Options are essential instruments in financial markets, offering flexibility and strategic opportunities for hedging, speculation, and income generation. This topic explores the fundamentals of options, including the mechanics of calls and puts, pricing models, and the factors affecting option premiums. It also covers key concepts like intrinsic and extrinsic value, the Greeks, and option strategies used by traders to manage risk and leverage positions. Understanding options enables technical analysts to incorporate options data into market analysis, enhancing insights into sentiment and potential market movements. Proficiency in these areas is crucial for effectively utilizing options within a technical analysis framework.

Learning Objectives

In studying “Options” for the CMT, you should learn to understand the fundamental concepts of options, including types (call and put options), terms (strike price, expiration date, premium), and intrinsic vs. extrinsic value. Analyze how options are used in trading strategies, focusing on risk management, leverage, and hedging techniques. Evaluate the pricing models for options, such as the impact of volatility, interest rates, and time decay on option value. Understand common strategies like covered calls, protective puts, and spreads, and how they apply to different market scenarios. Additionally, develop the ability to interpret option greeks (delta, gamma, theta, vega) to assess risk exposure and manage options portfolios effectively.

Fundamental Concepts of Options

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Options are versatile tools in finance and offer opportunities for income generation, hedging, and strategic investment, making them valuable in portfolio management. Here’s a breakdown of the key concepts:

1. Types of Options: Call and Put

- Call Option: A call option provides the holder the right to buy an underlying asset at the strike price before the expiration date. Investors typically buy call options when they expect the asset’s price to rise, as it allows them to purchase the asset at a lower price than the market if the asset appreciates.

- Put Option: A put option provides the holder the right to sell the underlying asset at the strike price before the expiration date. Investors buy put options when they expect the asset’s price to fall, as it allows them to sell the asset at a higher price than the market if the asset depreciates.

Example: If an investor holds a call option to buy a stock at $50 and the stock rises to $60, they can exercise the option to buy at $50, capturing a profit.

2. Key Terms in Options

- Strike Price: The price at which the option holder can buy (for calls) or sell (for puts) the underlying asset. The strike price is set when the option contract is created.

- Expiration Date: The last date on which the option can be exercised. After this date, the option becomes worthless if not exercised.

- Premium: The price paid by the buyer to acquire the option. The premium compensates the seller (writer) of the option for the potential risk they take in granting the option’s rights.

Example: A call option on a stock with a $100 strike price and a $5 premium would cost the buyer $5. If the stock rises above $100, the option can be profitable; if it stays below $100, the premium represents the buyer’s loss.

3. Intrinsic and Extrinsic Value

- Intrinsic Value: The difference between the option’s strike price and the current market price of the underlying asset. For call options, it’s the market price minus the strike price; for put options, it’s the strike price minus the market price. Intrinsic value only exists when an option is “in the money.”

- Extrinsic Value: Also known as “time value,” this reflects the additional value of an option due to time remaining until expiration and market volatility. Even if the option has no intrinsic value (is “out of the money”), it may still hold extrinsic value.

Example: A call option with a strike price of $50 on a stock trading at $55 has an intrinsic value of $5. If the option is priced at $7, the remaining $2 is extrinsic value.

Options in Trading Strategies

Options are versatile financial instruments that can be used to create a wide range of trading strategies tailored to different market scenarios, risk tolerance, and profit goals. Unlike standard equity trades, options provide unique benefits, such as leveraging positions, managing risk, and generating income, making them suitable for both speculative and conservative investors. Below are some key options trading strategies and their applications.

1. Covered Call Strategy

The covered call strategy involves holding a long position in a stock while selling a call option on the same stock. This approach generates income from the call premium and provides limited downside protection.

- Purpose: Primarily used for generating additional income from a stock position, especially if the investor expects limited price movement.

- Application: If the stock’s price remains below the strike price, the option expires worthless, allowing the investor to keep the premium. However, if the price rises above the strike price, the stock may be called away, limiting upside potential.

Example: An investor owns 100 shares of XYZ stock at $50 and sells a call option with a $55 strike price. They receive a premium, and if the stock remains below $55, they retain the shares and the premium. If the price goes above $55, they must sell the shares at that price.

2. Protective Put Strategy

A protective put involves buying a put option on a stock that the investor already owns, creating a form of insurance against downside risk.

- Purpose: Protects against potential losses in a stock while maintaining upside potential.

- Application: If the stock price declines, the put option’s value increases, offsetting losses on the stock. If the stock price rises, the investor benefits from the stock’s appreciation while the put option may expire worthless.

