Preparing for the CFA Exam requires a solid understanding of yield curve strategies, a key aspect of fixed-income investing. Mastery of yield curve shapes, shifts, and their implications on bond portfolios is essential. This knowledge provides insights into interest rate forecasts, risk management, and optimizing portfolio performance, critical for achieving a high CFA score.

Learning Objective

In studying “Yield Curve Strategies” for the CFA Exam, you should aim to understand the core strategies used to interpret and leverage yield curve movements, including bullet, barbell, and ladder approaches. Analyze how shifts in the yield curve impact bond prices, duration, and convexity. Evaluate the principles behind strategies like riding the yield curve, and explore applications of yield spreads in managing interest rate risks. Additionally, assess how yield curve positioning can enhance returns under varying economic conditions, and apply your understanding to case scenarios that involve portfolio optimization and risk assessment for CFA exam practice passages.

Understanding Yield Curve Shapes and Movements

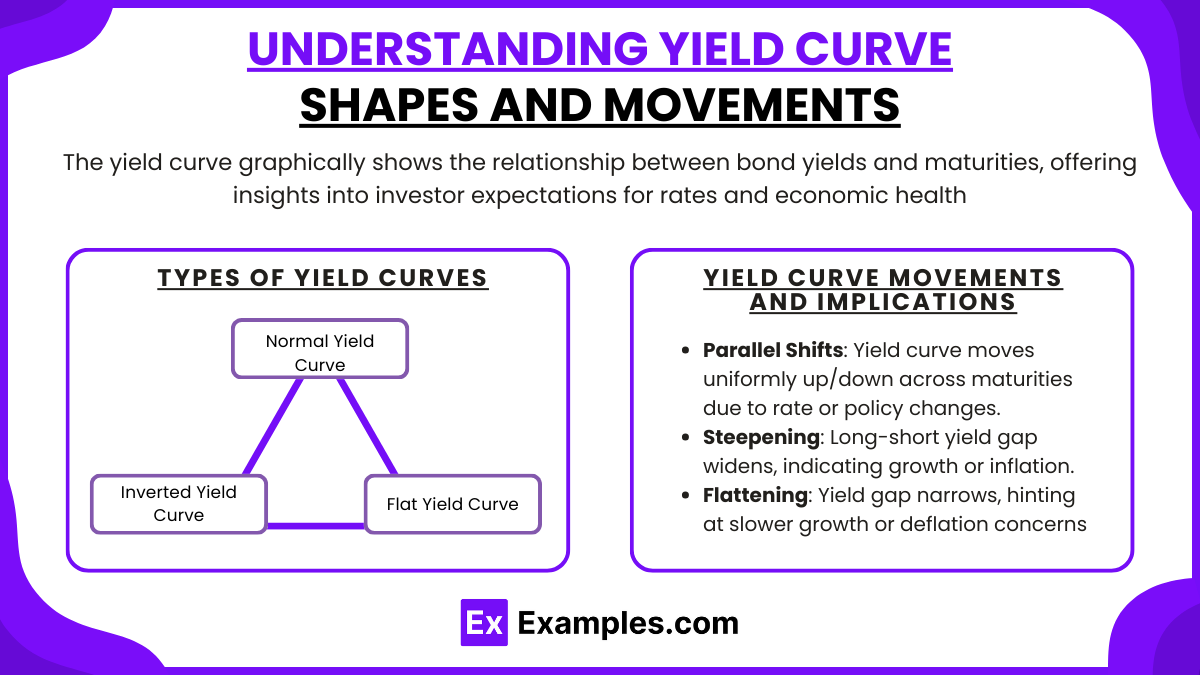

The yield curve is a graphical representation that shows the relationship between interest rates (or yields) and different maturity periods for bonds, usually government securities. It provides insights into investor expectations for interest rates, inflation, and overall economic health.

Types of Yield Curves

- Normal Yield Curve: This shape occurs when long-term yields are higher than short-term yields, indicating positive economic growth expectations. Investors demand a higher yield for the risk of holding bonds over a longer term, given potential inflation and interest rate increases.

