10+ Payroll Budget Examples to Download

One of the important tasks that every business management has to keep an eye on is the accounting of the employees’ monthly payrolls. But before doing so, you have to go through a budgeting process to determine whether the financial assets are enough for every salary and payslip. A payroll budget also serves as an annual tracker of the operating expense. Moreover, it is also a forecast document that is often used for the comparison of the current financial status to the projected one. If you want to know more about the said budget, you better check our examples and our highly relevant article below.

10+ Payroll Budget Examples

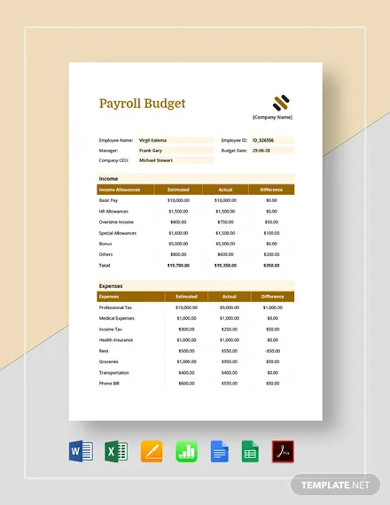

1. Payroll Budget Template

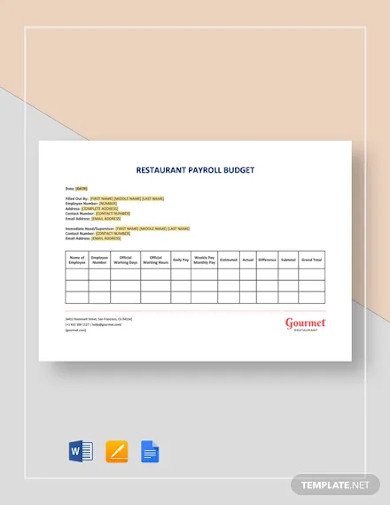

2. Restaurant Payroll Budget Template

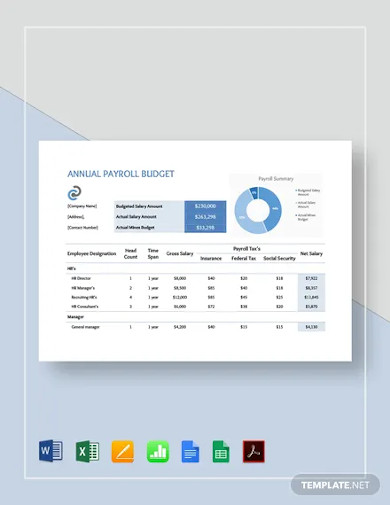

3. Annual Payroll Budget Template

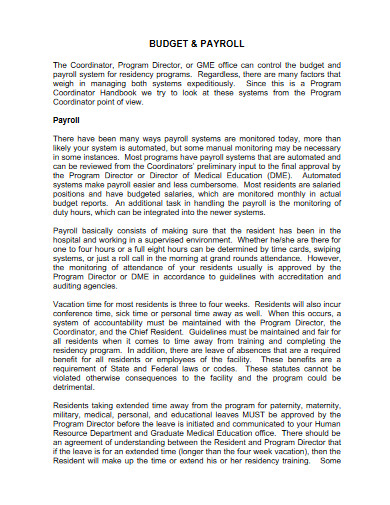

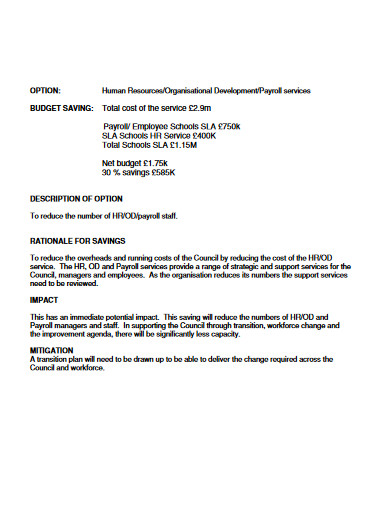

4. Budget and Payroll Template

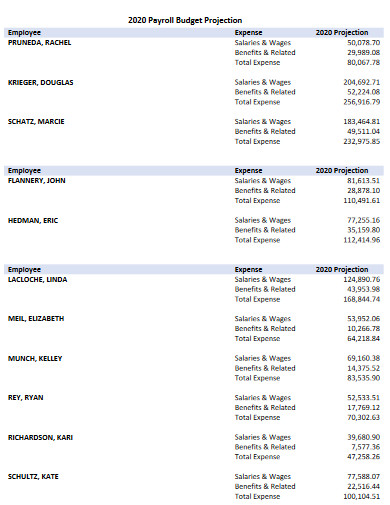

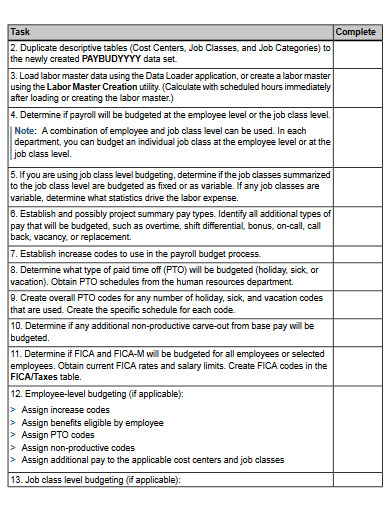

5. Payroll Budget Projection

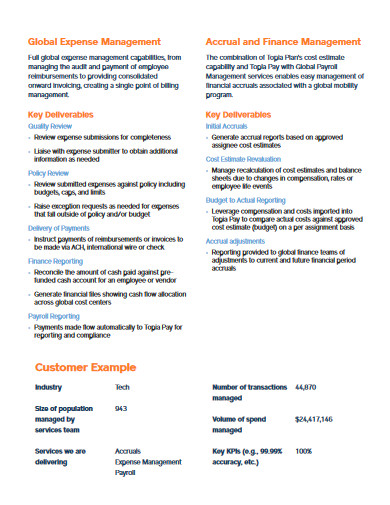

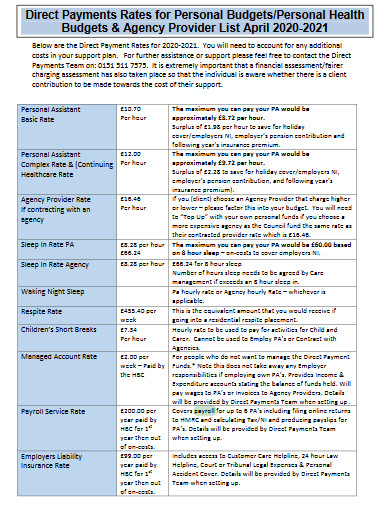

6. Payroll Budget Financial Services

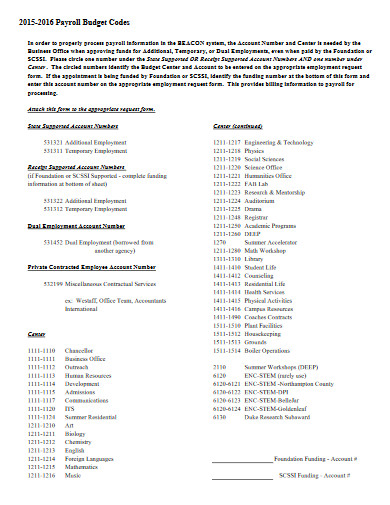

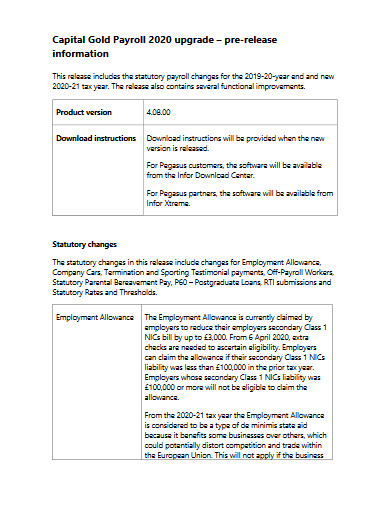

7. Payroll Budget Codes in PDF

8. Agency Payroll Budget

9. Payroll Budget Release Information

10. Payroll Budget Example

11. Payroll Budget in PDF

What Is a Payroll Budget?

