12+ Petty Cash Log Examples to Download

A petty cash log, as you may have gathered from its name, is a document that a company or a business uses to record the small amounts of cash that they spend, such as for reimbursing an employee for buying office supplies, paying the postal courier, paying for food and a company meeting, and other miscellaneous expenses that require payment in cash.

It comes along with the business’s petty cash log account which is just cash stored in a safe or a sealed manila envelope. The amount in a cash log account vary for every business.

At the end of every reporting period, perhaps every month or so, or every time the cash log is filled up, the person in charge of it will count the money and make sure that it matches the ending balance written on the document. He will also be responsible for making sure that employees, and everybody else who takes money from the cash log account, will submit receipts and vouchers to serve as a proof of the transaction. You may also see workout log examples.

When the custodian of the fund counts the money and finds it lacking, there will be what is known as an underbalance. The custodian must then try to find where the deficit is, and what has caused it. If there is more money, on the other hand, there is an overbalance. You may also like daily work log examples.

As much as this extra money is welcome, you can’t simply settle with having it in your account without knowing where it’s from. For all you know, it might be a fund supposedly for something else. It can cause problems to your overall account. You may also check out activity log examples.

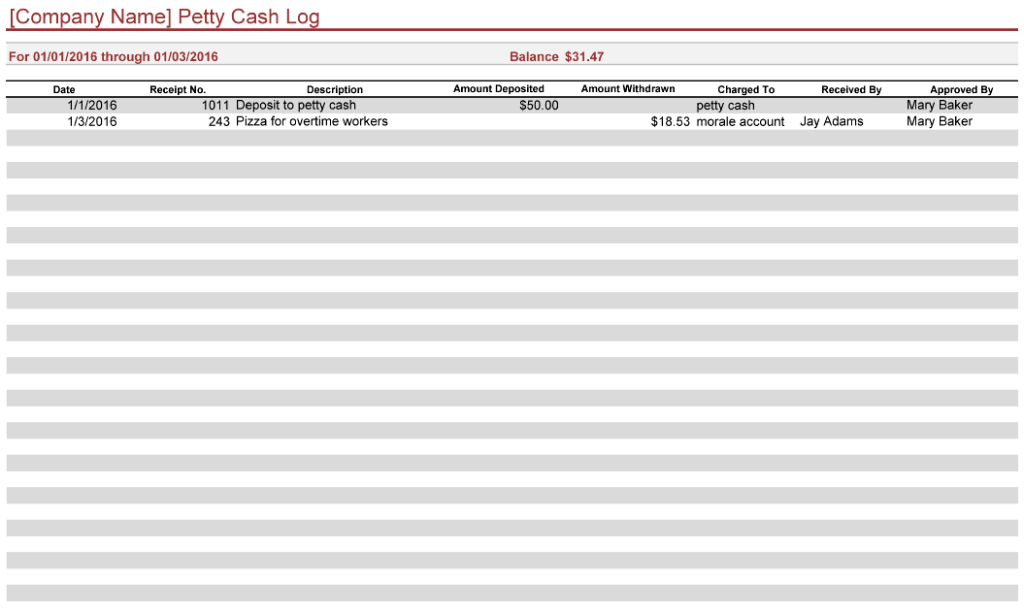

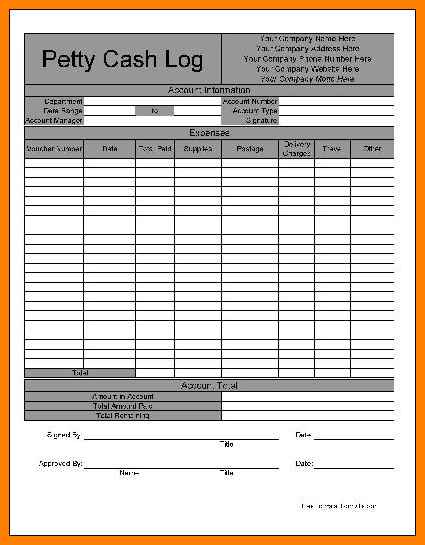

Freelancer Petty Cash Log Template

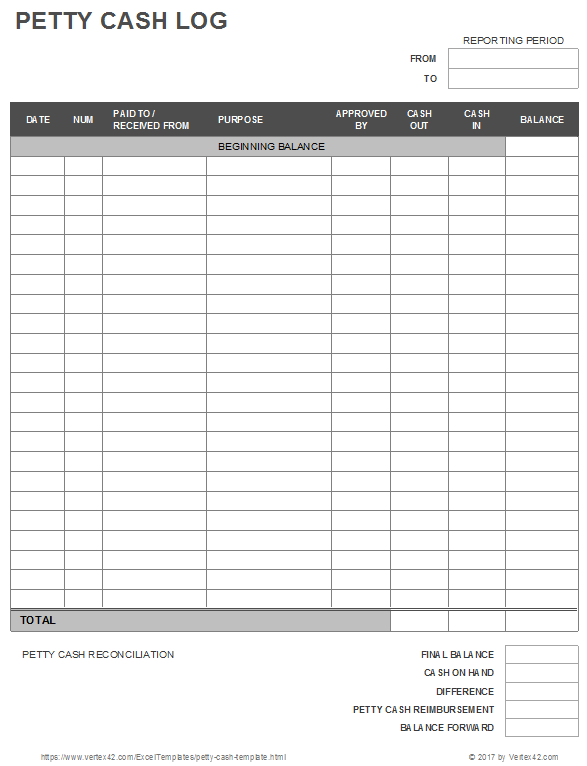

Simple Petty Cash Log Template

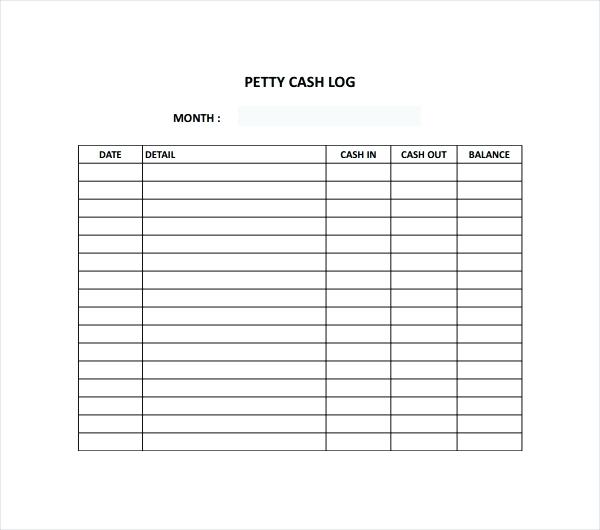

Petty Cash Log Sample

Importance and Purpose of a Petty Cash Log

