Preparing for the CFA Exam requires a comprehensive understanding of security market indexes, a key aspect of financial markets analysis. Mastery of index construction, types, and applications is essential. This knowledge provides insights into benchmarking, portfolio management, and performance evaluation, crucial for achieving a high score on the CFA Exam.

Learning Objectives

In studying “Security Market Indexes” for the CFA Exam, you should understand the purpose, construction, and applications of various market indexes. Learn to analyze how indexes, such as price-weighted, market-cap-weighted, and equal-weighted indexes, reflect market trends and provide performance benchmarks. Evaluate the calculation methods, including those for rebalancing and reconstitution, and explore the distinctions between broad-market, sector-specific, and style-based indexes. Additionally, investigate the use of indexes in passive and active portfolio management and apply your knowledge to assess index-based performance and risk measures, which are essential skills for analyzing investment products in CFA practice scenarios.

What is Security Market Indexes?

A security market index is a statistical measure that reflects the composite value of a specified set of securities, which represent a particular segment of the market. It is used to give investors and financial analysts an indication of the overall market performance and to benchmark the performance of individual securities, portfolios, or funds against the broader market.

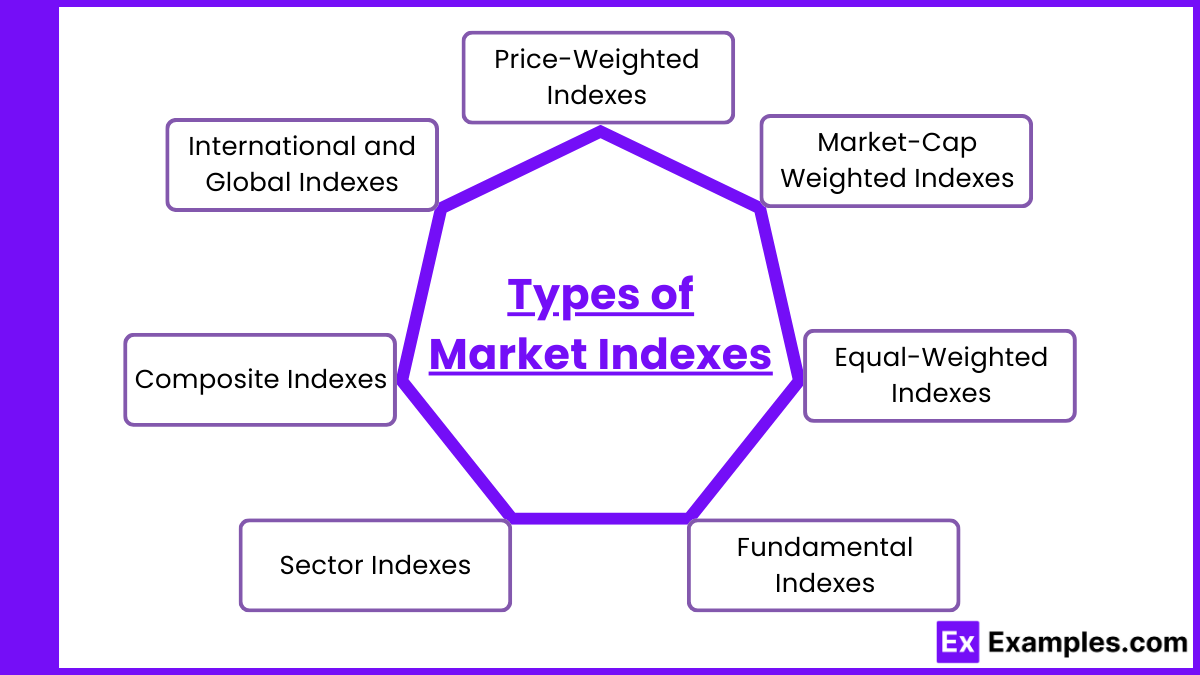

Types of Market Indexes

Market indexes can be classified based on their construction methodology, coverage, and the weighting approach used to calculate the overall index value. Here are some of the primary types of market indexes:

1. Price-Weighted Indexes

In a price-weighted index, each constituent stock contributes to the index based on its price per share. The higher the stock price, the greater the impact that stock has on the index’s movements. The Dow Jones Industrial Average (DJIA) is one of the most well-known examples of a price-weighted index. The calculation is straightforward: the sum of the prices of all the stocks in the index is divided by a divisor, which may change due to stock splits or other adjustments.