- Inverted Yield Curve: When short-term yields are higher than long-term yields, an inverted curve forms, often signaling economic slowdown or recession. Investors expect interest rates to fall in the future, which typically aligns with an anticipated economic downturn.

- Flat Yield Curve: A flat curve suggests that yields across different maturities are similar, indicating uncertainty or a transitional economic phase. It might precede a recession or signal a potential shift in monetary policy.

Yield Curve Movements and Implications

- Parallel Shifts: The entire yield curve moves up or down uniformly across all maturities. This can occur due to widespread changes in interest rate expectations or policy shifts, impacting bond prices universally.

- Steepening and Flattening:

- Steepening occurs when the difference between long-term and short-term yields increases. This can indicate expectations of stronger economic growth and potential inflation, prompting higher yields for longer-term bonds.

- Flattening happens when the yield difference between short-term and long-term bonds narrows. It often reflects concerns over slower growth or deflationary pressures and may signal that the economic expansion phase is peaking.

Practical Implications for Investors

Investors use the shape and movement of the yield curve to inform decisions on bond investments and risk management strategies. For example, when a steepening yield curve is anticipated, investors might favor longer-term bonds to capture higher yields. Conversely, an inverted yield curve might encourage a shift toward shorter-term bonds to avoid risks associated with a potential recession. Understanding these dynamics is crucial for managing interest rate risk, aligning bond portfolio strategies with economic cycles, and optimizing investment returns in line with changing yield curve conditions

Yield Curve Strategies: Bullet, Barbell, and Ladder Approaches

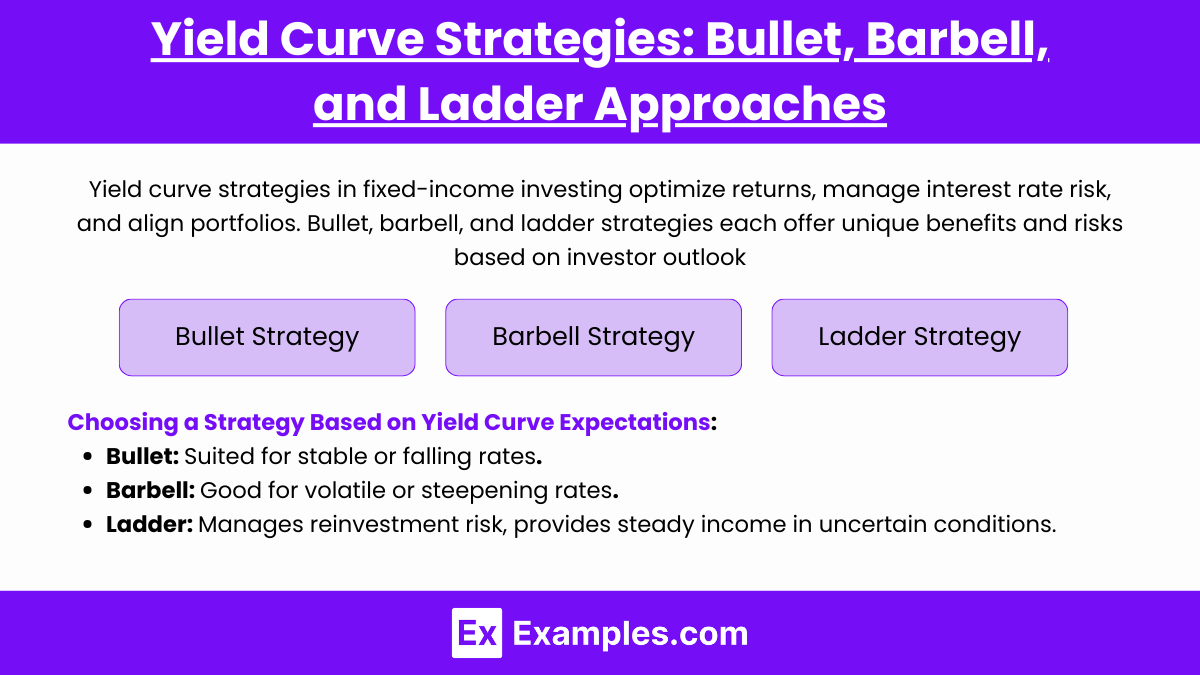

Yield curve strategies are used in fixed-income investing to optimize returns, manage interest rate risk, and align bond portfolios with investor objectives. Bullet, barbell, and ladder strategies each offer distinct advantages and risks based on their structure and the investor’s outlook on interest rates and the yield curve.

