14+ Inventory List Examples

An inventory list is the absolute best buddy of businessmen and store owners. These things, when done rightly, can help you track your items present in your stock, the items that are no longer in it, and the items that are still being reordered. It also helps you get a grasp on the things that your business uses or sells. You may also see grocery list examples.

An inventory list is necessary to keep track of the ingredients that every dish needs if you are running a restaurant. It can help you get a tangible number on how many items you have sold if you are in the retail business. If you own a clothing or jewelry store, keeping an inventory list can help you itemize the materials you have consumed and the materials you need to restock. You may also like contact list examples.

Inventories are considered a business asset because they contain every valuable material that goes in and out of your business. These are also necessary in keeping an accurate financial record because most, if not all, of the expenses of a business are documented during an inventory. You may also check out reading list examples.

Besides, an inventory list is considered an accepted evidence when making an insurance claim. If your business is victimized by theft, flood, fire, or other incidents, an inventory list can help you make an estimation of the damages, plus, it can also serve as a recorded support to avoid the hassle of trying to quantify how much loss an incident has caused to you. You might be interested in medication list examples.

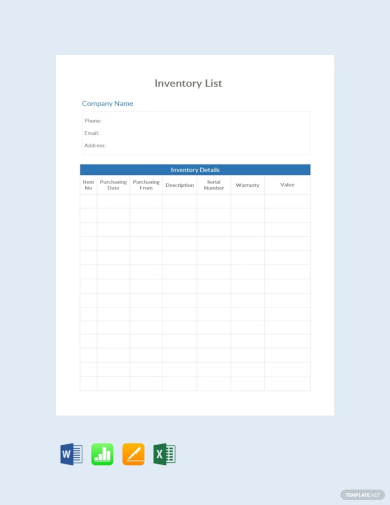

Simple Inventory List Template

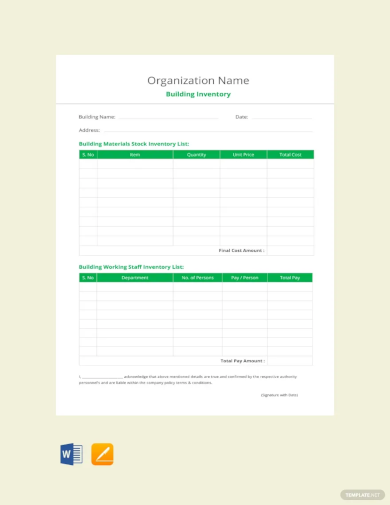

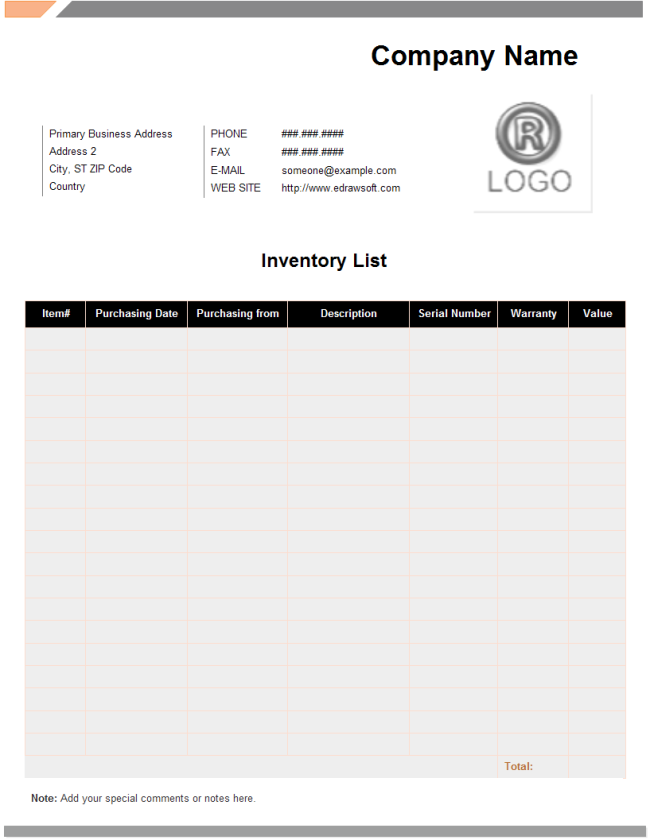

Building Inventory List Template

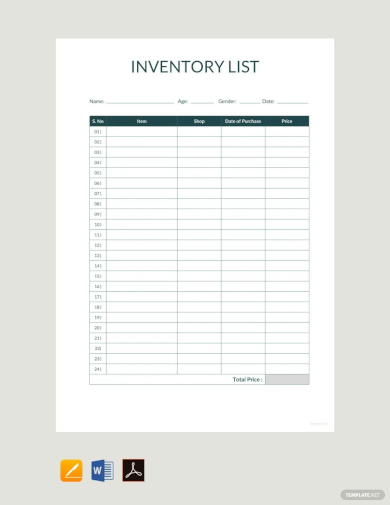

Sample Inventory List Template

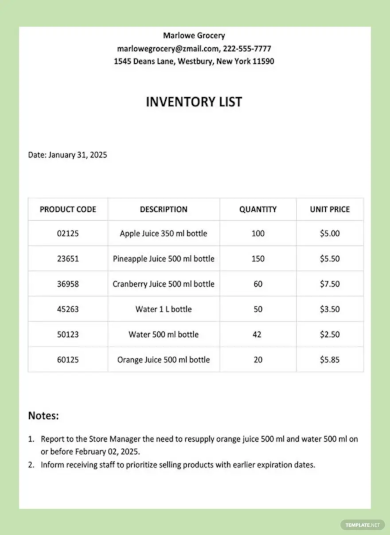

Inventory List Template

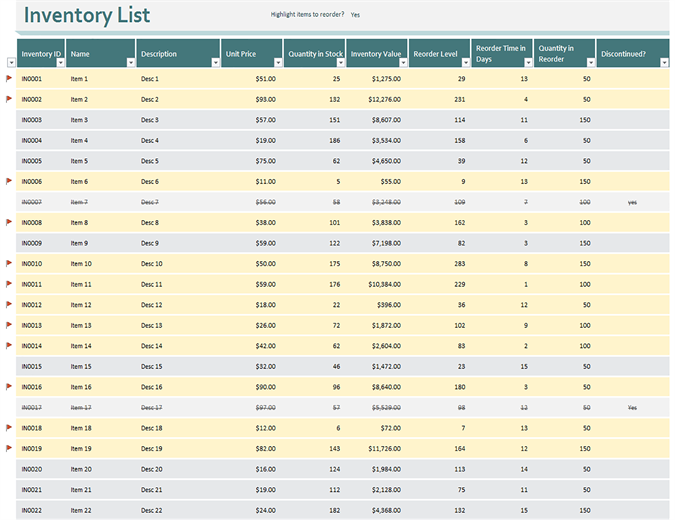

