22+ Promissory Note Examples to Download

When you have a debt and you that have to prove that you really have the intention to pay, you can always make use of a promissory note. A promissory note is a written and dated document where the writer or the payer puts into writing his or her promise to pay the payee the amount of money he or she borrowed from the lender or the payee. You may also check out what is a note.

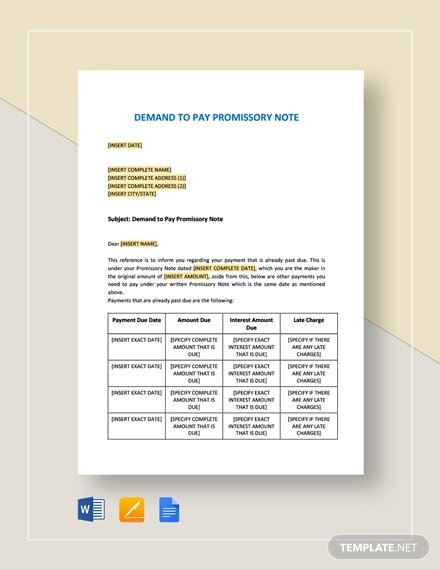

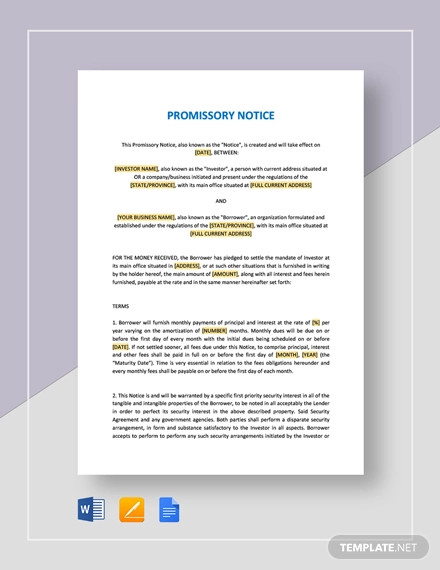

Demand to Pay Promissory Note Example

Collection Letter Following Promissory Note Example

Request for Extension of Time on Promissory Note Template

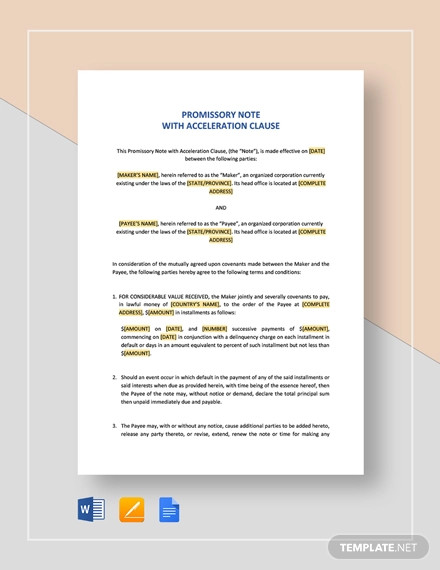

Promissory Note with Acceleration Clause Template

Example of Promissory Note Line of Credit Template

General Promissory Note Template Example

Demand for Payment on Instalment Promissory Note Template

Guarantee of Claim Promissory Note Template

Restaurant General Promissory Note Template

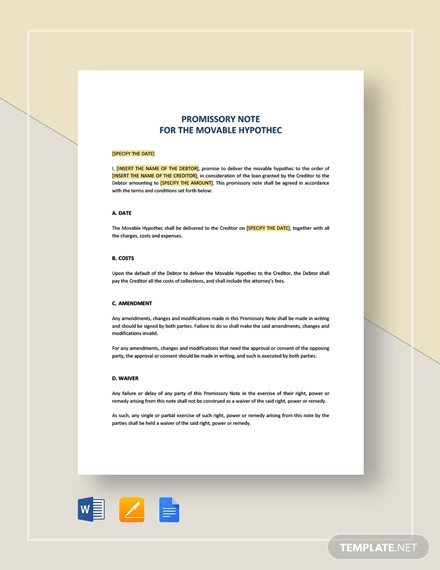

Movable Hypothec Promissory Note Example

Promissory Note With Acknowledgement Template

Movable Hypothec Promissory Note Template

Demand to Pay Promissory Note Template

The Essential Elements of a Promissory Note

To ensure that the promissory note that you have contains important elements, do take note of this list of essential elements that your promissory must have. You may also check out progress note examples.

1. Name of the payer.

This is where the name of the person who has obligations to pay debts must write his or her full name.