2. Market-Cap Weighted Indexes

Market-cap weighted indexes assign weights to the stocks based on their market capitalization, which is the total market value of a company’s outstanding shares. Stocks with a higher market cap have a more significant influence on the index. This method is widely used in major indexes, including the S&P 500 and the NASDAQ Composite. The index value is calculated by multiplying the market cap of each company by its stock price, summing these products, and then dividing by a divisor.

3. Equal-Weighted Indexes

An equal-weighted index gives the same weight, or importance, to each stock in the index, regardless of the company’s size or industry prominence. This approach can provide a more balanced view of the market’s performance, as it prevents larger companies from disproportionately influencing the index. The S&P 500 Equal Weight Index is an example, where each stock is rebalanced periodically to maintain equal weighting.

4. Fundamental Indexes

These indexes use company fundamentals, such as earnings, dividends, sales, or book value, rather than market cap, to determine the weight of each stock in the index. Proponents of fundamental indexing argue that this method can avoid the market distortions that might occur with market-cap weighted indexes, which can become overly concentrated in overvalued stocks.

5. Sector Indexes

Sector indexes measure the performance of specific sectors of the economy, such as technology, healthcare, or finance. These indexes are useful for investors looking to gauge the health of particular industries and for those looking to invest in sector-specific funds.

6. Composite Indexes

A composite index combines stocks from multiple market sectors or types. These indexes provide a broad overview of the financial markets and economic health. The NASDAQ Composite, for instance, includes more than 3,000 stocks listed on the NASDAQ stock exchange, including technology giants and smaller, emerging companies.

7. International and Global Indexes

These indexes track securities from multiple countries, offering insights into the performance of markets outside the investor’s home country. Examples include the MSCI World Index, which captures large and mid-cap representation across 23 developed markets countries, and the FTSE Emerging Index, which includes large and mid-cap securities from a variety of emerging markets.

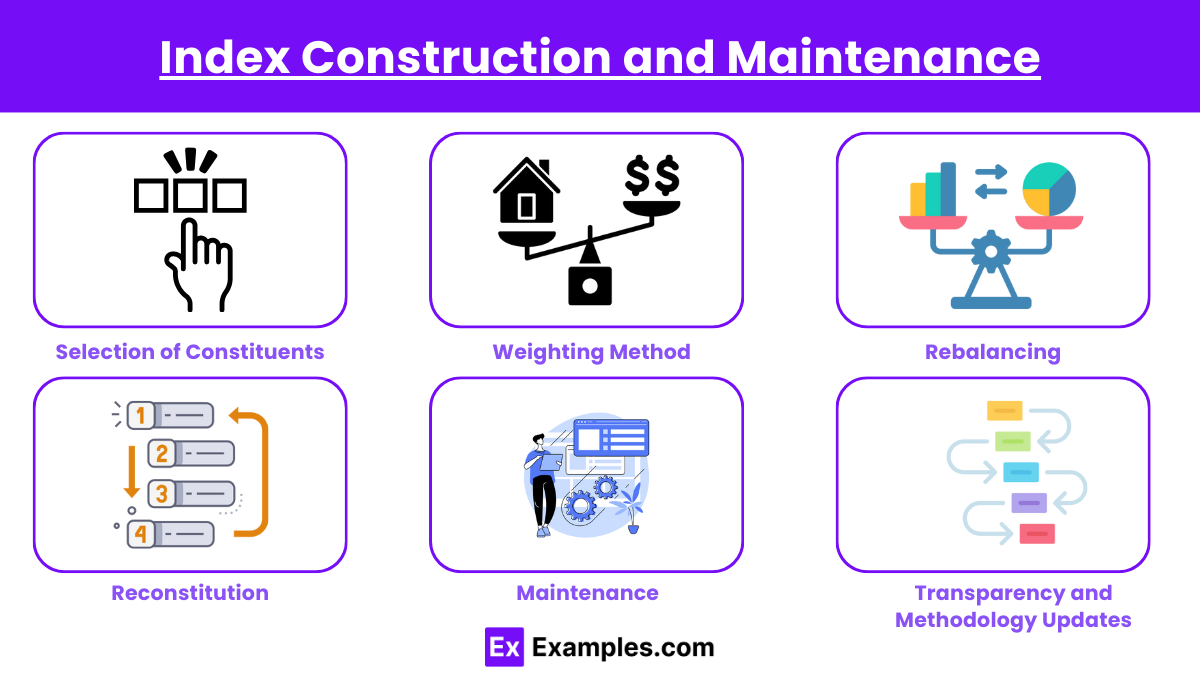

Index Construction and Maintenance

Index construction and maintenance are critical processes that ensure a market index accurately reflects the segment of the market it is designed to represent. These processes involve several key steps and methodologies:

1. Selection of Constituents

The first step in constructing an index is selecting the securities that will be included. This selection is based on predefined criteria, which may include market capitalization, liquidity, sector classification, and geographic location, among others. The criteria ensure that the index represents a particular market or segment effectively.

