Private company valuation is essential for determining the economic worth of privately held firms, especially in contexts like mergers, acquisitions, tax, and legal matters. Unlike public companies, private firms lack market transparency, leading to unique valuation challenges, such as limited liquidity and access to comparable market data. Valuation approaches often include the income, market, and asset-based methods, with adjustments for marketability and control. Accurate valuation requires assessing specific company factors, financial stability, and industry context to produce a meaningful estimate of a private firm’s intrinsic value.

Learning Objectives

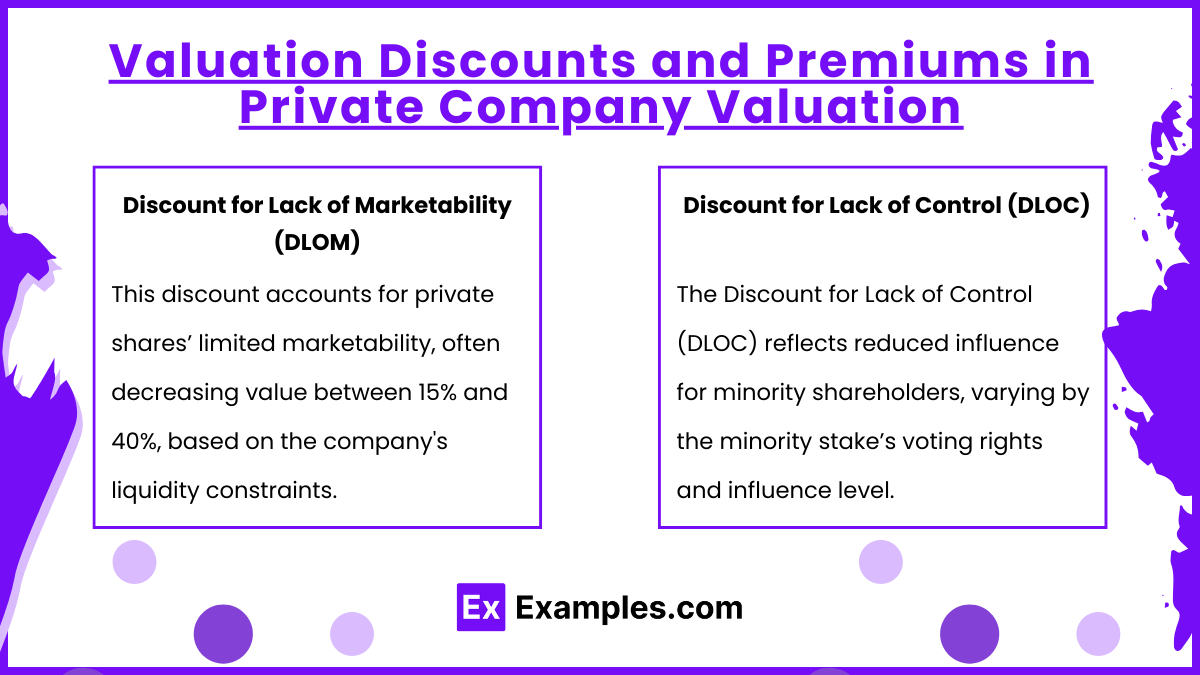

In studying “Equity: Private Company Valuation” for the CFA Exam, you should learn to understand the various approaches to valuing private firms, including income, market, and asset-based methods. Analyze how these methods address the challenges unique to private companies, such as lack of marketability, limited financial transparency, and ownership control factors. Evaluate principles behind the Discount for Lack of Marketability (DLOM) and Discount for Lack of Control (DLOC), and understand their applications in private equity valuation. Additionally, explore the contexts in which each method is most appropriate and apply these insights to assess private company valuations in practice-based CFA exam scenarios.

1. Introduction to Private Company Valuation

Private company valuation is essential in various contexts, including mergers and acquisitions, financial reporting, litigation, and tax matters. Valuing private companies differs significantly from public companies due to the lack of readily available market prices, differences in ownership structure, and unique risks associated with privately held firms.

