10+ Acquisition Agreement Examples to Download

One of the strategic ways to consolidate a certain business is to get into a settlement or contract for merger and acquisition (M&A) process. Obviously, such a process goes two ways. First is the merging process, where two company owners decide to combine their assets and operate on a larger scale under one brand. The second process, the acquisition, is when an organization purchases the property or the entire business of another, taking over everything that the purchased business holds. Whichever business journey suits to your liking, you know you have to create a signed and legal document for it as part of the due diligence. But that won’t be a problem because we have our article and a bunch of examples that you can refer to below!

10+ Acquisition Agreement Examples

1. Acquisition Agreement Template

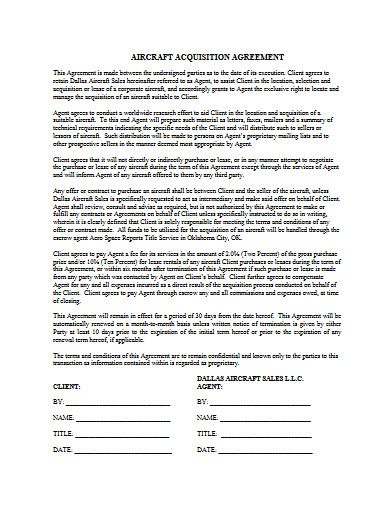

2. Aircraft Acquisition Agreement

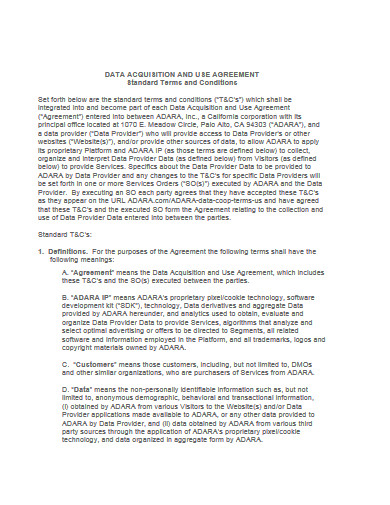

3. Data Acquisition and Use Agreement Template

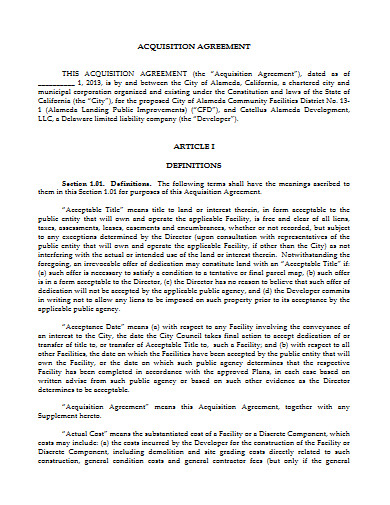

4. Acquisition Agreement Example

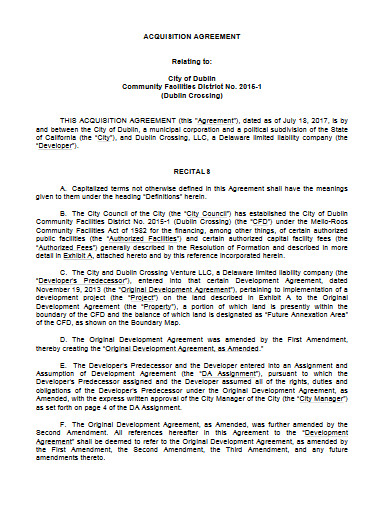

5. Acquisition Agreement in PDF

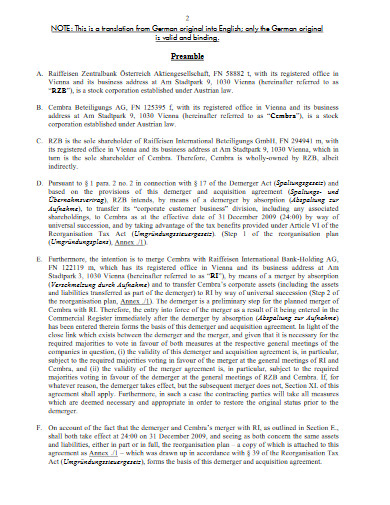

6. Demerger and Acquisition Agreement

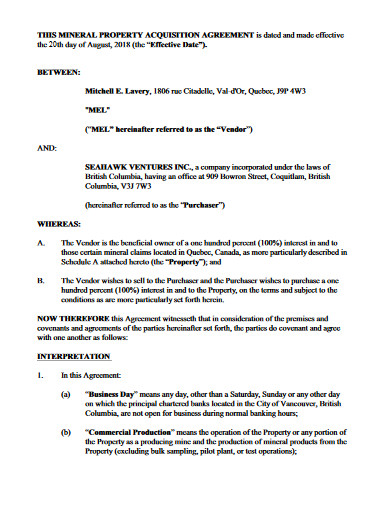

7. Property Acquisition Agreement

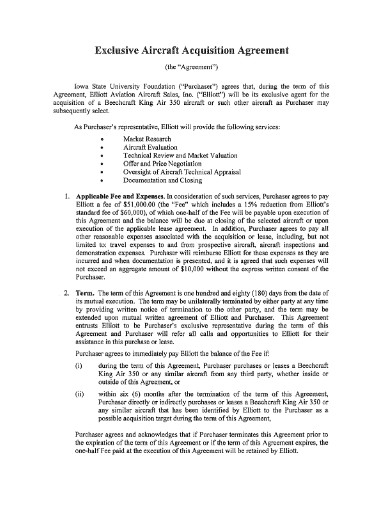

8. Exclusive Aircraft Acquisition Agreement

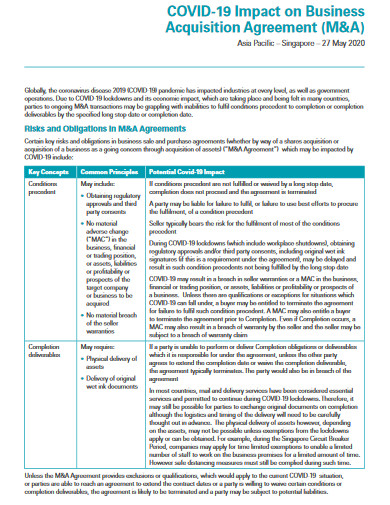

9. Business Acquisition Agreement

10. Hotel Acquisition and Services Agreement

11. Revised Land Acquisition Agreement

What Is an Acquisition Agreement?

An acquisition agreement is a process document highlighting the business arrangement between a seller of a business entity and its buyer. According to Startup Company Counsel, it has two types, namely entity purchase agreements and asset purchase agreements. When a buyer purchases the majority of a business’s stocks, the former takes place, conjecturing control on its entire operations. Meanwhile, the latter type occurs when the buyer purchases all or a certain amount of the seller’s stocks, allowing them to retain ownership despite the expiration of physical business. Small businesses, usually the ones that adopt sole proprietorship as its business structure, benefits from it.

Purposes of Acquisition

The process of the acquisition comes with many purposes. Below are the most common ones.

1. Enhance Target Company – Buying stocks on the target companies actually enhances them. As they grow, your return of investment (ROI ).

2. Eliminate Counterparts – Purchasing businesses makes your company the sole producer or service provider of a certain product or service.

3. Obtain Technology and Expertise – Acquisition is a cost-effective way to obtain technologies and workforce expertise at the same time.

4. Extends Operations – No matter how big an establishment is, it has its limitations. The acquisition helps increase the company’s capacity, as well as improve its capabilities.

5. Invest in Promising Companies – Some small businesses have the potential to grow big time in the long-run. The acquisition allows a company to obtain them while retaining the brilliant idea and the benefits that come with it.

How To Create an Acquisition Agreement

Comprehensiveness and simplicity are two must-have qualities of an agreement. In order for you to incorporate them into your acquisition agreement, you have to learn what the standards are and understand each of its sections. Fortunately, we have our ready-made outline prepared for you! It comes with insights that can help you better understand how to make every section.