2. Weighting Method

Once the constituents are selected, the index must be weighted. There are several methods for this, including price-weighting, market-cap weighting, equal weighting, and fundamental weighting. Each method has a significant impact on the index’s behavior and performance characteristics.

- Price-Weighted: Each stock affects the index in proportion to its price per share.

- Market-Cap Weighted: Companies with higher market caps have a more significant influence.

- Equal-Weighted: All companies have the same influence regardless of size.

- Fundamental Weighted: Weights are based on economic factors rather than market price or capitalization.

3. Rebalancing

Rebalancing is the process of realigning the weights of an index’s constituents to meet the original weighting method. It is necessary because over time, market movements can cause the initial weightings to shift, potentially distorting the index’s reflective accuracy. Rebalancing schedules can vary and may be quarterly, semi-annually, or annually, depending on the index’s rules.

4. Reconstitution

Reconstitution involves periodically reviewing and modifying the list of index constituents. This process ensures the index continues to reflect the changing landscape of the market. For example, new companies may be added to an index if they meet the criteria for inclusion, while others that no longer meet the standards, perhaps due to a decrease in market capitalization or liquidity, are removed.

5. Maintenance

Ongoing maintenance of an index is crucial and includes monitoring for and adjusting to corporate actions such as mergers, acquisitions, stock splits, and dividend payments. These adjustments ensure the index continues to provide a consistent, fair representation of its market without any biases that could occur due to structural changes in its constituents.

6. Transparency and Methodology Updates

Maintaining transparency about how an index is constructed and managed helps maintain investor confidence. Methodology updates may be required to adapt to new financial instruments, evolving markets, and economic conditions. These changes are typically subject to rigorous review processes and are announced well in advance to provide market participants with sufficient time to adjust.

Calculating Index Values

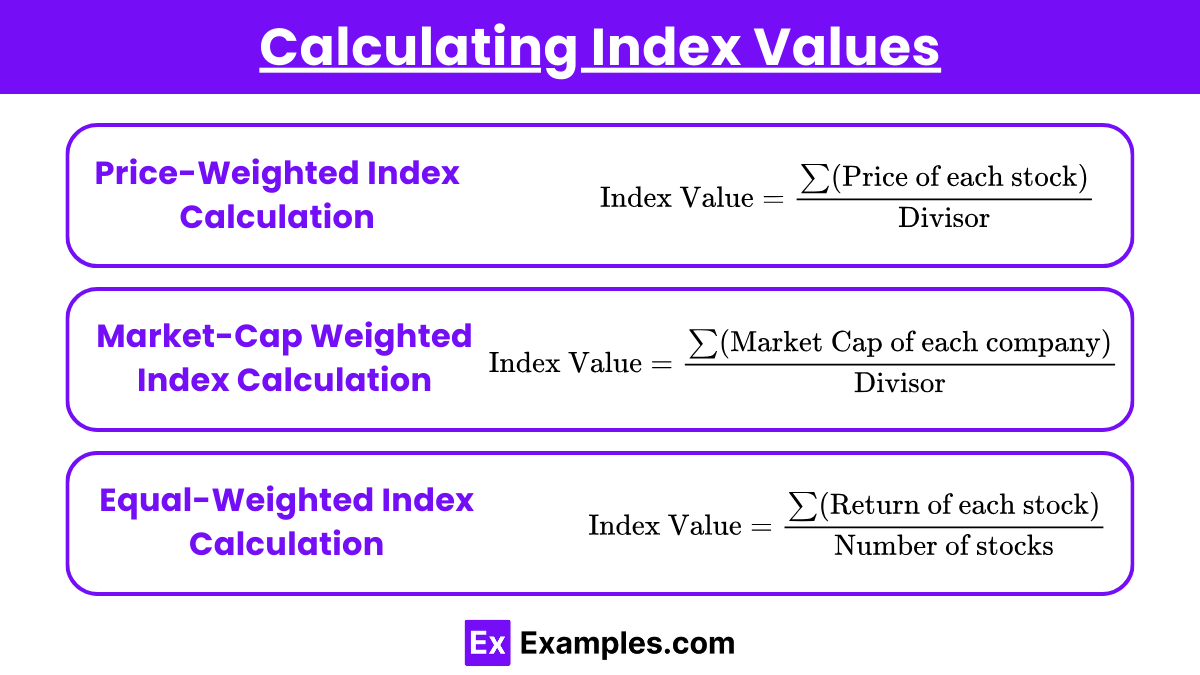

Calculating the value of a market index involves mathematical methods tailored to the specific weighting and criteria of the index. Here are the primary methods used to calculate the most common types of market indexes:

1. Price-Weighted Index Calculation

In a price-weighted index, each constituent stock contributes to the index value based on its price per share. The calculation is relatively simple:

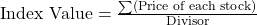

- Calculation Formula:

- Divisor: The divisor is a normalization factor that is adjusted in cases of stock splits, dividends, or changes in the list of index stocks to ensure that such events do not distort the index value.

