Intercorporate Investments encompass the various methods by which one company can invest in another, impacting financial statements and valuation. This topic covers the classification and accounting treatment of investments, including equity method, consolidation, and fair value measurement. It also examines the effects of these investments on financial reporting and the implications for analyzing financial health and performance. Understanding intercorporate investments is essential for evaluating the strategic and financial relationships between companies, and mastering these concepts is critical for accurate financial analysis and valuation in corporate finance.

Learning Objectives

In studying “Intercorporate Investments” for the CFA, you should learn to analyze the various methods of accounting for intercorporate investments, including the cost method, equity method, and consolidation. Understand the criteria for choosing each method based on the level of influence or control over the investee, and how these methods impact financial statements. Evaluate the effects of intercorporate investments on key financial metrics, such as earnings, assets, and liabilities. Analyze the implications of goodwill and non-controlling interests in consolidated financial statements. Additionally, understand how changes in investment levels, impairment considerations, and foreign currency impacts are accounted for in intercorporate investments, and how they affect investor decision-making and financial analysis.

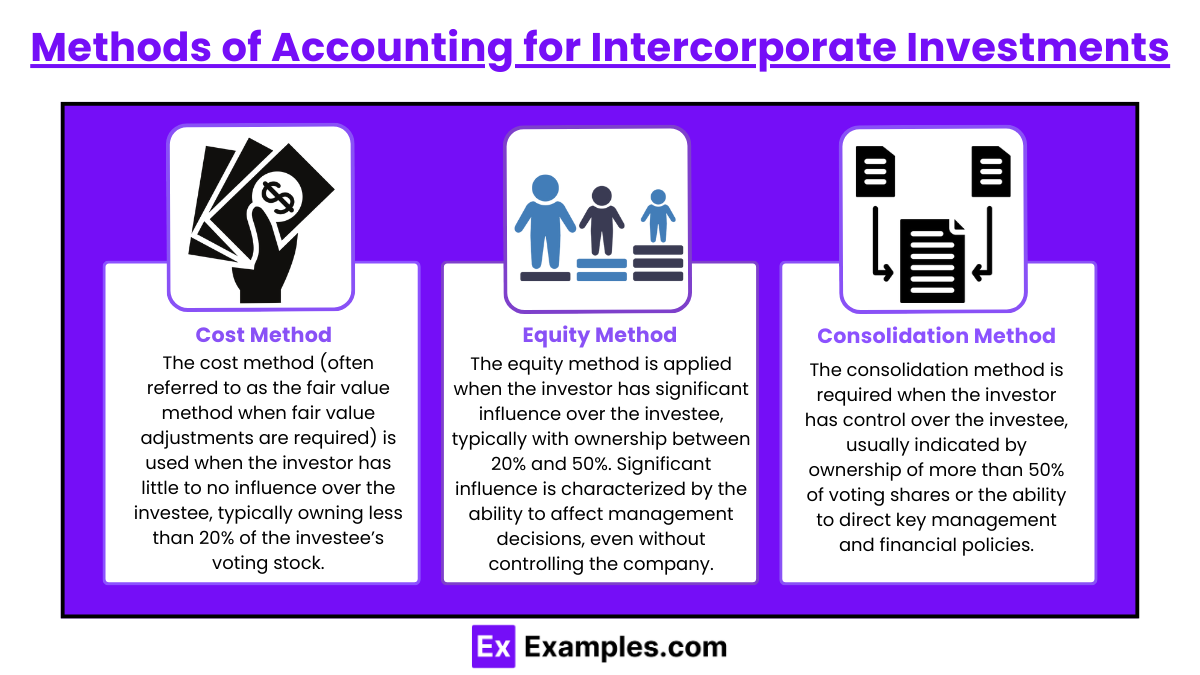

Methods of Accounting for Intercorporate Investments

Intercorporate investments refer to investments made by one company in another company’s equity or debt securities. The method of accounting for these investments depends on the level of influence or control the investing company (investor) has over the investee company. Proper accounting for intercorporate investments provides a realistic view of an investor’s financial position, and different accounting methods apply based on the extent of influence.

1. Cost Method (or Fair Value Method)

The cost method (often referred to as the fair value method when fair value adjustments are required) is used when the investor has little to no influence over the investee, typically owning less than 20% of the investee’s voting stock.

