Preparing for the CFA Exam requires an understanding of “Case Study in Risk Management: Institutional,” a crucial concept in managing risks within large financial organizations. Institutional risk management involves identifying, assessing, and mitigating various types of risks—such as credit, market, operational, and regulatory risks—with the goal of preserving portfolio stability and adhering to compliance standards. Understanding this approach helps candidates evaluate complex risk exposures, design effective risk controls, and respond to regulatory changes efficiently. Mastery of this concept supports a high CFA score by enhancing insights into advanced risk management techniques and institutional investment protection.

Learning Objectives

In studying “Case Study in Risk Management: Institutional” for the CFA, you should aim to understand the key methodologies and strategies involved in managing risk within institutional portfolios. This includes learning how institutions identify, assess, and mitigate diverse risks—such as market, credit, operational, and regulatory risks—to protect portfolio value and ensure compliance. Analyzing these risk factors, along with understanding their impact on institutional stability, is essential to mastering this topic. Understanding institutional risk management enables you to evaluate complex risk exposures across large portfolios and implement robust risk controls. Mastery in this area empowers you to develop effective risk mitigation strategies, enhance organizational resilience, and optimize risk-adjusted decision-making in institutional investment contexts.

Key Components of an Institutional Risk Management Case Study

- Introduction

- Brief overview of the institution (e.g., industry, size, operations).

- Objectives of the risk management study.

- Context for risk analysis (e.g., regulatory, operational, or market challenges).

- Risk Identification

- Description of key risks (e.g., operational, financial, reputational, strategic).

- Methods used for identifying risks (e.g., risk assessment workshops, audits, SWOT analysis).

- Categorization of risks (e.g., internal vs. external, controllable vs. uncontrollable).

- Risk Assessment

- Tools and frameworks used (e.g., Risk Matrix, Probability-Impact Analysis).

- Analysis of likelihood and impact of each risk.

- Prioritization of risks based on criticality.

- Risk Mitigation Strategies

- Policies and procedures implemented to manage identified risks.

- Preventative measures and controls (e.g., technology, training, process redesign).

- Contingency plans for high-impact risks.

- Implementation and Monitoring

- Steps for rolling out risk management initiatives.

- Monitoring systems in place (e.g., Key Risk Indicators, dashboards).

- Feedback and reporting mechanisms for ongoing improvement.

- Case Study Analysis

- Examples of specific risks encountered and how they were addressed.

- Metrics or outcomes achieved (e.g., reduced losses, enhanced compliance).

- Challenges faced during implementation and lessons learned.

- Stakeholder Involvement

- Roles of internal stakeholders (e.g., Risk Committee, management, employees).

- Role of external stakeholders (e.g., regulators, auditors, consultants).

- Communication strategies employed.

- Outcomes and Benefits

- Measurable results (e.g., reduced risk exposure, cost savings).

- Strategic benefits (e.g., improved resilience, enhanced reputation).

- Unexpected insights or innovations resulting from the process.

- Future Outlook

- Recommendations for sustaining risk management efforts.

- Emerging risks and trends to monitor.

- Suggestions for scalability or improvement.

- Conclusion

- Summary of the institutional risk management approach.

- Overall impact on the institution’s operations and objectives.

- Final reflections on the importance of risk management.

Purposes of Institutional Risk Management

- Financial Stability: Protect against potential losses caused by market volatility or operational failures.

- Regulatory Compliance: Ensure adherence to local and international financial regulations like Basel III.

- Reputation Management: Minimize reputational risks through robust controls.

- Portfolio Optimization: Balance risk and return in institutional portfolios.

- Operational Resilience: Prepare for unexpected disruptions through risk mitigation strategies.

