15+ Basic Budget Examples to Download

“Money can’t buy happiness”, they say. Perhaps, that is true for personal reasons. However, it could be different for most entrepreneurs. In the business industry, money is an asset. And so when the sales are booming, expect that there is also a rise in expenses. It can be challenging to separate different budget categories. You have to calculate how much goes to the materials and the labor fees. Therefore, you have to consider budgeting basics to align all your expenses with your income. Basic budgets give clarity to the purpose of an organization. Every company has a specific set of goals. Having a budget makes it easy to streamline itself and become more goal-oriented.

Basic Budget Examples & Templates

1. Budget Sheet Template

2. Budget Proposal Template

3. Budget Analysis Template

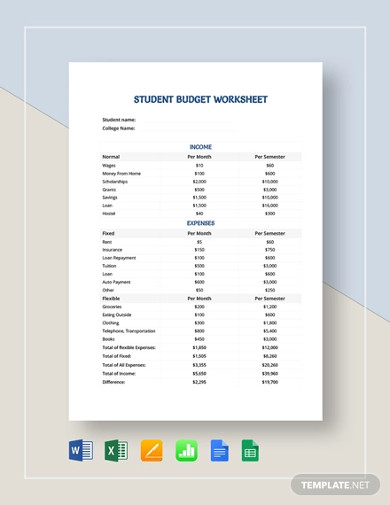

4. Student Budget Worksheet Template

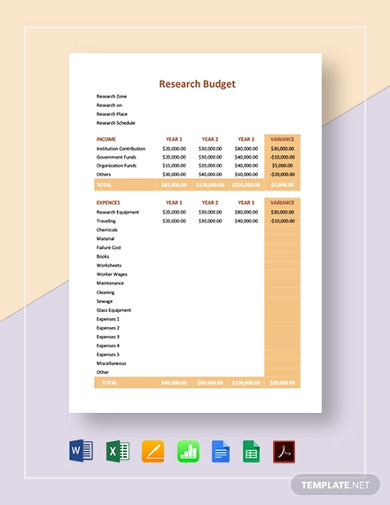

5. Research Budget Template

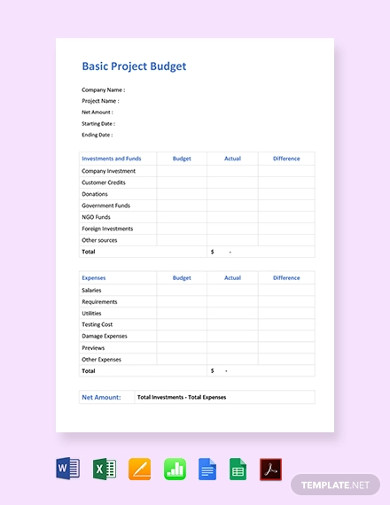

6. Free Basic Project Budget Template

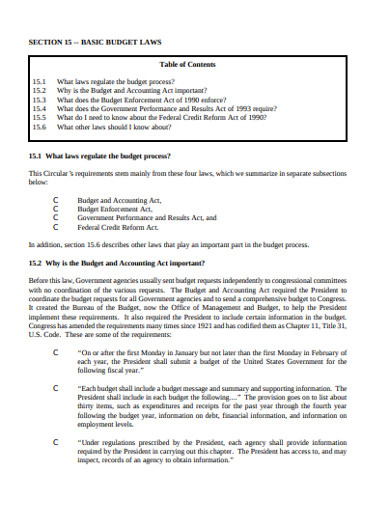

7. Basic Budget Laws

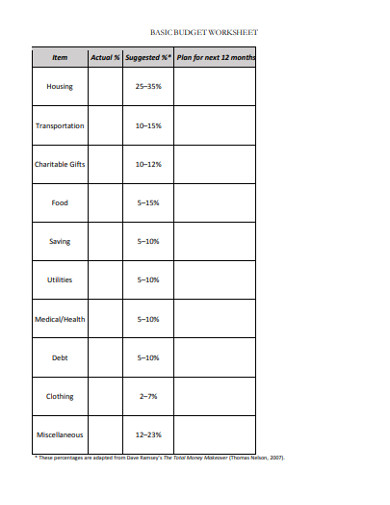

8. Basic Budget Worksheet

9. Basic Budget Lesson

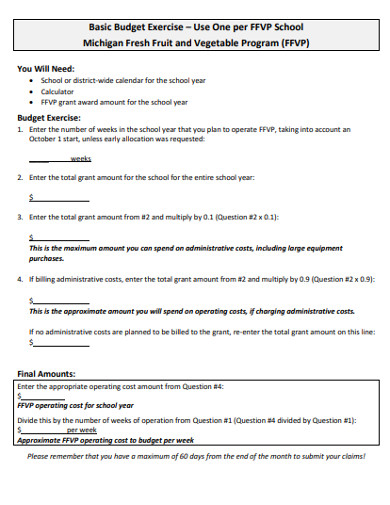

10. Basic Budget Exercise

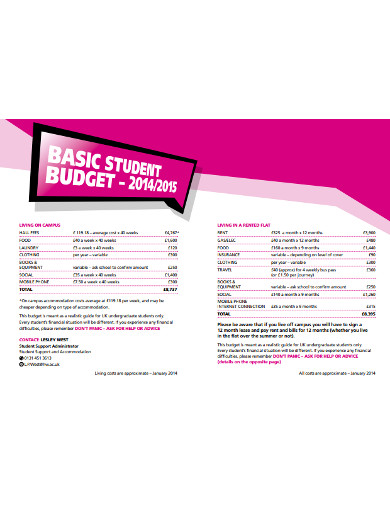

11. Basic Student Budget

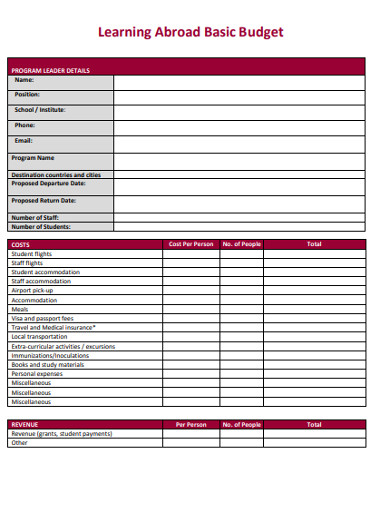

12. Learning Abroad Basic Budget

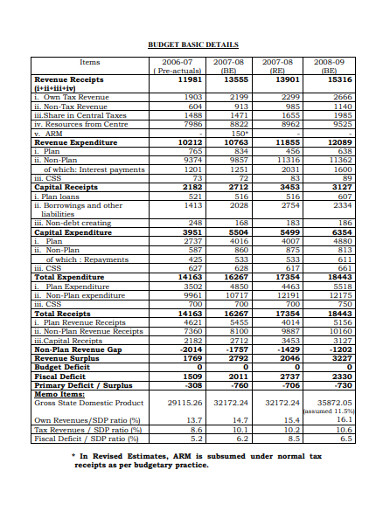

13. Basic Details of Budget

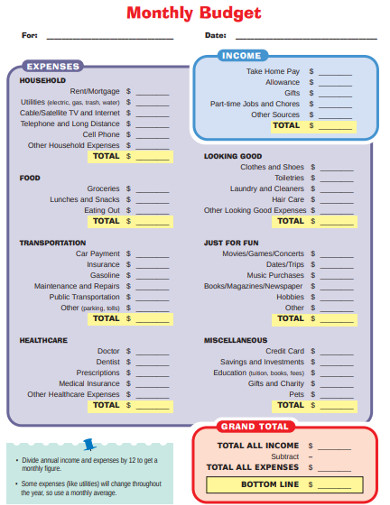

14. Monthly Budget Sample

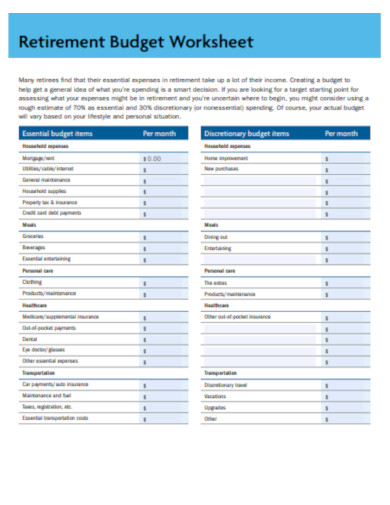

15. Retirement Budget Worksheet

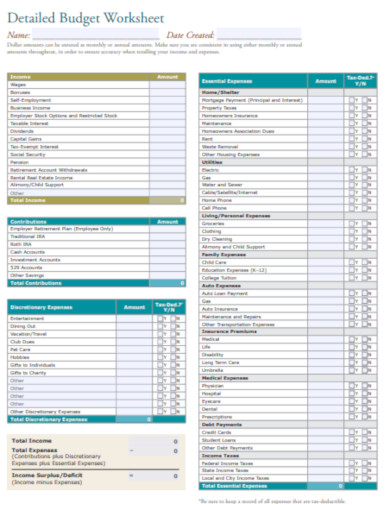

16. Detailed Budget Worksheet

What Is a Basic Budget?

