10+ Revenue Sharing Agreement Examples to Download

Revenue sharing has long been a practice among business partners or any parties involved in a business organizational chart. It’s a practice that ensures every stakeholder will receive money generated from the business’ revenue. In other words, it solidifies a win-win deal. However, there’ll be no assurance of a revenue sharing’s fulfillment if agreement terms will not be put into the paper. Yes, there’s such a thing called a verbal agreement, but a written agreement is more secure. So if you’re about to take part in a revenue sharing deal, make it official using our revenue sharing agreement examples.

10+ Revenue Sharing Agreement Examples

1. Consulting Agreement with Sharing of Software Revenues Template

2. Revenue Sharing Agreement

3. Sample Revenue Sharing Agreement

4. Form of Revenue Share Agreement

5. City Revenue Sharing Agreement

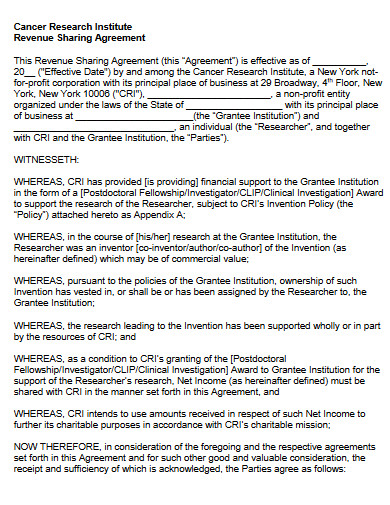

6. Institute Revenue Sharing Agreement

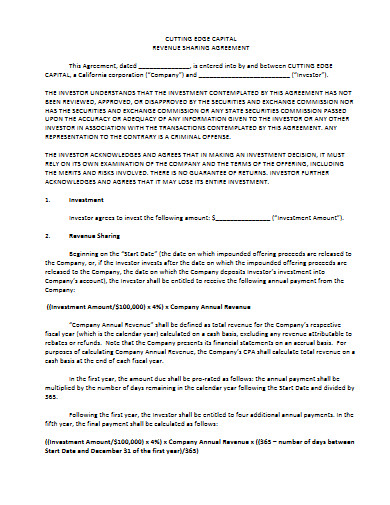

7. Capital Revenue Sharing Agreement

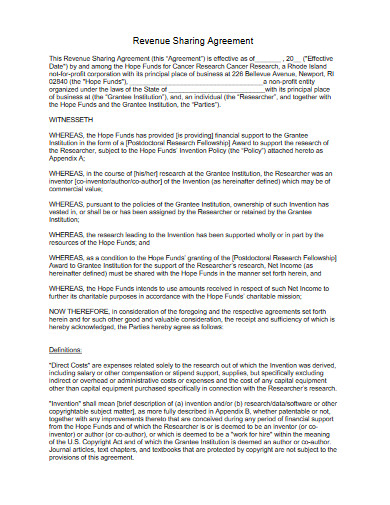

8. Revenue Sharing Agreement Example

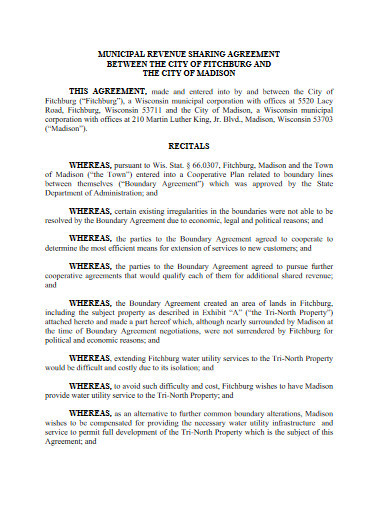

9. Municipal Revenue Sharing Agreement

10. Revenue Sharing Agreement in PDF

11. College Revenue Sharing Agreement

What Is a Revenue Sharing Agreement?

A revenue sharing agreement is a legally binding document that outlines the terms that the two parties must follow in splitting shares of the generated revenue. This is the kind of document that usually comes along with a business partner agreement or investment agreement. Moreover, revenue sharing can also be called as profit sharing.

Revenue sharing is most prominent in professional sports industries, specifically the National Football League (NFL). In the NFL, both the team owners and players typically receive a significant percentage of the league’s revenue. According to a report by CBS Sports, players received 47%, while team owners received 53% in 2020. As you can see, it’s a near 50-50 split.

