9+ Real Estate Expense Report Examples to Download

Managing a real estate venture is not without its own challenges. The bulk of real estate business is done outside the office, which makes managing expenses even more complicated than if it was a business operating from one fixed location. Because most of the transactions are outdoors, you have an extra duty to ensure you keep your receipts and record them later when you get into the office. That said it’s important to have a proper expense management in order to successfully run your business. Through tracking your expenses, you will be able to maintain a good cash flow and at the same time maximize your tax deductions. This article talks about 5 real estate expenses report examples and templates that you can use to create your own report.

Real Estate Expense Report Examples & Templates

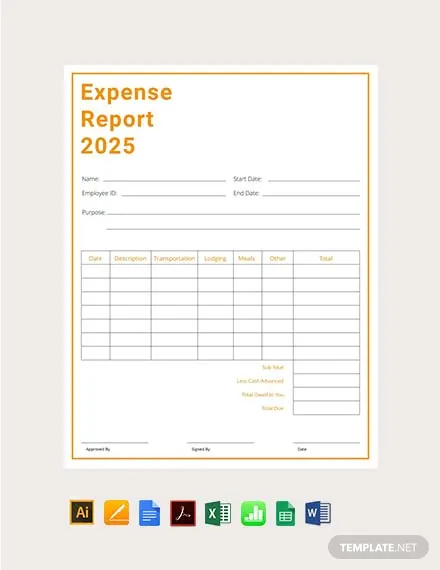

1. Simple Expense Report Template

2. Monthly Expense Report Example

3. Free Real Estate Expense Report Example

4. Free Expense Report Template

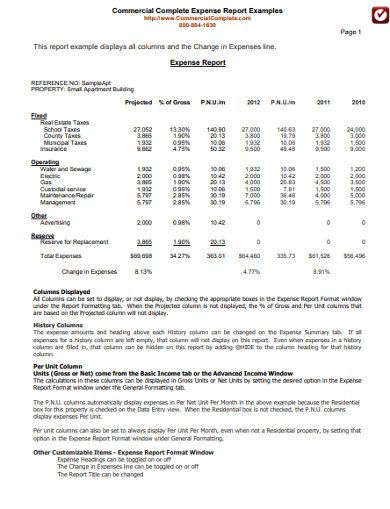

5. Commercial Real Estate Complete Expense Report

This 8-page real estate expense report offers a great start to creating your own document. It lists down all the expenses incurred, when they were incurred, and the type of expenses. It has categorized them into fixed expenses, operating expenses and others. Fixed expenses include real estate taxes, county taxes, school taxes, municipal taxes and insurance. Next category is operating expenses which include electric, gas, water and sewerage, management, custodial services and maintenance or repair expenses. Capturing all your real estate expenses is important because this information can help determine the proper market value of your income generating real estate.

Use this document as a template for your next real estate expenses report. It is easily customizable and allows you to modify it in the way you want. The report is easily downloadable from the internet so you can access it anytime from anywhere. With this report, you don’t have to start from the scratch when preparing your document. Just look at how this one has been prepared and start from there.

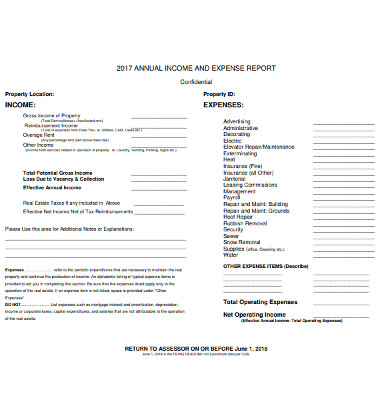

6. Real Estate Annual Income and Expense Report

This template offers a great way of tracking your income and expenses. At the end of the day, you want to know how viable your income generating real estate project is. The best way to do this is to track income and expenses.

The report has is divided into three sections. The first one is the commercial rent income schedule and has columns for name of the tenant, type of space, date of initial occupancy, and total base rent among other things. Next is the vacant space schedule which has columns like vacant space, type of space, square footage, whether space can be subdivided or not, and whether the space is currently being marketed by a broker.

The report also has a section for people who have mixed use properties. It has columns for unit type, no. of units, unit size, and monthly rent among other columns. Preparing this kind of report is no easy task, since there is so much information that you have to include. However, starting with this template, the size of task that faces you is reduced significantly. It tells you the format, the structure and the type of information that you should include.

