10+ Bank Reconciliation Examples to Download

Finance has been a very big part of every adult and every business organization. Its main function is to manage the monetary assets of an individual or a corporate entity. Because the said assets are among the very foundations of a business, handling them meticulously is a must. The management of these finances consists of many processes, and one of them is bank reconciliation. It is a basic financial accounting course of action where a company’s cash book, accounting summary, balance journal entry, or general ledger is compared to its bank statement. Typically, it is done on a monthly basis to keep track of the accounts receivables and other claims, and as a requirement for audit reports. Know more about bank reconciliation by reading our article and browsing through our examples below.

10+ Bank Reconciliation Examples

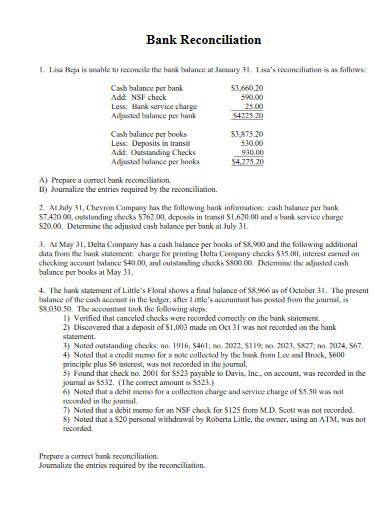

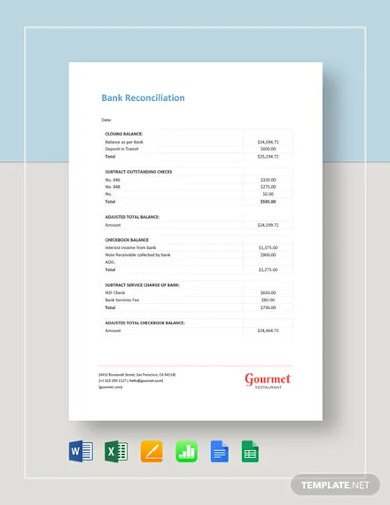

1. Bank Reconciliation Template

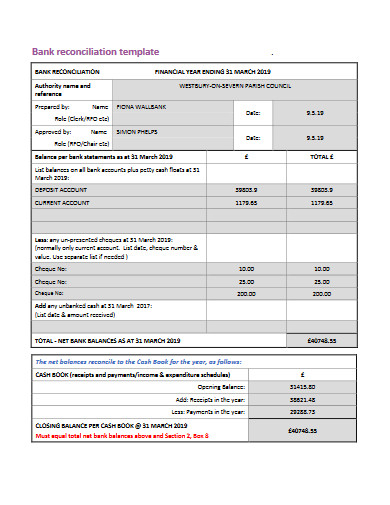

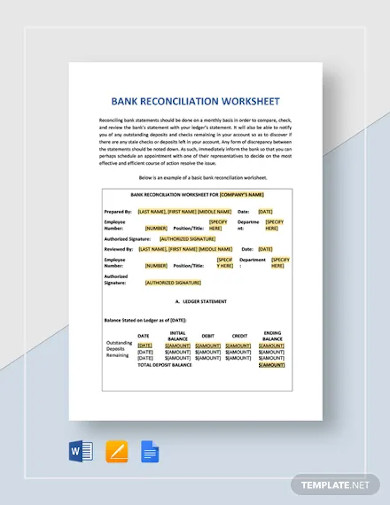

2. Bank Reconciliation Worksheet Template

3. College Bank Reconciliation

4. Sample Bank Reconciliation Template

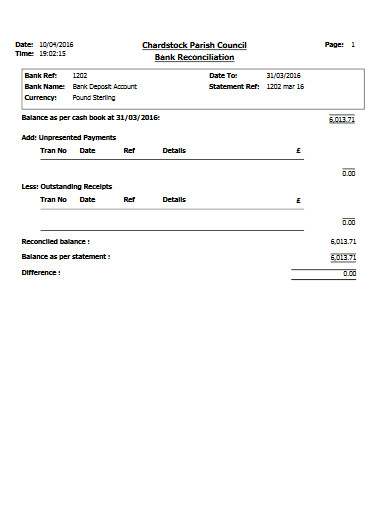

5. Bank Reconciliation Deposit Account

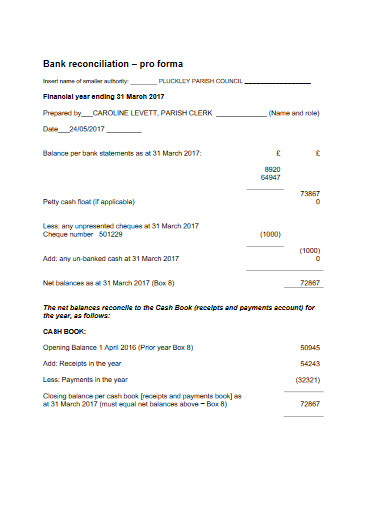

6. Bank Reconciliation Proforma

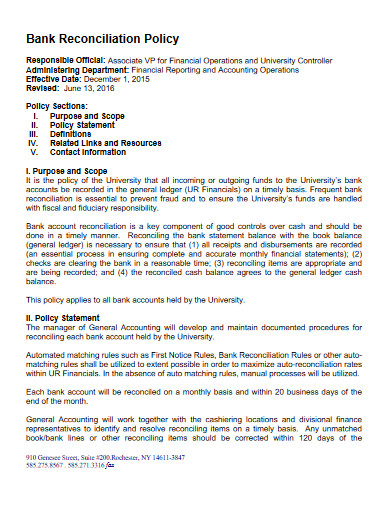

7. Bank Reconciliation Policy

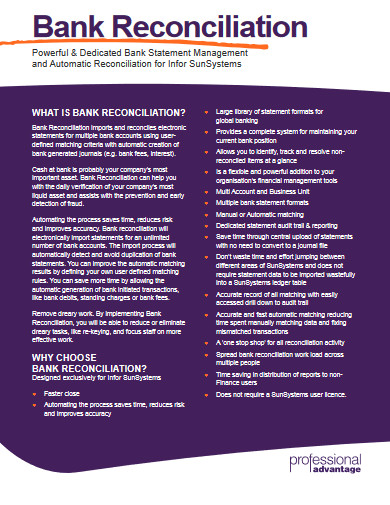

8. Professional Bank Reconciliation

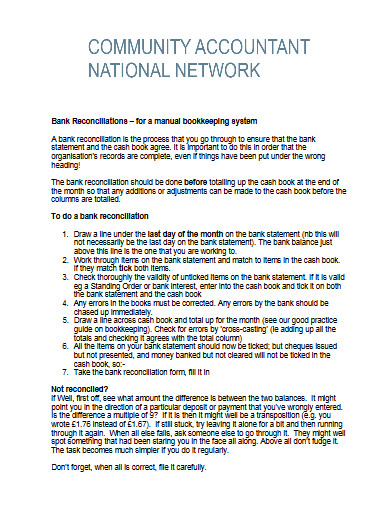

9. Community Accountant Bank Reconciliation

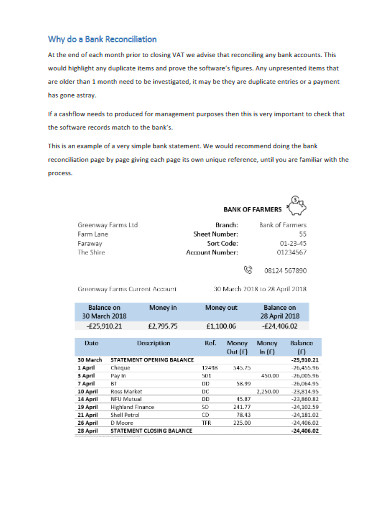

10. Bank Reconciliation Example

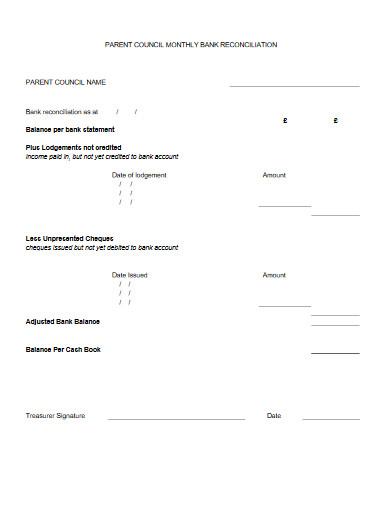

11. Monthly Bank Reconciliation

What Is Bank Reconciliation?