Inventory List with Highlighting Example

Product Inventory List

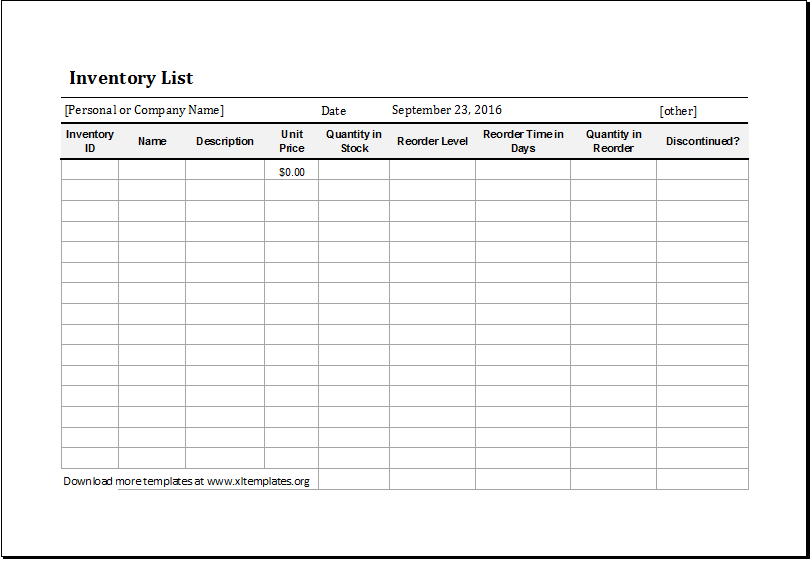

Inventory List Template

Making an inventory and keeping an inventory list is like keeping a constantly watchful eye on your bank account. After all, what you’re making an inventory on is your assets although, in this one, they may come in the form of vegetables or clothing materials or furniture. You may also see birthday list examples.

The amount of concern you give your actual cash should be spent on your stocks as well because although they don’t come in the same form, they hold equal worth.

The Importance of Making Inventories

1. It is important that you are thoroughly familiar with the things your business considers to be an asset. For example, restaurant owners view the tiniest piece of onion with as much value as the biggest pumpkin because they serve the same purpose. Irregardless of the monetary investment that was spent on an object necessary to keep the business running, it will still be considered an asset because it helps the business in its own way. You may also see to-do list templates and examples.

Because of this reason, it is the owner’s responsibility to intricately know about these things, as little as they may seem at first. An effective way to do this is by conducting inventories.

2. A regular inventory will also help you keep everything in your warehouse (or your stockroom) organized because constantly checking up on these items will unconsciously enable you to arrange them in a more orderly fashion to help your inventory run smoother. (You don’t want to conduct an inventory on a chaotic warehouse, right? So, of course, after every restocking, as an automatic response, you will reorganize the items.) You may also like checklist examples in pdf.