Purpose of Private Company Valuation

- Private firms lack public stock, complicating market-based valuation methods.

- Private valuation serves transactions, financing, tax planning, and legal disputes.

2. Differences Between Public and Private Company Valuations

Public Company Valuation

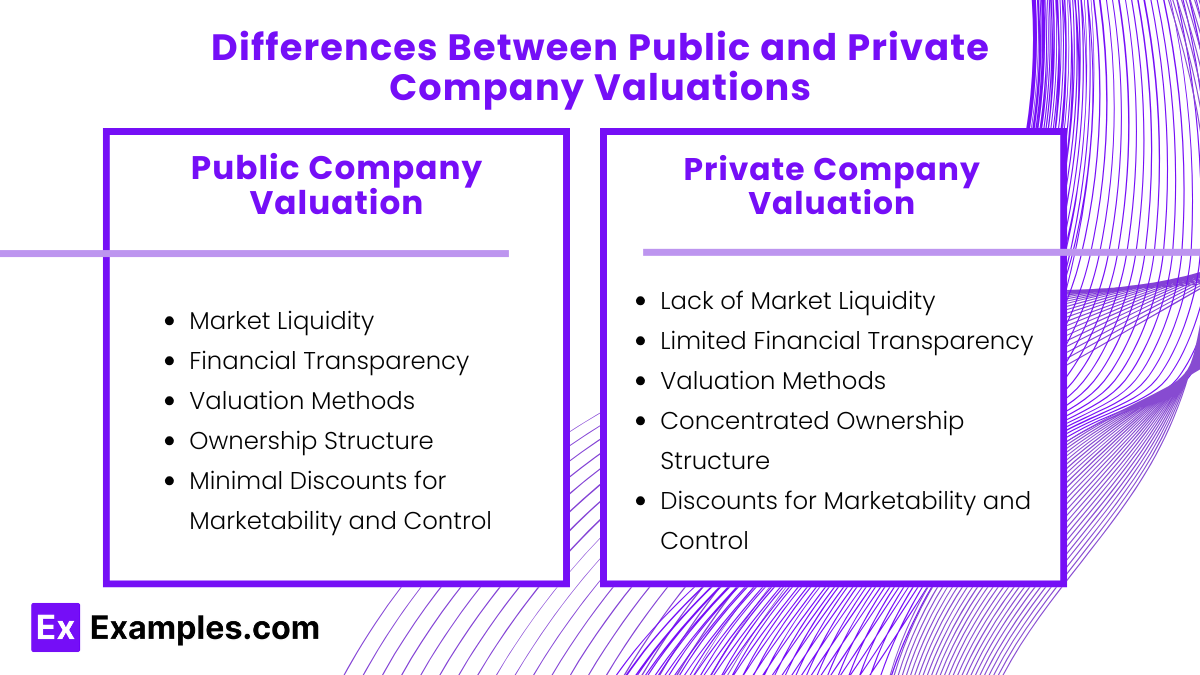

- Market Liquidity: Public companies have active markets for shares, allowing for easy buying and selling, which provides market-driven price data and enhances liquidity.

- Financial Transparency: Public companies are required to disclose detailed financial information regularly, ensuring high transparency and consistency in reporting.

- Valuation Methods: Public company valuations commonly rely on market-based methods, such as price multiples, because share prices are available from public exchanges.

- Ownership Structure: Public companies typically have a wide base of shareholders, resulting in dispersed ownership and potentially more complex governance structures.

- Minimal Discounts for Marketability and Control: Public companies generally do not require discounts for lack of marketability or control, as shares are freely traded and ownership is often spread across many investors.

Private Company Valuation

- Lack of Market Liquidity: Private companies lack an active secondary market for shares, making their shares less liquid and harder to trade.

- Limited Financial Transparency: Private companies often provide less detailed financial information and may not follow the same level of reporting consistency as public companies.

- Valuation Methods: Private company valuations more frequently use income or asset-based methods, as they lack the publicly available price data needed for market-based methods.