Money is important (and that is just an understatement). In fact, is one of the most vital resources in a company. No endeavor, no activity, and no plan can ever be put into action without any funds, which is why it’s not much of a surprise why every business or organization does their best to keep a straight record of all the money that goes in and out of their hands. You may also see food log examples.

A petty cash log template is just another attempt at this. It serves as a record-keeping device, of a more traditional sort since it still involves writing unlike those advanced gadget that automatically records things through codes, that will make keeping track of every penny easier. You may also like mileage log examples.

It plays the role of a bookkeeper, similar to the tool that banks use. It also gives you an available separate set of funds for small, everyday transactions where paying through a check is just unnecessary.

It has adapted the imprest funding system which involves a fixed amount reserved for when circumstances require it, and when the amount has been all used up, it will be replenished so that the cycle will start over again. You may also check out printable workout log examples.

Petty cash logs are exactly the same way. It will start with a specific amount in its hand, say, $100.

After a couple of postal carrier payments, emergency runs to the office supply depot, and donuts for an early morning meeting, the $100 will be nothing but receipts, and vouchers, and eaten cinnamon-filled donuts. So the person managing it will have to replenish the amount, another $100, for a new set of small transactions.Thus, the imprest fund system. You might be interested in weekly workout log examples.

This tool, as petty as it may seem to you (because who needs to keep track of just $100, right?), actually serves an important role. It lets you understand what your company’s hard-earned money has been wasted on.

