22+ Insurance Brochure Examples to Download

There is also insurance which includes savings and investments. These are usually the things offered by insurance companies to the public. However, in order to sell, they must showcase their services to the general market. They must use different methods and types of advertising campaigns to captivate people’s attention. With this, brochures come into view. Through best brochure, the clients of these insurance companies can easily figure out the insurance plans that a company is offering. Hence, these brochures must be designed well to be effective and efficient in communicating with people.

Insurance Tri-Fold Brochure Template

Insurance Bi-Fold Brochure Template

To help you in designing your brochure, below are the examples of insurance brochure designs. Check them all out now. You may also check other brochure designs as well.

Simple Health Insurance Company Tri-Fold Brochure Template

As we grow older and older, we feel the need to be secured especially in terms of health and money to have a guaranteed future. Not only that, in terms of anticipating misfortunes and preventing large losses, we want to be compensated even for an amount equal to or lower than what has been lost. And, that is when insurance companies take the spotlight. These companies help people prepare for their future depending on their insurance plan.

Health Insurance Company Bi-Fold Brochure Template

Car Insurance Company Tri-Fold Brochure Template

Car Insurance Company Bi-Fold Brochure Template

Insurance Agency Bi-Fold Brochure Template

Insurance Agency Tri-Fold Brochure Template

Insurance Tri-Fold Brochure Example

Insurance Company Tri-Fold Brochure Example

Continental Insurance Pavilion New York World’s Fair Brochure Example

Landscape Brochure for Insurance Companies Example

Insurance Agency Tri-Fold Brochure Example

Insurance Company Bi-Fold/Half-Fold Brochure Example

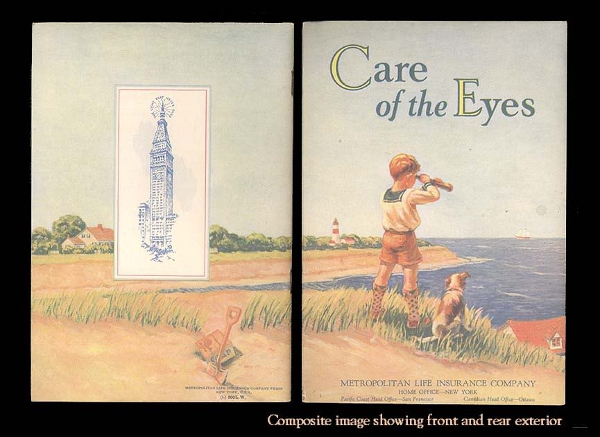

Care of the Eyes—A Beautifully Poignant Vintage Book Example

Types of Insurance

Many people would not fully believe in investing in insurance companies because they feel like their insurance premiums might seem to be a waste especially when the insured never encounter a loss. But, you must know that the primary function of insurance programs is to ensure and safeguard you or your business against unexpected losses. You may also see examples of company brochure.

There are several types of insurance that you need depending on the type of business you are in or you own. Generally, there are two broad categories of insurance which is the required insurance and the optional insurance. Required insurance encompasses the insurance that is required by the government if you are an employer or those that are required by the lenders to protect their investment. On the other hand, there are a lot of insurance types under optional insurance which includes liability insurance, property insurance, and home-based business insurance. A detailed discussion will be presented below. You may also like real estate brochure designs & examples.

1. Required Insurance

In most of the countries, the government requires certain types of insurance. This is effective if you are an employer whether in a public or private section. The insurance purchased, at a minimum, must be workers’ compensation and unemployment insurance. There are some places in which you must also purchase disability insurance for your employees, if you own a business in places such as California, Puerto Rico, New York, New Jersey, Rhode Island, Hawaii, and many others. The insurance is to provide a financial safety net to the employees in case they get into an accident while doing the job or in case they lose their jobs. The company need not worry to pay any part of the insurance plan since it can just be deducted as a business expense when filing the entity’s business taxes. You may also check out advertising brochure examples.

2. Liability Insurance

Although this is a requirement for some companies and professionals, it is not generally a must to pay liability insurance. Liability insurance plans are used to pay legal fees with regard to the accident, professional errors, or negligence. This is common for trucking companies to have a general liability insurance and for physicians and other similar professions to have a professional liability insurance. In case the company receives a lawsuit, the insurance company will pay the settlements or judgments against the company for a certain ceiling or limit of the insurance policy. In a manufacturing company, they must have product liability insurance to pay for a product defect that results in an injury. You might be interested in medical brochure examples.