1. Bullet Strategy

In a bullet strategy, the investor concentrates bond maturities around a specific date or period, creating a “bullet” of maturities. Typically, all bonds in the portfolio mature around the same time, allowing the investor to capture yields specific to that timeframe.

- Advantages: A bullet strategy is often used when an investor expects interest rates to remain stable or decrease, making it advantageous to hold bonds to maturity without reinvesting at potentially lower rates. It’s also suitable for meeting a specific cash flow need or funding requirement on a future date.

- Risks: This strategy can be sensitive to changes in interest rates. If rates rise significantly before the bonds mature, the portfolio might experience losses. Additionally, it provides limited flexibility in reinvesting at higher yields since all bonds mature at the same time.

2. Barbell Strategy

The barbell strategy involves holding a mix of short-term and long-term bonds, with little to no intermediate-term maturities, resembling the shape of a barbell.

- Advantages: The barbell strategy offers flexibility and can perform well in a volatile interest rate environment. The short-term bonds provide liquidity and the ability to reinvest quickly at new rates, while the long-term bonds secure higher yields if rates decrease over time.

- Risks: A barbell strategy can expose investors to more volatility since it lacks intermediate-term bonds that might offer some stability in rate changes. If interest rates fall, the portfolio might suffer from reinvesting short-term bond proceeds at lower yields.

- Ideal Conditions: The barbell strategy is typically used when investors expect a steepening yield curve, with short-term rates staying low and long-term rates rising.

3. Ladder Strategy

A ladder strategy diversifies bond maturities across a range of time periods, with bonds maturing at regular intervals. This approach creates a “ladder” effect, as bonds are consistently maturing and freeing up cash for reinvestment.

- Advantages: Laddering provides a balance between risk and flexibility. As bonds mature at regular intervals, the investor can reinvest in bonds with the current market yield, managing interest rate risk and creating consistent cash flow.

- Risks: Though generally less risky than bullet or barbell strategies, a ladder strategy may not maximize returns in rapidly changing interest rate environments. If interest rates fall, reinvested bonds will earn lower yields, which could impact long-term income.

- Ideal Conditions: Laddering works well for investors seeking steady income and reduced reinvestment risk, particularly in unpredictable interest rate environments. It can also be ideal for creating predictable cash flows for future obligations.

Choosing a Strategy Based on Yield Curve Expectations

Each strategy aligns with different expectations about interest rates and the yield curve:

- Bullet: Best for stable or declining interest rates.

- Barbell: Effective in volatile or steepening rate environments.

- Ladder: Ideal for managing reinvestment risk and generating steady income in uncertain rate conditions.

Selecting the right approach depends on the investor’s goals, time horizon, and economic outlook, as each strategy offers distinct benefits and trade-offs in adapting to yield curve dynamics

Interest Rate Risk Management and Duration Matching

Interest rate risk management is a fundamental aspect of fixed-income investing. It involves strategies that help investors mitigate the potential losses from changes in interest rates, which directly affect bond prices. Duration matching is one of the most effective techniques for managing interest rate risk, as it helps align a portfolio’s sensitivity to interest rate changes with an investor’s goals or liabilities.

Understanding Interest Rate Risk

Interest rate risk arises because bond prices and interest rates have an inverse relationship: when interest rates rise, bond prices fall, and vice versa. This effect is more pronounced for bonds with longer maturities and higher durations, which are more sensitive to rate changes. Therefore, managing this sensitivity is crucial for protecting a bond portfolio’s value, especially in volatile interest rate environments.

What is Duration?

Duration is a measure of a bond’s sensitivity to interest rate changes. It estimates how much a bond’s price will change for a 1% change in interest rates. Longer duration bonds are more sensitive to interest rate fluctuations, while shorter duration bonds are less affected.

- Modified Duration: Measures the percentage change in bond price for a 1% change in interest rates.

- Macaulay Duration: The weighted average time until a bond’s cash flows are received. It is often used as an indicator of interest rate risk for matching purposes.