Example: An investor buys 100 shares of ABC stock at $60 and purchases a put option with a $55 strike price. If ABC drops below $55, the investor can sell at $55, limiting their losses.

3. Long Call Strategy

A long call strategy involves buying a call option, giving the investor the right to purchase the underlying asset at a specified price within a certain time frame.

- Purpose: A speculative strategy used to profit from an expected rise in the asset’s price.

- Application: The investor’s maximum loss is limited to the premium paid, while potential profit is unlimited if the asset’s price rises significantly.

Example: An investor buys a call option for DEF stock with a $50 strike price, expiring in one month. If DEF rises to $60, the investor profits from the price increase, as they can buy at $50 and sell at $60.

4. Long Put Strategy

The long put strategy involves purchasing a put option, which provides the investor with the right to sell the asset at a specific price, useful when expecting a price decline.

- Purpose: A bearish strategy aimed at profiting from a decrease in the asset’s price.

- Application: The maximum loss is the premium paid, and the potential profit increases as the asset’s price falls.

Example: An investor buys a put option for GHI stock at a $45 strike price. If GHI’s price drops to $35, the investor can sell at $45, earning a profit from thSTANDARDS OF PROFESSIONAL CONDUCTe decline.

5. Straddle Strategy

A straddle strategy involves buying both a call and a put option on the same asset, with the same strike price and expiration date. This strategy profits from significant price movements in either direction.

- Purpose: Used when an investor expects high volatility but is uncertain about the direction of the price movement.

- Application: If the asset’s price moves significantly, either the call or put option will become valuable. However, if the price remains stable, both options may expire worthless, resulting in a loss of premiums paid.

Example: An investor buys both a call and a put option on JKL stock at a $100 strike price. If JKL rises to $120 or falls to $80, the investor profits from the movement. If JKL remains around $100, they lose the premiums.

6. Iron Condor Strategy

The iron condor strategy involves selling an out-of-the-money call and put, while buying further out-of-the-money call and put options on the same asset. This strategy profits when the asset’s price stays within a specified range.

- Purpose: Generates income in a low-volatility market, where the asset’s price is expected to remain stable.

- Application: The maximum profit is limited to the premiums received, and the maximum loss is capped by the protective long options.

Example: An investor creates an iron condor on MNO stock by selling a $90 put and $110 call and buying a $85 put and $115 call. If MNO stays between $90 and $110, the investor keeps the premiums.

7. A bull call spread involves buying a call option at a lower strike price and selling another call at a higher strike price. This strategy limits both potential profit and risk.

- Purpose: Profits from a moderate price increase in the asset.

- Application: The maximum profit is the difference between the strike prices minus the net premium paid, while the maximum loss is limited to the net premium.

Example: An investor buys a call option for PQR at a $50 strike price and sells a call at a $55 strike price. If PQR rises to $55, they realize the maximum profit.