In a household or business, budgeting is a method that builds an excellent financial plan. A basic budget contains a list of elements, such as income and expenses to help you determine an accurate monthly or annual revenue or savings.

Budget for Starting a Business

Do you ever think about how much it costs to run a business or just an ordinary daily life? Retirement, family, or small business, all of these require proper budget planning. Perhaps, based on a report published by the Aarp.org, starting a business cost $30,000 on an average. This analysis showcases the truth on the importance of proper management plan, especially when it comes to the budget. To get the capital that you’ve invested, tracking necessary expenses is a substantial solution to that.

How To Make a Basic Budget

The basic budget isn’t an excruciating task, as you think it is. But somehow, you need to gather much information to come up with a comprehensive annual budget. So, to guide you through, follow the list of steps below.

1. Know Your Current Income

When making a monthly budget, always start with the most basic—determining your income. Since many factors add up to your budget, you have to know what are these. Is it from an investment project? Do you have regular work? Make use of your time going through your financial statements. With this, you can quickly evaluate how much you earn monthly.

2. List Down the Fixed Costs

Don’t settle on your income when you haven’t considered the recurring costs. These are expense budget or fixed costs that you must specify, such as the house rent, insurance, debts, and retirement budget. Because these are unchanging in amount, you won’t have difficulty in calculating and subtracting these from your income. When you do this, make sure you don’t miss anything to avoid affecting your actual budget later on.

