Preparing for the CFA Exam requires a comprehensive understanding of “Capital Market Expectations, Part 1: Framework and Macro Considerations,” a crucial topic in investment strategy. Mastery of economic analysis, macroeconomic indicators, and their impact on asset class returns is essential. This knowledge provides insights into portfolio management and strategic asset allocation, critical for achieving a high CFA score.

Learning Objective

In studying “Capital Market Expectations, Part 1: Framework and Macro Considerations” for the CFA Exam, you should learn to understand the process of developing informed capital market expectations for asset allocation and investment strategy. Analyze the macroeconomic factors influencing capital markets, including GDP growth, inflation, interest rates, and government policies. Evaluate how these macro variables interact with financial markets and shape expectations for future asset class performance. Additionally, explore the frameworks and models used in economic forecasting, such as economic growth theories and business cycle analysis, and apply your understanding to assessing long-term investment opportunities and constructing diversified portfolios.

Introduction to Capital Market Expectations (CME)

Capital Market Expectations (CME) refer to the forecasts or assumptions about future returns, risk levels, and economic conditions that investors and portfolio managers use to guide their investment decisions. These expectations play a fundamental role in strategic asset allocation and portfolio construction, impacting decisions on how to allocate capital across various asset classes to achieve desired risk-return profiles.

Importance of Capital Market Expectations

- Strategic Asset Allocation: CME helps in setting long-term investment strategies by estimating future returns and risks associated with different asset classes.

- Risk Management: By understanding potential future market conditions, investors can better manage and mitigate risks within their portfolios.

- Economic Forecasting: CME incorporates macroeconomic analysis, which is essential for understanding how economic variables (e.g., GDP growth, inflation, interest rates) may affect investment performance.

- Performance Benchmarking: Provides a basis for measuring portfolio performance relative to market expectations.

- Investment Policy Development: Helps institutions develop investment policies and guidelines that align with their financial goals and risk tolerance.

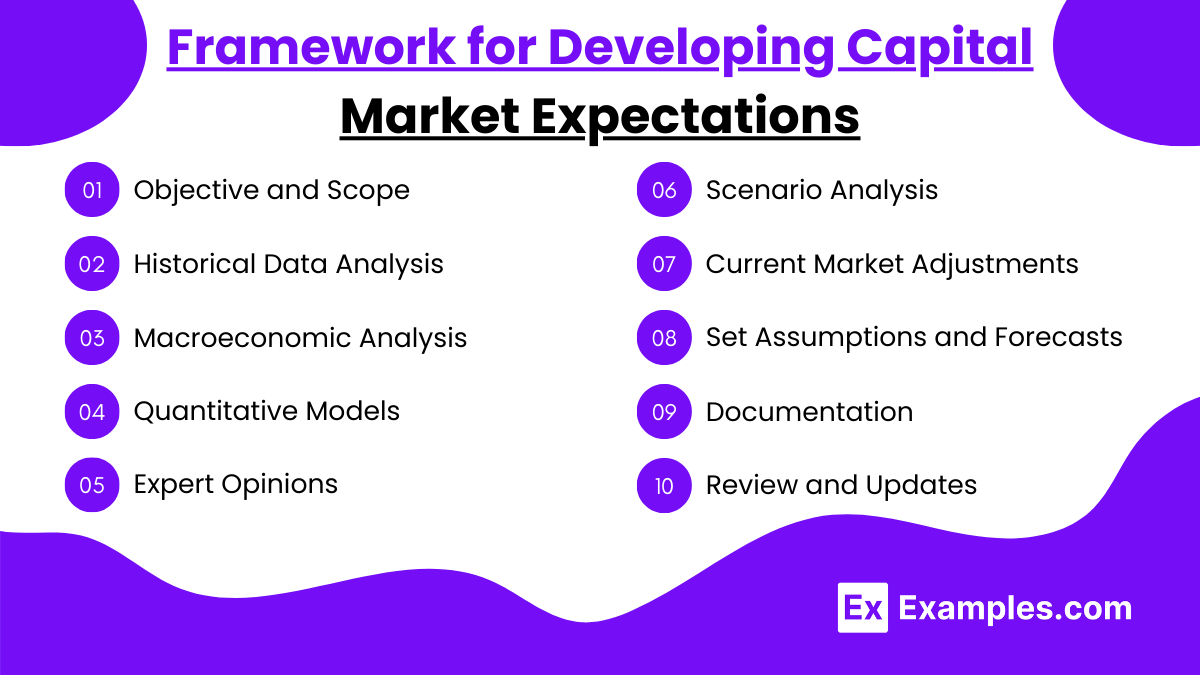

Framework for Developing Capital Market Expectations

Developing Capital Market Expectations (CME) requires a structured framework that combines qualitative and quantitative approaches to forecast future asset class returns, risks, and correlations. Here’s a step-by-step framework for creating comprehensive capital market expectations:

- Objective and Scope

- Define the purpose (e.g., asset allocation) and time horizon.

