5+ Nonprofit Annual Budget Examples to Download

Nonprofit activities are paved with good intentions, but many organizations are unaware of the importance of budgeting when implementing plans and strategies for the coming year. Nonprofits frequently struggle and discover too late that a well-planned budget is critical to the organization’s long-term viability and revenue tracking. Learning how to create an annual nonprofit budget can make all the difference in a fundraising year’s success.

5+ How to Make a Non-Profit Annual Budget Examples

1. How to Make a Non-Profit Annual Budget Basics

2. How to Make a Non-Profit Annual Budget of Income and Expenses

3. How to Make a Non-Profit Annual Budget of Cash Flow

4. How to Make a Non-Profit Annual Budget of Investment

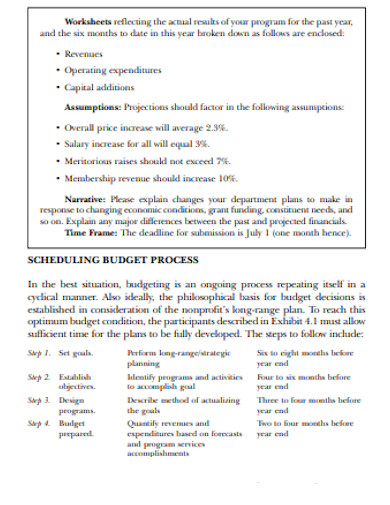

5. How to Make a Non-Profit Annual Budget Scheduling

6. How to Make a Non-Profit Annual Budgetary System

What Is a Budget Plan?

Budgeting is the process of establishing a spending plan for your money. A budget is a term used to describe this spending plan. By creating this spending plan, you can determine in advance whether you will have enough money to accomplish the tasks you need or want to achieve. Budgeting is nothing more than balancing your expenses and income.

How To Create a Non-Profit Annual Budget Plan?

The significance of budgeting to better allocate funds and make more informed decisions for your nonprofit expenses cannot be overstated. The templates we’ve included in this article can assist you in creating a more efficient nonprofit annual budget. But first, if you’re serious about making a plan, here are some guidelines to follow.

1. Reduce the number of line items.

Ensure your line items aren’t too specific and that you don’t have too many items listed. Otherwise, your budget will be too difficult for the rest of your team to interpret and comprehend. Having too many line items makes the budget appear longer than it needs to be, and it limits your ability to allocate costs for the year.

2. Plan your month-by-month budgeting.

Instead of doing an overall annual tracking, use a format that allows you to budget your non-profit activities monthly. This is good for a fiscal year, allowing you to monitor monthly progress or milestones accurately and check for any realignment that may have been overlooked. Then, if necessary, you can make plans to increase revenue.

3. Prioritize short-term objectives.

If you concentrate on your budgeting over a short period, you can only account for monthly or quarterly fundraising events. During the process, you will outline one-time costs and then achieve the remaining short-term goals one by one.

4. Timing and inconsistencies should be considered.

Timing is everything, and fundraising is no exception. When you consider events, funders’ willingness to donate, revenue drives, grants, and large gifts, there are seasons when revenue and expenses will come in and out. Examine and analyze the year when you will have more income coming into the budget for costs more effectively.

5. Fixed costs should be prioritized.

It’s not impossible or difficult to think about your fixed costs. In incurring fixed expenses, you can reduce your overall costs, making it less wasteful. Determine your fixed costs, regardless of the number of financial responsibilities you have, such as rent, employee salaries, insurance, and materials. Create the variable costs from there.

FAQS

What is a nonprofit’s annual operating budget?

A nonprofit operating budget details the organization’s projected annual revenue and expenses. It categorizes your income according to its funding source and your operating expenses according to program and overhead costs. This typically covers capital campaigns and other significant expense campaigns for your nonprofit.

Why is it necessary for a nonprofit to have a budget?

A budget is a tool that can assist a nonprofit in both plannings for the future and assessing its current financial situation. It is common practice to review the budget regularly and compare it to actual cash flow and expenses to see if things are going as planned throughout the year.

Which budget is the most important to prepare first?

Businesses create a sales budget to estimate the revenue they anticipate from their products and services. Because sales are the top line item in all operating budgets, the sales budget is typically the second budget that businesses prepare after the master budget.

A nonprofit budget template is essential for nonprofit organizations to manage their financial resources effectively. A well-planned budget is the first step toward planning the future of a nonprofit organization, as it enables the organization to accomplish its objectives with limited resources.

There is a collection of free nonprofit budget templates available in Word, PDF, and Excel formats that will assist you in making plans about your organization. You can download free monthly and annual nonprofit budget templates in various designs to help you keep track of your financial resources, such as how to raise money and spend it wisely. These templates are fully customizable and designed in a manner that clearly defines each item. So, what are you waiting for? Check the templates and begin creating your annual budget plan today!