10+ Insurance Business Plan Examples to Download

Back in 2018, the Insurance Information Institute (III) reported that the insurance industry’s written premiums reached USD 1.22 trillion worth in the United States alone. In line with this, fifty-one percent consists of car and other property insurance, while the forty-nine percent are covered by health and annuity or life insurance. With that much worth in mind, making your very own insurance agency is surely a good idea. So, what’s stopping you? Don’t waste time and create a business plan that outlines your future business process, market analysis, SWOT analysis, marketing strategies, budget, and other business development coverage! For your convenience in planning your financial protection service provider business, we encourage you to look at our examples below!

10+ Insurance Business Plan Examples

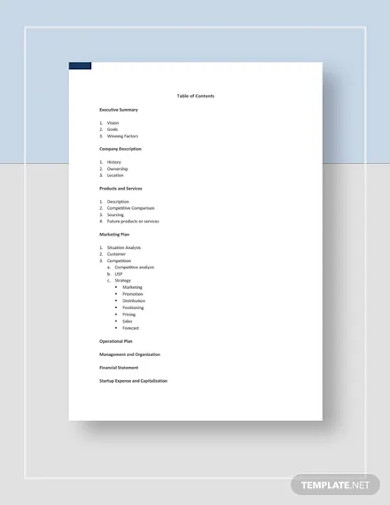

1. Insurance Business Plan Template

2. Insurance Agency Business Plan Template

3. Sample Insurance Agency Business Plan Template

4. Insurance Business Plan Example

5. Insurance Business Plan in PDF

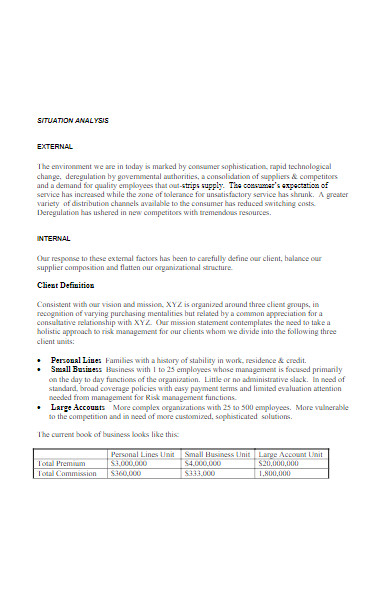

6. Insurance Agency Business Plan

7. Insurance Financial Business Plan

8. Insurance Agency Business Plan in PDF

9. Basic Insurance Business Plan

10. Insurance Company Business Plan

11. Client Insurance Business Plan Template

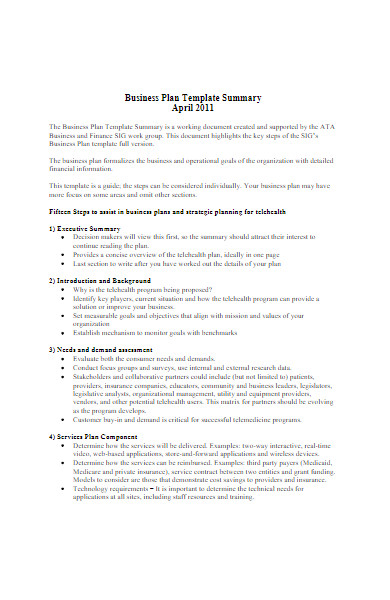

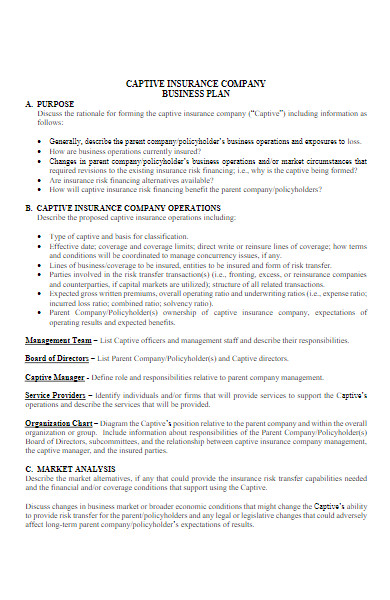

What Is an Insurance Business Plan?

An insurance business plan is a process document covering how an insurance agency will be developed and maintained. In the blog site Now From Nationwide, such a document is referred to as a roadmap towards a business’s success. The same article shared that it provides entrepreneurs a clear understanding of all aspects of a business right from its operations to the complete description of its products or services. This document is necessary, especially for startup businesses, to acquire much-needed financial assistance from bank loans or investors. It is also a crucial element in the documentation policy or documentation plan of the business.