- Identify relevant asset classes.

- Historical Data Analysis

- Collect and analyze historical returns, risk (volatility), and correlations.

- Note limitations of past data due to changing market conditions.

- Macroeconomic Analysis

- Review key economic indicators like GDP growth and inflation.

- Factor in monetary, fiscal policy, and global trends.

- Quantitative Models

- Use models such as CAPM and multi-factor models for return forecasts.

- Apply econometric techniques for more refined projections.

- Expert Opinions

- Incorporate insights from analysts and consensus forecasts for balanced assumptions.

- Scenario Analysis

- Create base, upside, and downside scenarios.

- Conduct stress tests for extreme market conditions.

- Current Market Adjustments

- Adjust for current valuations (e.g., P/E ratios, yield spreads).

- Consider market sentiment and investor behavior.

- Set Assumptions and Forecasts

- Estimate expected returns, risk levels, and correlations.

- Documentation

- Record all data, methods, and assumptions used for transparency.

- Review and Updates

- Periodically update CME to reflect new data and market shifts.

- Use performance feedback to refine future forecasts.

Key Macro Considerations in Developing CMEs

Key macro considerations play a crucial role in developing Capital Market Expectations (CME) as they influence the projected performance of asset classes and the overall investment landscape. Here are the main macroeconomic factors to consider:

- Economic Growth (GDP)

- Strong GDP growth boosts equity returns; weak growth signals risk.

- Analyze historical and forecasted trends.

- Inflation Rates

- Moderate inflation benefits equities; high inflation impacts bonds negatively.

- Assess current and projected inflation rates.

- Monetary Policy

- Central bank policies (e.g., rate changes, QE) affect bonds and equities.

- Monitor policy statements and rate forecasts.

- Interest Rates

- High rates lower bond prices and affect corporate profitability.

- Study yield curves and future rate expectations.

- Fiscal Policy

- Government spending/taxation influences economic growth.

- Evaluate budget policies and public debt levels.

- Global Economic Trends

- Affects international investments and capital flows.

- Analyze global growth, geopolitical stability, and trade policies.

- Exchange Rates

- Currency changes impact multinational earnings and foreign investments.

- Assess currency strength and trade balances.

- Commodity Prices

- Affects sectors like energy and manufacturing.

- Track key commodity trends and supply-demand dynamics.

- Political and Geopolitical Risks

- Instability can disrupt markets and investor sentiment.

- Monitor political events and regional tensions.

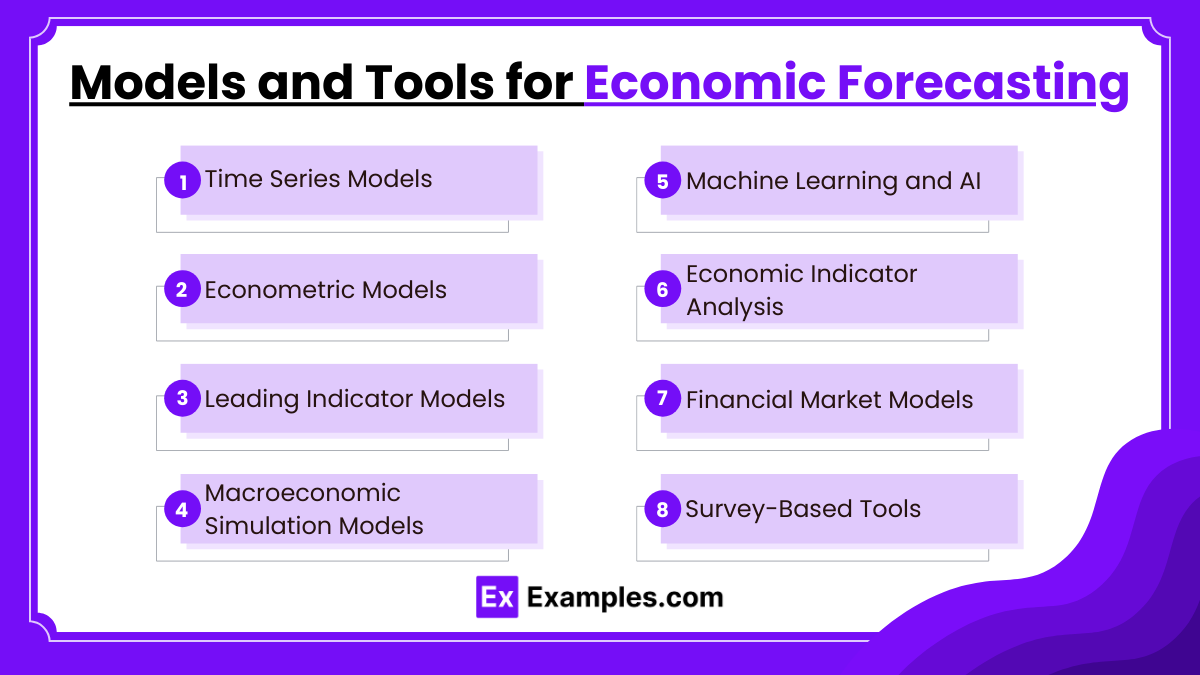

Models and Tools for Economic Forecasting

Economic forecasting relies on various models and tools to predict future economic conditions and inform investment strategies. Here’s an overview of the most commonly used models and tools:

- Time Series Models

- ARIMA & VAR: Capture trends, cycles, and relationships between variables.

