10+ Term Sheet Examples to Download

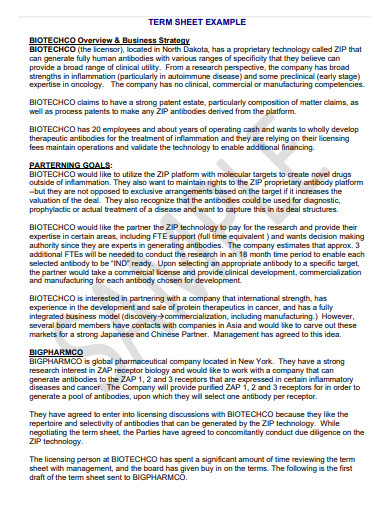

Angel investors are always on the lookout for startup businesses to bond with. At the same time, startup businesses highly expect such partnerships too. Once these two groups come across with one another, negotiations about a joint venture, private equity, investment, financing, venture capital, and even acquisition take place. All investors and entrepreneurs already knew that all of these things can get a little bit complicated during the discussion of terms. This is why a non-binding document known as term sheets are developed before actualizing an investment agreement. They provide a summary of the terms and conditions of the planned funding. You can learn more about the paperwork by skimming on our list of examples and speed-reading on our highly relevant term sheet templates article below.

10+ Term Sheet Examples

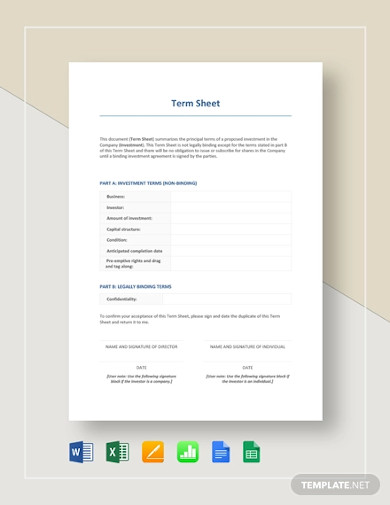

1. Term Sheet Template

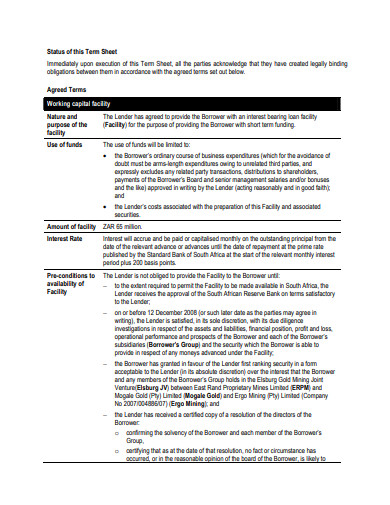

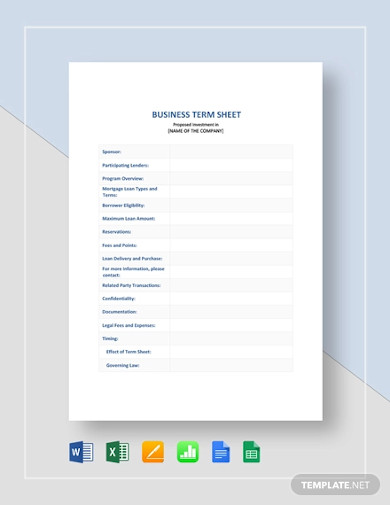

2. Business Term Sheet

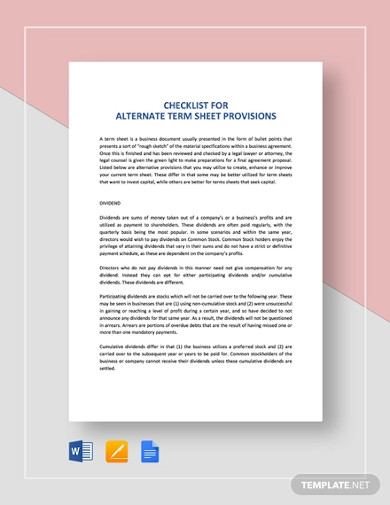