3. Specify the Variable Costs

Aside from the fixed costs, there are also variable costs that you need to take a look into. Ask yourself how much have you spent from your groceries last week. How much did you pay for the office supplies? Generally, these are your weekly or monthly payments that don’t come consistently. These, too, are items amounting depending on the service or product. So, collect your receipts and financial documents. Then, subtract the variable costs with the fixed expenses from your monthly income to come up with an actual budget.

4. Update It Regularly

Whether for a personal budget plan or business budget, whatever the purpose is, always take time to review your work. Check every amount that you calculate. Since prices and rates change dramatically from time to time, you have to update your budget worksheet regularly. This will help you track progress and consistency with your money.

FAQs

What are the types of budget?

A budget has three types, including the balanced, surplus, and deficit. These are valuable for different purposes.

How is a general budget defined?

A general budget is a document that contains the monthly prediction of non-selling expenses. The business manager typically prepares it.

How do you define a budget plan?

A budget plan is a method of planning on how money should be spent. It tracks the spending and how much is left for you.

It’s almost ordinary that you spend much money than save. This could be a result of neglect, and without you knowing you are already in debt. Therefore, you must be keen enough to know your income and expenses. Creating a business or personal budget plan isn’t complicated at all, as long as you know what you are doing. So, follow the tips above to calculate how much you’ve spent in the last month.