Plus, it keeps you from holding anyone liable for the few dollars you have forgotten where you spent. Because there is a document with attached receipts that will serve as an evidence that the money was, in fact, used and not stolen, you can avoid pointing fingers at innocent people. You may also see reading log for kids examples.

It also gives you the chance to maintain control within your organization. It will show your team that, even if there is money available, it can’t be simply used for every random transaction by any random purpose since it’s reserved for more important purposes. You may also like blood pressure log examples.

You must maintain a tight rein over your petty cash since it always runs the risk of being abused. As much as possible, you should only allow one or two custodians to manage your petty cash log.

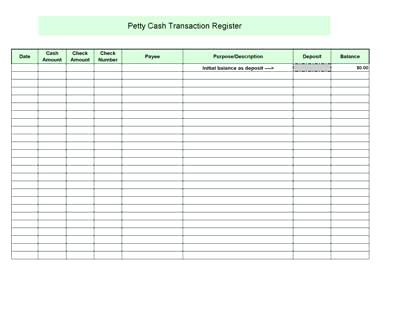

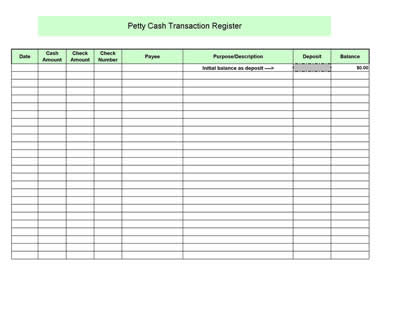

Petty Cash Transaction Register

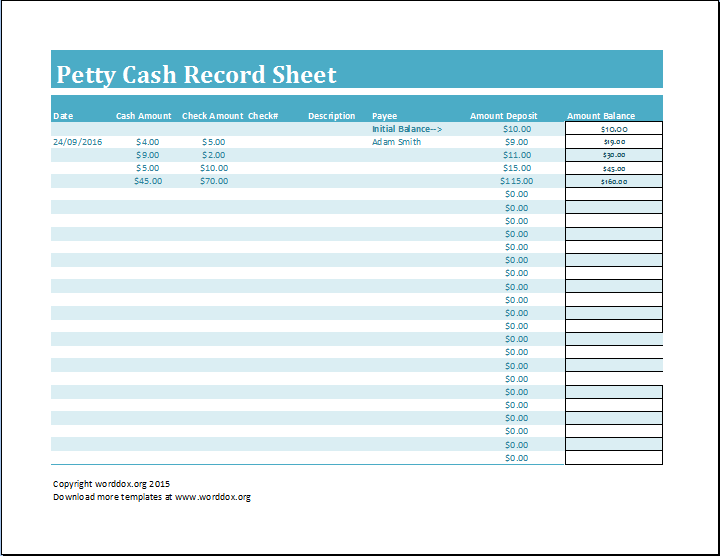

Petty Cash Record Sheet

Setting Up a Petty Cash Log

Since a petty cash log involves money, which is a valuable property, you can’t simply decide to have one and leave the rest to the winds. You need to plan its important aspects to make sure that your cash log has a system to it that can help you make sure that your business’s money is in good hands. You may also see printable mileage log examples.

For first-timers, here are four easy steps you can follow to start your own petty cash log:

1. Purchase a petty cash box.

If you don’t have a safe ready at the moment to store your money in, and you think that a manila envelope is not a reliable house for something so valuable, you can opt for a petty cash box instead. These are just simple square metal boxes with a lock and key most importantly where you can store your money. You may also like job sheet examples.

To help you pick one, here are six things you must consider in choosing your petty cash box:

- Size. Your box should be big enough to hold both paper dollars and coins. You should consider the amount of money you’re going to put into it to help you decide on how big it’s supposed to be. Take into consideration receipts and vouchers as well since it’d be best to keep them both in one place. Also, think about where you’re planning to keep it so that you can buy a size perfect for the spot, such as inside your desk drawer, or behind your books in your shelf.

- Style. We’re not talking about elegance and fashion by saying style here. We’re referring to the box’s physical qualities. Should your box have a lid for easy carrying? Do you want it with sharp edges or round corners to avoid hurting yourself? There are also boxes that come in the form of books to trick any potential thief (because why would they look at a book?) You may also check out training sheet examples.

