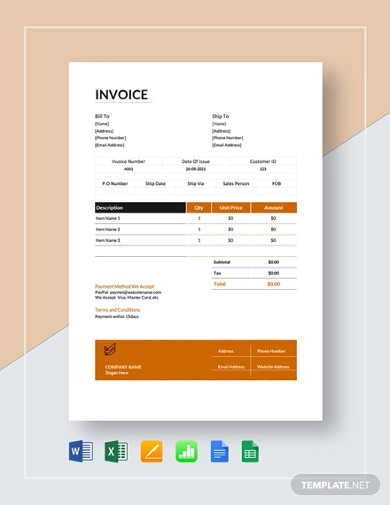

Small Business Sales Invoice

However, in this article, we will focus on one of the important document in a sales transaction, the sales invoice. Other documents are briefly discussed in one of the sections below. These documents are equally important in a sales transaction. You may also like payment invoice examples & samples.

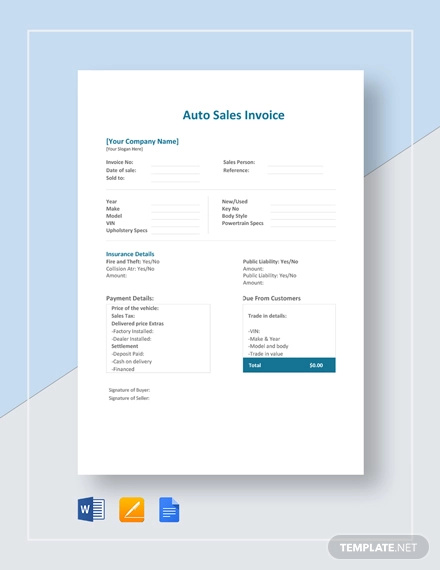

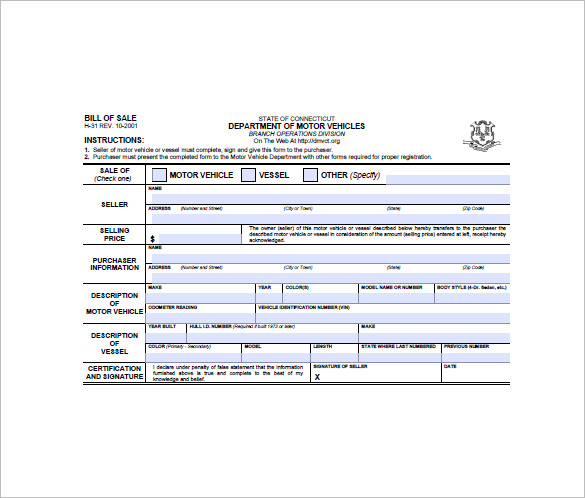

Auto Sales Invoice Example

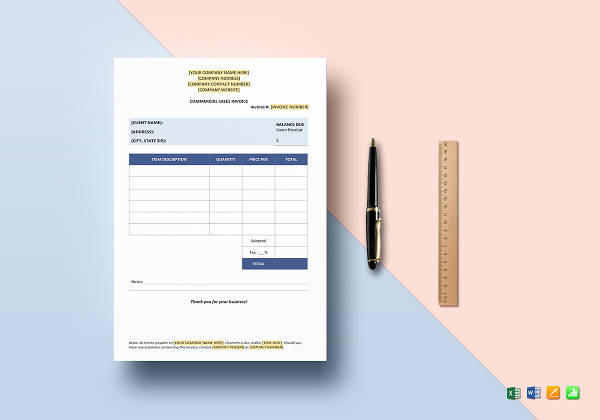

Commercial Sales Invoice Example

Sales Tax Invoice Example

To give you examples of sales invoice, the next section provides a lot of elegant, formal, and uncomplicated sales invoice examples. You might also want to see related invoices as well in these links:

