5+ Restaurant Profit Loss Statement Examples to Download

Profit and loss statements or P&L statements are weekly, monthly, yearly, or quarterly financial reports. They are necessary for all kinds of business plans, like in restaurants and event planning companies, to get and set budget summaries that are essential in accomplishing their corporate goals. Through it, the 12-month income statement and the expense of a company will be easily determined. Furthermore, the documents are also useful tools for various undertakings, such as new or first-year construction projects. If you are in search of good references for making a P&L statement for your restaurant, then our Free 5+ Restaurant Profit and Loss Statement Examples are perfect for you! Check them all out in PDF, Microsoft Word, Google Docs, and Apple Pages file formats!

5+ Restaurant Profit and Loss Statement Examples

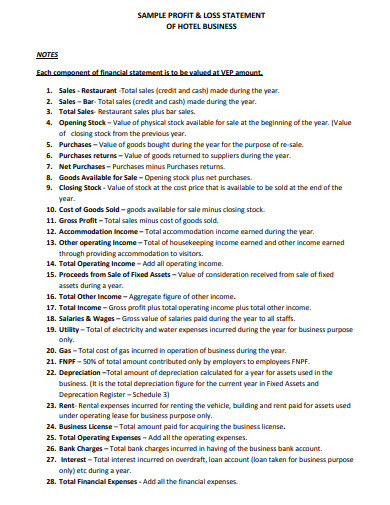

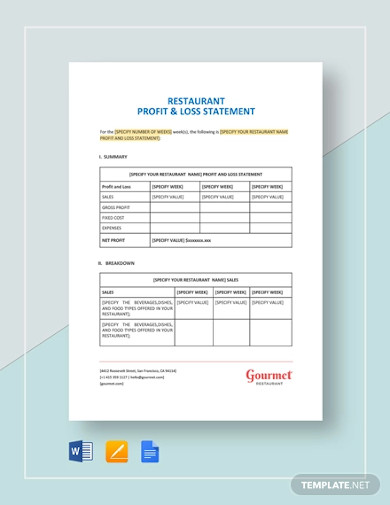

1. Restaurant Profit and Loss Statement

2. Sample Restaurant Profit and Loss Statement

3. Food Business Profit and Loss Statement

4. Restaurant Financial Statement

5. Restaurant Profit and Loss Statement Example

6. Printable Restaurant Profit and Loss Statement

What Is a Restaurant Profit and Loss Statement?

A restaurant profit and loss statement outlines the revenues and expenses brought about by a certain restaurant during a specific period. According to the Corporate Finance Institute?, the financial statement or financial report showcases a business organization’s capability to make sales, control expenditures, and produce profits. Aside from those benefits on the company, as a whole, the document also incorporates many advantages to the company’s individual constituents. Not only does it accord to legal compliance, but a profit and loss statement also helps restaurant stakeholders understand their company’s current financial standings, impacting their decision making positively.

How Frequent P&L Statements Should Be Made?

A profit and loss statement should be made on a quarterly basis. The following are the reasons why.

1. Entrepreneurs and other company stakeholders must be updated with their businesses’ current financial status.

2. Banks, investors, and other external entities also need to be constantly informed about the conditions of your company’s fundings. The details which will be included in the financial statement are one of the decision criteria of many investors and lenders.

3. Profit and loss statements are among the finance essentials. They help in the approximation of other financial documents, such as restaurant annual budget, marketing budget plans, rental budget, and more.

4. External influencers change from time to time. Being notified about the standing of your company’s financial aspect gives you ample time to adjust accordingly.

5. If your company is new, then you have to include in your start-up business checklist the regular tracking of your revenues and expenses. A profit and loss statement is the perfect tool for you to do so.

How To Prepare a Restaurant Profit and Loss Statement

Preparing your restaurant’s profit and loss statement is as easy as filling in a form. However, you need to make sure that the things you will be writing down are true and accurate. So, know more about what you have to put in and how you can organize them by following our outline of the proper guidelines below.

1. Gather All Necessary Details

Sales receipts and restaurant invoices are a few of the most effective references where you can get the necessary details for your planned profit and loss statement. Not only that, but past financial statements are also effective sources. By preparing these documents ahead of time, you make the development of your restaurant P&L statement more convenient for the later part of the process.

2. Sort Company Expenses From Company Earnings

After gathering all the necessary details, you proceed in sorting all the business expenses reports of your company from its income portfolio. In this way, recipients of the statement can easily navigate the particular thing that they are looking for.

3. Identify Your Company’s EBIT

EBIT is the abbreviation for earnings before interest and tax. To identify it, all you have to do is deduct your company’s total revenue to its total expenses. Make sure that the figures correspond perfectly to a particular business timeline.

4. Incorporate Interests and Taxes

Once you have successfully identified your company’s EBIT, you can move on to the incorporating of interests and taxes. Many considered it to be the most complicated part of making a profit and loss statement. This is because you have to calculate first the EBIT. Since we have already done so, it is more convenient for us. In incorporating the interests and taxes, all there is to do is subtract them to your identified EBIT. For your information, you can get these interests and taxes from tax invoices and tax receipts.

5. Find Out You’re At a Profit or Loss

Following the integration of interests and taxes, you can then conclude your restaurant’s profit and loss statement. Do this by affirming whether your company is performing at a profit or at a loss.

FAQ’s

Is there a formula in calculating profit and loss statements?

Yes, there is. Investing Answers revealed that the basic formula to determine whether your company is operating at a profit or loss is Revenue – Expenses = Profit. What remains in the calculations is what we all know as net income.

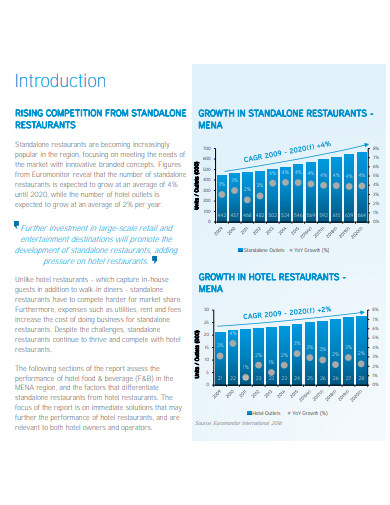

What are the common expense items of restaurants?

Restaurants have fixed and variable costs. The fixed costs consist of property rental fees, insurance, and employee salaries, while the variable costs include food ingredients, utilities, and advertising.

What is the difference between a fixed cost and variable cost?

Both fixed and variable costs are spending’s that a company has to make for its continuity. The only difference is that the fixed costs are not affected by any factor, while variable costs fluctuate depending on the usage of resources.

Corporate financial management, especially for restaurants, can’t be done satisfactorily without the help of restaurant profit and loss statements. Most companies prefer to have them on a quarterly basis to keep close track of their financial status. However, there are instances when a corporate entity is required to produce such a document earlier in accordance with advanced financial management or financial risk management. As mentioned before, preparing a restaurant profit and loss statement is not a difficult task. But, you have to ensure the accurateness of both your gathered data and the process of identifying your longed outcome. With that, our set of examples will surely provide you with your much-needed guidance.