3. Inventories will also help you get familiar with every aspect of your warehouse and the things in it. As the owner, or the manager, this is an important part of your duty. Being familiar with your warehouse will mean that you are more acquainted to its needs, which will lead to a more effective managing of it. You may also check out quality checklist examples & samples.

Plus, mastering the contents of your stocks can help you avoid doubling some items and forgetting to restock others. Inventories can give you a better knowledge of the items you are tasked to handle.

4. Inventories will also help you maintain balance in your stocks. The trick to a successful business is to always be ready for everything. This includes large orders or demands. If you haven’t done a regular inventory for quite some time, you may find yourself lacking the stocks necessary to provide for a customer. This will not bode well for the image that your business will portray. You may also see printable checklist examples.

Your customers will look for a different patron since you are obviously incapable of giving them an exemplary tune-up. On the other hand, having too much items in your stock may only lead to one thing—profit loss. These items are very vulnerable to damages such as decay, expiration, or simply going out of the season or trend. You may also like list templates in word.

By maintaining an inventory, you are actually keeping in touch with your customers’ demands which can help you get to know them better. Bottom line, an inventory is a necessity to better your customer service.

5. Inventories can give you a clear idea of how well your business is doing. If you find your warehouse needing to be restocked more and more often, it’s easier to think someone is stealing from you or your business is at its peak. Let’s all agree it’s the latter. Through constantly reflecting on your stocks, you can know if you are actually getting something out of all your effort or if you need to double them to get some positive results. You may also check out task checklist examples.

