11+ College Financial Plan Examples to Download

A good college education is an important step towards having a life of success and prosperity. However, a college education is expensive. Parents of college-going students worry about their child’s financial stability. Many parents put a lot of effort into putting up a college fund. They save up for years and years so their child will have a better chance at life with a good college education. It is important that the savings and the spending on college fees be managed well in order to ensure a stress-free college experience. A college financial plan comes in handy for that.

On the other side of the college, education coin is colleges themselves. Colleges also need to have a proper college financial plan to keep track of their revenues and expenditures and be able to allocate resources properly. Running a college is not an easy task, from managing the revenue from college fees to appropriating funds to various disciplines on campus, everything must be well planned. A college financial plan ensures just that.

So whether you’re a student looking to track your expenses, a parent planning for your child’s college education, or you need guidance on managing your college finances, you’ve come to the right place. Take a look at these college financial plan examples and templates to find the right one for you.

College Financial Plan Examples & Templates

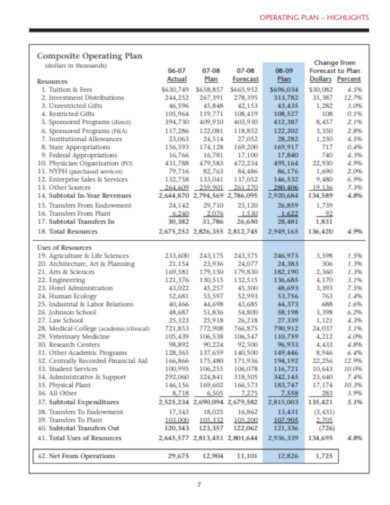

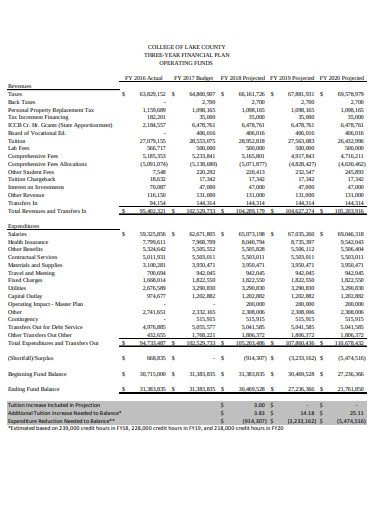

1. College Financial Operating Plan Example

Like any business, for your college to run smoothly, you need a college financial operating plan. This ensures responsible resource allocation and sound financial management for your college. Here is a standard college financial operating plan example for your ease.

2. Financial Planning for College Student

Often students don’t know how to manage finances during college. This leads to a lot of stress and confusion as debt starts to mount. Check out these useful guidelines for responsible financial planning for college students.

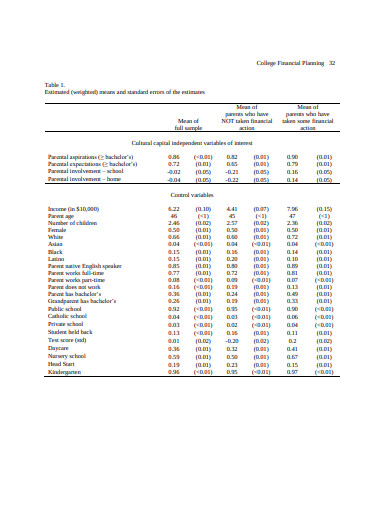

3. College Financial Plan Template

With the rising cost of living and tuition, it has become increasingly hard for students to manage their finances. A lot of students find themselves on their own and begin to learn about managing money, as they are expected to earn and be responsible about finances. All this is not easy to manage with the busy college schedule along with maintaining a healthy social life. For many students it is a stressful time as they are juggling between studies and side jobs. As a student your finances needs to be carefully planned in order to avoid huge debt burdens and the ensuing stress. For that you need a college financial plan. Colleges also need data on their prospective student population to make the college financial plan. Check this template with data on a number of relevant variables.

4. Financial Planning for College Graduate

If you’re looking for detailed information on financial planning for college graduates, this research report would help you greatly.

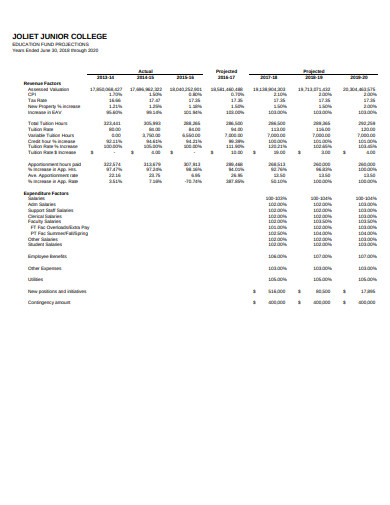

5. Junior College Financial Plan Example

It is even more important for junior colleges to manage their finances well. Here is a junior college financial plan example with detailed assessment of revenue factors vs. expenditure factors.