3. Checklist Alternate Term Sheet Provisions

4. Fund Term Sheet

5. Startup Term Sheet

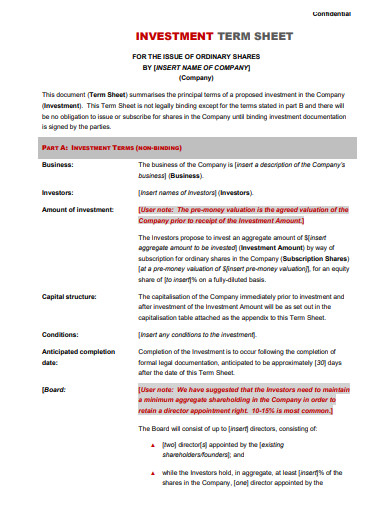

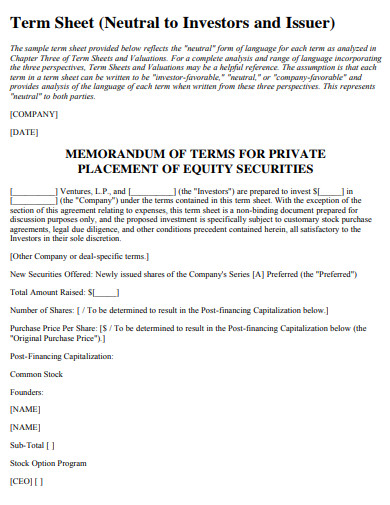

6. Investment Term Sheet

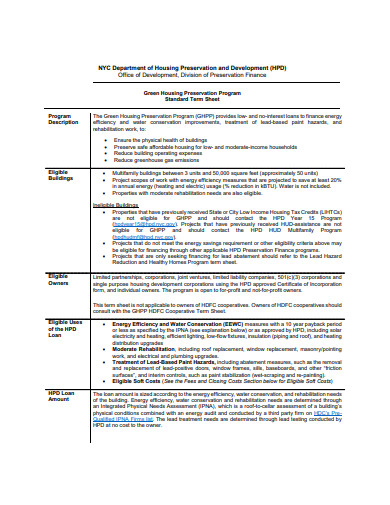

7. Housing Term Sheet

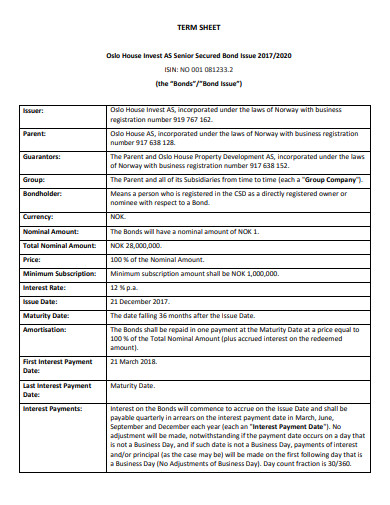

8. Term Sheet For Investment

9. Term Sheet Example

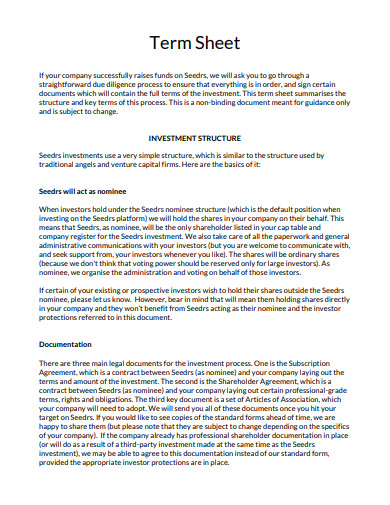

10. Simple Term Sheet

11. Printable Term Sheet

What Is a Term Sheet?

A term sheet is an outline that highlights the terms and conditions of an investment process. According to Akhilesh Ganti of Investopedia, the majority of its coverage should consist of an investment deal’s important aspects. This leaves the less important details and uncertainties up to the investment contract. In another aspect, lawyer Padraig Walsh posted in his LinkedIn account that a term sheet is considered a legal document even though it is not binding. He also shared that even though it can cost the investment parties some money, it is still a very efficient tool to be used in investment negotiations.