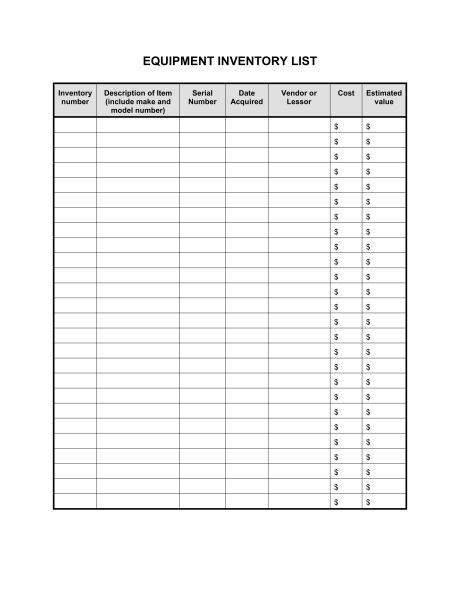

Equipment Inventory List

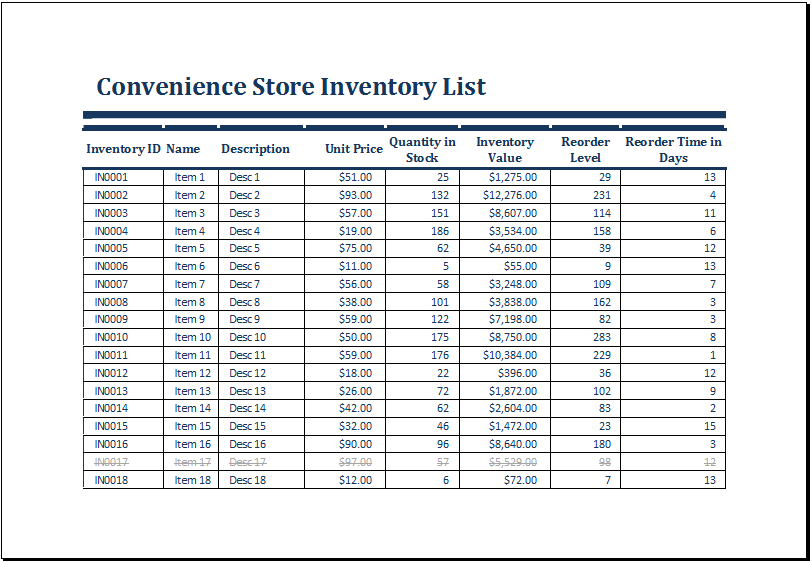

Convenience Store Inventory List

Steps in Conducting an Inventory

Inventories can actually be a difficult job. Especially if you are not yet adept at handling the task or if you happen to manage a big corporation (for which an inventory is conducted with the help of many people because you cannot do it alone). However, the key to effective inventory lies in the following steps:

1. Setting up systems to keep a well-documented record of every inventory.

Which would imply that your business has been under a constant inventory since the very beginning. Otherwise, this step would be difficult. The general list you have from the last inventory is an important ingredient in the next one because you are basically just comparing the items on that list from the things that are physically in your warehouse, and you cannot do this if you have no record of the items.

Plus, records of past inventories can help you track the progress of your business and the rise and fall of the products demanded by customers as based on the most consumed items as recorded in every inventory.