Duration Matching as a Risk Management Strategy

Duration matching is a technique in which the duration of a bond portfolio is aligned with the investor’s investment horizon or liability schedule. By matching the portfolio’s duration with the timing of expected cash needs or liabilities, investors can minimize interest rate risk, as fluctuations in interest rates will have a lesser impact on the portfolio’s market value relative to its cash flow needs.

- Liability-Driven Investment (LDI): In LDI, investors match the duration of their bond holdings to the duration of their liabilities, reducing the risk that interest rate changes will disrupt their ability to meet obligations. This approach is often used by pension funds, insurance companies, and others with defined liabilities.

Key Benefits of Duration Matching

- Reduces Interest Rate Sensitivity: By matching the portfolio’s duration with the time horizon, investors minimize sensitivity to interest rate fluctuations.

- Protects Against Reinvestment Risk: Duration matching reduces the risk of having to reinvest at lower rates when liabilities or future cash flow needs are due.

- Optimizes Portfolio Stability: With a matched duration, the portfolio’s market value is more stable, offering a predictable alignment between asset values and future obligations.

Implementing Duration Matching

Investors can implement duration matching by choosing bonds with maturities that align with their investment horizon or liabilities. For instance, if an investor expects to need funds in 5 years, they may select bonds with an average duration of 5 years. Additionally, investors may adjust the portfolio periodically to keep duration aligned as time passes and interest rates fluctuate.

Duration matching is a powerful tool for managing interest rate risk, providing a systematic approach to aligning bond portfolio sensitivity with investor needs. Through careful monitoring and adjustment, duration matching helps ensure stability and predictability in the face of interest rate changes, a critical factor for long-term fixed-income investing

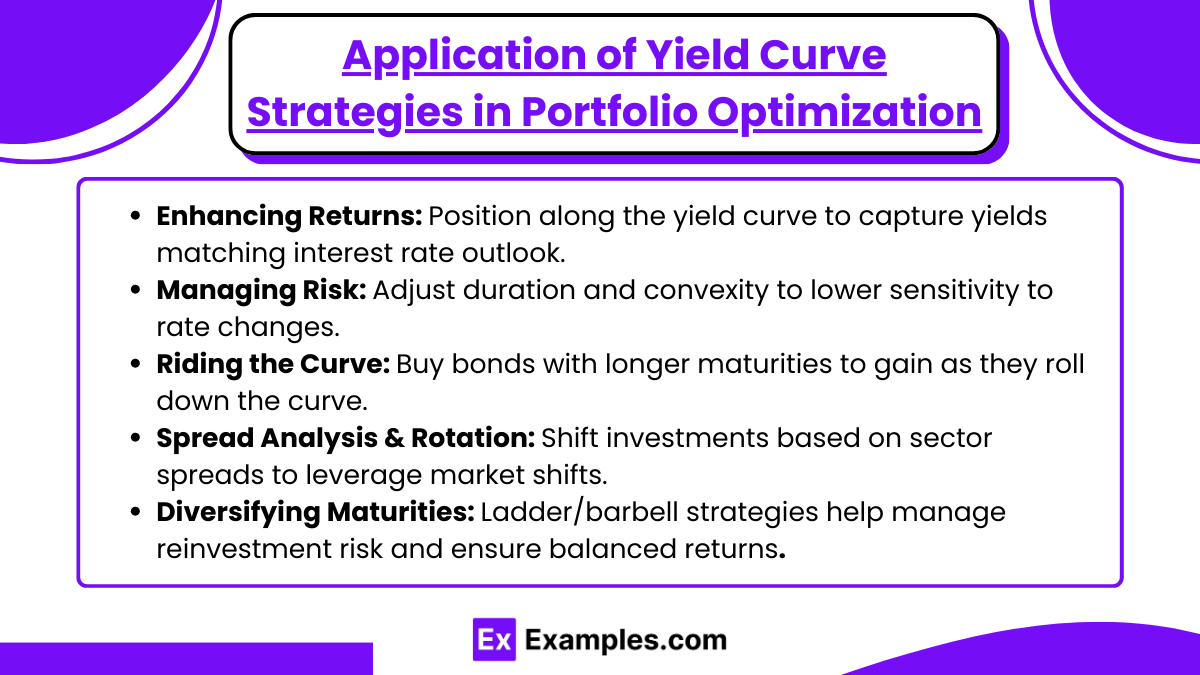

Application of Yield Curve Strategies in Portfolio Optimization

Yield curve strategies play a vital role in optimizing bond portfolios to enhance returns, manage risks, and align with economic conditions. Here’s how these strategies contribute to portfolio optimization:

- Enhancing Returns: By positioning along the yield curve (e.g., short, intermediate, or long-term bonds), investors can capture optimal yields based on their interest rate outlook.

- Managing Interest Rate Risk: Yield curve strategies help adjust bond duration and convexity to reduce portfolio sensitivity to interest rate changes.

- Riding the Yield Curve: When interest rates are expected to remain stable, investors can buy bonds with maturities slightly longer than their investment horizon to earn higher returns as bonds move down the yield curve.

- Spread Analysis and Sector Rotation: Investors assess yield spreads between different sectors or credit qualities, shifting investments as spreads tighten or widen to capitalize on market conditions.

- Diversifying Maturities: Using laddered or barbell strategies helps manage reinvestment risk and liquidity needs, providing a balanced approach to return generation.

Examples

Example 1

An investor expects a steepening yield curve due to economic growth, so they adopt a barbell strategy by holding short-term and long-term bonds. This approach allows them to capture higher long-term yields while retaining the flexibility to reinvest in short-term bonds if rates rise.

Example 2

A portfolio manager uses a bullet strategy by concentrating bond maturities around a 10-year horizon, anticipating stable interest rates. This strategy minimizes reinvestment risk and allows the manager to match a future cash flow requirement, such as a pension fund payout.

Example 3

An investor predicts that short-term rates will decline while long-term rates remain stable. They implement a riding the yield curve strategy by buying intermediate-term bonds, planning to sell them at a premium as they approach maturity, benefiting from the roll-down effect on the curve.

Example 4

A fund manager utilizes a ladder strategy to manage a portfolio for predictable cash flows. They invest in bonds maturing every two years over a 10-year period, ensuring consistent reinvestment opportunities and balanced interest rate exposure across changing market conditions.

Example 5

To capitalize on widening credit spreads during a market downturn, an investor adopts a sector rotation strategy, shifting from government bonds to corporate bonds. As the yield curve flattens, they seek higher yields in corporates, expecting credit spreads to tighten as the economy stabilizes

Practice Questions

Question 1

Which yield curve strategy would likely be most effective if an investor anticipates a stable interest rate environment and wants to avoid frequent reinvestment risk?

A. Bullet strategy

B. Barbell strategy

C. Ladder strategy

D. Sector rotation strategy

Answer: A. Bullet strategy

Explanation: A bullet strategy concentrates bond maturities around a single point, ideal for a stable interest rate environment where the investor seeks to avoid frequent reinvestment. By choosing bonds with similar maturities, reinvestment risk is minimized, and returns are stabilized over the holding period.

Question 2

In which scenario would an investor most likely implement a barbell strategy?

A. Interest rates are expected to decrease across all maturities.

B. The yield curve is expected to steepen, with short-term rates decreasing.

C. The investor requires consistent cash flows over time.

D. The investor expects no change in interest rates for the next decade.

Answer: B. The yield curve is expected to steepen, with short-term rates decreasing.

Explanation: A barbell strategy, which involves holding short- and long-term bonds, is effective in a steepening yield curve environment. If short-term rates are expected to decrease, holding short-term bonds allows reinvestment flexibility, while long-term bonds lock in higher yields.

Question 3

An investor who wants steady reinvestment opportunities and a balanced exposure to interest rate changes is best suited for which strategy?

A. Bullet strategy

B. Barbell strategy

C. Ladder strategy

D. Riding the yield curve strategy

Answer: C. Ladder strategy

Explanation: A ladder strategy spreads bond maturities across regular intervals, providing steady cash flow from maturing bonds and reducing interest rate risk. This strategy allows for regular reinvestment opportunities, balancing risk and return while providing flexibility in different rate environments.