A bank reconciliation is a process where individuals or organizations make sure that the financial statements’ figures perfectly accord with their respective bank account’s paperwork. As part of the process, a summary, statement, or financial audit report that features the withdrawals, deposits, and other banking activities has to be made. According to Justin Prichard of The Balance, the bank reconciliation document is helpful in two ways. First, it helps individuals or organizations in identifying unfamiliar transactions that could be brought about by fraudulent activities or by accounting errors. Second, it helps individuals or organizations in determining the inefficiencies in their finance-related undertakings, such as business financial plans and financial analyses.

Positive Pay

Banks hold a lot of money coming from different people. This fact makes them the number one target of frauds. To prevent such wrongdoings, these firms developed tight safety and security plans. One of the plan’s mechanisms is called positive pay. DRV Technologies defined positive pay as an effective fraud prevention system that is rendered by many banks to keep accounts safe from counterfeited, forged, and tweaked checks. According to them, the methodology inspects the accuracy of the check’s basic information, such as the account number, date, and amount. When discrepancies occur during the inspection, a report will be filed while withholding the withdrawal of the amount until the account holder accepts or rejects the transaction.

How To a Prepare a Bank Reconciliation Statement

When money is at stake, you know that you have to be very careful in preparing a document. That’s what makes the preparation of a bank reconciliation statement (BRS) difficult. But, there’s no need for you to worry. Below, we have provided you with the complete list of steps to make sure that you don’t only make your statement thorough but also compliant with the standards.

1. Check Bank Statements

Start the preparation of your BRS by gathering and checking out the statements from your bank. You can check your online banking platforms, or make a request letter that asks the bank to send you the complete list of banking transactions.

2. Look Into Data Inventory

The next set of documents that you will be collecting are those of your business records, such as the general ledger, memos, invoices, debit and credit card receipts, as well as debit and credit notes. Most of these can be found in your company’s data inventory.

3. Identify Starting Point

Once you have all the necessary documents ready, begin identifying your starting point so you can start with the reconciliation. The best technique is to find out when your company’s cash book and bank account’s total balance last aligned.

4. Scrutinize Bank Deposits and Cash Book Incomes

From your starting point, make a quick run-through of your bank deposits and cash book incomes. Check if each transaction on your bank deposits turns up the same on your company’s cash book. If there are any missing links, you have to find out what caused them immediately. They could be because of sales interests, refunds, or anything.

5. Inspect Bank Withdrawals and Cash Book Outgoings

After scrutinizing the bank deposits and cash book incomes, begin the inspection on the withdrawals and outgoings. Just like the previous step, you have to examine whether or not every figure is perfectly duplicated. If the outgoings do not match, you have to identify whether it is because of incomplete payments, paying using a different account, or for whatever reason.

6. Compare and Note Discrepancies

Right after analyzing your bank’s deposits and withdrawals, as well as your cash book’s incomes and outgoings, start making your comparison. Since you have everything already laid out, it will be easy for you to tell which figures do not match up. And if that case scenario happens, it’s best to write them down in your notes. These lists of items will be subjects for investigations.

FAQs:

Is there any software that we can use to make bank reconciliation statements?

Yes, there is. But, it’s not just one but a lot. Some of the popular software that helps you create a BRS are the following:

1. BlackLine

2. Xero

3. OneStream

4. CashMatching

5. Cashbook

6. ReconArt

7. Duco

8. Bank Rec

9. ReconNet

10. Traverse

11. Bank Link AnyWare

What are the other types of financial reconciliation?

There are six kinds of financial reconciliation. They include bank reconciliation, credit card reconciliation, customer account reconciliation, vendor account reconciliation, tax reconciliation, and inter-company reconciliation.

What is a cash book?

A cash book is a book that works as a journal and a ledger that records receipts or any cash payments. Its records are arranged chronologically, updating them continually for every transaction made.

The safety of our financial assets starts with ourselves. With that being said, we should take time to look into the basics of accounting and bookkeeping. Though not necessarily intensive, doing so can help us understand how we can keep track of our financial activities. Learning more about BRS is a good headstart for all the people who want to secure their monetary resources. The pieces of information presented above are only parts of its whole. Further details about it are for you to find out.