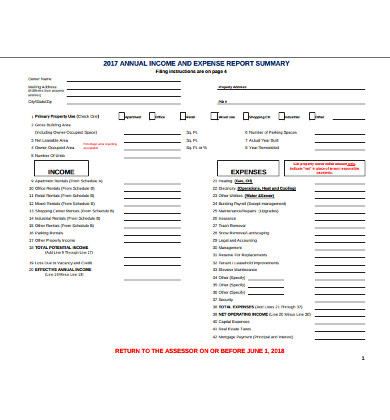

7. Real Estate Expense Summary Report

This report comprehensively lists all the incomes and expenditures for your real estate property for the entire year. It is as exhaustive as possible, allowing you to capture every detail of income and expense. The incomes are categorized into apartment rent, and tenant lessee. The report also has a section where you provide the details of the property purchase. Remember that this is an income and expenses summary report, so it must include your purchase price for the property. It’s so exhaustive and even includes details about property inspection.

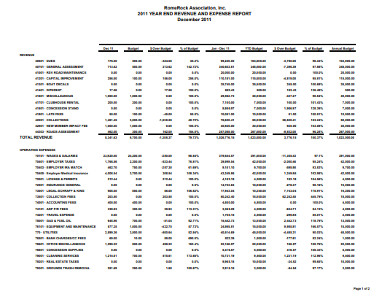

8. Real Estate Revenue and Expense Report

This report has been created to help real estate investors correctly capture their incomes and expenditures to the most accurate level. It starts by listing all possible sources of revenues like late fees, collections, interests and new member impact fees among other incomes.

On the next part, the report provides provisions for entering expenses. The list of expenditures is so exhaustive, covering every minute detail of your expenses. All the expenses, like employer taxes, wages and salaries, license and permits, collection fees, accounting fees, equipment and maintenance, cleaning services, utilities and travel expenses are included. The only thing remaining s for you to provide the information and you have your report. Creating this report might appear daunting, even insurmountable, but with this report, it becomes a lot easier.

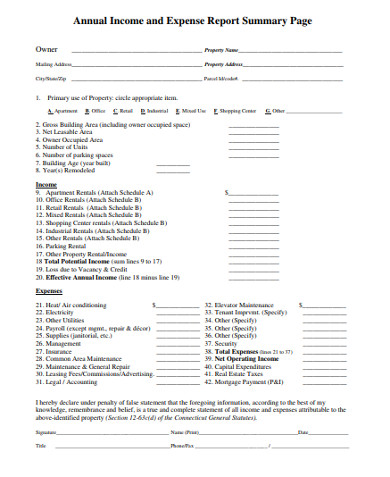

9. Real Estate Expense Report Summary Page

Expense reporting is critical in real estate not only to help you know what your actual annual take-home is, but also for the purposes of taxation. Remember you are supposed to be taxed on your net income, which are all your incomes minus expenses. This is why you need to keep those receipts, and make sure that each and every expense is written down.

This calls for an expense reporting system to help you track down your expenses. The document below is an example of such a report. It lists down all your incomes for the year on one part and then your entire annual expenses on the other end. Expenses like heat/air conditioning, electricity, janitorial supplies, insurance, legal/accounting, general repair and maintenance and management costs have been aptly captured in the document.

It provides an easy way of capturing your incomes and expenditures, so you know your exact income from the property. This will enable you to know the fair market value of your property.

10. Real Estate Expense Management Report

An accurate expense reporting is critical for income generating real estate investment. This template offers a perfect way of creating an expenses reporting template for your real estate. It categorizes your expenses into fixed and operating. Fixed expenses are things like real estate taxes, school taxes, county taxes, insurance and land rates. On the other hand operating taxes include repair and maintenance costs, water and sewerages, electricity, gas and custodial services among other things.

If you need to create an expense reporting document for your real estate, this is just as good a place to begin as any. The report contains the structure and format that you should follow, and captures all the expenses that you need to track. It groups the expenses into fixed and operating, making it easier for you to track them. The report is also easily downloadable, and you can modify it to suit your own real estate property. Next time you want to create a report, you don’t have to prepare it from the scratch. Just use this template as a guide. It contains all the expense items that you need to capture, and also provides a clear format of capturing them. Your only work will be to make sure that you track all the expenses, but the reporting bit has been made easier for you by this template.