How to Analyze a Balance Sheet Examples

A balance sheet contains specific information about the net worth, assets, and liabilities of a business. It is essential for this tool to be precise as financial records are taken seriously by investors and other stakeholders of the business no matter what industry the company belongs to. Unlike the task sheets which already provide details in an easy to understand manner, financial statements like a balance sheet must be reviewed in a formal and professional manner as there are areas of discussions that may be too technical for some. This is the reason why certain financial ratios are used to analyze this document.

A better view of the condition of the business in terms of finances can be seen if you know how to properly analyze the balance sheet with the help of financial ratio analysis. Being able to immerse in this process accurately will allow you to see how efficient the company is in terms of its operations, financial standing, and current business condition. If you want to know how to properly review or analyze a balance sheet examples, keep on browsing through this post. You may also see profitability ratio analysis.

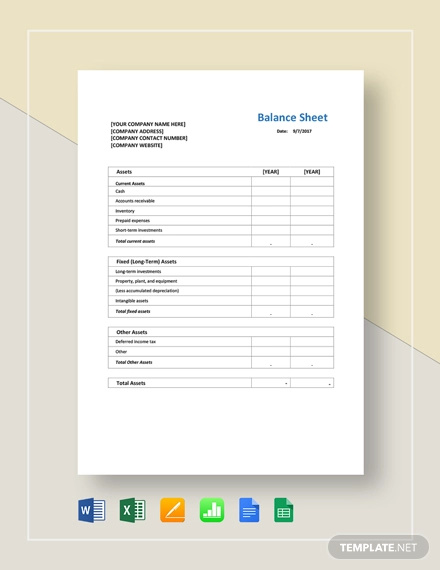

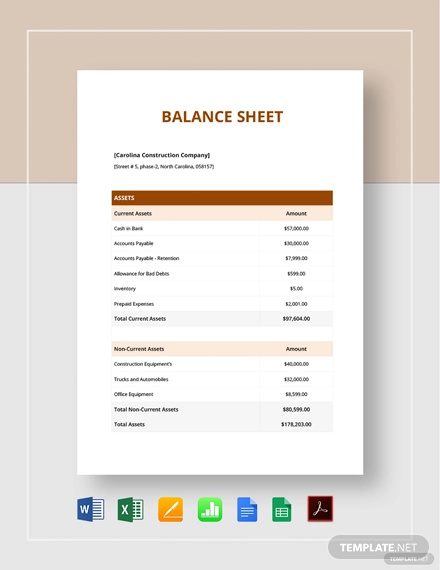

Balance Sheet Example

Simple Balance Sheet

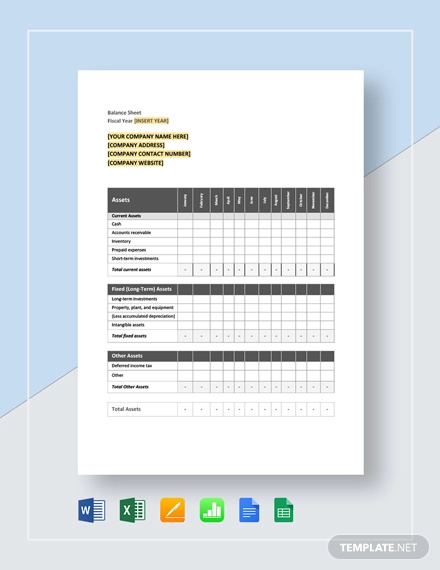

Monthly Balance Sheet Example

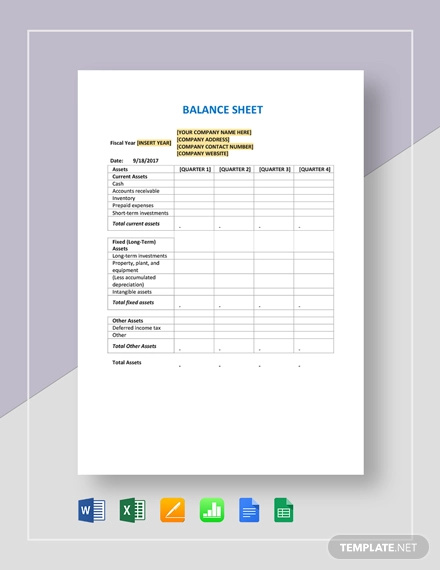

Quarterly Balance Sheet

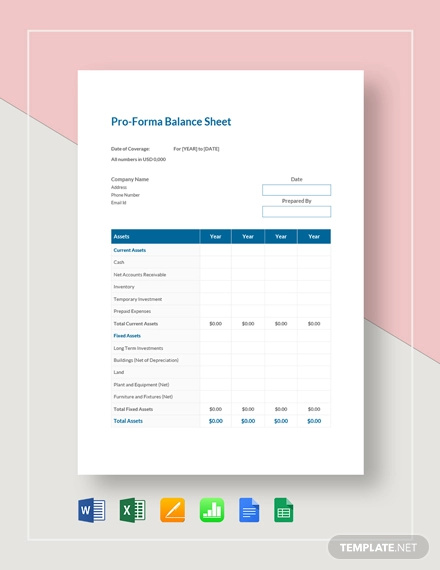

Proforma Balance Sheet Example

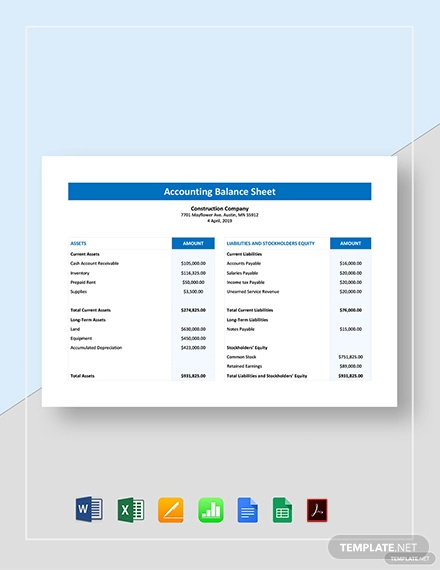

Accounting Balance Sheet Example

How to Effectively Analyze a Balance Sheet

Since a balance sheet acts as a corporate document which states or specifies the financial policy position of the business, it is important for the people who will review this tool to be keen when browsing through the entirety of the material. Here is how you can analyze a balance sheet in an efficient and effective manner:

1. Research about balance sheets and their specifications. Doing this can help you be more prepared when you are already faced with an actual balance sheet that you need to review and analyze. You may also see business reports.

2. Be knowledgeable of the equation used in the development of the balance sheet. Always be reminded that the assets or the items owned by the company are equivalent to its shareholder’s equity and liabilities.

3. Be aware of how the current assets of the business are composed. There are different kinds of current assets which can affect the balance sheet. Some samples of current assets include the following You may also see financial reports.

- Inventory

- Cash Equivalents

- Actual Cash

- Checks

- Accounts Receivable

- Bank accounts that are non-restricted

4. Be specific about how you review non-current assets as well. Aside from current assets, businesses also have tangible and intangible assets with full values accounted and realized for a long time period within a specific accounting year.These assets are referred as long-term investments and a few of them include the following. You may also see buying a business

- Buildings

- Copyright

- Properties

- Land

- Machines

5. Other than assets, you need to give focus on the liabilities of the business. Companies have a variety of financial obligations and it varies on the kind of operations that they have, the scope of the debt of the business and the amount that they owe to other entities. It is essential to properly identify the debt of the business as well as the due dates of these debts to have a proper view of the balance sheet as a whole document. You may also see client information sheets.