Similarity and Difference Between Term Sheets, LOI, and MOU

In general, there is not much difference between the term sheets, letter of intent (LOI), and memorandum of understanding (MOU). As discussed above, term sheets are outlines that are set as a starting point of a much more complex documentation procedure of a business deal. The LOI and MOU function in the same way. The only thing that differentiates the three among themselves is the formatting. Term sheets use a bulleted format to highlight the terms and conditions of a certain deal. Whereas, LOIs are written in the form of formal letters, while MOUs are prepared in contract forms. Regardless of how they seem alike and different from each other, the three types of documents share the same purpose. At most times, they also have similar content.

How To Create a Term Sheet?

Creating a non-binding investment term sheet is much more crucial than creating a binding funding agreement. This is because, during the development of the term sheet, investment participants can set, assess, and correct the deal’s provisions. With that being said, it is safe to say that contracts and agreements are mere byproducts of the term sheet development process. Since such a process is of utmost importance, you need to be guided thoroughly in creating one. Hence, we offer you our outline of the necessary steps. Check them out below.

1. Clarify Term Sheet’s Constraints

As the beneficiary who’s responsible for preparing the term sheets, you should clear things up with your investors about the paperwork’s purpose, the scope of work, as well as their limitations. It was repeatedly stated that term sheets are non-binding documents. So, expound that fact to the investors and encourage them to identify and correct unagreeable terms. In the same manner, urge them to make suggestions on how to make the investment agreement simple.

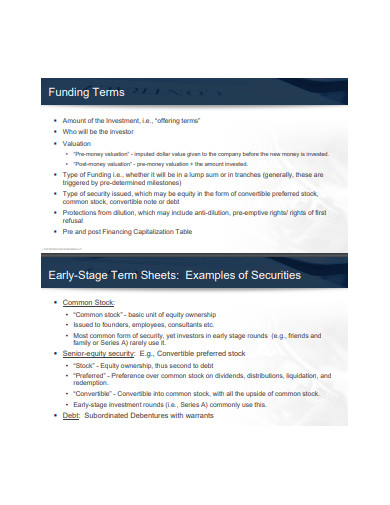

2. Lay Out Investment Figures

Since we are dealing with investments, it is given that you should be presenting figures. These numbers should consist of company valuation, investment sum, and shares. The company valuation can also be referred to as company quotation. It identifies the total worth of a business by calculating the prices of items in its asset inventory. Investment sum, on the other hand, is the total amount that an investor is willing to offer the beneficiary. This amount will define how much shares the investor will be getting from the business profits.

3. Explain Voting Rights

Investors, especially for startups, will surely demand authority over a business’s monetary policy. Some investors even go beyond that area. To avoid complications at an early stage, you should explain what aspects of your business they can get hold of and what aspects are off-limits. This power to have a say in specific business aspects is what we know as voting rights.

4. Identify Investment Duration

Investors invest, and by the time they reach their financial goals, they have the option to reinvest or completely cut the ties from your business. Whichever the case may be, you should identify how long the investment will be going on. Doing so does not only help in projecting returns but also in mitigating issues that variability can cause.

5. Set Forth Profit Distribution

Always provide investors a clear layout of how your business distributes its profits to them. In doing so, there are many things you should be taking into account, like profit and loss statements, investment amount, and investment duration. These factors play a very important role in the calculation of shares.

FAQs:

Should I get a lawyer to prepare a term sheet?

Getting a lawyer is up to you. Though it is practical to do so, most of the time, the lawyer is only needed to review the formulated term sheet and counsel investors on the advantages and disadvantages of provisions. Nonetheless, having a lawyer to write your term sheet ensures the document’s conciseness.

Are there any preparations before discussing term sheets with investors?

The best preparation that must be done before talking terms with investors is education. As the beneficiary, you should have the knowledge about the technicalities of your current undertaking. The lack of understanding in some aspects can put you at a disadvantage for as long as the investment is effective.

Is it possible to walk away from a signed term sheet?

Yes, it is possible. But, doing so will give your business a bad name among investors, which may escalate to a difficulty in acquiring capital in the future.

An agreement or contract is very important to seal a business arrangement. For it to become effective in knotting the ties between its participants, it must go through preliminary processing in the form of a term sheet. Through it, the likeliness of errors in the agreements or contracts is lessened, making way for a successful investment and a newfound business relationship. Forbes Magazine founder Bertie Charles Forbes, once said, “The bargain that yields mutual satisfaction is the only one that is apt to be repeated.”