Key Features of the Cost Method

- Initial Investment: Recorded at cost, which is the purchase price of the investment.

- Income Recognition: Dividends received from the investee are recognized as income on the investor’s income statement when declared.

- Fair Value Adjustments: If the investment is classified as a trading or available-for-sale security, it may be adjusted to fair value. Changes in fair value are reported in net income for trading securities or other comprehensive income for available-for-sale securities.

Example: A retail company invests in 5% of a technology company’s stock with no significant influence. The investment is recorded at cost, and any dividends are recorded as income when received. If the stock is classified as available-for-sale, changes in fair value are recorded in other comprehensive income.

2. Equity Method

The equity method is applied when the investor has significant influence over the investee, typically with ownership between 20% and 50%. Significant influence is characterized by the ability to affect management decisions, even without controlling the company.

Key Features of the Equity Method

- Initial Investment: Recorded at cost.

- Proportionate Share of Income: The investor recognizes its share of the investee’s net income or loss in its income statement. The investment’s carrying amount is increased or decreased accordingly.

- Dividends Received: Dividends are treated as a return of investment and reduce the carrying amount of the investment, rather than being recognized as income.

Example: A manufacturing company owns 30% of a supplier company and can influence its business decisions. Using the equity method, it records 30% of the supplier’s net income as investment income, and the carrying value of the investment increases by this amount. Dividends received reduce the investment’s carrying value rather than being treated as income.

3. Consolidation Method

The consolidation method is required when the investor has control over the investee, usually indicated by ownership of more than 50% of voting shares or the ability to direct key management and financial policies.

Key Features of the Consolidation Method

- Full Integration of Financial Statements: The investor (parent) combines the investee’s (subsidiary) financial statements with its own, line by line, consolidating assets, liabilities, revenues, and expenses.

- Non-Controlling Inthttps://www.examples.com/cfaerest: If the parent owns less than 100% of the subsidiary, the portion owned by other shareholders is reported as non-controlling interest in the equity section of the parent’s balance sheet.

- Elimination of Intercompany Transactions: Transactions between the parent and subsidiary (such as intercompany sales, dividends, or loans) are eliminated to avoid double-counting.

Example: A corporation owns 80% of another company, qualifying for consolidation. The parent company consolidates the subsidiary’s assets, liabilities, revenues, and expenses with its own, and the 20% non-controlling interest is reported in the equity section of the consolidated balance sheet.

Criteria for Choosing the Appropriate Method

The appropriate accounting method for intercorporate investments depends on the level of influence or control the investing company (investor) has over the investee company. Generally, the ownership percentage serves as a guideline, but other factors like voting power, representation on the board, and contractual agreements also play a role. Below are the key criteria for choosing the appropriate method of accounting for intercorporate investments.

1. Ownership Percentage

The ownership percentage held by the investor in the investee company’s voting stock is a primary indicator of the level of influence or control, which generally guides the choice of accounting method.

- Less than 20% Ownership: Typically indicates minimal influence, leading to the cost or fair value method.

- 20% to 50% Ownership: Suggests significant influence, uGoodwill and Non-Controlling Interests in Consolidated Financial Statementssually requiring the equity method.

- More than 50% Ownership: Implies control, requiring consolidation under the consolidation or acquisition method.

Example: If a company holds 15% of another company’s shares without any other control mechanisms, it would generally use the cost or fair value method.

2. Degree of Influence

In addition to ownership percentage, the level of influence the investor has over the investee’s operations and financial policies is crucial. Significant influence may be indicated by factors such as board representation, participation in policy-making processes, or material intercompany transactions.

- Cost or Fair Value Method: Used when the investor has no significant influence over the investee’s financial and operating decisions.

- Equity Method: Applied when the investor has significant influence but not control over the investee. This is usually evidenced by the ability to participate in strategic or operational decisions, even without majority ownership.

- Consolidation Method: Required when the investor has control, allowing it to direct the investee’s financial and operating policies. Control can result from holding a majority of voting power or through contractual agreements.

Example: If a company holds only 25% of an investee’s stock but has board representation and participates in strategic decisions, the equity method would likely be appropriate.

3. Legal or Contractual Rights

Certain rights or contractual agreements, such as voting rights, veto powers, or decision-making authority, can indicate a higher level of influence or control than the ownership percentage alone might suggest.