Types of Insurance Most People Need

There are many types of insurance, with each of them serving a distinct purpose. However, not all of them are necessary for most people. Investing in the wrong insurance policy can obviously do more harm than good. Here are the types of insurance that people must have:

1. Life Insurance – covers your funeral expenses while securing the financial assistance of your beneficiaries

2. Health Insurance – insure people from medical expenses

3. Disability Insurance – provides financial assistance to workers who lost the capability to work due to a certain disability

4. Auto Insurance – indemnifies people during vehicle mishaps

How To Create an Insurance Business Plan

Every element of a business plan is essential for the development and sustainability of a business. Because of that fact, there’s a need for you to be thorough and concise on its content. Not only those, you also have to make it in accordance with the standard documentation procedure. In order for you to achieve the aforementioned qualities, we have made our standardized outline ready for you. Check them out below.

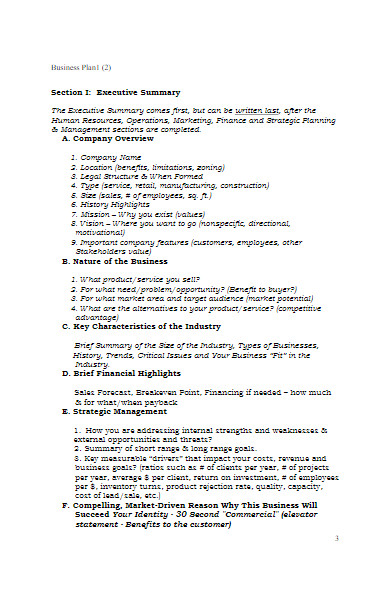

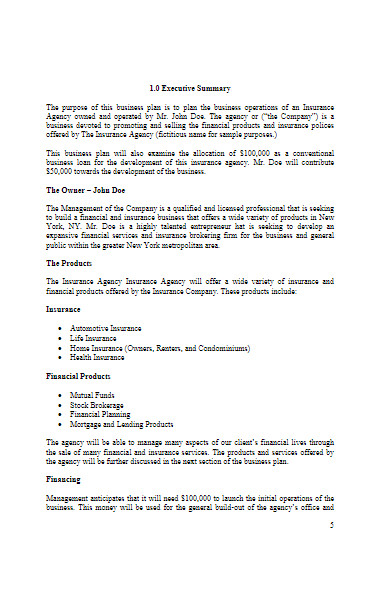

1. Provide the Executive Summary

Even though the executive summary is the first section of a business plan, it is written last. Its role is to make a good first impression to the readers by abiding by the proper executive summary writing practices. This section must give brief details on the overall business, long-term goals, products or services, target market, methodologies, and financial outlook.

2. Present the Business Overview

The business overview section comes right after the executive summary. In this section, you give out the full details of the mission statement, short-term and long-term goals, target market, business structure, competitive advantage, as well as the product and service descriptions. These areas will help readers know what kind of business you have, how you can sustain it, and who your audience will be.

3. Write Down Sales & Marketing Strategy

After presenting the business overview, write down the sales and marketing strategies for your business. With most business activities shifting to digital platforms, both the sales and marketing aspects of a business plan should focus on online engagement. In fact, many insurance companies attract potential policyholders through their respective websites and social media accounts. The same goes in the selling of these policies.

4. Advance the Operations & Management Processes

Once the strategies for both sales and marketing aspects have been laid down, give the full details on how your business will operate and how it will be sustained in the years to come. It is in this section where you have to proffer various insurance workflows and methodologies. The stakeholders for each of your business’s departments are also considered in this part, along with their job descriptions.

5. Summarize Financial Plan

To conclude your business plan, summarize your financial plan. This should thoroughly discuss the money that you’ll be getting to get your business started and how you’ll be getting them. If you’re a startup, the most common way is to reach out to banks to make loans, which pretty much require business plans.

FAQs:

What is an insurance policy?

An insurance policy is a contract that binds the insurer and the insured. It provides complete details of the premium payment, insurance coverage, and more. The most common provision in all insurance policies is the insurer’s rights to withhold coverage if the insured refuses to pay the premiums.

How does an insurance company make money?

An insurance company makes money in two ways. The first one is through underwritings, where the insurer gambles to offer coverage to the insured with high hopes to collect more money than the payouts. The second one is with investments. Whenever the insured pays their premium, the insurer places them down in financial markets to grow.

What happens to the insurance company when policyholders decide to get their cash back?

Insurance companies not just secure the money of the policyholders, but also grow them. Once these policyholders find that out, they will most likely try to withdraw them right away along with the cash value. At the same time, they close their accounts.

When such a circumstance happens, all the liabilities that the insurance company holds will end. Moreover, it keeps the paid premiums but pays the customer with deductions on the interests brought about by investments. These interests and other remaining cash goes directly to the company’s revenue.

If helping out individuals does not always go hand in hand with making profits, then an insurance business is a special case. There’s no denying that such a business is too risky for an entrepreneur. However, we can’t also disagree with the fact that it can be profitable when done carefully. And, an insurance business plan is a perfect document that can help you with being so.