Preparing for the CFA Exam requires a solid understanding of Asset-Backed Securities (ABS), a key component of fixed-income investments. Mastery of ABS structures, cash flow characteristics, and credit enhancement techniques is essential. This knowledge enhances insights into risk, return, and valuation, crucial for achieving a high CFA score.

Learning Objective

In studying “Asset-Backed Security” for the CFA Exam, you should develop a clear understanding of the structure and purpose of asset-backed securities (ABS). Explore how ABS are created through the securitization of various asset types, including auto loans, credit card receivables, and mortgages. Evaluate the role of tranching and credit enhancement in ABS to address different risk levels for investors. Understand the cash flow characteristics, prepayment risk, and potential yield associated with these securities. Additionally, apply this knowledge to analyze ABS in portfolio construction and risk assessment, enhancing your insights for real-world application and CFA practice questions.

Introduction to Asset-Backed Securities (ABS)

Asset-Backed Securities (ABS) are financial instruments created through the process of securitization, where a pool of diverse assets, typically loans or receivables, is packaged and sold to investors. The assets backing these securities often include auto loans, credit card receivables, student loans, or home equity loans, providing a way to finance these debts outside of traditional lending.

ABS enable lenders to free up capital by selling their loans, allowing for greater liquidity and lending capacity. For investors, ABS offer the opportunity to diversify portfolios with securities that can have relatively stable cash flows and different risk profiles due to tranching. By breaking the asset pool into various tranches—each with distinct risk and return characteristics—ABS cater to investors with varying risk appetites. The structure and credit enhancements within ABS, such as reserve accounts or guarantees, help mitigate credit risk, making them an attractive option in fixed-income portfolios

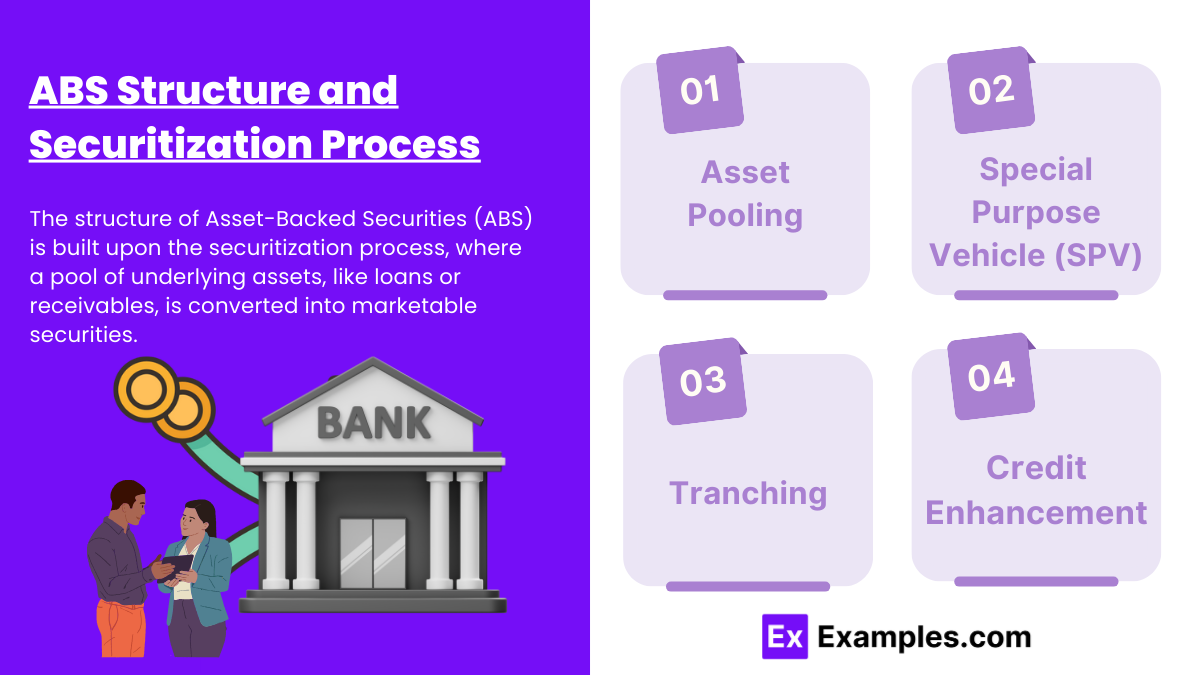

ABS Structure and Securitization Process

The structure of Asset-Backed Securities (ABS) is built upon the securitization process, where a pool of underlying assets, like loans or receivables, is converted into marketable securities. Here’s an overview of the key steps and components involved in creating ABS:

- Asset Pooling: Originators, such as banks or finance companies, group similar financial assets (e.g., auto loans, credit card debts) with predictable cash flows. These assets are bundled into a single pool to diversify risk and create a stable income source.

