Preparing for the CMT Exam requires a comprehensive understanding of Money and Portfolio Risk Management, a critical aspect of financial analysis. This concept highlights the importance of managing trading capital efficiently and identifying risks associated with portfolio investments under diverse market scenarios. Money and Portfolio Risk Management involves evaluating risk tolerance, optimizing asset allocation, and applying risk control measures to minimize losses. It also emphasizes maintaining a balanced portfolio, leveraging diversification, and ensuring consistent performance in fluctuating market conditions. By mastering these strategies, candidates can enhance the reliability, adaptability, and effectiveness of their portfolio management techniques.

Learning Objectives

In studying Money and Portfolio Risk Management for the CMT Exam, you should learn to understand its importance in effectively managing trading capital and mitigating portfolio risks. Successful risk management requires assessing risk tolerance, implementing diversification, and optimizing asset allocation to balance returns with acceptable levels of risk. Techniques such as drawdown analysis, value-at-risk (VaR), and stress testing help evaluate portfolio performance under various market conditions and identify potential vulnerabilities. This process ensures that portfolios are resilient, adaptable, and capable of achieving consistent performance, which is essential for success in the CMT Exam.

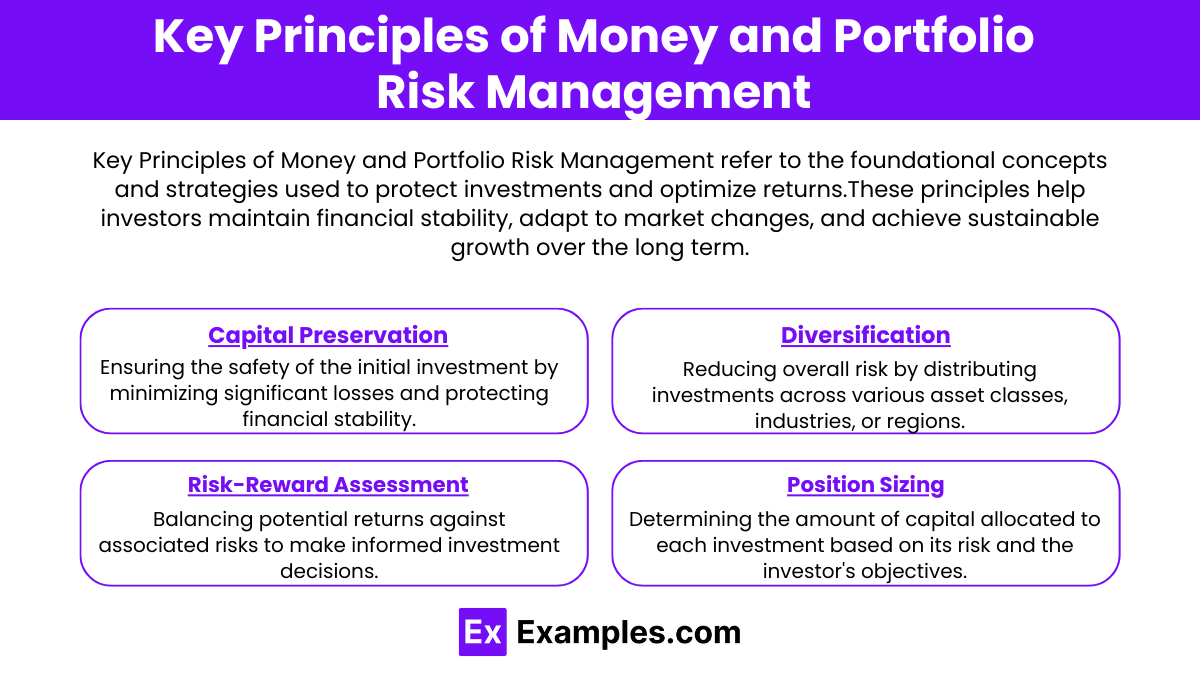

Key Principles of Money and Portfolio Risk Management

- Capital Preservation

- The primary objective of risk management is to protect the initial capital.

- Avoid unnecessary exposure to high-risk assets that could lead to significant losses.

- Use conservative strategies to ensure the longevity of the portfolio, especially for long-term goals.

- Diversification

- Spreading investments across asset classes (stocks, bonds, real estate, etc.), industries, and geographical regions reduces concentration risk.

- Diversification ensures that poor performance in one area does not significantly impact the overall portfolio.

- Maintain an optimal mix based on risk tolerance and market conditions.

- Risk-Reward Assessment

- Analyze the potential return on an investment relative to the risk involved using metrics like the Sharpe ratio.

- Consider whether the risk aligns with the overall investment objectives and financial goals.

- Avoid investments with disproportionate risks compared to expected returns.

- Position Sizing

- Limit the size of any single investment within the portfolio to control exposure to individual asset risks.

- Use formulas such as the Kelly Criterion or allocate based on percentage risk per trade.

- Ensure the portfolio remains balanced even when a single investment performs poorly.

Importance of Money and Portfolio Risk Management

- Preservation of Capital: Effective money management ensures the protection of the initial investment, minimizing the risk of substantial losses.

- Optimization of Returns: Proper risk management balances risk and reward, enabling investors to achieve optimal returns without taking unnecessary risks.

- Control Over Financial Stability: Managing portfolio risk helps maintain financial stability by avoiding overexposure to volatile assets.

- Alignment with Financial Goals: Risk management strategies ensure that investment decisions align with long-term financial objectives.