- Joint Control: In cases where two or more parties share control, the investment may qualify as a joint venture, requiring the equity method under U.S. GAAP or proportionate consolidation under IFRS.

- Significant Influence Without Majority Ownership: Rights such as veto powers or substantive participation in policy decisions can indicate significant influence, even with ownership below 20%.

Example: An investor with 15% ownership but with contractual veto rights over major decisions may use the equity method rather than the cost method, as it has significant influence.

Goodwill and Non-Controlling Interests in Consolidated Financial Statements

When a parent company gains control over a subsidiary, typically through owning more than 50% of voting shares, it consolidates the subsidiary’s financial statements. This consolidation process introduces two key components: goodwill and non-controlling interests (NCI). Both have a significant impact on the consolidated balance sheet, income statement, and equity, reflecting the parent’s ownership and the interests of minority shareholders in the subsidiary.

1. Goodwill in Consolidated Financial Statements

Goodwill represents the excess of the acquisition cost over the fair value of the identifiable net assets acquired. It arises in business combinations where the parent company acquires a controlling interest in the subsidiary.

Calculation of Goodwill

The formula for calculating goodwill is: Goodwill = Purchase Price − Fair Value of Identifiable Net Assets.

- Purchase Price: The total consideration paid to acquire the subsidiary, including cash, stock, or other assets.

- Fair Value of Net Assets: The fair value of all identifiable assets and liabilities of the subsidiary at the acquisition date.

Example: If a parent company pays $1 million to acquire a subsidiary with identifiable net assets of $800,000, the resulting goodwill is $200,000.

Impact of Goodwill on Financial Statements

- Balance Sheet: Goodwill is recorded as an intangible asset in the consolidated balance sheet. It is tested annually for impairment, meaning it is reviewed to ensure its value hasn’t declined.

- Income Statement: Goodwill does not directly affect the income statement. However, if goodwill is impaired, an impairment loss is recognized as an expense on the income statement, reducing net income.

- Cash Flow Statement: Goodwill is included in the investment activities during acquisition but does not directly affect cash flows in subsequent periods unless an impairment loss is recorded.

Goodwill Impairment

Goodwill is tested for impairment annually or when there are indicators of potential impairment, such as a decline in the subsidiary’s market value. If the fair value of the subsidiary falls below the carrying amount, including goodwill, an impairment loss is recognized.

Example of Goodwill Impairment: If a subsidiary’s fair value decreases and goodwill is determined to be impaired by $50,000, an impairment loss of $50,000 is recorded as an expense on the income statement, and the goodwill asset on the balance sheet is reduced by $50,000.

2. Non-Controlling Interest (NCI) in Consolidated Financial Statements

Non-controlling interest (NCI), also known as minority interest, represents the portion of the subsidiary’s equity that is not owned by the parent company. It is shown separately in the consolidated financial statements to reflect the interests of outside shareholders.

Calculation of Non-Controlling Interest

At the acquisition date, NCI is calculated based on the fair value of the subsidiary’s net assets. If the parent acquires less than 100% ownership, the remaining percentage is attributed to NCI.

NCI = (Percentage of Non-Owned Shares) × (Fair Value of Subsidiary’s Net Assets)

- Initial Recognition: NCI is initially measured at fair value or the proportionate share of the subsidiary’s identifiable net assets, depending on the accounting standards (e.g., IFRS allows both options, while U.S. GAAP requires fair value).

- Subsequent Measurement: After acquisition, NCI is adjusted for its share of the subsidiary’s net income and reduced by dividends paid to non-controlling shareholders.

Example: If a parent company acquires 80% of a subsidiary and the fair value of the subsidiary’s net assets is $500,000, NCI is 20% of $500,000, or $100,000.

Impact of Non-Controlling Interest on Financial Statements

- Balance Sheet: NCI appears as a separate line item in the equity section of the consolidated balance sheet, reflecting the non-controlling shareholders’ interest in the subsidiary’s net assets.

- Income Statement: NCI’s share of the subsidiary’s net income is deducted from consolidated net income to show the income attributable to the parent company.

- Statement of Changes in Equity: NCI is adjusted for changes in the subsidiary’s equity, such as profits, losses, and dividends distributed to non-controlling shareholders.