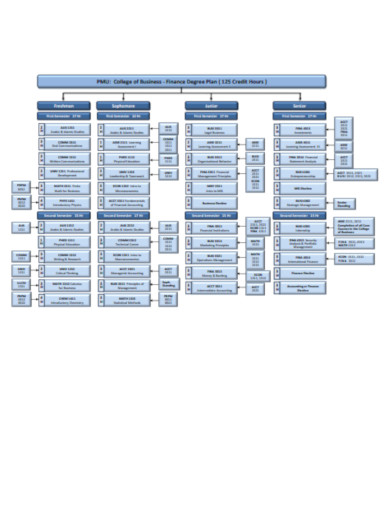

6. College of Business Financial Plan Template

Colleges also have to provide a financial plan for their degree programs for the benefit of enrolling students. This is a template for a financial plan for a 125 credit hour finance degree at College of Business.

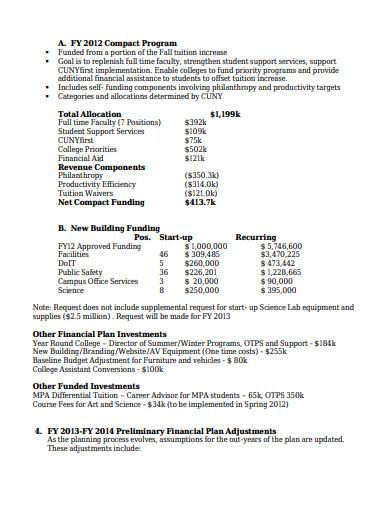

7. Summery of College Financial Planning

Colleges have to be thorough in their financial planning to avoid any dents in the quality of their educational services. If you’re not fully confident about your college financial plan then take a look at this summary of college financial planning for CUNY, listing the total allocation and revenue components along with other funding and investment plans.

8. College Financial Plan in PDF

It is important for colleges to inform their students about their financial plan and awards including grants and scholarships. Students feel better about knowing their options. This college financial plan in PDF is a useful resource to help you lay out your financial plan in a comprehensive manner.

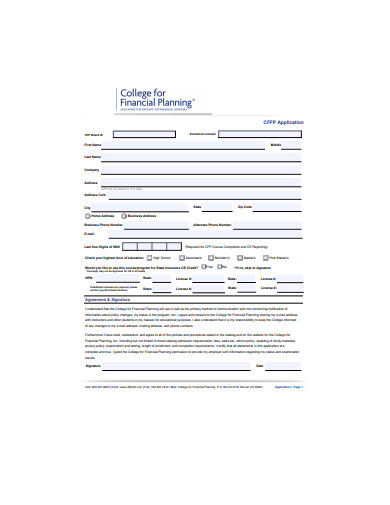

9. College Financial Planning Form Example

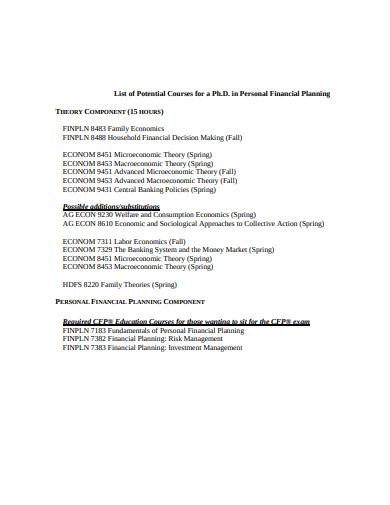

Financial planning has become a popular discipline. If you’re looking to get a degree in financial planning, this college financial planning form example would help you understand what to expect.

10. College Financial Plan Example

Having a solid college financial plan is all the more important in today’s uncertain economy. If you’re concerned with keeping your college running smoothly through economic downturns, this college financial plan example would be useful with its revenue vs. expenditure listings along with the budgetary allocations and the projected estimates in the coming years.

11. College Personal Financial Planning

If you are interested in personal financial planning and want to take it a step further by pursuing a doctoral degree in the field, take a look at this list of potential courses for a PhD program in Personal Financial Planning. It is useful to understand the core components as well as additional courses so you know what to expect.

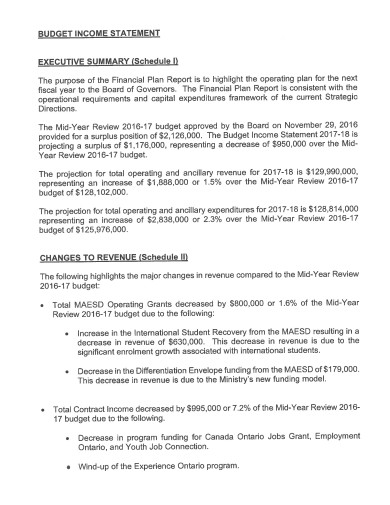

12. College Financial Plan Report

Colleges have to present their annual financial reports to the board of governors for laying out the operating plan for the next fiscal years. Here is a college financial plan report with a summary of the budgetary expenditure and details the changes to revenue. You can download this in a PDF format but after reading, you can definitely make changes according to your own requirements.