- Special Purpose Vehicle (SPV): The pooled assets are sold to an independent entity known as a Special Purpose Vehicle (SPV) or Special Purpose Entity (SPE). This separation from the originator isolates the asset pool from the originator’s financial health, protecting investors if the originator faces financial trouble.

- Tranching: The SPV structures the ABS into different tranches, each with varying levels of credit risk and expected returns. Tranches are typically categorized into senior, mezzanine, and equity levels. The senior tranches have priority for payment and lower risk, while mezzanine and equity tranches bear more risk but offer higher returns. This tranching attracts different types of investors based on their risk tolerance.

- Credit Enhancement: To make the ABS more attractive, credit enhancements are often added. These can be internal (e.g., overcollateralization, subordination) or external (e.g., third-party guarantees, reserve funds). Enhancements reduce the risk for senior tranches by providing an extra layer of protection against potential defaults in the underlying assets.

This structured securitization process allows ABS to offer various investment opportunities across risk and return profiles. It provides the originators with liquidity, freeing up capital for new lending, and enables investors to participate in assets they might not directly access otherwise

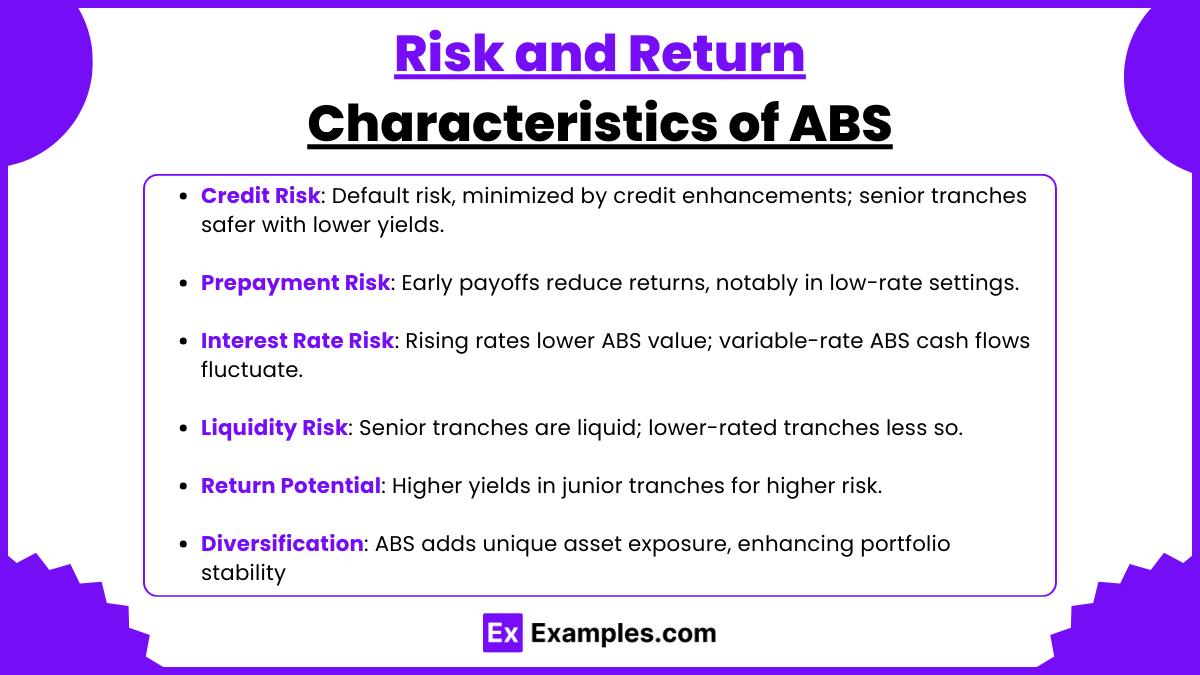

Risk and Return Characteristics of ABS

The risk and return characteristics of Asset-Backed Securities (ABS) are shaped by the underlying asset pool, the structure of the ABS, and the associated credit enhancements. Investors in ABS should understand these characteristics to assess how these securities fit into their portfolio and meet their risk tolerance and return objectives. Key risks and return factors include:

- Credit Risk: Credit risk in ABS is the potential that borrowers within the asset pool may default on their payments. While credit enhancements (like overcollateralization and tranching) help mitigate this risk, lower tranches still bear more risk, as they absorb losses first. Senior tranches are relatively safer due to their payment priority, but they typically offer lower yields as a result.