2. Name of the payee.

This is where the name of the person who lent the money must write his or her full name, or if it is an entity, this is where the full name of the entity will be written.You may also like blank note examples.

3. Date.

This indicated date on your promissory note is the date when the payer should pay the lent money.

4. The amount borrowed by the payer.

This is the total amount of money that is borrowed by the payer. This is not necessarily the amount payable by the payer.You may also see welcome note examples.

5. The interest rate.

A promissory note should be able to indicate the interest rate that is charged and topped on the amount borrowed. It is either a simple interest or compounded interest.

6. The date of the first payment is due.

This is the very first day when the payer should be able to pay.

7. Subsequent payments.

These subsequent payments can be paid along with the first payment if ever there is any.You may also like SOAP note examples.

8. The end date of payment.

This date is when every single money, as well as interest, borrowed by the payer should be completely paid off.

9. Terms of pre-payment penalties.

There are some promissory notes that do not have a prepayment penalty, but if you encounter a lender or if you are the lender yourself and that you would want to include a prepayment penalty to be assured that you will get paid by your borrowers, you may include your preferred terms of pre-payment penalties.You may also see chart note examples.

Do take note that, depending on the state where you live in, these elements may be changed or added. You may also see loan note examples.

Promissory Note Line of Credit Template

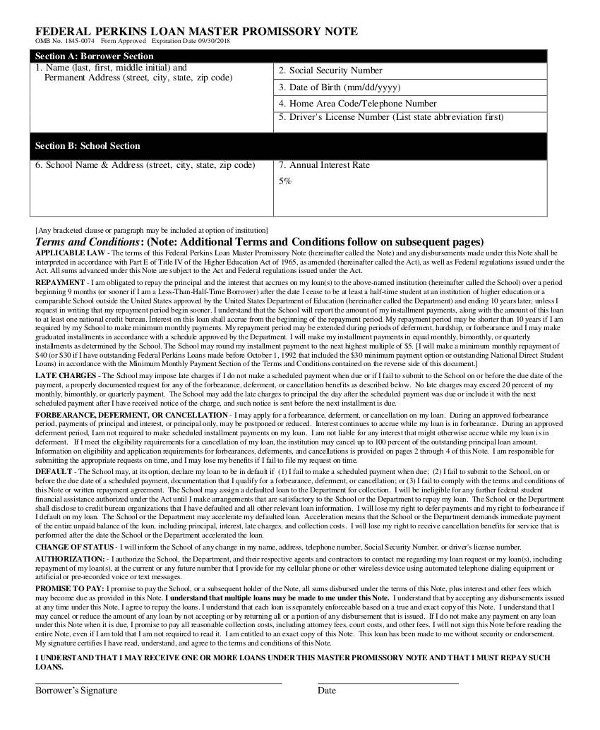

Loan Master Promissory Note Example

Promissory Notes: Promises and Problems

Sample Bank Promissory Note

Types of Promissory Note

Find out the types of promissory notes below. Do take note that each of these types are legally binding contracts. You may also like medical note examples.

1. Personal Promissory Note

This type of promissory note is the one that you might use in order to record your personal loan from another person or party, usually friends and family. While it is unusual that lenders would make use of legal writings when it comes to family and friends, the use of promissory note can be used in order to avoid any confusion and even hurt feelings in the long run. You may also check out progress note examples.

By securing a personal promissory note, you will be able to show proof your good faith that you will surely heed to your promise of paying your debt despite your relationship with the person you have borrowed money from. You may also see loan note examples.

2. Commercial Promissory Note

A commercial promissory note is used and required especially if it comes from commercial lenders. Compared to personal promissory notes, commercial promissory notes are more strict. If the borrower would default on his or her loan, it means that the commercial lender has the right to demand and require the borrower to pay the entire full balance or amount of money paid and not just the past due amount.

You may also like nursing note examples. There are even some cases wherein the lender would place a lien on the borrower’s property until the borrower will be able to fully pay the entire amount of money borrowed along with the interest if ever there is. You may also check out delivery note examples.

3. Real Estate Promissory Note

This type of promissory note is similar to that of a commercial note since lien can also be placed on the borrower’s properties, such as his or her house and lot, in the event that the borrower will default. You might be interested in how to write a thank-you note to a client. But in the case of real estate promissory note, once a borrower will default on his or her real estate loan, that information will become a public record. You may also see thank-you note examples.

4. Investment Promissory Note

This type of promissory note is commonly used in business transactions and these are specifically used to exchange in order to raise capital for the business. Investment promissory notes even contain clauses that would deal with investment returns within a specific period of time. You may also like death note examples.