- Strength and sturdiness. Of course, you can always have a box made of plastic but that’s not very safe since you can easily cut through the material (unless the thief decides to carry the whole thing). Metal boxes are the more popular choice but it still depends on the thickness of the steel. You might be interested in overtime sheet examples.

- The inner accessories. There are cash boxes that have removable trays inside where you can store your receipts. There are also those with partitions for coins or cash notes or jewelries because you never know when you might need to hide a ring. There are also boxes with clips attached on the lids to hold the cash secure much like in cash registers in retail stores. You may also see task sheet examples.

- Locking mechanism. This is one of the most important functions that you should look for in your cash box. There are some with built-in locks with a set of small keys. There are also those with combination boxes instead. There are battery-operated, digital locks and biometric ones you can choose from but they’re going to be a little more expensive.

- Color. You might think that it’s a little over the top, having to choose a color for a box. But color is actually important if you want your box to blend to its surroundings making it more difficult to be seen. Or if you just want a bright color to match the room’s decor. You may also like score sheet examples.

2. Decide on the petty cash float.

The petty cash float is just a fancy name for the amount of money you choose to put inside your cash box. If you think that $100 is enough, then your cash float is $100. It’s important that you decide how much will just be enough for your business. You may also check out monthly sheet examples.

Having too little would take the whole point of having a cash log since that would mean that you would still need to provide the money yourself since your cash box is out of funds.

Having too much might also make your members too lavish in their spending, you don’t want that added hassle to think about. So settle on a cash float that you think is sufficient for your periodical expenses and leave a little allowance for unexpected payments. You might be interested in reference sheet examples.

Blank Excel Petty Cash Log

Petty Cash Register Template

3. Have a petty cash voucher.

Petty cash vouchers are basically a printed template that you can fill out with the details of your petty cash account. It will help you remember information like the amount of money you’ve placed inside and when you’ve put it in. But, of course, blank pieces of paper will serve the job just as well but it often creates a sloppy result since you may forget necessary details.

4. Have a petty cash log.

This is probably one of the most important aspects of having a petty cash account that you should see to. You can use a small book you can personalize for it, or download any of the templates we have attached along with this article. This log should be updated on a daily basis to make sure that deficits are avoided and the money is well tracked. You may also see activity sheet examples.

Also, keeping a running balance of the amount inside the box can help you avoid shortage of cash. If your petty cash box’s contents are only a small amount, like $50, you can just directly enter the information from the attractive voucher to your bookkeeping system rather than writing them down on cash logs. This is most important for considerable amounts.

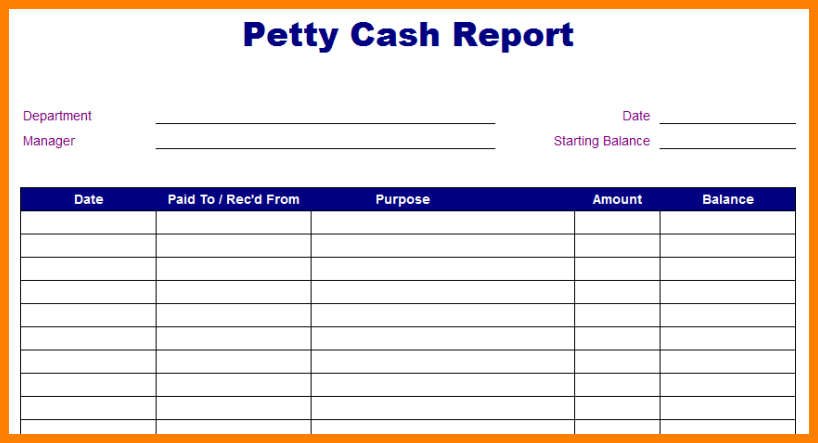

Petty Cash Report

Printable Petty Cash Log

Maintaining a Petty Cash Log

Since you now know the preparations needed to be done in acquiring a cash log account, let’s proceed to discussing what you need to do to maintain it. Even if it only holds a small amount of money, petty cash logs still need to be updated on a regular basis, especially if it has been used on that day. You may also see bid sheet examples.