- Use: Short to medium-term GDP, inflation, and interest rate forecasts.

- Econometric Models

- Multiple Regression & Structural Models: Analyze relationships between economic variables.

- Use: Examining impacts of consumer spending and policy changes.

- Leading Indicator Models

- Composite Indexes: Combine indicators to predict economic turning points.

- Use: Anticipate future growth or downturns.

- Macroeconomic Simulation Models

- DSGE & CGE: Analyze responses to economic shocks and policy impacts.

- Use: Long-term trend and policy effect forecasting.

- Machine Learning and AI

- Neural Networks: Manage complex relationships for improved predictions.

- Use: High-frequency data and pattern recognition.

- Economic Indicator Analysis

- Lagging, Coincident, Leading Indicators: Assess trends for comprehensive forecasts.

- Use: Gauge economic conditions using indicator trends.

- Financial Market Models

- Yield Curve Analysis: Predicts economic growth and recessions.

- Use: Understand market expectations and interest rate impacts.

- Survey-Based Tools

- Business & Consumer Surveys: Real-time insights into sentiment and spending.

- Use: Assess expectations and behavior changes.

Examples

Example 1: Impact of Inflation Projections on Bond Portfolios

Analyze how expectations of rising inflation impact bond portfolio management. Discuss strategies such as shifting to inflation-protected securities (e.g., TIPS) and adjusting portfolio duration to mitigate the negative effects of inflation on fixed-income returns.

Example 2: GDP Growth and Equity Market Allocation

Study how projected GDP growth influences equity market allocations. For example, analyze how robust GDP forecasts may prompt an overweight in cyclical sectors like industrials and consumer discretionary, while low growth expectations may shift focus toward defensive sectors like utilities and healthcare.

Example 3: Central Bank Policy and Interest Rate Projections

Evaluate how anticipated central bank policies, such as tightening or easing measures, influence expectations for future interest rates and their impact on investment decisions. Discuss how these projections guide strategies for fixed income, equity, and currency exposure.

Example 4: Exchange Rate Movements and International Investments

Examine the impact of currency forecasts on global portfolio allocation. For instance, discuss how an expected appreciation of the U.S. dollar might affect the returns of foreign investments and influence decisions regarding currency hedging.

Example 5: Business Cycle Analysis and Strategic Asset Allocation

Provide an example of how an investment manager uses business cycle analysis to make asset allocation decisions. Discuss how different phases of the cycle (expansion, peak, contraction, and trough) inform the weighting of asset classes such as equities, bonds, and commodities.

Practice Questions

Question 1

Which of the following macroeconomic factors is most directly associated with assessing future equity market performance?

A. Inflation rate

B. GDP growth rate

C. Current account balance

D. Exchange rate volatility

Answer:

B. GDP growth rate

Explanation:

The GDP growth rate is a key indicator of economic activity and overall economic health. Higher GDP growth generally signals a growing economy, which supports corporate earnings and, consequently, equity market performance. While other factors like inflation and exchange rates can influence the equity markets, GDP growth is most directly associated with future equity market performance.

Question 2

Which of the following is not typically a consideration when using yield curve analysis to inform capital market expectations?

A. The slope of the yield curve

B. The presence of an inverted yield curve

C. The average dividend yield of major stocks

D. The spread between long-term and short-term yields

Answer:

C. The average dividend yield of major stocks

Explanation:

Yield curve analysis focuses on the relationship between short-term and long-term interest rates and is used to gauge market expectations of future interest rate changes and economic conditions. The average dividend yield of major stocks is unrelated to yield curve analysis, which is primarily concerned with bond yields and interest rates.

Question 3

When evaluating the potential impact of central bank policy on capital markets, which of the following is most relevant?

A. Corporate tax rates

B. Unemployment data

C. Changes in interest rate targets

D. Trade balance figures

Answer:

C. Changes in interest rate targets

Explanation:

Central bank policy often focuses on setting interest rate targets to influence economic activity. Changes in these targets can directly impact borrowing costs, consumer spending, investment decisions, and overall market sentiment. While factors like unemployment data are considered by central banks when forming policy, changes in interest rate targets are most directly relevant to capital market expectations.