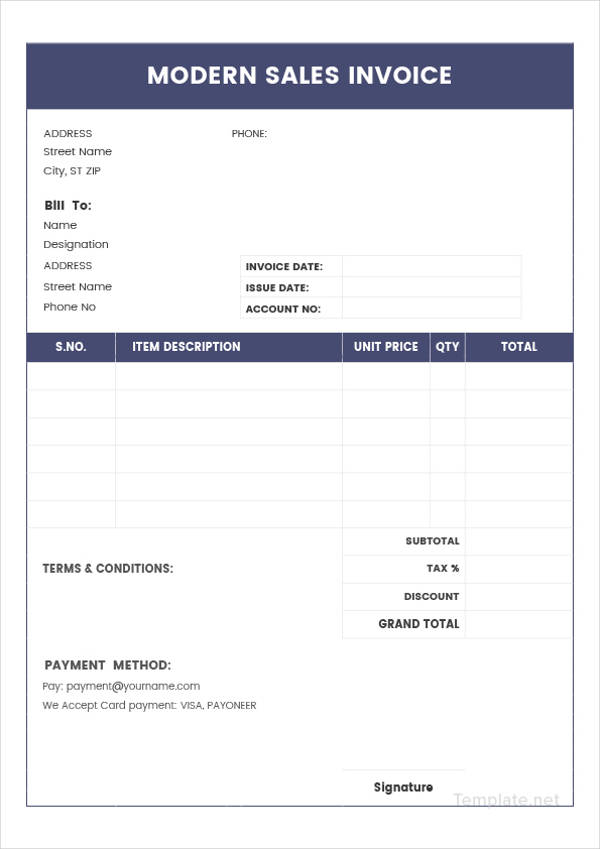

Modern Sales Invoice Example

Sales Invoice Definition

A sales invoice, also known as purchase invoice or commercial invoice, is a request of payment by the customer for the goods sold or services provided by the seller. In general, it lists the description, the quantity of the item sold or service provided, the date it was dispatched, as well as the amount of money owed by the buyer. It can also serve as a document evidencing the sale of goods or services to a customer. You may also see service invoice examples & samples.

Free Commercial Sales Invoice Example

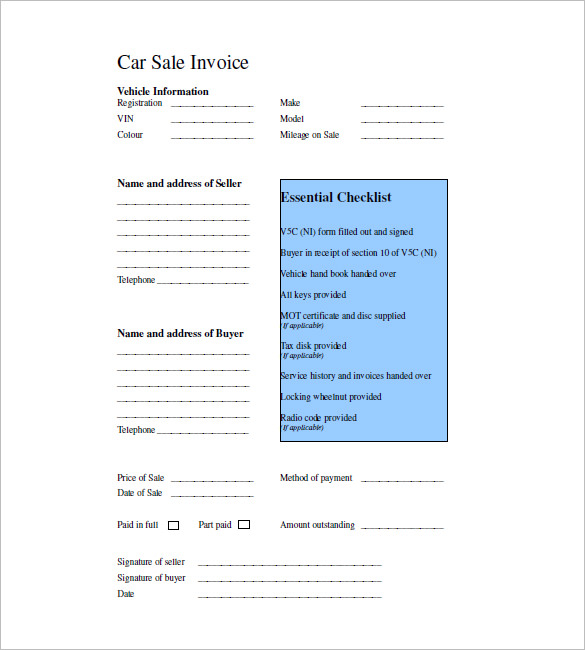

Car Sales Invoice Template Example

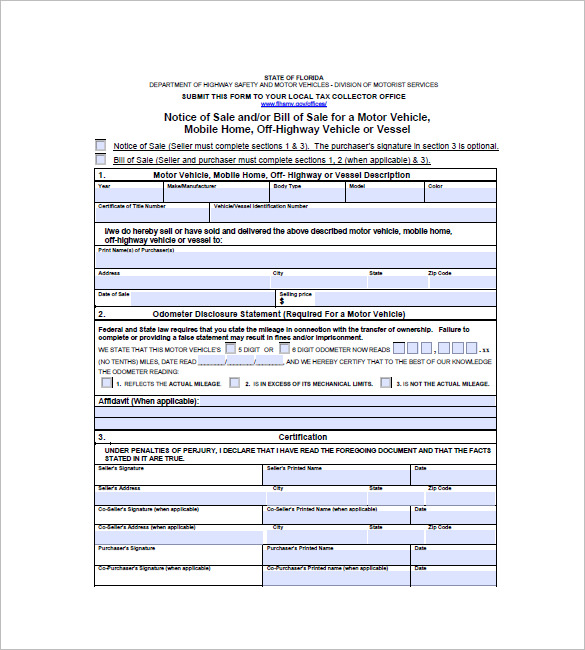

Florida State Sales Invoice Template Example

Free Printable Sales Invoice Example

Quotation, Sales Order, Sales Invoice, Receipt

As been previously said, in a single transaction, certain documents are needed such as quotation, sales orders, sales invoice, and receipt. These documents are beneficial since they keep proper documentation as well as accountability or safety of the items being sold. Each of them has their own characteristics and roles to play in a sales transaction process. You may also like travel invoice examples & samples.