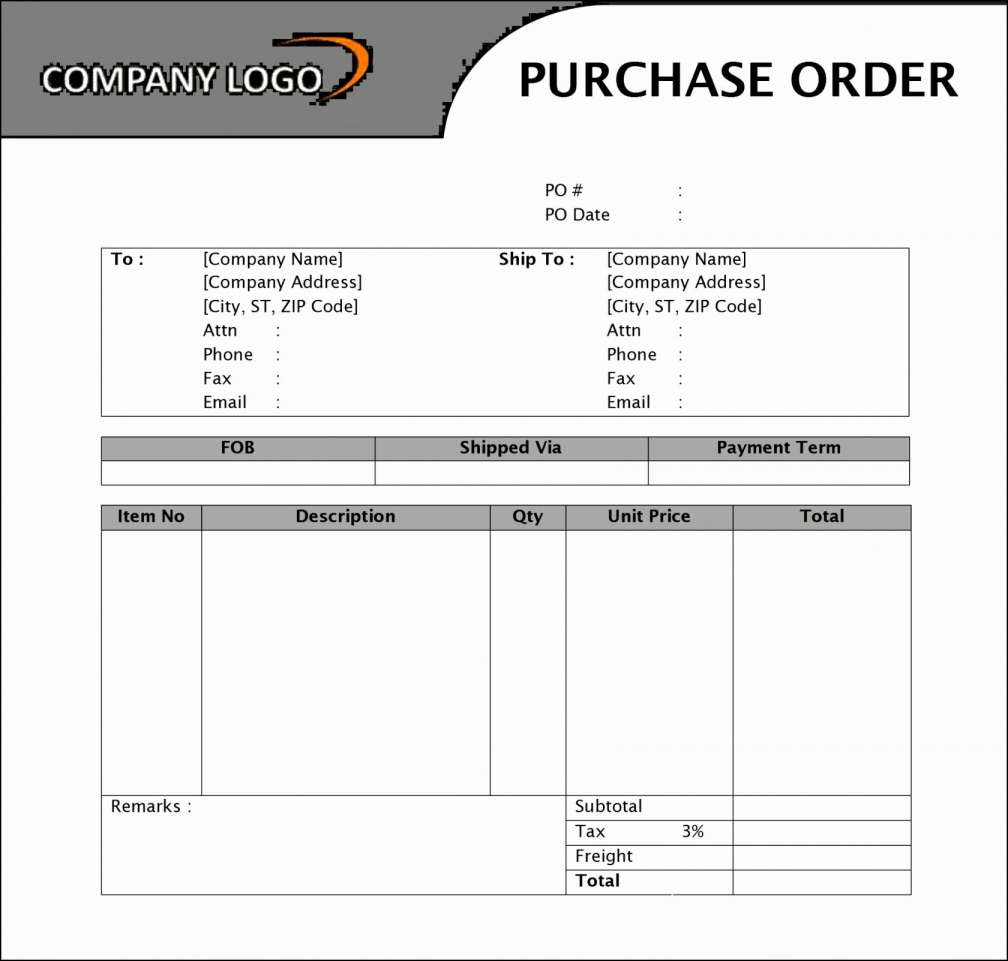

2. Develop specific instructions for ordering and purchasing.

When it comes to the technicalities of running a business, you cannot be random or haphazard. There should be a system that everyone involved can follow. And this system should be as systematic and as organized as possible. In relation to ordering and purchasing or simply restocking the items on your warehouse, you need to give out detailed instructions to avoid unfortunate incidents such as having a specific item restocked more than necessary. You may also see registry checklist examples & samples.

These situations often can’t be helped especially in dealings that involve a lot of people. To avoid them, make sure that each one knows their respective responsibilities and that they stick to it.

3. Know how many times an inventory is needed.

Of course, if you are the owner or a manager of a business, you have a lot on your plate, and listing and crossing out items from a piece of paper is probably the last thing you want to do.

Fortunately, an inventory need not be conducted every day. In fact, it can be done as seldom as once every three months or as often as once every three weeks. It will all depend on how big your company is and how plenty your items that need inventory are. This is an aspect that you need to decide yourself. You may also like project checklist examples & samples.

4. Know the areas for improvement.

The best thing about an inventory is that it gives you the chance to introspect. But not with yourself, with your business.

Through regular inventories, you can come face-to-face with problems that you may not notice if you stayed behind your desk. For example, you learn that the items delivered to you are not in the best quality. Or that the deliveries don’t come on time. Or that one of your products doesn’t reach your quality expectations. You may also check out blank checklist examples & samples.

There are things about your business that you can only discover if you are given the chance to handle them. When you do, make sure you work them out.