- Concentrated Ownership Structure: Private companies usually have fewer owners, often with more concentrated ownership, which can influence control and strategic decisions.

- Discounts for Marketability and Control: Private companies often apply discounts for lack of marketability and control to reflect illiquidity and ownership limitations.

3. Approaches to Valuing Private Companies

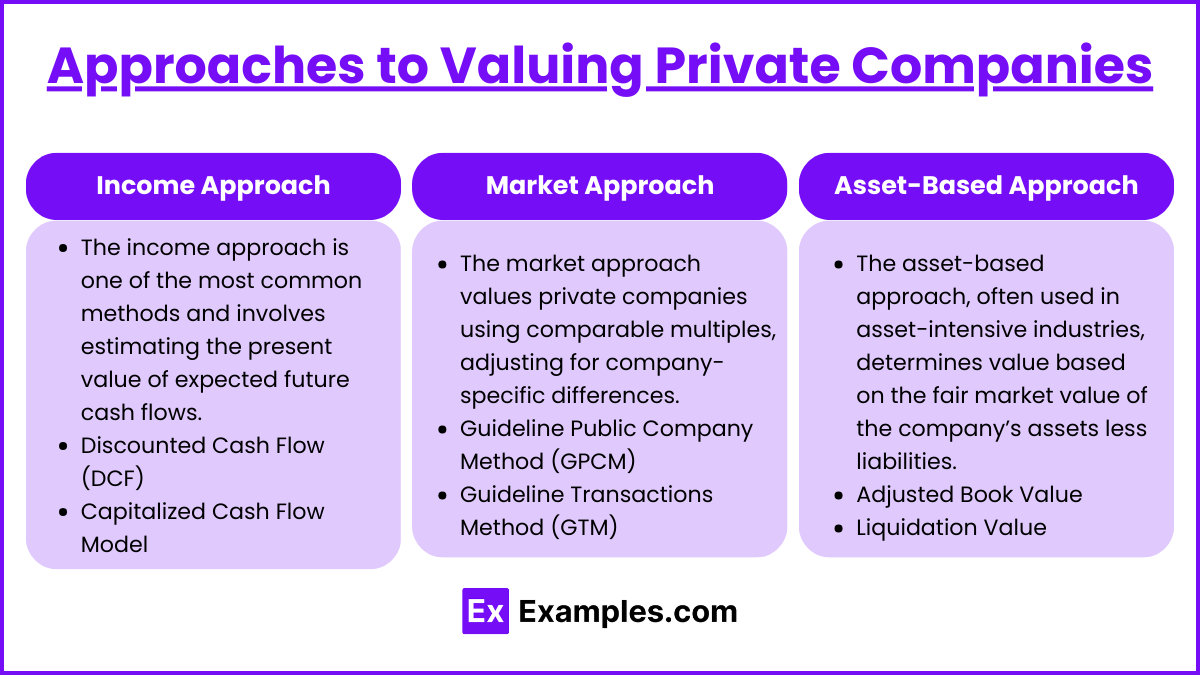

There are three primary methods for valuing private companies, similar to public company valuation approaches, but each method requires modifications for private firms.

a. Income Approach

The income approach is one of the most common methods and involves estimating the present value of expected future cash flows. The most frequently used models under this approach include:

- Discounted Cash Flow (DCF): This method projects future cash flows and discounts them back to the present using a discount rate that reflects the company’s risk profile. Key considerations in private company DCF include:

- Cash Flow Projections: Estimating cash flows can be more complex due to the lack of historical data and more volatile financial performance.

- Discount Rate: The discount rate often includes adjustments for private company risks, such as a small-company premium or an additional risk premium for liquidity.

- Terminal Value Calculation: Typically calculated using the Gordon Growth Model or an exit multiple, with adjustments to account for private company characteristics.