For quotation, this refers to the document that will be handed to the customer allowing him to see the costs that would be involved for the work they would like to have done. Commonly, the cost differs in the materials that would be used as well as the labor of the said project. You may also check out simple invoice examples.

On the other hand, a sales order is a document given to the seller from the buyer requesting a certain product or service usually based in the quotation that has been previously endorsed to the buyer.

Then, the seller will request payment from the buyer through a document called invoice, which is the focus in this article’s discussion.

Lastly, a receipt will be released and given to the buyer as a proof of payment by the buyer and to complete the transaction.

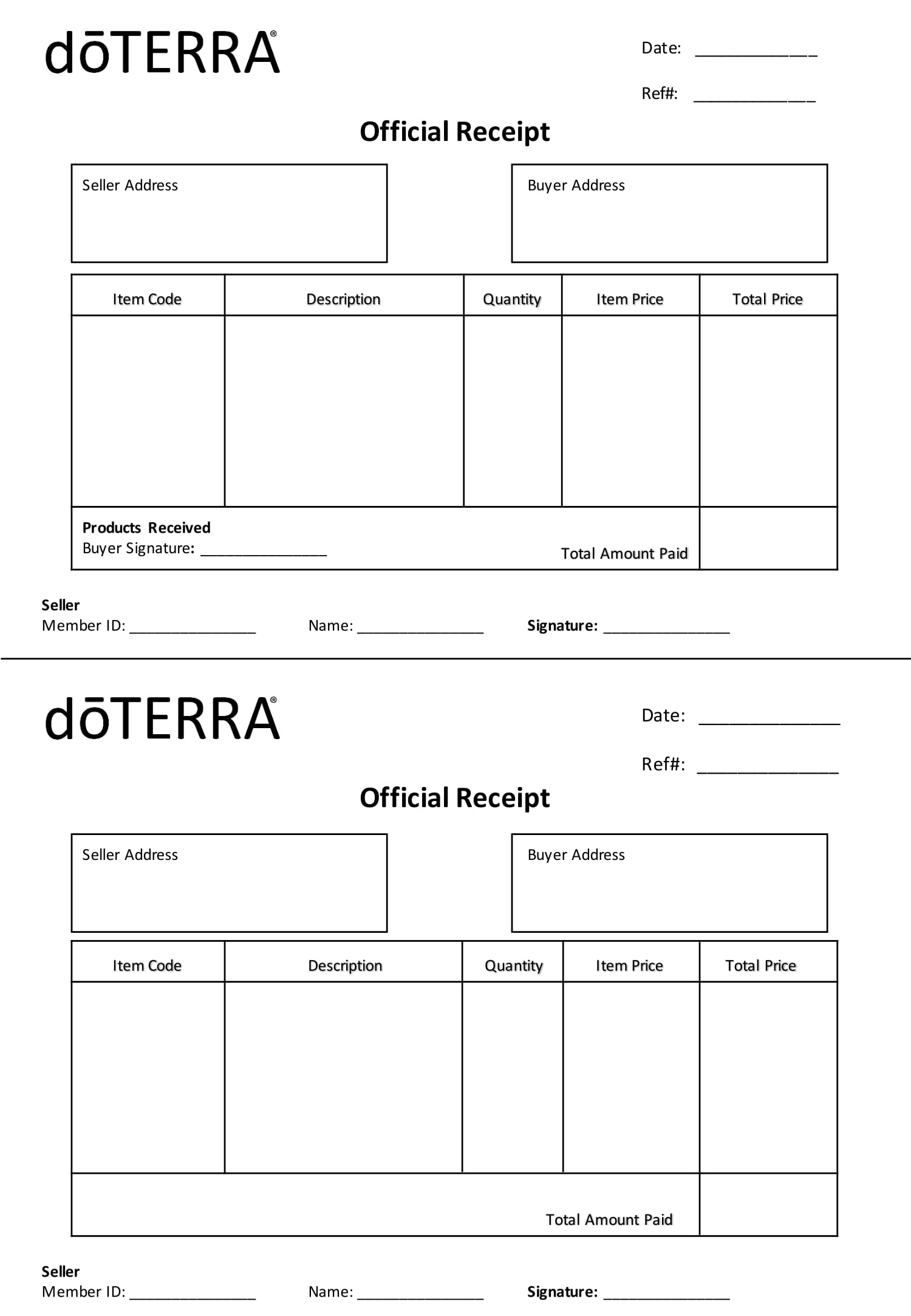

Free Sales Invoice Example

Free Sales Tax Invoice Example