Evaluating Pricing Models for Options

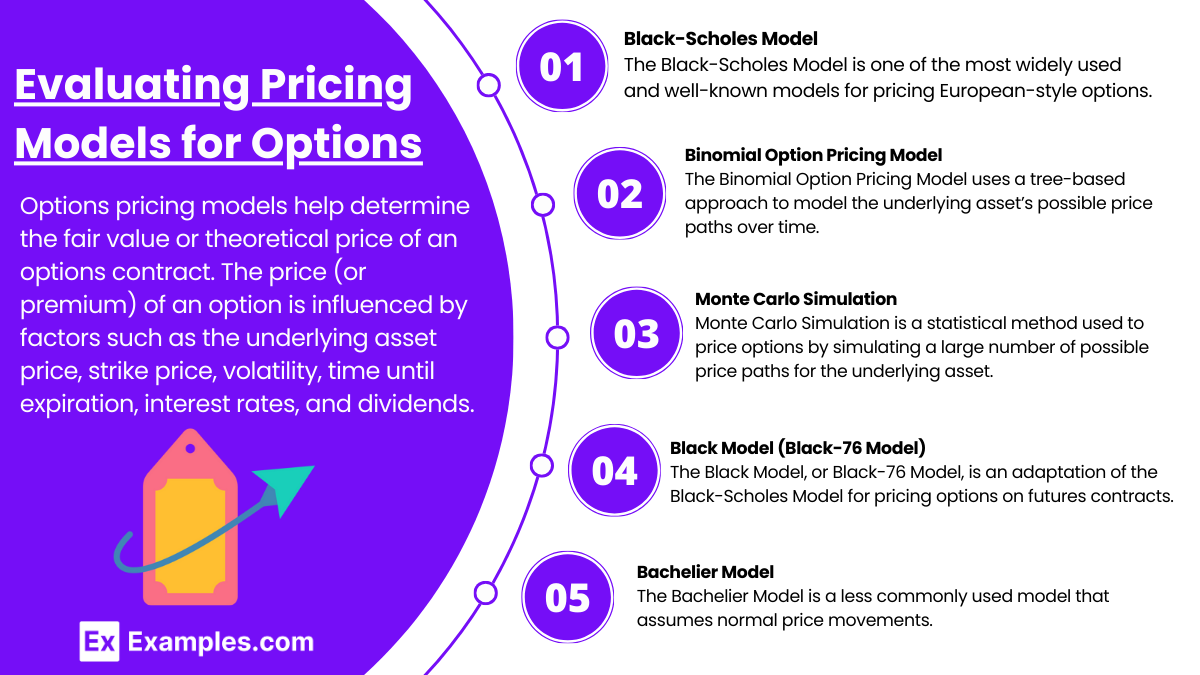

Options pricing models help determine the fair value or theoretical price of an options contract. The price (or premium) of an option is influenced by factors such as the underlying asset price, strike price, volatility, time until expiration, interest rates, and dividends. Here are the fundamental pricing models used to evaluate options:

1. Black-Scholes Model

The Black-Scholes Model is one of the most widely used and well-known models for pricing European-style options, which can only be exercised at expiration.

- Key Variables: The Black-Scholes formula considers the underlying asset price, strike price, time to expiration, volatility, and risk-free interest rate.

- Assumptions: It assumes constant volatility, no dividends, and continuous trading in a frictionless market.

- Formula: C = S0⋅N(d1)−X⋅e−rt⋅N(d2) where:

- C is the call option price

- S0 is the current stock price

- X is the strike price

- t is the time to expiration

- r is the risk-free interest rate

- N(d1)) and N(d2) are the cumulative distribution functions of the standard normal distribution.

- Pros and Cons: While it provides a closed-form solution for option pricing, its assumptions of constant volatility and no dividends limit its real-world accuracy for certain assets.

Example: An investor using the Black-Scholes model might calculate the price of a European call option on a stock trading at $100 with a strike price of $110, expiring in 6 months, at a volatility of 20%, and a risk-free rate of 5%.

2. Binomial Option Pricing Model

The Binomial Option Pricing Model uses a tree-based approach to model the underlying asset’s possible price paths over time. It can be used to price both European and American-style options, as it allows for early exercise.

- Process: The model creates a tree of possible future prices for the underlying asset, where each node represents a possible price at a given time. The model moves up or down based on assumed probabilities.

- Calculation: The option value is derived by working backward from expiration, calculating the option’s price at each node, considering the probability of up or down movements.

- Adjustability: The binomial model is flexible and can handle variable volatility and dividends, making it suitable for American options.

Pros and Cons: Although more computationally intensive, it is advantageous for American options since it allows for early exercise decisions at each step.

Example: A trader might use a 3-step binomial model to evaluate the price of an American put option, factoring in the possibility of exercising the option early based on the asset price at each node.

3. Monte Carlo Simulation

Monte Carlo Simulation is a statistical method used to price options by simulating a large number of possible price paths for the underlying asset. It’s particularly useful for complex options or exotic options with unique payoff structures.

- Process: Thousands of random price paths are generated for the underlying asset, and the payoff is calculated for each path. The average of these payoffs, discounted back to present value, represents the option price.

- Flexibility: Monte Carlo simulation is adaptable to various asset types, volatility structures, and payoffs, making it ideal for complex and exotic options.

- Applications: This model is often used in situations where standard models are insufficient, such as for path-dependent options (e.g., Asian options, barrier options).

Pros and Cons: Monte Carlo is powerful for complex options but computationally intensive, requiring a large number of simulations for accurate results.

Example: An analyst might use Monte Carlo simulation to price a barrier option that pays off only if the underlying asset stays within a specific price range during the option’s life.

4. Black Model (Black-76 Model)

The Black Model, or Black-76 Model, is an adaptation of the Black-Scholes Model for pricing options on futures contracts. It’s used in interest rate derivatives, commodities, and currency options.

- Adaptation: The Black Model adjusts for the forward or futures price rather than the spot price, making it suitable for pricing options on futures and other derivatives with non-equity underlyings.

- Applications: It’s commonly used to price European options on futures contracts and for caps, floors, and other interest rate derivatives.

Pros and Cons: The Black Model is well-suited for futures-based options but limited to instruments that don’t pay dividends or other yields.