- Reduction of Emotional Decision-Making: A structured approach to money and portfolio risk management reduces the impact of emotions like fear or greed during market fluctuations.

Applications of Money and Portfolio Risk Management

1. Investment Portfolio Optimization

Asset allocation strategies to maximize returns for a given risk level. Balancing equities, bonds, and alternative investments using models like the Efficient Frontier or Monte Carlo simulations. Using risk-adjusted metrics like the Sharpe Ratio to fine-tune portfolio performance.

2. Financial Risk Assessment

Identifying, quantifying, and mitigating risks such as market, credit, or operational risks. Utilizing Value-at-Risk (VaR) models to estimate potential losses over a specified timeframe. Applying stress-testing scenarios to assess risk under adverse market conditions.

3. Hedging Strategies

Mitigating risk exposure using derivatives like options, futures, and swaps. Protecting portfolios from currency fluctuations, interest rate changes, or commodity price volatility. Employing dynamic hedging techniques to manage financial uncertainty.

4. Capital Allocation

Ensuring efficient allocation of resources within diversified portfolios. Prioritizing high-performing sectors and reducing exposure to underperforming areas. Using quantitative techniques to optimize capital distribution.

5. Liquidity Management

Monitoring and managing cash flows to meet short-term obligations without sacrificing returns. Maintaining liquidity reserves to handle unforeseen expenses or market downturns. Utilizing cash flow forecasting to ensure financial stability.

6. Regulatory Compliance

Implementing systems to adhere to financial regulations and reduce operational risks. Monitoring compliance with Basel III, MiFID II, or similar frameworks. Maintaining accurate documentation and audit trails to avoid penalties.

7. Scenario Analysis and Stress Testing

Simulating adverse market conditions to understand potential impacts on portfolio performance. Preparing contingency plans to manage extreme financial downturns. Enhancing risk management frameworks based on testing outcomes.

8. Performance Attribution

Analyzing portfolio performance to identify contributing factors like asset selection or market timing. Adjusting strategies based on detailed performance metrics. Enhancing decision-making processes for future investments.

Examples

Example 1. Diversification to Reduce Portfolio Risk

Money and portfolio risk management emphasize diversification across asset classes to minimize risk. By allocating investments across stocks, bonds, real estate, and other assets, an investor ensures that a downturn in one sector does not drastically impact the portfolio. This strategy optimizes risk-return balance, aligning with financial goals while safeguarding against market volatility.

Example 2. Implementing Stop-Loss Strategies

Risk management often involves setting stop-loss orders to limit potential losses. For example, an investor holding a volatile stock can place a stop-loss at 10% below the purchase price. This approach protects the portfolio from significant declines while maintaining liquidity to reinvest in more promising assets.

Example 3. Assessing Risk Tolerance

Effective money and portfolio management requires assessing an investor’s risk tolerance based on factors like age, income, and financial goals. A conservative investor might focus on low-risk bonds and fixed-income securities, while an aggressive investor may allocate more to high-growth stocks. This personalized approach ensures that investment decisions align with an individual’s financial comfort and objectives.

Example 4. Utilizing Hedging Techniques

Portfolio risk management can involve hedging strategies like options or futures contracts. For instance, an investor anticipating market volatility might use index options to hedge against potential losses in a stock-heavy portfolio. This minimizes exposure to adverse price movements while maintaining the potential for gains.

Example 5. Rebalancing Portfolios Regularly

Money and portfolio risk management stress the importance of regular portfolio rebalancing to maintain the desired asset allocation. If a portfolio’s equity portion outperforms and becomes disproportionately large, rebalancing involves selling some equities and reinvesting in underperforming asset classes. This disciplined approach helps in managing risk and aligning the portfolio with long-term financial goals.

Practice Questions

Question 1

What is the primary objective of portfolio diversification in risk management?

A. Maximizing returns by focusing on high-performing assets

B. Minimizing investment costs through low-cost index funds

C. Reducing unsystematic risk through asset variety

D. Eliminating systematic risk entirely

Answer: C. Reducing unsystematic risk through asset variety

Explanation:

Portfolio diversification aims to reduce unsystematic risk—risks specific to individual companies or industries—by spreading investments across various asset classes, sectors, or geographic regions. While diversification cannot eliminate systematic risk (market-wide risk), it can help mitigate the impact of poor performance from specific investments, ensuring the portfolio is less volatile.

Question 2

Which of the following is a characteristic of systematic risk?

A. It can be mitigated through diversification.

B. It arises from factors like economic recessions and inflation.

C. It impacts only specific industries or companies.

D. It is entirely avoidable with proper risk management strategies.

Answer: B. It arises from factors like economic recessions and inflation

Explanation:

Systematic risk, also known as market risk, is caused by macroeconomic factors that affect the entire market, such as interest rate changes, political instability, or global economic events. Unlike unsystematic risk, systematic risk cannot be mitigated through diversification and must be managed through strategies like asset allocation or hedging.

Question 3

Which measure is commonly used to evaluate a portfolio’s risk-adjusted return?

A. Standard deviation

B. Sharpe ratio

C. Beta coefficient

D. Alpha

Answer: B. Sharpe ratio

Explanation:

The Sharpe ratio assesses how much return a portfolio generates for each unit of risk taken, making it a popular metric for evaluating risk-adjusted returns. It is calculated by subtracting the risk-free rate from the portfolio return and dividing the result by the portfolio’s standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance. Standard deviation measures total risk, Beta assesses sensitivity to market movements, and Alpha evaluates excess return relative to a benchmark.