Motorcycle Sales Invoice Template Example

Printable Blank Sales Invoice Example

Details Included in an Invoice

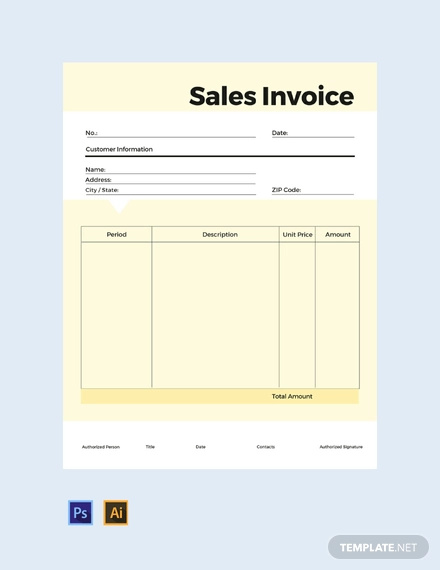

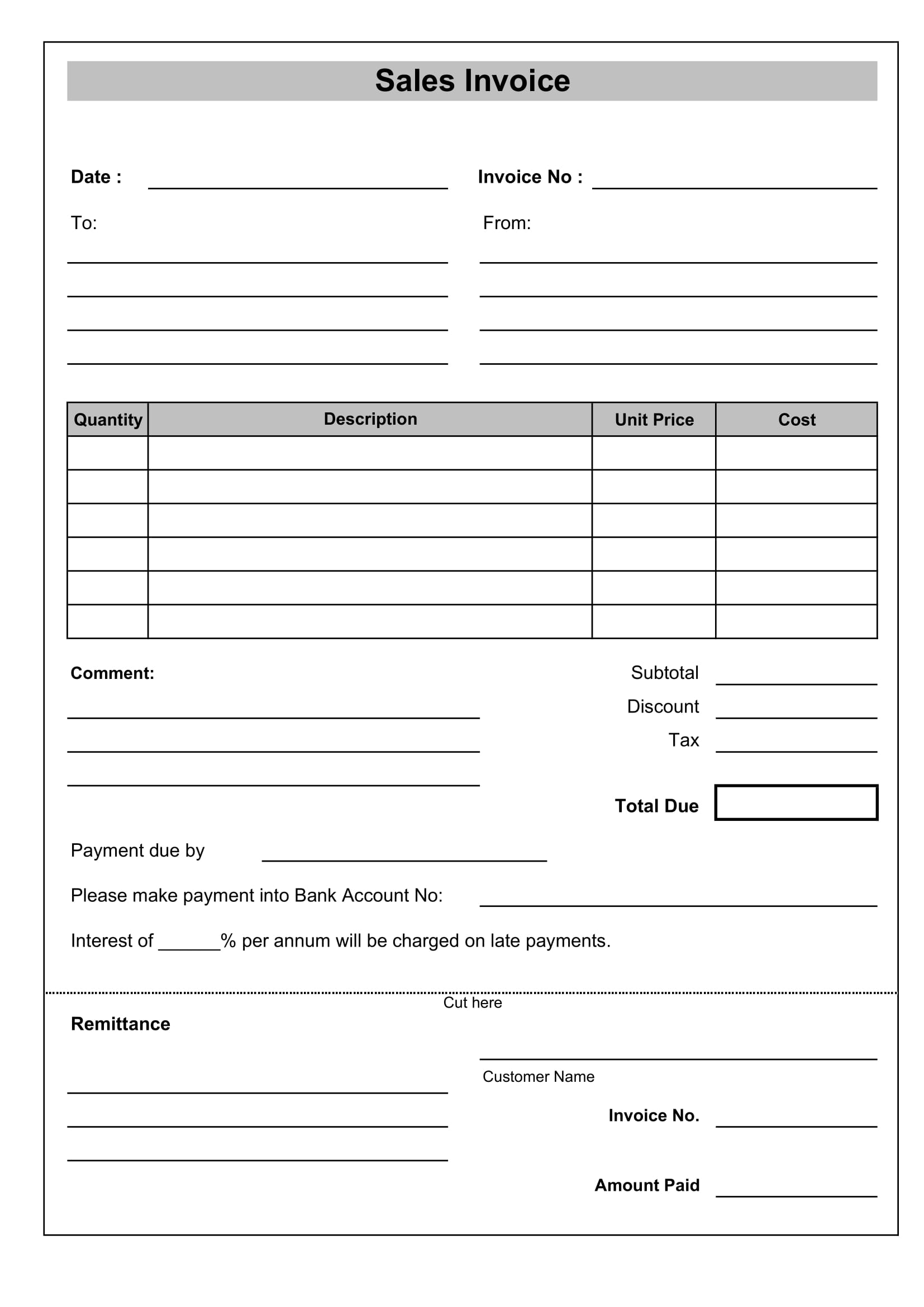

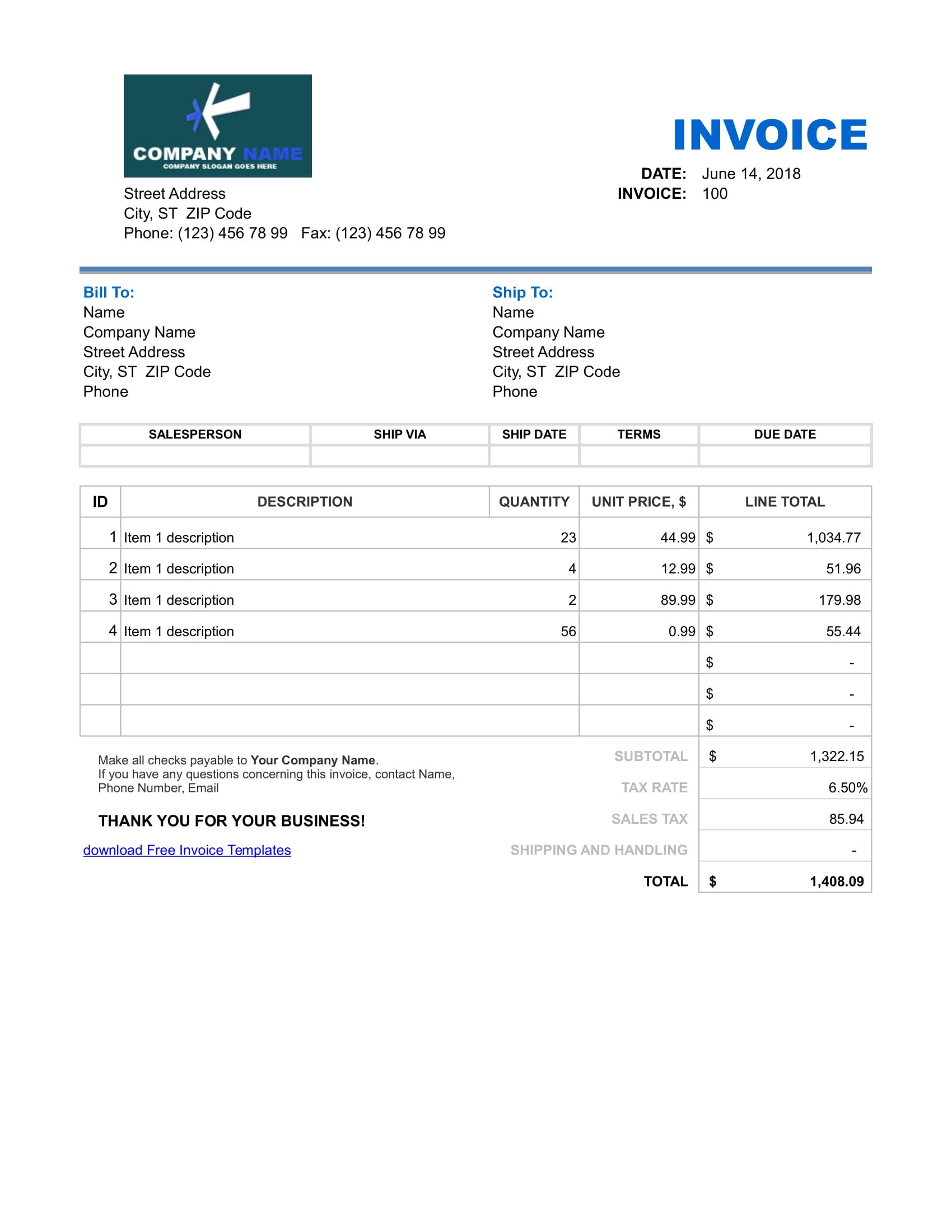

Below is the usual format of a sales invoice. There might be other variations for other business entities due to their nature of business or own preferences, but this is the common arrangement of the elements in an invoice.