Example: A commodities trader might use the Black Model to determine the fair price of a European call option on crude oil futures expiring in three months.

5. Bachelier Model

The Bachelier Model is a less commonly used model that assumes normal price movements (rather than log-normal), resulting in potential for both positive and negative prices.

- Applications: It’s often used in the interest rate markets, particularly for options on interest rate products and spread options.

- Difference: Unlike Black-Scholes, which assumes log-normal returns (always positive), the Bachelier Model allows for prices to theoretically go negative.

Pros and Cons: The Bachelier Model is limited in standard financial markets due to the assumption of normal rather than log-normal returns but useful in specific cases where negative prices are plausible.

Example: A fixed-income analyst might use the Bachelier Model for pricing an option on an interest rate swap, as it can handle negative rates.

Common Options Strategies

Options strategies are combinations of buying or selling options (puts and calls) designed to achieve specific objectives, such as generating income, managing risk, or speculating on price movements. Here are some widely used options strategies, each with unique risk and reward profiles suited for different market conditions and investor objectives.

1. Covered Call

The covered call is an income-generating strategy that involves holding a long position in an asset while selling (writing) a call option on the same asset.

- Objective: Generate additional income from the option premium, especially if the asset is expected to trade within a range.

- Risk and Reward: Limited upside if the asset price rises above the strike price (since the call can be exercised). Downside risk is mitigated somewhat by the premium received, but the stock price could fall.

Example: An investor holds 100 shares of a stock currently trading at $50 and sells a call option with a $55 strike price, collecting a premium. If the stock remains below $55, the option expires worthless, and the investor keeps the premium.

2. Protective Put

A protective put is a risk management strategy that involves holding a long position in a stock and buying a put option to protect against downside risk.

- Objective: Limit potential losses by setting a “floor” or minimum exit price.

- Risk and Reward: Limited downside risk due to the put, while the upside remains unlimited (minus the premium paid for the put).

Example: An investor holds 100 shares of a stock at $50 and buys a put option with a $45 strike price. If the stock falls below $45, the investor can sell at $45, limiting losses. If the stock rises, the put expires, but the investor still benefits from the increase.

3. Long Straddle

A long straddle involves buying both a call and a put option on the same asset with the same strike price and expiration date.

- Objective: Profit from significant price movement in either direction, making it a suitable strategy when high volatility is anticipated.

- Risk and Reward: High risk as the strategy requires a significant price move to cover the cost of both premiums. Unlimited upside if the price moves significantly in either direction, limited downside to the premiums paid.

Example: An investor buys a call and a put option on a stock trading at $50, both with a $50 strike price. If the stock moves significantly away from $50, either the call or put will generate a profit large enough to offset the cost of the other.

4. Long Strangle

A long strangle is similar to a straddle but involves buying a call and a put with different strike prices, typically out of the money.

- Objective: Profit from a significant price movement in either direction but at a lower initial cost than a straddle.

- Risk and Reward: Cheaper than a straddle but requires an even greater price movement to be profitable. Profit potential is still significant if the price moves beyond the break-even points.

Example: An investor buys a call option with a $55 strike and a put option with a $45 strike on a stock trading at $50. If the stock moves significantly above $55 or below $45, one of the options will become profitable, offsetting the cost of both premiums.

5. Bull Call Spread

A bull call spread involves buying a call option at a lower strike price while selling a call at a higher strike price.

- Objective: Benefit from a moderate price increase in the underlying asset.

- Risk and Reward: Limited risk to the net premium paid, with limited upside due to the cap created by the short call. This strategy is cheaper than buying a single call.

Example: An investor buys a call with a $50 strike price and sells a call with a $55 strike. If the stock rises to $55, the investor profits from the difference between the strike prices minus the net premium paid.\

6. Bear Put Spread

A bear put spread is the opposite of a bull call spread, involving buying a put option at a higher strike price while selling a put at a lower strike price.

- Objective: Profit from a moderate decrease in the price of the underlying asset.

- Risk and Reward: Limited downside risk and limited profit potential, as profits are capped at the difference between the two strikes minus the net premium.

Example: An investor buys a put with a $55 strike price and sells a put with a $50 strike. If the stock price falls to $50, the investor profits from the spread between the strike prices, offset by the premium cost.

7. Iron Condor

An iron condor is a more complex strategy that involves creating two spreads: a bull put spread and a bear call spread. It involves selling two options (a call and a put) close to the current price and buying further out-of-the-money call and put options as protection.