- Capitalized Cash Flow Model: In cases where a company’s cash flows are relatively stable, the Capitalized Cash Flow (CCF) model may be preferred. This method calculates the value as a single cash flow capitalized by the appropriate rate, which includes considerations for growth.

b. Market Approach

The market approach values a private company by referencing the valuation multiples of comparable public or private companies, adjusting for differences between the subject company and comparable entities.

- Guideline Public Company Method (GPCM): This method uses valuation multiples from comparable public companies as a benchmark for valuing the private company. Adjustments are required to account for liquidity and size differences between the public comparables and the private subject company.

- Guideline Transactions Method (GTM): This approach considers recent transactions of comparable companies in the same industry. It may provide more accurate insights as these transactions represent actual market prices. However, finding relevant comparable transactions can be challenging due to the private nature of such deals.

c. Asset-Based Approach

The asset-based approach, often used in asset-intensive industries, determines value based on the fair market value of the company’s assets less liabilities. It can be a viable method for firms with significant tangible assets but is less applicable for service-oriented companies or companies relying on intellectual property.

- Adjusted Book Value: This method adjusts the company’s book value by marking assets and liabilities to their current fair market value.

- Liquidation Value: This approach estimates the net value if the company’s assets were sold off, either in an orderly liquidation (going concern) or a forced liquidation scenario. It is commonly used when a company faces financial distress.

4. Valuation Discounts and Premiums in Private Company Valuation

- Discount for Lack of Marketability (DLOM): This discount reflects the lack of an active market for private company shares, typically reducing value by a range of 15% to 40% depending on the company’s liquidity.

- Discount for Lack of Control (DLOC): This discount applies when valuing a minority interest in the company, accounting for the limited influence over corporate actions. The DLOC can vary based on the level of influence and voting rights associated with the minority stake.

Examples

Example 1. Family-Owned Business Acquisition

In the acquisition of a family-owned manufacturing business, the buyer wants to assess fair value. Since family-owned companies often lack robust financial transparency, the valuation involves significant normalization adjustments, including normalizing the owner’s salary to industry standards and removing non-recurring expenses related to family benefits. A discounted cash flow (DCF) model is employed, projecting future cash flows and applying a discount rate that reflects the company’s size, liquidity, and unique risks. Given the private nature of the business, a Discount for Lack of Marketability (DLOM) is also applied, which reduces the valuation to account for the challenges in reselling a private firm.

Example 2. Venture-Backed Startup Valuation

A venture capital firm wants to value its minority stake in a technology startup to determine the fair value for an upcoming financing round. The valuation uses the market approach, drawing on recent transactions and comparable public companies in the tech sector to determine appropriate revenue multiples. Adjustments are necessary to reflect the growth potential and risk profile unique to early-stage companies. Due to the minority nature of the stake, the firm applies a Discount for Lack of Control (DLOC), recognizing that it cannot influence significant business decisions.

Example 3. Private Equity Buyout

In a private equity buyout of a healthcare services company, the acquiring firm values the target using both an income and a market approach. The income approach focuses on the company’s future cash flows discounted at a rate adjusted for industry risks and the specific credit risk of the target. The market approach benchmarks the valuation against similar healthcare companies recently acquired. Given the intent to acquire a controlling interest, the valuation includes a control premium, which reflects the acquiring firm’s ability to drive strategic changes in the company post-acquisition.

Example 4. Valuation for Divorce Settlement

In a divorce proceeding, the valuation of a privately-owned retail business is required to equitably divide assets. The asset-based approach is chosen because the business has significant tangible assets, including real estate and inventory. This approach evaluates the adjusted book value of assets and deducts liabilities to determine the business’s net asset value. Since the business’s assets are not easily liquidated in a short time, a discount is applied to reflect the estimated market value in a hypothetical orderly sale, ensuring a fair valuation in the context of the divorce settlement.

Example 5. Estate Planning Valuation for Tax Purposes

A high-net-worth individual seeks to transfer shares in a family-owned agricultural business to their heirs. For estate planning purposes, the business must be valued accurately to comply with tax regulations. The valuation applies the income approach using a capitalized cash flow model, which is appropriate given the company’s stable cash flows. Adjustments are made for the owner’s above-market salary, and a DLOM is applied to account for the lack of liquidity in private shares. Additionally, the valuation considers minority discounts since the heirs will receive a minority, non-controlling stake in the company.