1. Header

- Business name

- Tagline (optional)

- Location of business

- Contact number

- Logo (optional)

You may also see commercial invoice examples & samples.

2. Top

- Date of sale

- Invoice or transaction number

- Customer’s name

- Customer’s complete address

3. Middle

- Quantity

- Description

- Unit price

- Discount (optional)

- Cost

You may also like catering invoice examples & samples.

4. Bottom

- Subtotal

- Tax amount (optional)

- Grand total

- Discount terms (optional)

- Payment terms (optional)

Introducing Automatic Invoicing

Although a lot of transactions today are still paper-based, due to the increasing use of technology, invoicing can also be done and transmitted electronically over the Internet. Some companies would still print paper invoice even if they are transacting invoices online for record-keeping and auditing purposes. Sales invoice window allows the user, typically the seller, to browse information about all sales invoices registered in the system. You may also check out proforma invoice examples & samples.

Furthermore, it also allows to issue and manage customer’s invoices. The elements of a sales invoice might be overwhelming at first, but once you get used to the process, everything will run smoothly and you can appreciate the system for its efficiency and speed in dealing every transaction. You might be interested in blank invoice examples & samples.

Here is a quick overview of the elements of a sales invoice window.

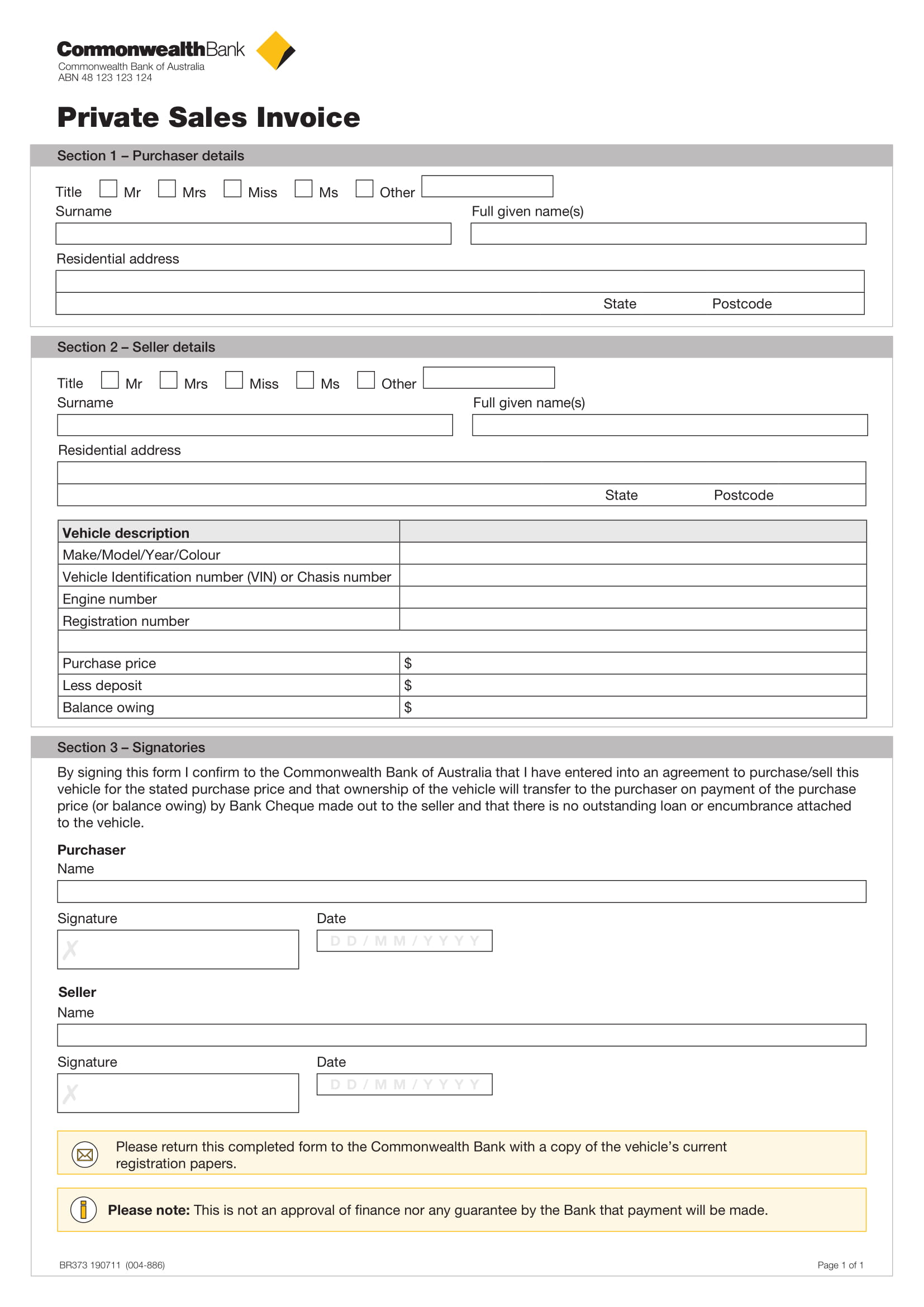

Private Car Sales Invoice Template Example

1. Header

In the header section of the sales invoice window, the invoice can be registered and managed. Basically, the items to be filled in in the header section is as follows:

- Transaction document

- Document number

- Invoice date

- Business partner

- Partner address

- Description

- Payment terms

- Payment method

- Document status

- Total gross amount

- Total net amount

- Currency

- Payment complete

- User

- Total amount paid

- Add payment button

- Posted

- APRM process invoice

- Process invoice

- Create lines from

- Copy lines

- Total outstanding

- Amount currently due

- Days till next due

- Percentage paid late

- Trx Organization

- Days to pay in full

- Paid in full date

- Price list

- Sales representative

- Sales order

- Order reference

- Accounting date

- Update payment monitor

- Tax date

- Activity

- Charge

- Charge amount

- Order date

- Document type

- Calculate promotions

- Project

- Cost center

- Asset

- Sales campaign

- 1st dimension

- 2nd dimension

- Prepayment amount

- Withholding amount

- Self-service

- Sales transaction

- Processed

- Process invoice

- Print discount

- Last calculated on date

- Invoice