3. Property Insurance

Another type of insurance is the property insurance which comes in three subcategories which are basic, broad, and special. The coverage differs on the type of policy, and the insurance company has to pay for the damages caused by typhoon or theft either replacement cost or the actual value of the property damaged whichever is stated in the insurance policy. The items covered by the insurance policy include the following: machinery, inventory, building, and intangible assets such as trademarks, copyrights, and patents. In cases where you need to close your business and do repairs because of the damage caused by storm or fire, business interruption policies will pay for your lost earnings. You may also see examples of bi-fold brochure design.

4. Home-Based Businesses

For home-based businesses, it is not necessary that the homeowner’s policy will cover your insurance needs. To cover your business, it is possible to add an endorsement to your homeowner’s policy. You may also refer to insurance agents and talk about stand-alone policies such as a business owner’s policy in case you satisfy one of the following conditions: your revenue is $5000 and above, the clients will come to your home, or you own an expensive equipment. The role of the insurance company is to pay for losses in case of theft and storms or provide assistance if you are sued. You may also like tri-fold brochure designs & examples.

Benefits of Insurance

At this point, you already know the primary benefit of insurance which is to safeguard against losses. The next thing you need to know is the details on what kind of losses your insurance company will cover for you. Having an understanding of these benefits is critical especially when deciding on whether or not to get the insurance and which insurance fits what your business or you as an individual. It is also helpful in justifying your purchase for a certain insurance. You will pay for the insurance policy; hence, it’s fitting and proper that you have at least a basic understanding of them. You may also see examples of business brochure design.

Below are the benefits of insurance that one must know before purchasing an insurance plan.

1. Firstly, the most blatant benefit of having an insurance policy is to cover losses. It compensates organizations or individuals who encountered losses or damages as specified in the insurance plan that the organization or individual purchased.

2. The next benefit of insurance is it manages cash flow uncertainty. The insurance will cover a certain amount of losses when they occur, reducing significantly the uncertainty of paying for losses out-of-pocket.

3. Insurance policies are also in compliance with legal requirements. It also provides evidence of enough financial resources and meets statutory and contractual requirements.

4. Also, insurance policies are beneficial because it promotes risk control activity. It provides incentives to implement a loss control program. This is to meet the policy requirements and premium savings incentives. You may also check out examples of education brochure design.

5. Another benefit of insurance is the efficient use of an insured’s resource. The insured’s money will be efficiently used because it is no longer necessary to set aside a large amount of money to pay for unexpected losses or financial consequences of the risk exposures that can be insured.

6. An uncommon benefit of having an insurance policy is to support the insured’s credit. In some types of insurance policies, the lender will be guaranteed to be paid in case the collateral of the loan is destroyed or damaged by an event covered by the insurance, reducing the lender’s uncertainty of default by the party who borrowed the funds. You may also see sales promotion brochures.

7. Many insurance companies collect premiums, invest them in a different investment vehicle, and pay claims in case they will source, thus providing a source of investment funds. There are also insurance policies that include investment plans as well as saving plans for the future of the insured.

8. Lastly, an insurance policy is beneficial as it reduces social burden, such as those uncompensated accident victims and other uncertainties in the society. The burden will be passed on to the insurance company offering the insurance, hence lowering the burden of the people in a society. You may also like event brochure designs & examples.

Insurance Companies Multipurpose Brochure Template Example

Health Insurance DL Card and Brochure Template Example

Insurance Corporate Bi-Fold Brochure Example

Vintage 1950’s Booklet Brochure Example

Company Brochure Insurance Bi-Fold Design Template Example

Health Insurance Poster and Brochure Template Example

Auto Insurance Multipurpose Tri-Fold Brochure Example

Health Insurance Brochure Template Example

General Idea

Most, if not all, wanted to have a secured future to look forward to. We also wanted to receive something in return in case of any losses or damage caused by accidents, fire, theft, storm, or other uncertainties. Insurance companies know what we desire, and that is why they offer services to meet the need for security of the people. You may also see examples of service brochures.

There are many types of insurance and they are: required insurance which is required by government agencies for the employer; liability insurance which pays the legal fees associated with accidents; property insurance which comes in three types such as basic, broad, and special; and home-based business insurance which covers employers working home-based. You may also like indesign brochure examples.

So why do people grab these insurance plans and programs? The reasons are as follows: it serves as the payment for losses; it manages cash flow uncertainty; this is to comply with legal requirements; it promotes risk control activity; this is to have an efficient use of an insured’s resources; it serves as a support for the insured’s credit; it provides a source of investment funds; and lastly, it reduces social burden. You may also check out fitness brochure designs & examples.

Knowing these things would make you want to get started with your insurance today. From the service providers’ perspective, knowing this will help them improve their offers and services to the people. They will also get a glimpse of what is commonly preferred by people when it comes to insurance programs. You might be interested in training brochure designs.