Practice Questions

Question 1

Which of the following valuation methods would most likely be appropriate for a private company with stable cash flows in a mature industry?

A. Guideline Public Company Method (GPCM)

B. Liquidation Value

C. Capitalized Cash Flow (CCF) Model

D. Adjusted Book Value

Answer: C. Capitalized Cash Flow (CCF) Model

Explanation: The Capitalized Cash Flow (CCF) Model is a commonly used valuation method for private companies with stable cash flows. This method capitalizes a single representative cash flow (often the expected cash flow for the next year) by a capitalization rate, which is the discount rate minus the growth rate. The CCF model is especially useful when future cash flows are expected to remain relatively consistent over time, which is typical in mature industries with stable revenue and expense patterns.

- A. Guideline Public Company Method (GPCM): This method is often used for benchmarking against publicly traded companies, but it may not be appropriate if the private company’s cash flows are stable and predictable, as direct comparisons can be challenging in mature industries with few market peers.

- B. Liquidation Value: This method is generally applied to companies facing financial distress or when assessing the value of assets if sold off individually rather than as a going concern.

- D. Adjusted Book Value: This method values the firm based on the market value of its assets and liabilities, which may not accurately capture the company’s earning potential if it is operating with stable cash flows.

Question 2

In the valuation of a minority interest in a private company, which of the following discounts is most likely applied to account for the lack of control by the minority shareholder?

A. Discount for Lack of Marketability (DLOM)

B. Discount for Lack of Control (DLOC)

C. Control Premium

D. Discount for Intangibility

Answer: B. Discount for Lack of Control (DLOC)

Explanation: The Discount for Lack of Control (DLOC) is applied when valuing minority interests in a private company to reflect the reduced influence that minority shareholders have over company decisions. Minority shareholders cannot influence decisions related to dividends, mergers, acquisitions, or strategic direction, which can decrease the value of their shares compared to a controlling stake.

- A. Discount for Lack of Marketability (DLOM): This discount is applied to reflect the illiquidity of private company shares, as they are not easily traded in an open market. While DLOM is also commonly applied in private company valuations, it does not directly address control limitations.

- C. Control Premium: A control premium represents an increase in value for a controlling interest, reflecting the benefits of having control over the company’s decisions.

- D. Discount for Intangibility: There is no such term as “Discount for Intangibility” in the context of private company valuations.

Question 3

An analyst is valuing a private technology firm with significant intellectual property and minimal tangible assets. Which valuation method is least appropriate for this company?

A. Discounted Cash Flow (DCF)

B. Guideline Transactions Method (GTM)

C. Adjusted Book Value

D. Guideline Public Company Method (GPCM)

Answer: C. Adjusted Book Value

Explanation: The Adjusted Book Value method is generally least appropriate for companies with significant intangible assets, like technology firms, as this method focuses on the market value of tangible assets and liabilities. Private technology firms often derive much of their value from intellectual property and future cash flows rather than physical assets, making this method unsuitable. The DCF and Guideline approaches are often preferred for technology firms, as they better account for intangible asset value and growth potential.

- A. Discounted Cash Flow (DCF): This method projects future cash flows and discounts them to present value, making it a suitable approach for a high-growth technology firm that may generate significant future cash flows.

- B. Guideline Transactions Method (GTM): This method uses comparable transactions in the same industry to estimate value, which can be effective when recent sales of similar technology firms provide relevant benchmarks.

- D. Guideline Public Company Method (GPCM): This method values the private company based on valuation multiples of comparable public companies. For technology firms, finding public comparables is often possible, and it allows for the incorporation of industry benchmarks.

In summary, the Adjusted Book Value approach is generally inappropriate for firms with substantial intangible assets, such as technology firms, due to its focus on tangible assets.