- Generate receipt from invoice

- Mode of payment

- Date printed

- Creation date

- Client

- Active

You may also see medical invoice examples & samples.

2. Lines

After filling in and saving the sales invoice header, each sales invoice line can be registered in this tab one by one.

- Line number

- Product

- Operative quantity

- Alternative UOM

- Invoiced quantity

- UOM

- Net unit price

- Gross unit price

- Line net amount

- Line gross amount

- Tax

- List price

- Gross list price

- Financial invoice line

- Account

- Attribute set value

- Description

- Sales order line

- Goods shipment line

- Edit line net amount

- Alternate taxable amount

- Order UOM

- Order quantity

- Deferred revenue

- Base net unit price

- Base gross unit price

- Revenue plan type

- Period number

- Starting period

- Organization

- Project

- Cost center

- Asset

- 1st dimension

- 2nd dimension

- Explode

- BOM_Parent_ID

- Tax amount

- Resource assignment

- Promotion

- Project line

- Price limit

- Invoice discount

- Invoice line

- Invoice

- Description only

- Creation date

- Client

- Business partner

- Active

You may also like invoice examples in pdf.

3. Discounts and Promotions

This pertains to any applicable discounts and promotions that can be availed by the buyer.

- Line number

- Promotion

- Base net unit price

- Base gross unit price

- Discount per unit

- Total amount

- Displayed total amount

- Organization

- Invoice line offer

- Invoice line

- Client

- Active

You may also check out self-employed invoice examples and samples.

Retail Sales Invoice Example

4. Line Tax

The line tax information is automatically filled in for each sales invoice line upon the completion of the invoice. This includes the following:

- Line number

- Tax

- Taxable amount

- Tax amount

- Recalculate

- Organization

- Invoice line tax

- Invoice line

- Invoice

- Client

- Active

You might be interested in invoice form examples.

5. Accounting Dimension

This refers to the accounting dimension, which usually pertains to the cost process as well as the cost center for the item being produced or processed. Moreover, it also includes the following:

- Active

- Amount

- Organization

- Business partner

- Product

- Project

- Cost center

- Asset

- Activity

- Sales campaign

- 1st dimension

- 2nd dimension

- Invoice line

- Client

- C_Invoiceline_Acctdimension_ID

You may also see contractor invoice examples & samples.

6. Tax

In this tab, the summary of the sales invoice tax and other related information is shown. Other information are as follows:

- Line number

- Tax

- Taxable amount

- Tax amount

- Recalculate

- Organization

- Invoice

- Client

- C_InvoiceTax_ID

- Active

You may also like invoice examples in excel.