- Know whether there are other liabilities aside from debts. Liabilities can come in different forms and debts are only a portion of it. You have to analyze more forms of liabilities which includes payment for interests, accounts payable, borrowings, short-term financial responsibilities, long-term borrowing portions, and loans. You may also see monthly sheets.

- The last element that you must review is the shareholders’ equity. Technically, a shareholders’ equity is the money that is invested in a specific business. This amount, when added to the overall liabilities of the business must be equivalent to the assets of the company so you can ensure that the balance sheet is actually balanced. You may also see sign in sheets.

Tips to Follow When Analyzing a Balance Sheet

Unlike other sheet examples used in simple academic or business undertakings, specifically analyzing a balance sheet is not an easy task. You have to be careful with how you review certain information to ensure that you have an accurate understanding of the balance sheets content and their representations. Listed below are some of the tips that can help you analyze a balance sheet.

1. You need to have an idea of how the balance sheet has been formulated and formatted. The structure of balance sheets varies from one another depending on the guidelines followed by the business. If you are already aware of the balance sheet structure, then it will be easier for you to identify all the items presented which can make it faster for you to thoroughly read and review the document. You may also see bid sheets.

2. You have to remember that a balance sheet is only one of the financial statements of the business. If you want to be more observant when it comes to financial details of the company where the balance sheet is from, you may also gather information from the business’ income statement as well as its cash flow statement.

3. Have awareness of the economic cost of assets as this cost differs from the assets’ span of usage. This is where depreciation comes in as it is deducted mostly from the non-current assets of the company.

4. Prepare yourself mentally whenever you are ready to review a balance sheet. It will help if you have a calculator in your hand or if you have a sheet of paper in front of you so you can write down initial analysis. Compared to a client information sheet and other kinds of sheet examples in Word, a balance sheet is more technical. Hence, you have to be cautious about how you interpret its content.

Essence of Understanding How to Analyze a Balance Sheet

As honest as possible, answer this question: Do you really understand the content of a balance sheet? If your answer is yes, then it is good for you especially if you would like to invest in a business. If your answer is the other way around, then you might be in trouble when it comes to trusting your money to a particular business plans. Be reminded that a balance sheet is a very important financial statement. This is why you have to analyze it in a way that you can understand what each financial information present in the document means.

The decisions that you make for investment goals are life changing as it affects your actual finances. Do you want your money to go to waste just because of a decision influenced by a balance sheet that you do not even know how to interpret? If you do want to invest guided by the proper knowledge necessary for you to trust the financial capability statement, and promise of a business; then we believe that it is already time for you to consider analyzing a balance sheet effectively. We hope that the items that we have discussed in this post are helpful enough for you to create sound decisions on how you put your money to work.