- Objective: Profit from low volatility, earning premiums if the price stays within a defined range.

- Risk and Reward: Limited risk and profit potential, but the strategy benefits from a lack of significant movement in the underlying asset.

Example: An investor sells a $50 call and a $50 put while buying a $55 call and a $45 put. If the stock stays between $45 and $55, the investor profits from the premiums.

8. Collar

A collar strategy involves buying a protective put and selling a covered call on the same asset. This strategy is often used to lock in gains or limit potential losses.

- Objective: Provide downside protection on a long stock position while limiting upside gains.

- Risk and Reward: Limited risk (due to the put) and limited reward (due to the call), making it a conservative strategy for protecting gains.

Example: An investor holding a stock trading at $50 might sell a call at $55 and buy a put at $45. This setup protects against significant losses below $45 but limits profit above $55.

Examples

Example 1: Stock Market Options

In the financial markets, options are contracts that give an investor the right, but not the obligation, to buy or sell an underlying asset (like stocks) at a predetermined price before a specific expiration date. For instance, a call option allows the buyer to purchase a stock at a set price, while a put option allows selling it. This provides investors flexibility to hedge against price movements or speculate on future changes.

Example 2: Employee Stock Options

Many companies offer stock options as part of employee compensation packages. These options give employees the right to purchase company shares at a discounted price after a certain vesting period. The idea is to align the interests of the employees with the company’s long-term performance, allowing them to benefit from the company’s stock price appreciation.

Example 3: Real Estate Options

In real estate, an option agreement gives the buyer the right to purchase a property at a specific price within a certain time frame, without the obligation to do so. For example, a developer may secure an option to buy land for future construction, giving them time to evaluate the property’s potential without committing immediately.

Example 4: Options in Insurance

In the context of insurance, options can be added to a basic policy to customize coverage. For example, a life insurance policyholder may purchase additional riders, such as a critical illness option, which provides extra benefits in case the insured person is diagnosed with a serious illness. These options allow for flexible coverage tailored to individual needs.

Example 5: Investment Options

Investment options can refer to the various types of financial instruments or assets that an investor can choose to invest in, such as mutual funds, bonds, stocks, or real estate. The choice of options depends on the investor’s risk tolerance, investment goals, and time horizon. Investors use these options to diversify their portfolios and optimize returns based on their financial objectives.

Practice Questions

Question 1

Which of the following best describes a call option?

A) It gives the buyer the right to sell an asset at a specific price within a specified time.

B) It gives the buyer the right to buy an asset at a specific price within a specified time.

C) It obligates the buyer to buy an asset at a specified price within a specified time.

D) It gives the buyer the right to borrow money from a bank.

Correct Answer: B) It gives the buyer the right to buy an asset at a specific price within a specified time.

Explanation: A call option gives the buyer the right, but not the obligation, to purchase an underlying asset at a specified price, known as the strike price, before the option expires. This option is typically used when an investor expects the price of the asset to rise. Option A describes a put option, while C is incorrect because options are not obligations for the buyer. Option D is unrelated to options trading.

Question 2

What is the primary difference between a call option and a put option?

A) A call option allows the buyer to sell the asset, while a put option allows the buyer to buy the asset.

B) A call option gives the buyer the right to buy the asset, while a put option gives the buyer the right to sell the asset.

C) A put option is more expensive than a call option.

D) A call option can only be exercised if the asset price falls.

Correct Answer: B) A call option gives the buyer the right to buy the asset, while a put option gives the buyer the right to sell the asset.

Explanation: A call option gives the buyer the right to buy an underlying asset at a predetermined price, while a put option gives the buyer the right to sell the asset at a predetermined price. Both options provide the buyer with flexibility, but they apply to different types of market expectations. Option A is incorrect as it reverses the function of the two options, and Option C does not necessarily reflect the cost comparison, as option prices depend on various factors. Option D is incorrect since a call option is exercised when the asset price rises.

Question 3

Which of the following is true about options contracts?

A) They have no expiration date.

B) The buyer has an obligation to exercise the option.

C) They can be traded on exchanges or over-the-counter.

D) They always have a fixed price and cannot be changed.

Correct Answer: C) They can be traded on exchanges or over-the-counter.

Explanation: Options contracts can be traded on regulated exchanges, such as the Chicago Board Options Exchange (CBOE), or over-the-counter (OTC), where they are privately negotiated. Unlike stocks, options have expiration dates (option A is incorrect), and while the buyer has the right, not the obligation, to exercise the option (option B is incorrect), their prices are determined by market forces and may fluctuate (option D is incorrect).