7. Basic Discounts

In this tab, information about the discounts automatically applied based on the customer configuration is listed. This may also be manually entered by the selling party. The items in this tab are as follows:

- Line number

- Basic discount

- Cascade

- Organization

- Invoice discount

- Invoice

- Client

- Active

You may also check out photography invoice examples & samples.

8. Payment Plan

This tab lists the scheduled payments expected against the invoice. This contains the following information:

- Organization

- Invoice

- Due date

- Due date

- Expected date

- Payment method

- Expected amount

- Received amount

- Outstanding amount

- Currency

- Update payment plan

- Active

- Last payment date

- Days overdue

- Number of payments

- Description

- Modify payment plan

- Doubtful debt amount

- Fin_Payment_Schedule_ID

- Client

You might be interested in deposit invoice examples & samples.

9. Payment Details

The payments made against the invoice as well as the details are listed in this tab. They are as follows:

- Organization

- Payment details

- Order payment schedule

- Invoice payment schedule

- Received amount

- Active

- Write-off amount

- Business partner

- Activity

- Product

- Sales campaign

- Project

- Sales region

- Payment date

- Document number

- Payment method

- Payment method

- Amount

- Financial account

- Status

- Canceled

- Payment

- Invoice paid

- Payment schedule detail

- Client

10. Old Payment Plan

This contains the list of the scheduled payments expected against the invoice.

- Number of payments

- Payment method

- Due date

- Last payment date

- Expected amount

- Received

- Outstanding

- Currency

- Days overdue

- Modify payment plan

- c_ob_selected

- Sales order

- Organization

- Invoice payment in plan

- Invoice

- Client

- Awaiting execution amount

- Active

You may also see tax invoice examples and samples.

11. Old Payment Details

This contains the details of the payments received against the invoice.

- Payment in

- Payment method

- Due date

- Payment date

- Expected amount

- Received amount

- Write-off amount

- Financial account

- Expected (account currency)

- Received (account currency)

- Exchange rate

- Payment no.

- Finacc_Currency_ID

- Canceled

- Status

- Payment detail

- Organization

- Order no.

- Invoice payment in plan

- Invoice number

- Invoice amount

- Currency

- Client

- Business partner

- Active

You may also like freelance invoice examples & samples.

12. Payment

In this tab, an obligation for accounting to expect to receive all or part of the invoice amount in advance is created. Other information consist of the following items:

- Settlement cancelled

- Form of payment

- Due date

- Business partner

- Description

- Cashbook

- Cash journal line

- Bank account

- Bank statement line

- Amount

- Currency

- Write-off amount

- Initial status

- Project

- Receipt

- Payment complete

- Valid

- Payment

- Organization

- Manual

- Invoice

- Generate_Processed

- Client

- Change debt payment

- Cancel processed

- C_Settlement_Generate_ID

- Active

You may also check out professional invoice examples & samples.

13. Reversed Invoices

In this tab, the user is allowed to select the invoices being reversed by the invoice being created.

- Reversed invoice

- Organization

- Invoice

- Client

- Active

14. Exchange Rates

This tab allows to enter an exchange rate between the organization’s general ledger currency and customer’s invoice currency.

- Organization

- Active

- Currency

- To currency

- Invoice

- Financial account transaction

- Rate

- Foreign amount

- Client

- C_Conversion_Rate_Document_ID

You may also see plumbing invoice examples & samples.

15. Accounting

This pertains to the accounting information related to the transaction.

- Client

- Organization

- Active

- Record ID

- General ledger

- Currency

- Period

- Accounting date

- Sequence number

- Account

- Value

- Accounting entry description

- Debit

- Credit

- Description

- Business partner

- Product

- Project

- Cost center

- Asset

- 1st dimension

- 2nd dimension

- Withholding

- UOM

- Type of entry

- Trx organization

- Transaction date

- Tax

- Table

- Storage bin

- Sales region

- Sales campaign

- Record ID 2

- Quantity

- Posting type

- Location to address

- Location from address

- Line ID

- Group ID

- G/L category

- Foreign currency debit

- Foreign currency credit

- Document type

- Document category

- Activity

- Accounting fact

You may also like printable invoice examples.

Sales Invoice Template Example in PDF

In general invoice, just like other documents needed in a transaction, is important for the completion in closing the deal. One must design an invoice that is not only comprehensive and with complete details but also easy for record-keeping and to account for by the selling party. The above examples show perfect examples of comprehensive and easy-to-record sales invoice. Don’t forget to check them out!