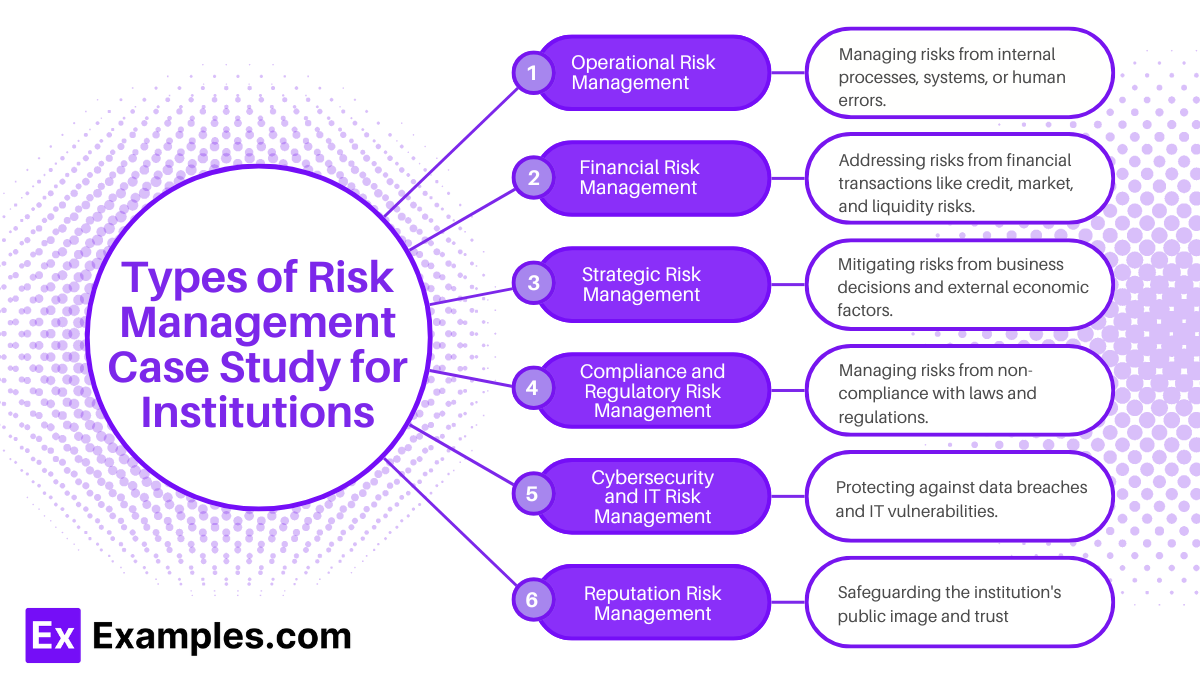

Types of Risk Management Case Study for Institutions

- Operational Risk Management

Focuses on risks arising from internal processes, systems, or human errors within the institution, such as compliance failures, system outages, or fraud. - Financial Risk Management

Deals with risks related to financial transactions, including credit risk, market risk, liquidity risk, and interest rate risk. - Strategic Risk Management

Involves risks related to business decisions, market competition, and external economic factors that could impact institutional goals. - Compliance and Regulatory Risk Management

Examines how institutions manage risks associated with changing laws, regulations, and non-compliance penalties. - Cybersecurity and IT Risk Management

Focuses on risks tied to data breaches, cyberattacks, and IT infrastructure vulnerabilities. - Reputation Risk Management

Addresses risks that could damage the institution’s public image or stakeholder trust due to scandals, poor performance, or external criticism.

Examples

Example 1. Risk Assessment in Financial Institutions

A case study on a major bank’s approach to identifying and mitigating credit risk can provide insights into how financial institutions manage exposure. By analyzing real-world scenarios, such as a global economic downturn, institutions can adapt methodologies for stress testing and improving creditworthiness assessments.

Example 2. Crisis Management and Decision-Making

Case studies on institutional responses to crises, such as cybersecurity breaches or natural disasters, illustrate effective risk mitigation strategies. These examples showcase how leadership decisions during high-stakes situations can influence recovery time and reputation management, helping other institutions prepare better.

Example 3. Policy Implementation in Public Institutions

Examining a government agency’s handling of operational risks during large-scale projects, such as public infrastructure development, highlights how effective policies and compliance protocols can reduce delays and budget overruns. This demonstrates the importance of aligning risk management frameworks with organizational objectives.

Example 4. Compliance in Regulated Industries

A case study on a pharmaceutical company’s efforts to adhere to stringent regulatory requirements provides an understanding of managing compliance risks. By exploring the company’s implementation of quality assurance processes, other institutions can learn about proactive risk identification and regulatory audits.

Example 5. Reputation Risk in Higher Education

Analyzing how a university navigated a public relations crisis due to ethical violations provides lessons on managing reputation risks. This example helps institutions understand the importance of transparency, stakeholder communication, and preemptive risk assessment to safeguard their public image.

Practice Questions

Question 1

Which of the following is a primary goal of institutional risk management in financial institutions?

A. To maximize shareholder value by taking excessive risks.

B. To ensure compliance with regulatory requirements and minimize potential losses.

C. To eliminate all risks and focus solely on low-risk investments.

D. To prioritize short-term profits over long-term sustainability.

Correct Answer: B. To ensure compliance with regulatory requirements and minimize potential losses.

Explanation:

Institutional risk management ensures a balance between achieving financial objectives and adhering to regulatory standards. Its aim is not to eliminate risks (which is impossible) but to manage them effectively. Option A is incorrect because excessive risks jeopardize institutional stability. Option C is impractical as risks cannot be entirely removed, and Option D undermines the long-term viability of the institution.

Question 2

Which of the following best describes operational risk in an institutional context?

A. The risk arising from fluctuations in market conditions.

B. The risk of loss due to inadequate or failed internal processes, people, or systems.

C. The risk of default by a counterparty in a financial transaction.

D. The risk associated with changes in legal and regulatory frameworks.

Correct Answer: B. The risk of loss due to inadequate or failed internal processes, people, or systems.

Explanation:

Operational risk involves losses due to internal failures in processes, systems, or human errors, distinct from market risk (A), credit risk (C), or regulatory risk (D). Managing operational risk requires strong internal controls and continuous monitoring to mitigate failures effectively.

Question 3

Which of the following is a key component of an effective institutional risk management framework?

A. Ignoring minor risks to focus only on major threats.

B. Continuous monitoring, assessment, and mitigation of risks.

C. Relying solely on external consultants for risk assessment.

D. Prioritizing growth strategies over risk management protocols.

Correct Answer: B. Continuous monitoring, assessment, and mitigation of risks.

Explanation:

An effective risk management framework emphasizes ongoing monitoring and mitigation to adapt to evolving risks. Option A overlooks the cumulative impact of minor risks. Option C is incorrect as internal expertise is essential for comprehensive risk management. Option D ignores the importance of balancing growth with risk control, potentially compromising institutional stability.