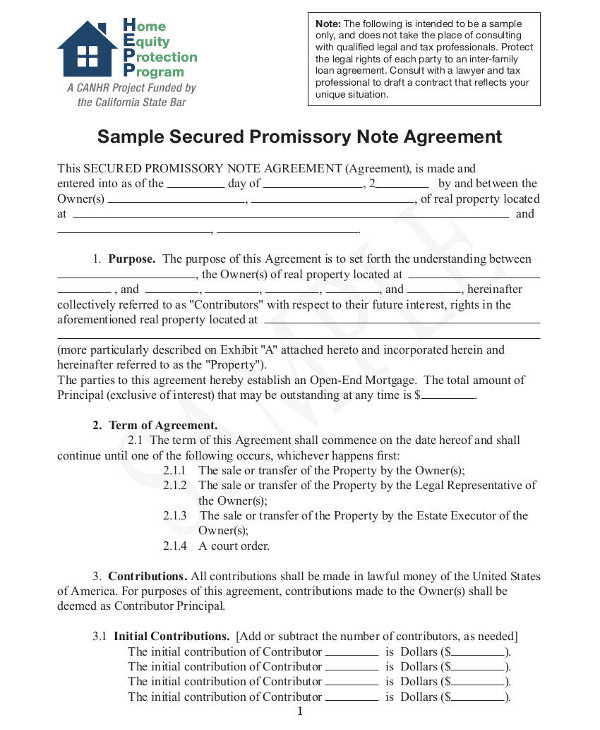

Sample Secured Promissory Note Agreement

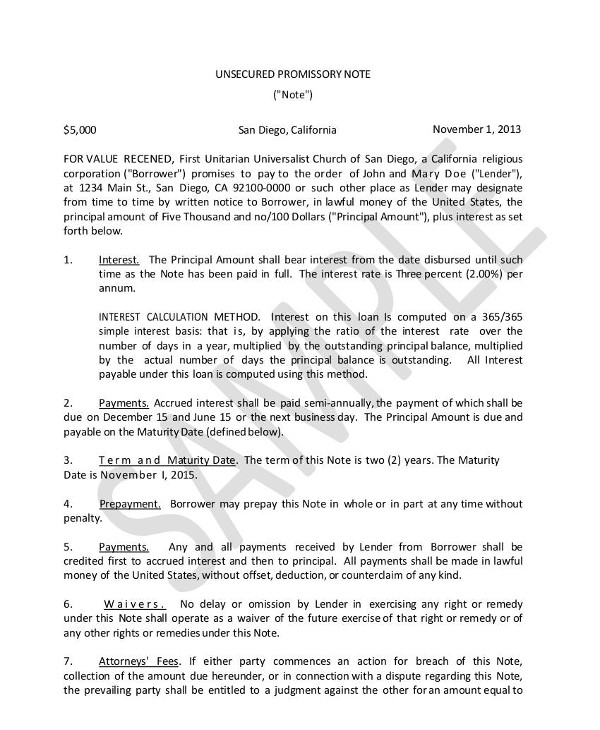

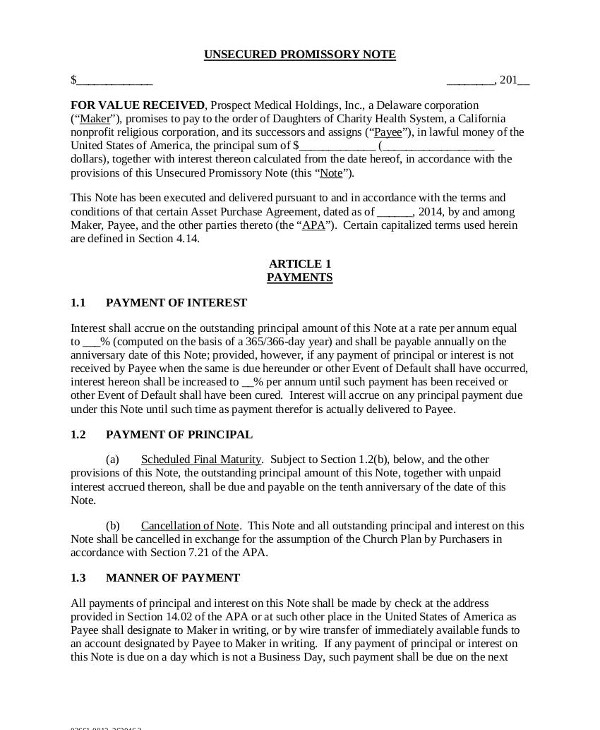

San Diego Unsecured Promissory Note Example

Simple Promissory Note Example

Features of a Promissory Note

Here are the ideal features that your promissory note should possess:

1. Your promissory note should be written.

Verbal promises or oral undertakings do not make up a promissory note, plus, it is also not reliable at all. If you are the maker of the promissory note, you must ensure that your intention in making the promissory note will be signified through writing it in clear details that you would indeed pay the particular amount of money to the person or entity you borrowed from. You may also see what is a note.