Example of NCI Impact on Income Statement: If a subsidiary generates $50,000 in net income and NCI owns 30%, $15,000 (30% of $50,000) is attributed to NCI and subtracted from consolidated net income, with the remaining $35,000 attributed to the parent.

Changes in Investment Levels and Impairment Considerations

Changes in investment levels and impairment considerations are crucial aspects of accounting for intercorporate investments. As the investor’s ownership level changes, the appropriate accounting method may need to be adjusted to reflect the new level of influence or control. Additionally, impairment assessments ensure that investments are accurately valued on the balance sheet, especially when market or operational factors reduce an investment’s fair value.

1. Changes in Investment Levels

When an investor’s ownership interest in an investee changes, the method of accounting may also change. The choice of method depends on the level of control or influence the investor has, which can vary as ownership percentages increase or decrease.

Impact of Increasing Investment Levels

- Transition to Equity Method: If the investor’s ownership increases from less than 20% to a level between 20% and 50%, the investment might move from the cost or fair value method to the equity method, as the investor now has significant influence.

- Accounting Adjustments: The investment’s carrying amount is adjusted to reflect the investor’s share of the investee’s earnings. The cumulative fair value gains or losses are often reclassified to retained earnings or accumulated other comprehensive income (AOCI), depending on the classification of the initial investment.

- Transition to Consolidation: If the investor’s ownership increases to more than 50%, giving it control over the investee, the investment is now accounted for using the consolidation method.

- Consolidation of Financial Statements: All assets, liabilities, revenues, and expenses of the investee are integrated with the parent’s financials, and any previous investment balance is revalued at fair value at the acquisition date.

- Recognition of Non-Controlling Interest: If the parent acquires less than 100% ownership, a non-controlling interest is recorded in equity for the portion not owned by the parent.

Example: A company initially holds 15% of another company’s shares. If it later increases its stake to 35%, it would shift from the cost method to the equity method. If the stake rises further to 60%, it would use consolidation.

Impact of Decreasing Investment Levels

- Transition from Consolidation to Equity Method: If the investor’s ownership decreases below 50%, it no longer has control, so it switches from consolidation to the equity method.

- Deconsolidation: The subsidiary is removed from the parent’s consolidated financial statements, and the investment is reclassified under the equity method at fair value on the deconsolidation date.

- Transition from Equity Method to Fair Value Method: If the ownership falls below 20%, indicating a loss of significant influence, the investor switches to the fair value or cost method.

- Adjusting Carrying Value: The carrying amount under the equity method is reclassified as a fair value investment. Any gains or losses due to revaluation are recorded in earnings or OCI.

Example: A parent company owns 55% of a subsidiary but sells shares, reducing its ownership to 25%. It would then account for the investment under the equity method rather than consolidation.

2. Impairment Considerations for Investments

Impairment assessments are crucial for ensuring that investments are accurately valued. Impairment occurs when the fair value of an investment falls below its carrying amount, and this decline is considered permanent or not recoverable. The criteria and accounting treatment for impairment vary depending on the type of investment.

Impairment for Cost or Fair Value Method Investments

For investments accounted for at cost or fair value, impairment is assessed periodically, and an impairment loss is recognized if there is evidence that the investment has declined in value permanently.

- Fair Value Assessment: The investment’s fair value is compared to its carrying amount. If the fair value is lower and the decline is other than temporary, an impairment loss is recognized in net income.

- Reversals Not Allowed: Once an impairment loss is recorded, it cannot be reversed under U.S. GAAP, even if the fair value subsequently increases.

Example: A company holds an investment in another company’s stock, initially valued at $50,000. Due to a prolonged economic downturn, the stock’s value declines to $30,000, leading to a $20,000 impairment loss.

Impairment for Equity Method Investments

Under the equity method, an investment is impaired if the fair value falls below its carrying amount, and the decline is considered other than temporary.

- Impairment Testing: The investor assesses qualitative and quantitative factors to determine if the decline is permanent. If impaired, the investment’s carrying amount is reduced to its fair value, and the impairment loss is recognized in income.

- No Subsequent Reversals: As with cost or fair value investments, impairment losses on equity method investments cannot be reversed.

Example: An investor holds 30% of a tech company, but due to significant regulatory changes, the company’s market value falls sharply. The investor writes down the investment to reflect the lower fair value and records an impairment loss.