A payroll budget is a document that estimates all of a company’s incomings and expenses on the compensation of employees. Through it, it will be easier for the company to formulate a compensation plan for its workforce. Jennifer Bender of Houston Chronicle said that the production of such a budget could greatly affect any business, from its employees’ optimism to the communication of its financial stability. By providing it to the workforce regularly and in a timely manner, the workforce will feel a sense of security regarding their compensations. Aside from that, it also reassures them as to where their taxes go.

Professional Payroll Services

The task of making payrolls could take ample time for a certain accounting officer. Fortunately for businesses, some offer professional payroll services. However, hiring such service providers has its advantages and disadvantages.

Making use of the service ensures the company to have a simple yet concise document provided to them on a regular basis. Not only that, but it also reassures the company of the compliance of the legal requirements. However, these services cost a lot of money, making it unfavorable for small businesses. And if errors occur, the internal employees have to answer the immediate inquiries of their colleagues.

How To Create a Payroll Budget

When creating a payroll budget, you have to keep in mind that all the information you have to put in it is crucial for all employees. In line with that, you have to know all about the standard document flow, to ensure that your document will not miss a single area of coverage. To help you with that, you can take a look at our research-based outline below.

1. Gather Necessary Details

To commence your budget preparation, you need to have all the necessary details in hand. This means that you have to request access in your company’s data inventory and collect important numbers and figures in the past and current profit and loss statements, financial reports or financial statements, as well as the previous salary slips of your employees. Your file of job descriptions are also a good reference to knowing how much the compensation of certain employees should be.

2. Determine Current Income

Once you have all details gathered up, determine how much money is coming into your company. Also, you have to identify where this money came from. For most organizations, the incomes are results of a good investment strategy, sales plan, and fair loans. Other types of organizations, such as the non-profits, also generate incomes from donations, and by developing and submitting grant proposals.

3. Organize Employee Information

After determining your company’s current income, start organizing your employees’ basic information. Do this by creating a list of employees that also incorporates their complete legal names, job positions, and their corresponding salary rates. If you take into account the number of employees, you might want to consider using software to help sort and duplicate them easily.

4. Include Incentives and Taxes

In the business world, it is mandatory to include in the employment contract the government incentives that the employees are going to receive. These incentives refer to medicare and social security, specifically. There are also businesses, such as brokerage, that involve commission plans. If your company provides such plans, you must include it too. In another aspect, you must never forget to deduct the mandatory taxes.

5. Find the Difference

Now that everything has been set out, all there is left for you to do is find the difference between your income and the payroll cost. If you’re using this budget for forecasting, then the difference indicates how much should be worked on to cover every employee’s salary fully.

FAQs:

What is payroll cost?

Basically, payroll cost is the cost of your employees. It includes their gross wages, taxes, benefits, unemployment taxes, and insurance.

How can I lower my payroll costs?

There are plenty of ways that you can decrease your payroll cost. Some of the best ones are the following:

– Reducing working hours

– Shifting fixed salaries to commission-based

– Fixing software issues

– Remove redundant job roles

– Outsource

– Review compensation rates regularly

– Consult with lawyers

What are the advantages of having an automated payroll?

An automated payroll process is when a company uses software or application to manage its payroll tasks. Here are the reasons why it is highly beneficial:

– Writing down of details is quicker, and the calculation of wages is easier

– It keeps track of employees working hours

– Automated calculations are more accurate

– Sorting out the employee information is easier because of organizational features

– Texts made on software are easy to remove or replace

In the business cycle, employees take care of companies, and companies take care of their employees. Surely, it sounds so simple, but believe it or not, conflicts often arise. And such conflicts are mostly caused by an error or a delay in the payroll. To lessen the payroll-related disputes, many companies shifted from manual accounting to digital. The latter changes almost all processes except for one – budgeting. Through it, companies can track the payroll movements, anticipate outcomes, and record data for safekeeping. It doesn’t matter if the company adopts the traditional or digital method of accounting; payroll budgeting works best for all businesses. With these facts, it is safe to say that the production of a payroll budget is an effective way to take care of your employees.