- Prepayment Risk: Certain ABS, especially those backed by loans with flexible repayment options, are exposed to prepayment risk. Prepayment occurs when borrowers pay off their loans earlier than scheduled, often in a low-interest-rate environment. This can lead to lower returns for investors, as they receive principal back sooner and may need to reinvest it at a lower rate. Mortgage-backed securities, for instance, are particularly susceptible to prepayment risk.

- Interest Rate Risk: ABS, like other fixed-income securities, are sensitive to interest rate changes. Rising interest rates can reduce the market value of ABS, as the fixed payments from the underlying assets become less attractive. Additionally, if ABS are backed by variable-rate assets, the cash flow to investors may fluctuate with interest rate changes, impacting the returns.

- Liquidity Risk: ABS can have varying levels of liquidity depending on the type of asset pool, tranche, and market conditions. Senior tranches of widely issued ABS, like those backed by mortgages, tend to be more liquid and trade more frequently. However, less common or lower-rated ABS tranches may be harder to sell quickly without incurring price discounts, especially in times of market stress.

- Return Potential: ABS provide a range of yield opportunities based on the tranche level and the underlying assets’ characteristics. Senior tranches, with lower risk due to payment priority, generally offer lower yields. In contrast, mezzanine and junior tranches provide higher yields to compensate for their higher credit risk exposure. The return on ABS can be attractive relative to traditional bonds, as the structured nature of ABS creates multiple levels of risk and reward for different types of investors.

- Diversification Benefits: ABS offer investors exposure to a variety of asset types that are not directly accessible in the bond market. This diversification can add stability to a fixed-income portfolio, as the performance of these assets may not be highly correlated with traditional corporate or government bonds

Examples

Example 1

Auto Loan-Backed Securities (ALBS): In this type of ABS, a pool of auto loans is bundled together and sold to investors. The cash flows generated by borrowers’ loan payments are passed to investors in the form of interest and principal payments. ALBS are often structured with credit enhancements like overcollateralization to mitigate credit risk.

Example 2

Credit Card Receivable-Backed Securities: This ABS is backed by pools of credit card receivables, meaning the principal and interest payments that consumers make on their credit card balances. Since these receivables are typically revolving and don’t have fixed terms, these ABS may have a higher level of prepayment risk. They also benefit from enhancements such as reserve funds to protect against defaults.

Example 3

Student Loan-Backed Securities: These ABS are backed by a pool of student loans, either federal or private, providing investors with a stream of payments as borrowers repay their educational debts. Due to the typically long repayment periods of student loans, these ABS may have longer durations, and risk varies based on whether the loans are government-backed or private.

Example 4

Mortgage-Backed Securities (MBS): Although technically a subset, mortgage-backed securities are among the most common ABS types. MBS are backed by pools of residential or commercial mortgages. These securities come with prepayment risk because borrowers can refinance or pay off their mortgages early, impacting cash flows to investors. Tranching and credit enhancements in MBS provide varied risk and return profiles.

Example 5

Home Equity Loan-Backed Securities (HELBS): These ABS are created from pools of home equity loans, where homeowners borrow against the value of their homes. Home equity loan-backed securities provide investors with regular cash flows from the interest and principal payments on these loans. Credit enhancements are typically added to these securities to address the risk of borrower default, as these loans are typically subordinate to the primary mortgage.

Practice Questions

Question 1

Which of the following statements best describes the purpose of credit enhancement in Asset-Backed Securities (ABS)?

A. To reduce the overall interest rate of the securities

B. To ensure faster repayment of principal to investors

C. To mitigate the risk of default in the underlying asset pool

D. To increase the liquidity of the asset-backed securities

Answer: C. To mitigate the risk of default in the underlying asset pool

Explanation: Credit enhancement mechanisms in ABS, such as reserve funds, overcollateralization, and guarantees, are designed to provide extra protection to investors by reducing the credit risk associated with the underlying asset pool. These enhancements help absorb potential losses from defaults, making ABS more attractive to investors.

Question 2

In an Asset-Backed Security backed by auto loans, what risk is most likely to impact the cash flows received by investors?

A. Prepayment risk

B. Interest rate risk

C. Liquidity risk

D. Market risk

Answer: A. Prepayment risk

Explanation: Prepayment risk is a common issue with ABS backed by loans, as borrowers may choose to pay off their auto loans early, especially in a low-interest-rate environment. This early repayment can affect the expected cash flows received by ABS investors, as they may receive principal payments sooner than anticipated.

Question 3

Which of the following is an example of an external credit enhancement in ABS?

A. Overcollateralization

B. Reserve fund

C. Subordination

D. Insurance or guarantee

Answer: D. Insurance or guarantee

Explanation: External credit enhancements include third-party guarantees or insurance, which add a layer of protection against potential losses. This type of enhancement is provided by an external entity, making it different from internal enhancements like overcollateralization or subordination that are structured within the ABS itself.