Impairment for Goodwill in Consolidated Statements

When an investor consolidates a subsidiary, goodwill arises if the purchase price exceeds the fair value of identifiable net assets. Goodwill is tested for impairment annually or when there are indicators of potential impairment.

- Testing Process: Goodwill is assessed at the reporting unit level. If the fair value of the reporting unit falls below its carrying value, including goodwill, an impairment loss is recorded.

- Impairment Losses in Income: Impairment losses on goodwill reduce net income. Unlike other assets, goodwill impairment losses cannot be reversed under U.S. GAAP.

Example: A retail company acquires a subsidiary with $1 million in goodwill. Due to market contraction, the fair value of the subsidiary declines, triggering a goodwill impairment test. If the carrying value exceeds fair value, an impairment loss is recorded.

Examples

Example 1: Equity Investments

A company may purchase shares of another corporation to gain ownership stakes, often for strategic purposes or to generate income from dividends. For example, a tech firm might invest in a startup developing innovative software technologies. This intercorporate investment allows the larger firm to access new technologies and market insights while supporting the growth of the startup.

Example 2: Joint Ventures

Two or more companies might enter into a joint venture to collaborate on a specific project or business initiative. For instance, a car manufacturer and a technology company could partner to develop electric vehicles. Each company contributes resources, expertise, and capital, sharing the risks and profits associated with the venture. This type of investment fosters innovation and enables companies to leverage each other’s strengths.

Example 3: Subsidiaries

A corporation may acquire another company to establish a subsidiary, fully owning the acquired entity. For example, a multinational corporation might acquire a smaller local business in a foreign market to expand its operations. This intercorporate investment allows the parent company to control the subsidiary’s operations and integrate its offerings into its broader business strategy.

Example 4: Debt Investments

Corporations can also invest in other companies by purchasing their bonds or debt instruments. For example, a financial institution may buy corporate bonds from a manufacturing company to earn interest over time. This type of intercorporate investment provides the borrowing company with capital while offering the investor a relatively stable return on investment.

Example 5: Strategic Alliances

Companies may form strategic alliances with other firms to collaborate on research and development, marketing, or production. For instance, two pharmaceutical companies might partner to develop a new drug, sharing research costs and resources. While this may not involve direct ownership, the intercorporate investment in joint efforts and shared resources can lead to significant advancements and competitive advantages for both parties involved.

Practice Questions

Question 1

What is the primary purpose of a company making intercorporate investments?

A) To improve its product line

B) To gain a competitive advantage

C) To increase market share

D) To diversify its investment portfolio

Correct Answer: B) To gain a competitive advantage.

Explanation: The primary purpose of intercorporate investments is often to gain a competitive advantage. By investing in other companies, either through equity stakes, joint ventures, or strategic alliances, a firm can access new technologies, enter new markets, and enhance its capabilities. While options A, C, and D can be secondary benefits, they are typically means to achieving the overarching goal of enhancing competitive positioning.

Question 2

Which of the following is an example of a joint venture?

A) A company purchasing shares in another firm

B) Two companies collaborating to develop a new product

C) A corporation buying another company outright

D) A company investing in government bonds

Correct Answer: B) Two companies collaborating to develop a new product.

Explanation: A joint venture is formed when two or more companies come together to collaborate on a specific project or business initiative, sharing resources, risks, and rewards. This example illustrates the essence of a joint venture, as both companies pool their expertise and assets to create a new product. Options A and C involve ownership but do not represent collaboration, while option D pertains to investment in fixed-income securities and does not involve another corporation.

Question 3

When a corporation acquires a subsidiary, what is the primary benefit of this intercorporate investment?

A) It allows the parent company to diversify into unrelated markets.

B) It enables the parent company to control operations and decision-making.

C) It guarantees immediate financial returns.

D) It eliminates competition in the market.

Correct Answer: B) It enables the parent company to control operations and decision-making.

Explanation: When a corporation acquires a subsidiary, the primary benefit is the ability to control the subsidiary’s operations and strategic decisions. This control allows the parent company to integrate the subsidiary’s resources, capabilities, and markets into its broader business strategy, thus enhancing overall efficiency and performance. While option A may occur, the main focus is on control rather than diversification. Options C and D do not accurately describe the direct benefits of acquiring a subsidiary.