10+ Operating Budget Examples to Download

A small business, like a restaurant, daycare, and cafe, operates at least five times a week. The same goes for a large corporate entity, such as a university and hotel. During this period, they utilize most items in their asset inventory that may include the basic necessities of businesses like electricity and water. As these organizations make use of their resources, their operating expenses increase, which threatens the capital or the total operating funds of their respective businesses. On this account, proprietors developed a system to manage their financial assets, which is known as the operating budget or production budget. We’d love to discuss more of such financial estimates! So, we highly recommend you take a peek on our list of examples, as well as on our related article below!

10+ Operating Budget Examples

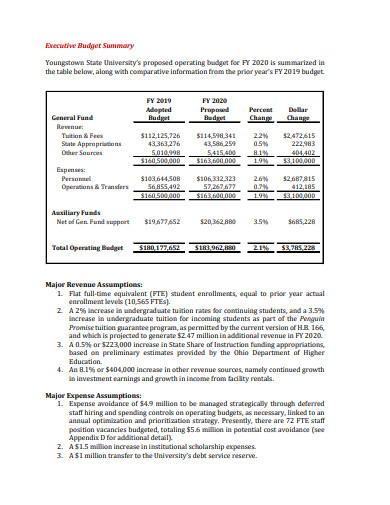

1. Sample Annual Operating Budget

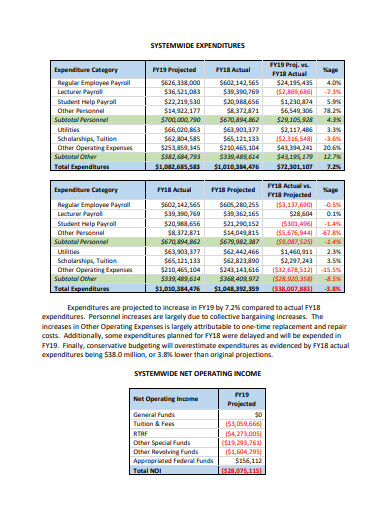

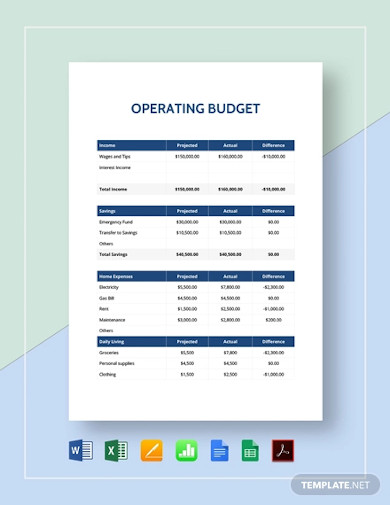

2. Operating Budget

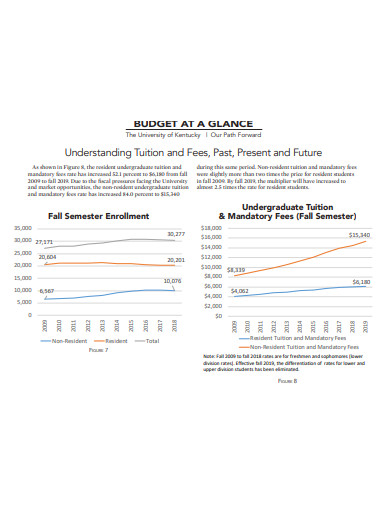

3. Simple Operating Budget

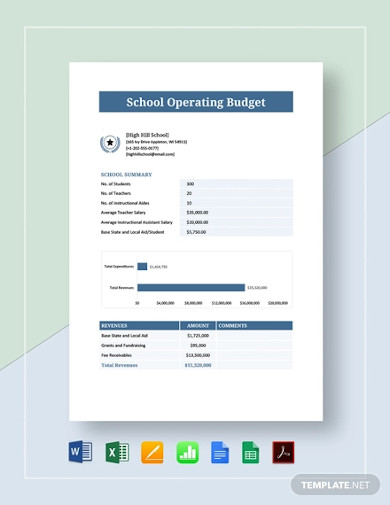

4. School Operating Budget

5. Operating Budget in Healthcare

6. Nonprofit Operating Budget

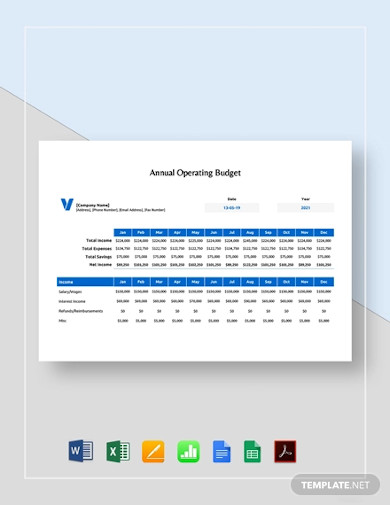

7. Annual Operating Budget Report

8. Business Operating Budget

9. Trust Operating Budget

10. Sample Operating Budget

11. Printable Operating Budget

What Is an Operating Budget?