Here are steps you need to perform to effectively maintain one:

1. Keeping track of cash withdrawals and deposits.

This is the most important element that constitutes to keeping a petty cash log. To successfully keep an account of your money, every penny that leaves your cash box must be listed down on your petty cash log. If you are particularly forgetful, you may find yourself, at the end of the month, with a couple of dollars of deficit since the money taken wasn’t recorded. You may also like fact sheet examples.

If you are the custodian of the petty cash account and this happens to you, you either have to admit to your boss that you’ve lost track of some of the money, or you replenish the deficit from your own pocket. Either way, it’s not pretty. So it’s best to not forget this particular task. It’s also important to have a receipt for every transaction for bookkeeping and accounting purposes. You may also check out medication sheet examples.

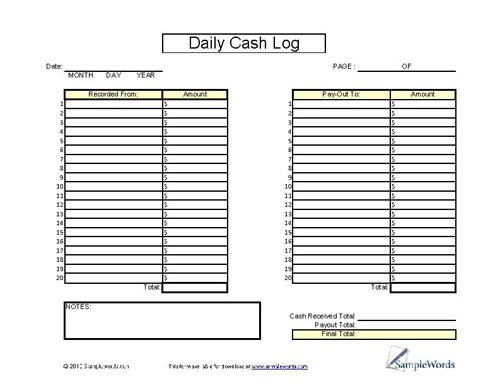

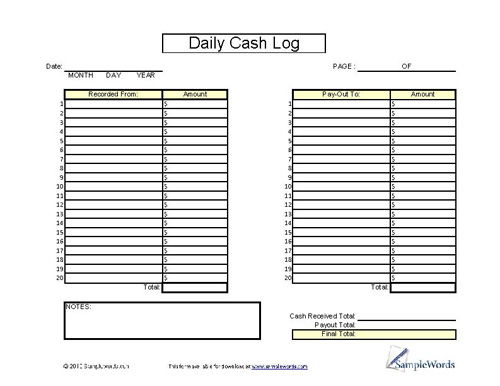

Daily Cash Log

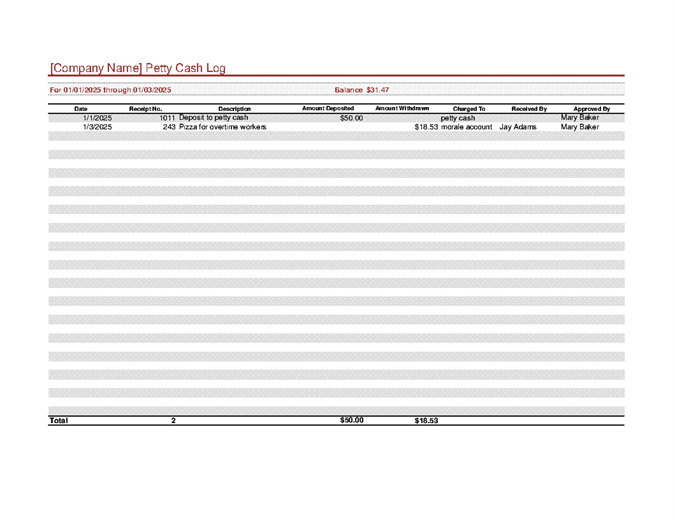

Petty Cash Log Example

2. Completing the petty cash log.

You have the option of using the voucher in your cash box for recording purposes. However, you can also go directly to your cash log to state any transaction that have occurred that is connected to the petty cash. You can choose to update your log every week, or after every transaction, as long as you don’t forget any detail and can easily match up both documents at the end of every period. You may also see sign-in sheet examples.

3. Making sure that your petty cash is counted.

There needs to be a serious computation that needs to happen at least every month, and it involves the remaining money in your cash box, and all the transactions listed in your cash log. Both numbers should match to the amount that was initially placed inside the cash box.

4. Topping up your petty cash.

Most people confuse the amount of their petty cash float. For example, you have $100 as your initial amount. If, at the end of the month, you find that you have a remaining $50, you don’t put another hundred for the next month’s cycle of your petty cash. You simply add another $50 to the existing $50 so that it will add up to $100. You may also like student sheet examples.