Warehouse Inventory List

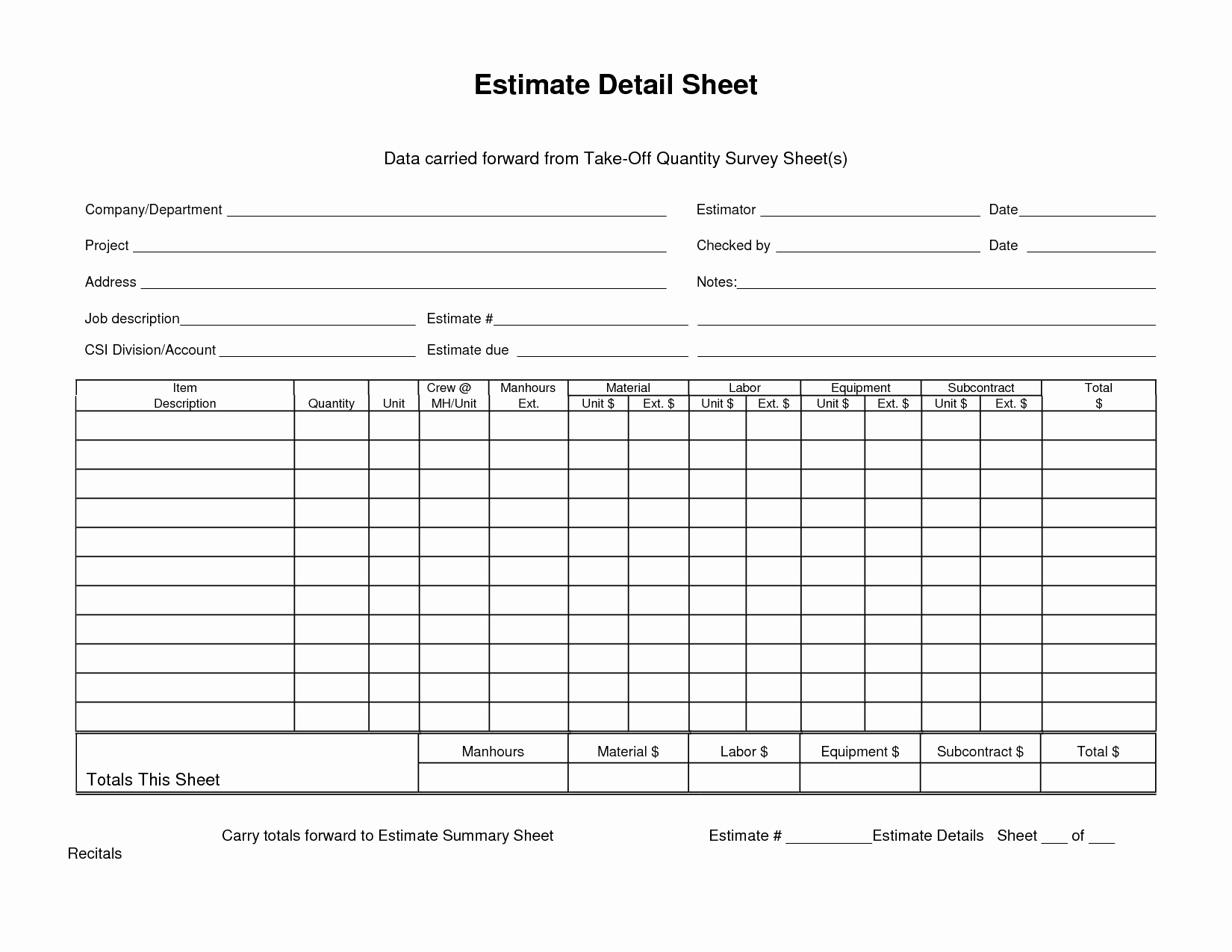

Inventory List for Orders

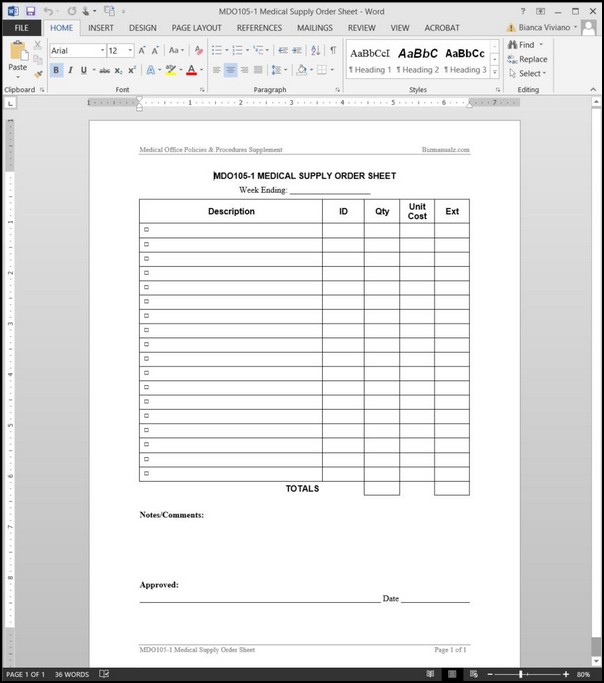

Medical Supply Inventory

How Do You Make an Inventory List?