2. Your promissory note should express your promise and intention to pay.

As mentioned above, it is very important that you should be able to write in clear details that you will pay the borrowed amount of money. You should also be able to pay the interest if ever there is. Acknowledging that you are indebted to a person or an entity is not enough; you should not defeat the purpose of a promissory note by not stating that you are promising to pay the amount you have borrowed and its interest. You may also like tips for writing a thank-you note.

3. Your promise to pay should be unconditional.

Do you know that if your promissory note contains conditions, it cannot be considered as a promissory note? Promissory notes should be definite and unconditional. Your promise to pay indicated in your promissory note does not constitute any conditions for you to stay true and heed to the promise you have made. You may also check out note templates & examples.

4. Your name as the maker of the promissory note should be clearly indicated.

If you are the one making the promissory note and that it is also you who would be using it, make sure that your name should be clearly and correctly written on the promissory note. Writing your name clearly and correctly on the promissory note enables the person or entity who lent you money to identify who exactly is liable to pay.You may also see credit note examples.

5. Your promissory note should be signed by you.

Your signature makes the promissory note complete and legal. If you are the one who promises to pay and if you do not want any person or entity to file charges at you for not making you promise to pay valid, then make your intention to pay clear by affixing your signature on the promissory note.You may also see field notes examples.

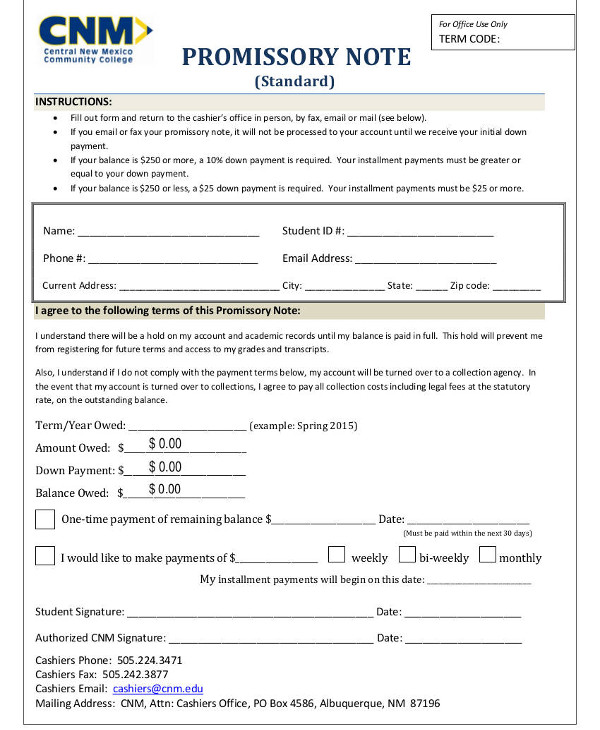

Standard Promissory Note Example

Sample Promissory Note

Unsecured Promissory Note Example

6. Your promissory note should contain the exact amount undertaken to be paid.

The amount that you should pay to the person or entity you were indebted to should be clearly indicated on the promissory note. It should be complete, exact, and should not be vague. This also means that this indicated amount is also not capable of any other contingent additions or subtractions. You may also see chart note examples.

7. Your promissory note should only be about the promise to pay money.

Your promissory note must only contain your promise and intention to pay money and money only. This means that your promissory note must not contain any other extensions such as goods, shares, bonds, stocks, and foreign exchange. You may also see loan note examples.

8. The name of the person or entity who lent money should be clearly indicated.

Aside from your name as the maker of the promissory note, you should also clearly and correctly write the full name of the payee, which is the person or the entity whom you borrowed money from. You may also check out case note examples.

9. Your promissory note should have the necessary dates.

Take note that the date indicated on the promissory note is not material except if the amount is made payable at a certain time after date. While the absence of the date does not necessarily invalidate the promissory note and that the date of execution can possibly be proved independently, the date is still needed to be indicated for the calculation of the interest can be done easily. Additionally, your promissory note can either be ante-dated or post-dated. You may also see meeting note examples.

We hope that this article has answered some of your curiosities regarding promissory notes. For more examples regarding notes, you may also be interested in these note examples in PDF.