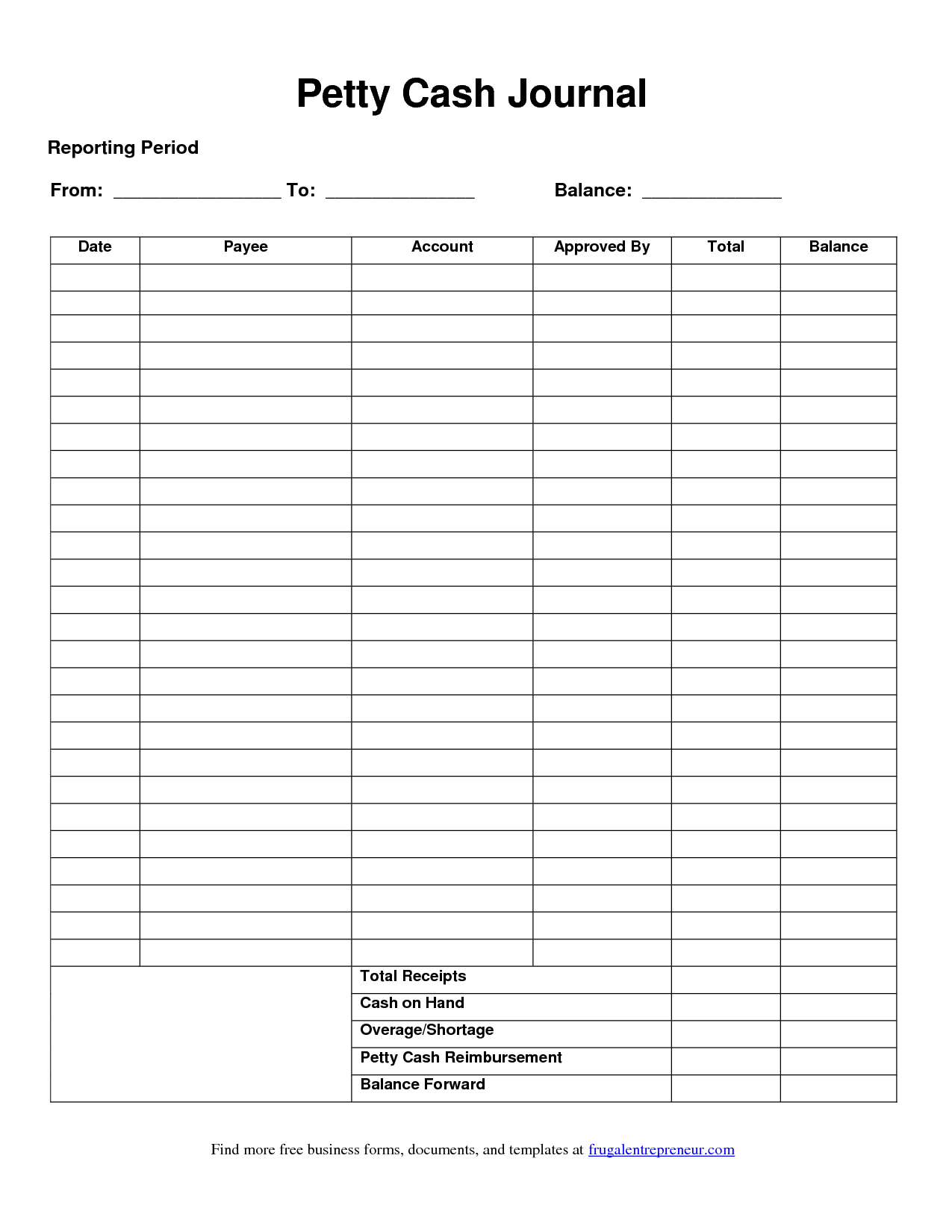

Petty Cash Journal

Petty Cash Log

Petty cash logs are important for a business’s day-to-day small transactions such as those mentioned above. Instead of taking from your own money to pay for whatever you need to pay, you can have this amount reserved for these situations instead. This way, you can have a more well-documented process that will help you manage your money more securely. You may also see assignment sheet examples.