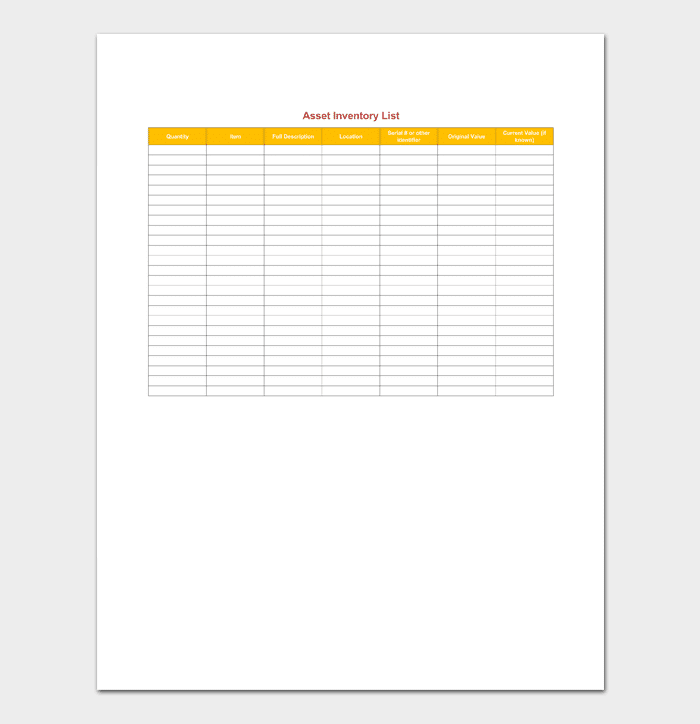

1. The easiest way to keep an inventory is to create a spreadsheet (because personally handwriting one is a waste of time and effort when computers are readily available). You can use a list template to make things easier for you. Include columns for product name, serial number for each item, quantity, and all the other details you feel the need to include.

You can design your spreadsheet in a way that can compliment the needs of your business. You can also create a separate column for all the things that you ship out or sell. This way, you can have a more detailed track of not only what comes into your warehouse but what also comes out of it. You may also see training checklist examples & samples.

It is important to note, however, that you don’t have to inventory every little thing in your business such as paper clips and folders unless you have a separate warehouse for these supplies. As a general rule, only inventory the items you would want to be protected by your insurance. You may also like maintenance checklist examples & samples.

2. Include scanned copies of the receipts related to the inventory that is taking place to your spreadsheet. In fact, it is better to keep the physical receipts ready as well if you want to do this documenting business the thorough way. You may also check out inventory checklist examples.

3. Include scanned copies of the photographs of your inventories in your spreadsheet.

4. Save your inventory list in a secure computer, which means that it should be password protected and that the password should only be shared to people you trust or those who need to know.

5. It is also best to keep physical copies of these documents. Despite the security that a computer or the Internet can offer you, they also have their setbacks. And in these cases, a tangible copy is the most reliable form. You can give copies to your lawyer, accountant, and insurance agent to make sure that you will have a surviving copy if ever you lose yours. You might be interested in audit checklist examples & samples.

Storage Inventory List Example

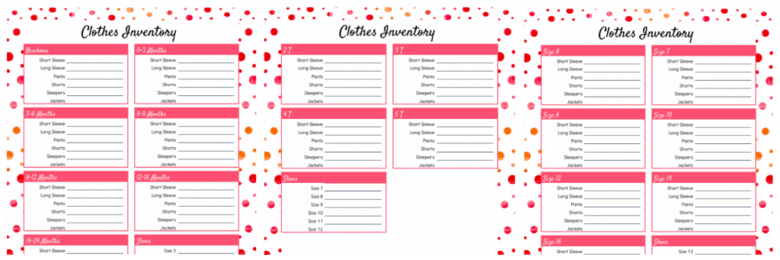

Clothes Inventory List

Asset Inventory List

Conducting an inventory is simply giving yourself the chance to be kept updated on the needs of your business and its present state. And a lot of successful businessmen will tell you that these two things are the only two most important things you need to make sure that your business gets the proper attention and pampering it demands. You may also see marketing checklist examples & samples.