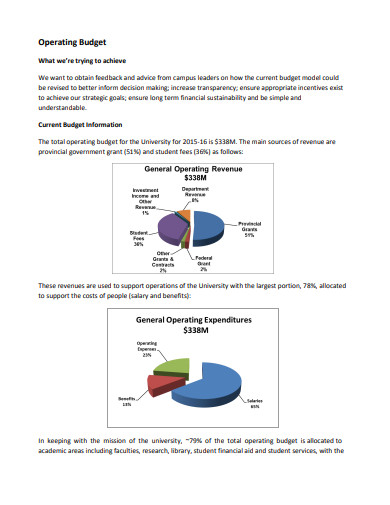

An operating budget is an outline that features an organization’s incomes and outgoings over a period of time. Corporate Finance Institute? stated that it is usually prepared in advance to support financial goals or financial plans. Moreover, it is said to be created and used for different business undertakings, such as marketing plans, sales plans, and others. The document’s main components consist of revenue, variable costs, fixed costs, non-cash expenses, non-operating expenses, and capital costs. Each component has its corresponding set of figures that needs to be collected. Once all of the necessary data are gathered, they will be computed to have a projection of how much money is needed for the continuous operation of a certain business department.

Major Benefits of an Operating Budget

An operating budget is highly beneficial if made concisely. In Richard Morgan’s September 2017 article for Bizfluent, the benefits are classified into four, including tracking, preparation, investing, and variables.

1. Tracking – Operating budget helps your sales tracking, as well as in inventory tracking and management. Since it indicates how much money should come in and out of your business, incompliant numbers easily determine if your company is experiencing problems.

2. Preparation – The document assists in working out all the finance essentials of your company in advance. It lets you sort and set aside adequate money for daily operations.

3. Investing – An operating budget is also a good record that can be used for investors’ investment research reports, investment analysis, and portfolio management.

4. Variables – There is no way for us to know what and when risks will take place. The operating budget ensures flexibility and financial readiness when these negative possibilities arise.

How To Create an Operating Budget

You have to understand that an operating budget involves a lot of items from your data inventory or an inventory database. Missing even with just one of its areas can put your financial risk management and financial risk analysis at play, which is obviously a hassle. Don’t worry! With our ready-made outline below, we make sure that you can create a clear and thorough operating budget for your company!

1. Determine Your Periodical Sales Projection

The very first thing that must be done in creating an operating budget is to determine your weekly, biweekly, monthly, or quarterly sales expectations. This part of your document should include a work estimate that focuses on the quantity of goods and services with their projected total sales revenue.

2. Identify Your Production Cost

Your goods and services don’t magically appear but made and done. Now that you have determined your sales projection, the next step is to identify how much it cost your company to produce the goods and complete the services. Materials and labors and their corresponding prices are the main content of this section.

3. Itemize Operational Expenses

Once you have successfully taken the production cost into account, you must make a list of all your operational expenses. In this section, your company’s past business expense reports might come in handy. They will be good references in the itemization of your operational expenses that will be including variable and fixed expenses.

4. Be Wary of Emergencies

We don’t know what the future brings for your business. It may bring you good fortune or the complete opposite. With that being so, you have to be ready to face the challenges that are lurking around. Always set aside an emergency fund for your business.

5. Account Taxes, Interests, and Unexpected Expenses

You have to learn to love business taxes and debt interests because they are inevitable. In that case, you have to put them into account and provide an adequate amount to pay them off. There are also some cases when unexpected expenses occur, and they should be appended, as well. An example of an unexpected expense is an employee’s promotion. In line with the promotion is his or her salary appraisal that falls under operational expenses.

6. Analyze Regularly

There are many factors that can affect a business’s income and expenditure statuses. They may include customer loyalty, economic changes, and more. As a result of these, fluctuations in the incomes and expenses happen from time to time. This is why it is important to inspect your operating budget regularly so you can adjust accordingly to the increasing and decreasing of figures.

FAQs:

What is a fixed cost?

Fixed costs are expenses that do not depend on any factor. Examples of this are rents, insurance, and subscriptions.

What is a variable cost?

Variable costs are expenses that conform to the production effort. It increases when production increases, and decreases when production decreases. A good example of this is the cost of labor.

How do I calculate profit?

The most basic formula to calculate a profit is total income – total expenses = profit.

“It is not necessary to do extraordinary things to get extraordinary results.” This is a quote from the American tycoon Warren Buffett. Budgeting is one of the simplest yet most effective methods of securing your financial future. Though it can be easily produced by any accounting professional, it also comes with various challenges. Once these challenges are prevailed over, the sweet varieties of benefits are for the taking.