Example: The Dow Jones Industrial Average (DJIA) is a famous price-weighted index.

2. Market-Cap Weighted Index Calculation

Market-cap weighted indexes reflect the market capitalization of the companies included. Larger companies have a greater impact on the index value.

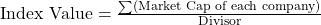

- Calculation Formula:

- Market Cap: Calculated as the current stock price multiplied by the total number of outstanding shares.

Example: The S&P 500 and NASDAQ are prominent market-cap weighted indexes.

3. Equal-Weighted Index Calculation

Each stock in an equal-weighted index contributes equally to the index value, regardless of the company’s size.

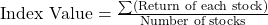

- Calculation Formula:

- Rebalancing: Equal-weighted indexes require frequent rebalancing to maintain equal weightings as individual stock prices fluctuate.

Example: The S&P 500 Equal Weight Index is a well-known equal-weighted index.

Examples

Example 1: Dow Jones Industrial Average (DJIA)

The DJIA is one of the oldest and most recognized stock market indexes in the world. It consists of 30 prominent companies traded on the New York Stock Exchange (NYSE) and the NASDAQ. The index is price-weighted, meaning that stocks with higher prices have a greater impact on the index’s performance. This makes it a significant indicator of the economic health of industrial giants in the U.S. economy.

Example 2: Standard & Poor’s 500 (S&P 500)

The S&P 500 measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is a market-cap-weighted index, which makes it a good indicator of the overall U.S. equity market.

Example 3: NASDAQ Composite

The NASDAQ Composite includes over 3,000 stocks of companies that trade on the NASDAQ stock exchange, including technology giants such as Apple, Amazon, and Google. This index is market-cap weighted and is heavily influenced by the technology sector.

Example 4: FTSE 100

Also known as the “Footsie,” this index comprises 100 of the largest publicly traded companies on the London Stock Exchange. The FTSE 100 is a market-capitalization weighted index and serves as a benchmark for the UK stock market.

Example 5: Nikkei 225

The Nikkei 225 is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index that includes Japan’s top 225 blue-chip companies, making it a major indicator of the market performance in Japan

Practice Questions

Question 1

Which type of market index is weighted based on the total market capitalization of the companies included in the index?

A) Price-weighted index

B) Market-cap weighted index

C) Equal-weighted index

D) Fundamental index

Correct Answer: B) Market-cap weighted index

Explanation:

A market-cap weighted index assigns weights to the components based on their market capitalization, which is calculated as the stock price multiplied by the total number of outstanding shares. Larger companies have a greater impact on the index’s movements. This method is used by major indexes like the S&P 500 and NASDAQ Composite, reflecting how shifts in the values of large companies can significantly influence the overall index.

Question 2

What is the primary characteristic of a price-weighted index?

A) It gives equal importance to all stocks regardless of company size.

B) It bases the index calculation on the underlying economic factors of companies.

C) It considers only the price per share of the included stocks.

D) It adjusts the stock weights according to their volatility.

Correct Answer: C) It considers only the price per share of the included stocks.

Explanation:

In a price-weighted index, the index is calculated based on the price per share of the included stocks. The higher the stock price, the more influence that stock has over the index’s performance. This is different from a market-cap weighted index where the total value of the company determines its impact on the index. A well-known example of a price-weighted index is the Dow Jones Industrial Average (DJIA).

Question 3

Which index would you expect to be most affected by a major movement in a single large-cap stock?

A) A market-cap weighted index

B) An equal-weighted index

C) A price-weighted index

D) A fundamental index

Correct Answer: A) A market-cap weighted index

Explanation:

In a market-cap weighted index, large-cap stocks, which have a higher market capitalization, exert a more substantial influence on the index’s movements. Therefore, significant price changes in any of these large-cap stocks can lead to noticeable fluctuations in the overall index value. This contrasts with equal-weighted and price-weighted indices, where the structure tends to distribute influence more evenly or based on stock prices, respectively