Almost every business practice revenue sharing, especially those with partnership deals with investors. However, revenue sharing is also possible internally—only the people within the organization as the involved parties.

Examples of Revenue Sharing

There are many forms of revenue sharing across different industries. But these below are the most prominent examples:

Sharing with Employees

Some companies would grant a bonus to their employees’ payslip if they were able to generate decent revenue. These bonuses can be commissions. It’s up to the management how much of the revenue they will share with their employees. However, if they stipulated a certain percentage on the employment contract or employee profit-sharing agreement, they have to follow it.

Sharing with Business Partners

Revenue sharing among business partners is very common. And not just common, but also necessary. Business partners own equal shares of their companies’ assets. That usually means that they have already formulated a 50/50 partnership agreement beforehand. Along with that is a 50/50 profit-sharing agreement or a joint venture profit-sharing agreement.

Sharing with Investors

Revenue sharing is also common with investors as well as business partners. But the stark difference is that it’s rarely a 50/50 share. Investors will only receive a certain percentage from the revenue, and it’s usually below 50 percent. Plus, it also depends on how much revenue was generated.

Sharing with Advertisers

Advertisers or advertising agencies can also get a chunk of a company’s revenue. That mostly happens if the advertisements they’ve made generated revenue successfully. There’s no exact percentage of how much shares they should receive. Only a profit-sharing agreement for investors can clarify that. But typically, the bigger the revenue that the ad generated, the bigger shares they will get.

How to Write a Revenue Sharing Agreement

As we’ve said, a written agreement is more secure than a verbal agreement. That’s because it’s tangible evidence or proof that what the two parties agreed upon are credible. With that said, we recommend you to opt for a written revenue sharing agreement when sharing revenue with other parties. So, here, we’ll show you the basic steps in writing one.

1. Emphasize Who Are the Involved Parties

A revenue sharing agreement form must clearly state who are the people involved in it. In your case, it’s you (your company name) and your business partners, investors, or subordinates. If the other party is your business partner, make sure to emphasize the name of his or her company. This step makes you and the other party as official stakeholders of the agreement—legally binding both of you.

2. State How Much the Split Will Be

The amount of the split is the most important content of your revenue share agreement contract. So, make sure it’s accurate. For that, you’ll need to come up with a revenue or profit sharing plan with the other party, especially if it’s a business partner or investor. Make sure that both of you agreed with the split before writing it on the contract.

3. Include Terms for the Revenue to be Shared

Of course, you should not just share revenue like it’s charity. You and the other party have to contribute things for the organization to earn your respective shares. For that reason, including such terms in the partners agreement contract is vital. Both of you should discuss this and reach a mutual set of terms.

4. Add Terms That Can Stop the Agreement If Needed

A revenue or profit sharing clause isn’t just about when and how to split the goods. It’s also about when is the right time to stop it due to unwanted circumstances caused by the other party. That’s why you must add terms to stop the agreement when necessary. These terms could be a lack of commitment, fraud, theft, and other actions that can damage your company’s assets. But if the other party’s violation isn’t that grave, issuing a warning letter or notice letter can be the first counteraction. If he or she commits them again, you can stop the agreement.

Once everything is set, make sure to proofread the agreement before affixing your respective signatures on it.

Is it practical to share revenue?

Yes, it is. Revenue sharing is an excellent method to maintain a healthy partnership with your business partners and investors. Plus, they rightfully and legally deserve to earn money from your company’s revenue. And, although not required by most labor laws, it’s also good to share revenue with your employees as a bonus. That encourages them to do continuous hard work.

What are the kinds of revenue?

In general, there are two kinds of revenue. These are operating revenue and non-operating revenue.

Operating revenue – These are revenues that companies make from their main business activities, such as providing services and selling products to their customers.

Non-operating revenue – As its name implies, these are revenues that companies generate outside of their core activities. A good example of this is investing in new assets, such as properties.

Who can benefit from a revenue sharing agreement?

Both parties of a revenue sharing agreement can benefit from it, especially if the deal is a perfect 50/50 split. But even if it won’t be a 50/50, it’s still going to be a win-win situation, as long as both parties agreed with the split in the first place.

Revenue sharing is a practice that will never go away from the business world. Everyone who’s an integral part of a profit organization will always want a piece of the cake. And they have the right to it as long as they do their part. So the next time around, make sure to prepare a revenue sharing agreement before giving your partners, investors, and subordinates a slice.