1. Describe the Transaction

Start your acquisition agreement by describing the entire transaction thoroughly yet briefly. In this section, you must include the complete and legal name of your company and the company you are trying to acquire. Aside from that, you also have to define the agreement’s structure and payment schedule.

2. Display Representations and Warranties

Whether you’re the seller or the buyer, you have to know if the assets included in your list of purchases are in good condition. This is why a detailed representation is highly necessary. Plus, it must come with statements of reassurance regarding the assets’ current qualities.

3. Set Conditions

After displaying the representations and warranties, enumerate the things needed to complete before proceeding in performing the set of agreement obligations. Prohibiting the seller from engaging with other buyers during the negotiation period is a good example of an acquisition agreement condition.

4. Make Covenants

Aside from setting the conditions, you also have to write down promises that have to be fulfilled before and after the deal’s closing. A great example of an acquisition agreement covenant is the business as usual approach of the acquired business after its purchase.

5. Communicate Indemnification

It is in this section where your dispute resolution policies take place. This is also the section where you set out the common disputes in an acquisition process, such as post-closing adjustments in the financial plan, fraud claims, as well as disputes about additional payments.

FAQs:

What are the types of acquisitions?

Even though merger and acquisition processes go hand in hand, there is a significant difference between them. In addition to that, each of them has its subcategories. The following are the different types of acquisitions:

1. Horizontal Acquisition – This is when a company purchases another company in the same line of business. A good example of this is Facebook’s acquisition of WhatsApp. This type of acquisition lessens the threat of competitors.

2. Vertical Acquisition – This type of acquisition refers to the situation where a company purchases its supplier or the supplier’s distributor. Most companies that practiced this type are to take better control of the source of materials and supply inventory.

3. Conglomerate Acquisition – This happens when a company purchases another company that is in a different industry. The reason for this is to diversify its source of income.

4. Congeneric Acquisition – This takes place when two different companies that share the same specific operation or two come together.

What are the metrics in buying and acquiring a business?

The decision criteria for buying and acquiring a business include the following:

– Comparative Ratios – Discounted Cash Flow (DCF) – Price-Earning Ratio (P/E Ration) – Replacement Cost – Enterprise-Value-to-Sales Ratio (EV/Sales)

What are the different types of M&A transactions?

Aside from merger and acquisition, M&A also has other forms, including consolidation, tender offer, asset acquisition, and management acquisition.

Renowned journalist, humorist, and cartoonist Frank McKinney Hubbard once said, “The safest way to double your money is to fold it over once and put it in your pocket.” Most companies are too focused on funding only their business, letting them think that they are making doubles. To be fair, doing so doubles their profits. This goes on up to the point where there’s no more room for expansion and then stops. Little did they know that there are plenty of ways for a business to continue to grow, and one of them is through acquisition.